Best Day Trading Platforms and Brokers in Kuwait 2025

As one of the richest countries in the world, Kuwait offers compelling opportunities to trade its most important commodity, oil, plus currency pairs involving the Kuwaiti dinar (KWD), and stocks listed on the Boursa Kuwait.

To day trade Middle Eastern and global markets you’ll need a broker. The Capital Markets Authority (CMA) and Central Bank of Kuwait (CBK) oversees the country’s financial markets, though some Kuwaitis choose international, well-regulated brokers.

Jump into DayTrading.com’s pick of the best day trading brokers in Kuwait. Some of these providers offer tailored services for Kuwaiti traders, such as Middle Eastern securities, Islamic accounts, and KWD accounts.

Top 6 Platforms For Day Trading In Kuwait

According to our latest tests, these are the 6 best trading platforms for short-term traders in Kuwait:

Here is a summary of why we recommend these brokers in April 2025:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- XM - XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC and CySEC and offers a comprehensive MetaTrader experience.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- Deriv - Established in 1999, Deriv is an innovative broker now serving over 2.5 million global clients. The firm offers CFDs, multipliers and more recently accumulators, alongside its proprietary derived products which can't be found elsewhere, providing flexible short-term trading opportunities.

Best Day Trading Platforms and Brokers in Kuwait 2025 Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage | Regulator | Islamic Account |

|---|---|---|---|---|---|---|

| Exness | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC | ✔ |

| AvaTrade | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM | ✔ |

| XM | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 | ASIC, CySEC, DFSA, IFSC | ✔ |

| IC Markets | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ASIC, CySEC, FSA, CMA | ✔ |

| RoboForex | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | R StocksTrader, MT4, MT5, TradingView | 1:2000 | IFSC | ✔ |

| Deriv | $5 | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView | 1:1000 | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA | ✔ |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Exness was the first brokerage to pass the $1 trillion and $2 trillion marks in monthly trading volumes, highlighting its legitimacy.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

Cons

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Retail trading services are unavailable in certain jurisdictions, such as the US and the UK, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | ASIC, CySEC, DFSA, IFSC |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of <2 minutes and now a growing Telegram channel.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Bonus Offer | $30 No Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

Cons

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

Deriv

"Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours."

Christian Harris, Reviewer

Deriv Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs |

| Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

| Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP |

Pros

- Although response times trail alternatives in our personal experience, Deriv offers 24/7 support and is one of the few brokers to offer WhatsApp assistance.

- Account funding is a breeze with a very low minimum deposit of $5 and a huge selection of payment options, plus Tether was added to the cashier in 2023.

- Deriv stands out with its innovative products, from multipliers and derived indices to its addition of accumulator options, providing exclusive short-term trading opportunities.

Cons

- Leverage up to 1:1000 will appeal to traders with a large risk appetite but frustratingly there is no ability to flex the leverage in the account area.

- Although there’s a basic blog, there's little in terms of technical analysis or market reports which could help active traders identify potential opportunities.

- While the Academy launched in 2021 is a step in the right direction, there is limited education on advanced trading topics for seasoned traders and no live webinars to upskill new traders.

Methodology

To compile our list of the top day trading platforms for Kuwaitis, we leveraged our database spanning 223 online brokers, focusing on all those accepting Kuwaiti traders.

We ranked them by their rating, using findings from our direct tests and a comprehensive set of data points.

- We focused on brokers that accept day traders from Kuwait.

- We only recommended brokers we trust after weighing their regulations.

- We prioritized brokers with competitive pricing for short-term trading.

- We favored brokers with a broad range of financial markets.

- We checked that brokers offer reliable charting platforms.

- We examined each broker’s leverage and margin requirements.

- We investigated each broker’s order execution quality.

- We checked for a halal account given that Kuwait is a Muslim-majority country.

How To Choose A Day Trading Broker In Kuwait

We’ve spent years analyzing day trading platforms and these are the key things to consider:

Trust

Trading scams are a notable risk in our industry, so choosing a trustworthy broker is vital to help protect your Kuwaiti Dinars.

The Central Bank of Kuwait oversees financial services providers in Kuwait, but since it doesn’t regulate many brokers, some residents turn to international providers licensed by other trusted bodies, such as the Dubai Financial Services Authority (DFSA). This is allowed, but you must follow the latest Kuwaiti regulations.

Alongside regulatory oversight, we also look for other indicators of a trustworthy brokerage:

- Researching the broker’s background and record to reveal any reports of unfair practices or lawsuits.

- Checking comments from users – traders can directly rate platforms on DayTrading.com’s broker reviews.

- Investigating whether a broker is listed on a stock exchange, suggesting excellent financial transparency.

- AvaTrade maintains its position as one of the most trusted brokers, boasting an impressive trust score of 4.8/5 in our tests. The firm holds licenses with multiple respected bodies including the ADGM (Abu Dhabi), CySEC (Cyprus), and CIRO (Canada). With over 15 years of experience, AvaTrade has won notable industry awards (including our ‘Best Trading App’) and provides safeguards like negative balance protection.

Market Access

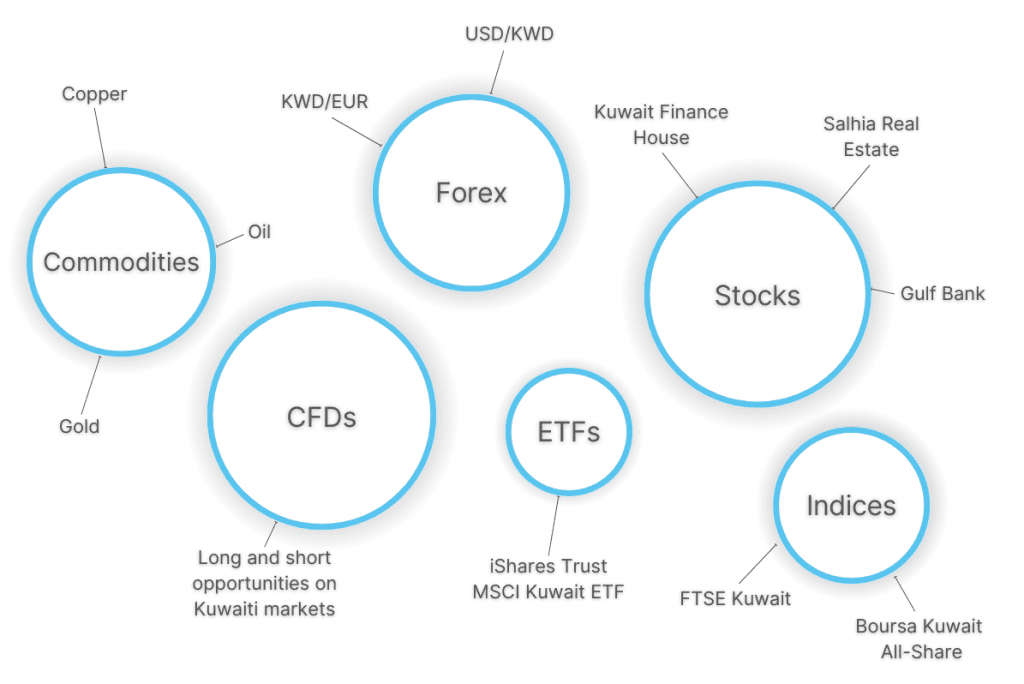

Day traders often look for liquid, volatile markets that cater to short-term trading strategies, such as major currency pairs like EUR/USD and US stocks listed on the NASDAQ.

However, it can be important to have access to a broad range of markets so you can build a diverse portfolio. Forex pairs involving the dinar (KWD) may also be appealing for Kuwaiti traders, as well as Middle Eastern stocks, and the country’s chief export commodity, oil.

- eToro‘s selection of 6000+ assets beats out most competitors, covering various regions and sectors. You can speculate on over 50 currency pairs, plus hundreds of equities including Middle Eastern stocks. There are also several ways you can speculate on oil, via futures, Smart Portfolios (including the OilWorldWide portfolio) and ETFs (including the iShares Oil & Gas Exploration & Production UCITS ETF).

Trading Fees

Day trading fees can build up quickly and eat into profits, so finding a broker that keeps costs down whilst delivering a high-quality trading environment is key.

Notably, we assess spreads and commissions on popular markets including EUR/USD and oil, taking into account the pricing structure used by the broker. For example, experienced active traders may want an ECN broker with raw spreads from 0.0 and low commissions.

We also weigh any funding charges (though most trading platforms let you deposit for free) as well as any account maintenance fees such as inactivity charges, or extra fees for Islamic accounts.

- IC Markets consistently ranks above most peers for its ultra-low fees on popular financial markets, coming in at just 0.03 on oil and 0.02 on EUR/USD. Holding fees in the Islamic account also start from only $1 per lot. There’s also no charge on inactive accounts, so casual traders aren’t penalized.

Charting Platforms

Day traders require a stable and powerful environment to build strategies and execute a high frequency of trades.

In our experience, most brokers offer a choice of third-party platforms such as MetaTrader 4 and TradingView. These house comprehensive packages of technical indicators, timeframes and drawing tools to capitalize on short-term price movements.

Some brands also provide a bespoke platform designed for specific needs, such as stock trading, or featuring a scaled-down interface for beginners. I find AvaTrade‘s own web platform much easier to navigate than most alternatives, making it ideal for newcomers.

- Deriv delivers a superb all-round solution for traders, offering MetaTrader 5 for trading CFDs, alongside their flagship Deriv Trader which is designed specifically for trading options and multipliers. The choice of platforms caters to both novices and experienced traders as well as those seeking trading opportunities not commonly found elsewhere.

Leverage Trading

A common tool used by day traders, leverage increases your buying power using a small outlay, known as margin.

But while this can increase your potential profits, it can also amplify losses. For example, using 1:20 leverage on an outlay of $100 could increase my gains (and losses) to the value of $2,000 (20x $100).

To protect against losses while day trading, risk management is crucial. Additionally, choosing a broker that offers negative balance protection will prevent your account balance from falling below zero.

- XM offers very high leverage up to 1:1000. That said, such rates are unsuitable for beginners, so start low and use a demo account to get familiar with margin trading. The broker sets a 50% margin call to warn you that you have insufficient equity to support open positions, and a 20% stop-out level to automatically close positions when your equity level reaches below 20% of the required margin.

Execution Quality

The speed and reliability at which orders are executed can make a considerable difference to fast-paced trading strategies.

In our experience, the top providers execute orders in less than 100 milliseconds, ensuring minimal latency (the time delay between the requested and executed trades).

They also aim to fill trades at the best possible price, ensuring low rates of slippage (the price difference between the requested trade and the fulfilled trade).

- Pepperstone still offers some of the fastest speeds in the industry, as low as 30 milliseconds on popular assets. It also ensures no requotes (where the price requested is no longer available and the broker provides a new one) or partial fills (where only part of the order is executed).

Account Funding

We evaluate a broker’s minimum deposit since this can make a big difference to beginners and traders on a budget.

Most brokers let you start with less than 250 USD (approximately 75 KWD), though there are some brokers with no minimum deposit.

We also consider whether any local payment methods are available for convenience. In Kuwait, credit cards still remain the most prominent form of online payment according to the latest industry research. However, it’s worth checking your bank’s credit card charges.

- Exness is a great option for beginners with just a $10 minimum deposit and accessible funding via cards, bank transfers and digital payments. It’s also one of the most flexible brokers we’ve evaluated when it comes to account currencies, being one of the few offering KWD accounts.

FAQ

Who Regulates Day Trading Platforms In Kuwait?

The Capital Markets Authority (CMA) and Central Bank of Kuwait (CBK) regulate the country’s financial markets and trading providers.

However, since they doesn’t actively license many day trading platforms, some traders turn to international firms. Following this route is legal, but you must adhere to local regulations and tax rules in Kuwait.

Which Is The Best Broker For Day Traders In Kuwait?

There is no single best broker, as this is different for everyone. However, you can start by exploring DayTrading.com’s choice of the top day trading platforms in Kuwait to find a suitable firm for your requirements.

IC Markets, for example, offers some of the lowest spreads we’ve seen on popular instruments like oil, whilst eToro‘s selection of assets is more diverse than most alternatives and is a particularly good choice for those looking to trade stocks and funds with exposure to the Middle East.

Recommended Reading

Article Sources

- Kuwait Economy

- Boursa Kuwait

- Capital Markets Authority (CMA)

- Central Bank of Kuwait (CBK)

- Payment Methods In Kuwait - Adyen

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com