Forex Trading In South Korea

Forex trading in South Korea has evolved significantly since its emergence in the 1980s, initially under strict restrictions. Liberalization began in the 1990s, with a substantial boost following the 1997 Asian Financial Crisis, prompting the government to deregulate and introduce new financial products.

Today, South Korea boasts well-developed forex markets facilitated by the Korea Exchange (KRX), allowing for broader participation from both institutions and online traders.

Let’s explore the fundamentals of forex trading in South Korea with hands-on guidance and a sample trade.

Quick Introduction

- South Korean traders often focus on major currency pairs like EUR/USD, USD/JPY, and GBP/USD due to their high liquidity and popularity, while also considering South Korean won (KRW)-related pairs such as USD/KRW.

- Forex trading in South Korea is overseen by the Financial Services Commission (FSC), ensuring compliance with regulations and promoting investor protection in the forex market.

- South Korean authorities may intervene in the forex market to stabilize the South Korean won (KRW) exchange rate, potentially impacting currency trading activities and market volatility.

Top 4 Forex Brokers In South Korea

Our personal tests reveal these 4 platforms are the best for trading currencies in South Korea:

See all Forex Brokers in South Korea

How Does Forex Trading Work In South Korea?

To start forex trading in South Korea, you need to select a trustworthy Korean forex broker.

You also need to analyze economic indicators, geopolitical events, and technical charts to identify short-term trading opportunities.

Then, execute buy or sell orders through your chosen trading platform, employing risk management techniques like stop-loss orders to limit losses and take-profit orders to secure profits.

Is Forex Trading Legal In South Korea?

South Korea adopts a regulatory approach similar to countries like China and Japan regarding the legality of forex trading.

While forex trading itself is not illegal in South Korea, the legal landscape surrounding forex trading is nuanced and not solely categorized as either fully ‘legal’ or ‘illegal.’

For example, a significant restriction is the prohibition of forex brokers from being headquartered and officially registered within South Korea. As a result, South Korean traders resort to utilizing overseas firms established in neighboring Asian jurisdictions such as Hong Kong or Singapore.

Under the supervision of the FSC and the Bank of Korea, South Korea also sets strict maximum leverage limits, capped at 1:10 for major currency pairs and 1:5 for other minor or exotic currency pairs, notably the USD/KRW.

These leverage restrictions are notably stringent in comparison to the standard offerings in other nations. This significantly raises the difficulty for forex traders in Korea to capitalize on minor fluctuations in currency values.

Is Forex Trading Taxed In South Korea?

Profits earned from forex trading are classified as ‘miscellaneous income’ under South Korean tax laws, necessitating their declaration and taxation. You should keep proper records to avoid any risks of penalties for tax evasion.

Such regulatory constraints present significant challenges for forex traders in South Korea compared to traders in other jurisdictions, with the absence of local brokerages further complicating matters and contributing to uncertainty regarding the legality of forex trading within the country.

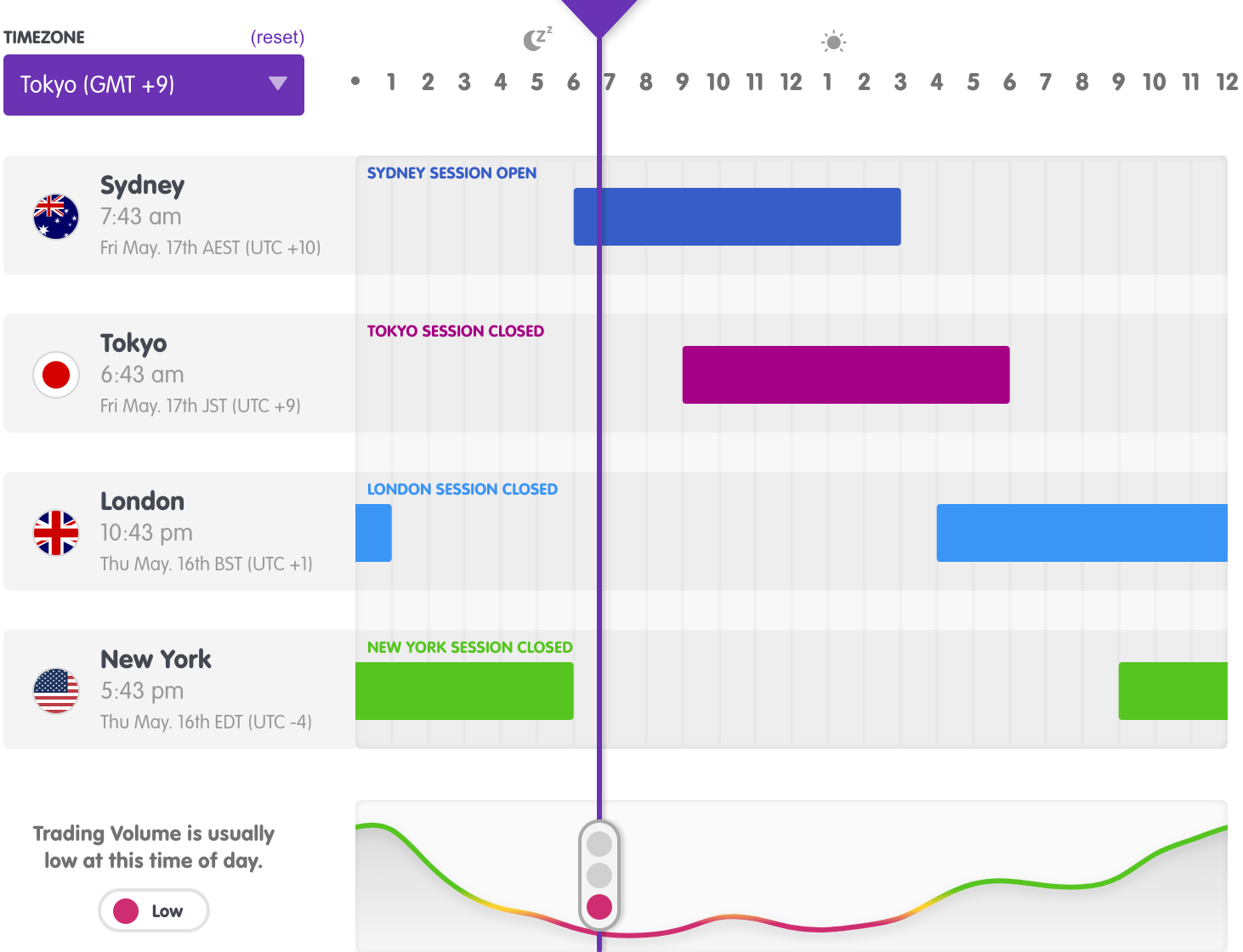

When Is The Best Time To Trade Forex In South Korea?

Forex trading in South Korea aligns mostly with the Asian trading session, coinciding with the Tokyo and Hong Kong stock exchanges’ operating hours.

This session typically ends shortly after the European market opens. Given the peak trading activity within the two hours after the New York market opens and before the London market closes (around 11:30 pm Seoul time), opt for a wide range of instruments from Asian markets to capitalize on market volatility during these times.

Example Trade

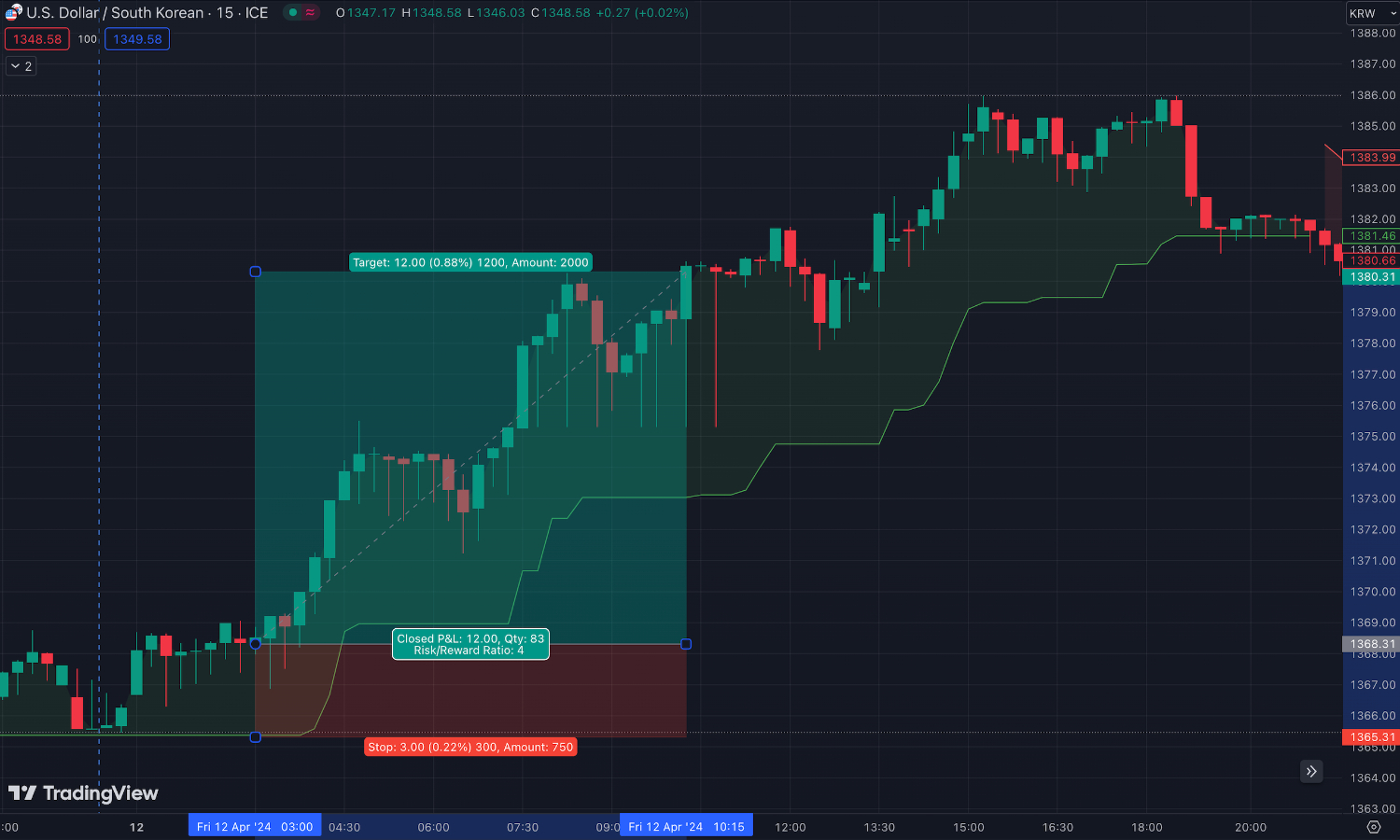

To provide a practical understanding of forex trading in South Korea, I’ll outline the steps I took to execute a short-term (intraday) trade on the USD/KRW currency pair:

Economic Event Analysis

I started by closely monitoring economic events that can impact the Korean won (KRW) exchange rate.

There was a significant announcement by the Bank of Korea regarding the interest rate decision, which had the potential to influence the value of the KRW against the USD.

Technical Analysis

Before placing the trade, I conducted technical analysis using various indicators such as moving averages, support and resistance levels, and relative strength index (RSI).

The analysis suggested that the USD/KRW pair was in a bullish uptrend and was likely to continue its uptrend after interest rates were held.

Position Sizing & Risk Management

To manage risk effectively, I determined my position size based on my risk tolerance and account balance. I implemented a stop-loss order to limit potential losses in case the trade moved against me.

Additionally, I calculated the appropriate leverage to use, considering the volatility of the currency pair.

Trade Entry

Based on the economic event analysis and technical indicators, I decided to enter a long position on the USD/KRW pair. I placed the trade using my preferred trading platform, specifying the entry price and stop-loss level.

For this trade, I managed to apply an impressive 4:1 risk-reward ratio (risking 3 pips to make 12 pips).

Trade Exit

As the currency trade progressed, I kept an eye on price movements and market conditions but didn’t need to react as the price kept moving in my favor towards my take-profit level.

The position was automatically closed after 7 hours and 15 minutes.

Post-Trade Analysis

After closing the trade, I conducted a post-trade analysis to review my decision-making process and performance. I assessed whether I adhered to my trading plan and risk management strategy effectively.

Additionally, I evaluated the impact of the economic event on the USD/KRW currency pair and identified any lessons learned for future trades.

Bottom Line

Forex trading isn’t explicitly illegal in South Korea, but stringent regulations are imposed on currency speculation, and domestic brokerage firms are not authorized.

This regulatory landscape creates ambiguity regarding the legality of forex trading, leading to a regulatory grey area.

Korean residents can participate in currency trading through overseas forex brokers, albeit with restrictions on leverage and funding. Due to the absence of clear forex trading laws and regulatory ambiguity, make sure to trade through approved foreign brokerages and comply with tax obligations.

To get started, use a top-rated forex broker in Korea.

Recommended Reading

Article Sources

- Financial Services Commission (FSC)

- Korea Exchange (KRX)

- The Asian Crisis: Causes and Cures - IMF

- Forex Market Time Zone Converter - Babypips

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com