Forex Trading in Kuwait

Forex trading is gaining popularity in Kuwait. While limited compared to those of major global financial hubs, the country’s strong economy and favourable tax regime – allied with the growing interest of its citizens in financial markets – mean that trading volumes are rising.

In this beginner’s guide, we’ll explain all you need to know about dealing currencies in the Middle Eastern territory. We’ll unravel the regulations governing forex trading in Kuwait and discuss the region’s tax rules.

We’ll also provide a hypothetical example of a trade involving Kuwait’s official currency, the dinar (KWD).

Quick Introduction

- Forex trading in Kuwait is a small but growing practice thanks to the country’s ‘zero tax’ environment for retail traders and robust oil-backed economy.

- Dealers can trade the Kuwaiti dinar (KWD) against a variety of local and global currencies. However, major pairs (like the EUR/USD and GBP/USD) dominate the market due to their superior liquidity and availability.

- The Central Bank of Kuwait (CBK) and Capital Markets Authority (CMA) are both tasked with ensuring the forex market operates in a fair, transparent and efficient manner, and in accordance with Sharia law.

Best 4 Forex Brokers in Kuwait

Our experts' tests indicate these 4 platforms as the stand-out options for forex traders in Kuwait:

How Does Forex Trading Work?

The forex market is the largest financial market in the world, with average daily trading volumes of $7.5 trillion, according to the latest Bank for International Settlements (BIS) data.

Trades involve buying one currency and selling another, which is why exchange rates are quoted in pairs (such as the EUR/USD, pitting the euro against the US dollar).

When a trader goes long, they purchase the first currency (the base currency) and sell the second currency (the quote currency). Taking a short position works in the opposite way.

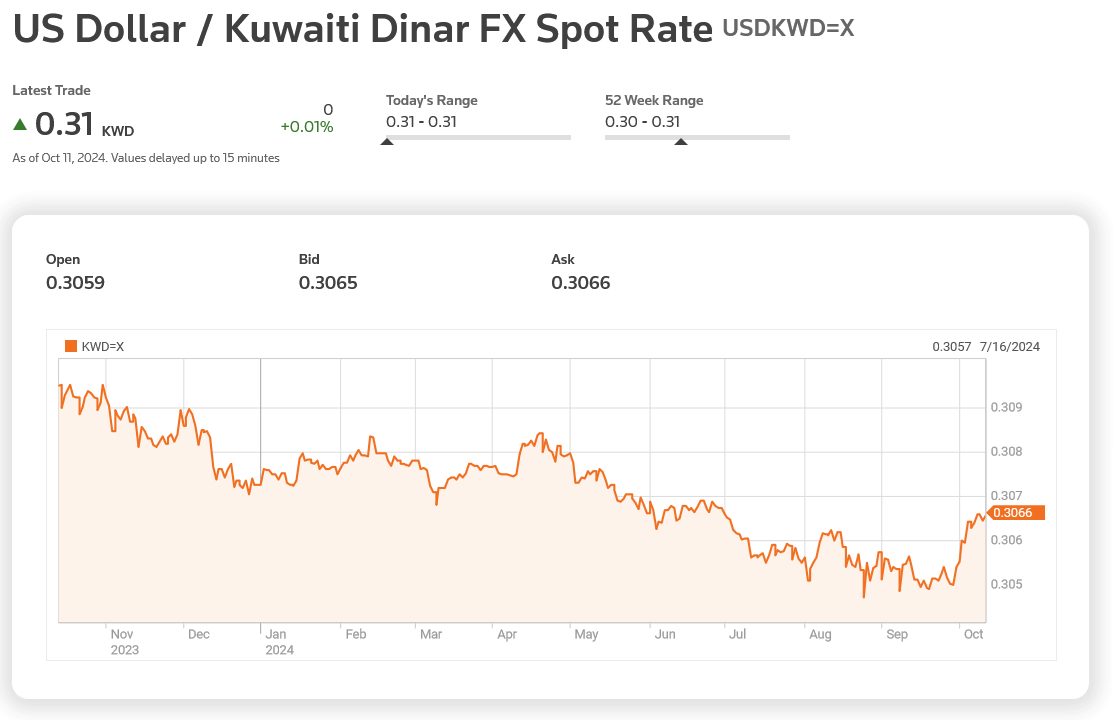

Traders in Kuwait can trade the dinar (KWD), the country’s official currency, against a variety of major counters (such pairings include the USD/KWD and EUR/KWD).

The KWD is the world’s strongest currency thanks to Kuwait’s strong economy, enormous oil industry, and its pegging to an undisclosed weighted basket of global currencies.

However, day traders tend to focus on major currency pairings such as the EUR/USD and USD/JPY. This is because non-KWD pairs tend to have better trading volumes, making it simpler, quicker and cheaper to enter and exit positions.

Some brokerages allow Kuwaiti traders to do business in their local currency rather than in an international one. Such accounts eliminate forex conversion fees and offer convenience.DayTrading.com has compiled a list of top brokers offering KWD-based accounts.

Is Forex Trading Legal In Kuwait?

Yes. The market is regulated by the Central Bank of Kuwait (CBK) and Capital Markets Authority (CMA), although these institutions have different objectives.

The CMA says that its role is to “regulate securities activities in a fair, transparent and efficient manner,” “enhance investor protection” and “impose requirements of full disclosure in order to achieve fairness and transparency,” among other things.

Forex brokerages must be CMA-approved to trade in Kuwait, and the regulator publishes a list of licensed companies on its website. It also provides a database of unlicensed firms.

As a result, non-Arabic speakers may wish to use a forex broker that’s authorized by a reputable overseas regulator (like the UK’s Financial Conduct Authority (FCA)). Consult DayTrading.com’s Regulation & Trust Rating to discover respected regulatory authorities from across the globe.

The CBK’s task, on the other hand, is to oversee the broader financial system and maintain monetary stability in the country. It also plays a vital role in ensuring that market practices are carried out in accordance with Sharia law, which reflects Islam’s position as Kuwait’s official religion.

Under Sharia law, the payment of interest (or riba) is prohibited. This means that forex trading accounts rewarding traders with interest payments or swap fees on overnight positions are banned. Other rules include restrictions on leverage (borrowed funds) and excessive speculation.

Is Forex Trading Taxed In Kuwait?

No. Active traders have the rare luxury of not having to pay a single dinar in income tax or capital gains tax on their currency dealing activities.

This is arguably the chief reason why day trading forex generally is taking off in the country.

When Is The Best Time To Trade Forex?

Currency trading is available 24 hours a day except on weekends, regardless of where one happens to be based. There are specific times, however, when serious traders prefer to do business.

In Kuwait, the most favourable times to trade forex are between 15:00 and 19:00 Arabia Standard Time (AST). This is the nation’s official time zone, operating three hours ahead of Greenwich Mean Time (GMT).

During this period, both the London and New York markets – the world’s number one and two forex venues respectively – are open. As a result, trading volumes are greater, and the potential for market volatility is higher.

A Forex Trade In Action

Let’s think about what a trade featuring the KWD might look like. In this example, I’ll be selling the dinar and buying one of the world’s most traded currencies, the EUR.

The Background

My plan is to buy the EUR/KWD pairing before the European Central Bank (ECB) makes its next interest rate statement, and to sell it later in the day for a profit.

I’m expecting rate-setters to keep rates on hold at 3.25%. Meanwhile, the broader market is tipping a 0.25% reduction. If I’m correct, the European single currency could strengthen against other currencies, including the KWD.

I come to this conclusion after studying recent economic announcements from the eurozone, policy comments from the ECB, and interest rate forecasts from analysts. But my research doesn’t stop here.

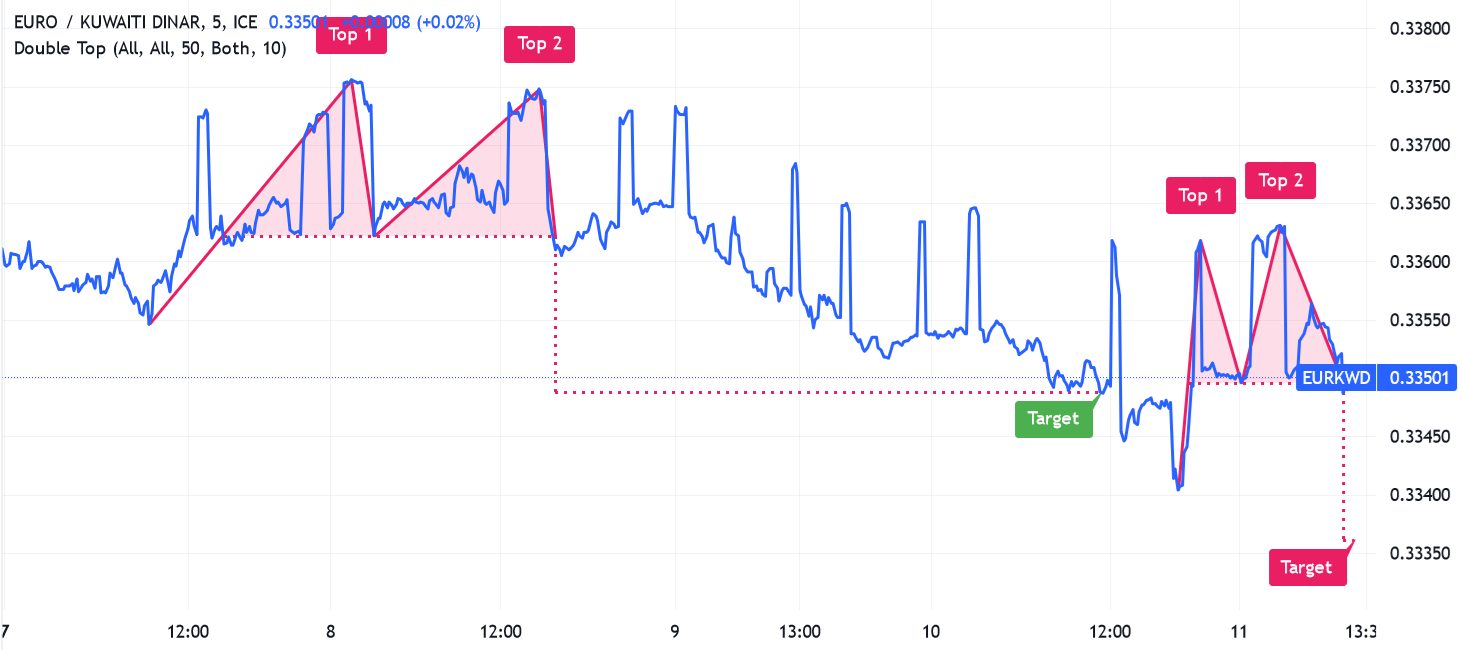

As with most forex day trades, I also carry out technical analysis to improve my understanding of where the EUR/KWD could head after the rate announcement.

Studying the charts, I try to identify chart patterns, indicators and trendlines related to historical price and volume data. By doing this, I can better pinpoint potential entry and exit points for my trade.

The Trade

The ECB is scheduled to make its interest rate statement at 15:15 AST. This is perfect for me, as it coincides with when dealing activity and market volatility are usually already at peak levels. I’d expect both to pick up further when the rate announcement happens, too.

I open my trading platform just after 15:00 AST, giving me enough time to key in my trade.

My trade involves two steps:

- Placing a ‘take profit’ order, which will close my trade automatically if the EUR/KWD appreciates to a pre-selected level.

- Putting in a ‘stop loss’ instruction that’ll shut my position if the pairing declines to a level I’ve chosen.

At this time, the currency cross is dealing at 0.33625, meaning I can buy 2.9717 Kuwaiti dinars for one euro. So I set my ‘take profit’ and ‘stop loss’ orders at 0.33659 and 0.33607 respectively. These tools help me to manage risk by limiting my losses or booking me a profit before the market has a chance to retrace.

Shortly after I’ve done this, the ECB makes its monetary policy announcement. It comes in as I’d expected, with rates bucking broader predictions of a 0.25% cut and remaining locked at 3.25%.

Consequently, the EUR/KWD appreciates as I’d hoped, and within half an hour my ‘take profit’ order of 0.33659 triggered, giving me a profit of 34 pips.

Bottom Line

Kuwait’s attractive tax regime and robust economy have resulted in a growing interest in forex trading. The market is regulated by the CMA and CKB, and brokers must be licensed to do business in the country.

However, many individuals choose to trade currencies with firms that are registered with respected regulators in other territories. Whether you choose a domestically or internationally approved brokerage, remain on the lookout for fraudulent activity.

If you’re ready to get started, take a look at DayTrading.com’s selection of top FX day trading platforms.

Recommended Reading

Article Sources

- OTC Foreign Exchange Turnover – Bank for International Settlements (BIS)

- The Kuwaiti Dinar: A Closer Look at the World’s Strongest Currency - Currency Transfer

- Capital Markets Authority (CMA)

- Central Bank of Kuwait (CBK)

- The Higher Committee of Shari’ah Supervision Responsibilities - CBK

- Time in Kuwait – Time.is

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com