Forex Trading in Kenya

Forex trading in Kenya has taken off in recent years, driven by the introduction of strict market regulations and greater protections for traders. Online dealing activity has also grown as internet accessibility in the country has steadily improved.

The Kenyan shilling (KES) has depreciated against the US dollar (USD) in recent years but remains fairly stable against regional currencies like the Tanzanian shilling (TZS) and the Ugandan shilling (UGX).

This guide explains how traders can earn money with Kenya’s online forex market. Besides describing the regulatory and tax environment, it reveals the best times of the day to trade currencies, and illustrates how a short-term trade on the KES/GBP could work in practice.

Quick Introduction

- Kenya is one of Africa’s biggest forex markets, mainly reflecting closer regulatory scrutiny and rapid digitalization in the country.

- The nation’s forex market is chiefly regulated by the Kenyan Capital Markets Authority (CMA) – a ‘yellow-tier’ body in line with DayTrading.com’s Regulation & Trust Rating.

- Individuals pay tax of between 10% and 35% on their forex trading profits to the Kenya Revenue Authority (KRA).

- The value of the KES is heavily influenced by commodity prices given the country’s position as a major exporter of tea, coffee and agricultural products.

Top 4 Forex Brokers in Kenya

Our hands-on testing shows these 4 platforms are a cut above the rest for forex traders in Kenya:

See all Forex Brokers in Kenya

How Does Forex Trading In Kenya Work?

Currency trading in Kenya is expanding rapidly, and the country now ranks as the third-largest market in Africa (behind South Africa and Nigeria).

Significant regulatory reforms, advancements in digital infrastructure, and strong economic growth are driving Kenya’s increasing prominence in the continent’s forex landscape

Traders can deal in a wide range of currency pairings, including crosses involving the Kenyan shilling (KES). This is the country’s official counter, which is also expressed as KSh.

Popular forex pairs involving the Kenyan shilling include KES/USD (US dollar), KES/EUR (euro), and KES/JPY (Japanese yen). Additionally, crosses like KES/ZAR (South African rand) and KES/NGN (Nigerian naira) also see substantial trading activity.

Is Forex Trading Legal In Kenya?

Yes. People have been dealing currencies in Kenya for centuries, although trading them legitimately is a relatively modern phenomenon.

A sharp rise in fraudulent activity during the 2010s finally prompted the Capital Markets Authority (CMA) to establish a legal framework to protect traders and the broader market.

In August 2017, the ‘Capital Markets Online Foreign Exchange Trading Regulations’ were introduced to ensure that brokers are licensed and closely supervised. Following the legislation, EGM Securities became the first brokerage to set up shop in Kenya in July 2018.

Forex is primarily regulated by the CMA, although the Central Bank of Kenya (CBK) also plays an important role here and across the broader financial services sector.

In March 2023, the CBK rolled out the Kenya Foreign Exchange Code to further improve the functioning, openness and integrity of the country’s wholesale currency market in line with broader global standards.

Recent legislation aims to protect retail forex traders by reducing market manipulation, improving stability, boosting transparency, and ensuring that trading platforms accurately reflect trading conditions.

Is Forex Trading Taxed In Kenya?

Yes, annual trading profits are taxable and need to be declared to the Kenya Revenue Authority (KRA).

Earnings are generally considered to be part of an individual’s taxable income and are charged at the following rates:

- 10% on the first KSh 288,000

- 20% on the next KSh 100,000

- 30% on the next KSh 5,612,000

- 32.5% on the next KSh 3,600,000

- 35% on earnings of more than KSh 9,600,000

Taxpayers aren’t required to pay a levy on the first KSh 28,800 that they earn.

When Is The Best Time To Trade Forex?

Broadly speaking, currency trading is available 24 hours a day on weekdays. However, doing business at particular times of day tends to be especially profitable for traders, wherever they are based.

In Kenya, this ‘sweet spot’ is between 4:00pm and 8:00pm local time, or East Africa Time (EAT). During this period, the domestic trading session crosses over with those in the UK and the US.

Liquidity and volatility in forex markets spikes when the major financial hubs of London and New York are open. This can provide more chances for individuals to make a profit, while it can also be cheaper to trade (due to narrower bid and ask spreads).

EAT is three hours ahead of Greenwich Mean Time (GMT), which means that 11:00am local time coincides with when markets open in the UK. Trading volumes tend to pick up sharply around this time and in the following hours, reflecting London’s position as the world’s busiest forex venue.

Liquidity improves even further at around 4:00pm EAT, at which point traders in New York – running seven hours behind those in Kenya, on Eastern Standard Time (EST) – begin trading at the same as their British and East African counterparts.

Forex volumes in the huge US market begin to drop off four hours after the open, which corresponds to around 8:00pm EAT.

A Forex Trade In Action

Now let’s consider how a currency trade in Kenya might work in practice. For this example, I’ll show how a trader like me could make money from the KES/GBP cross following a key economic announcement.

The Background

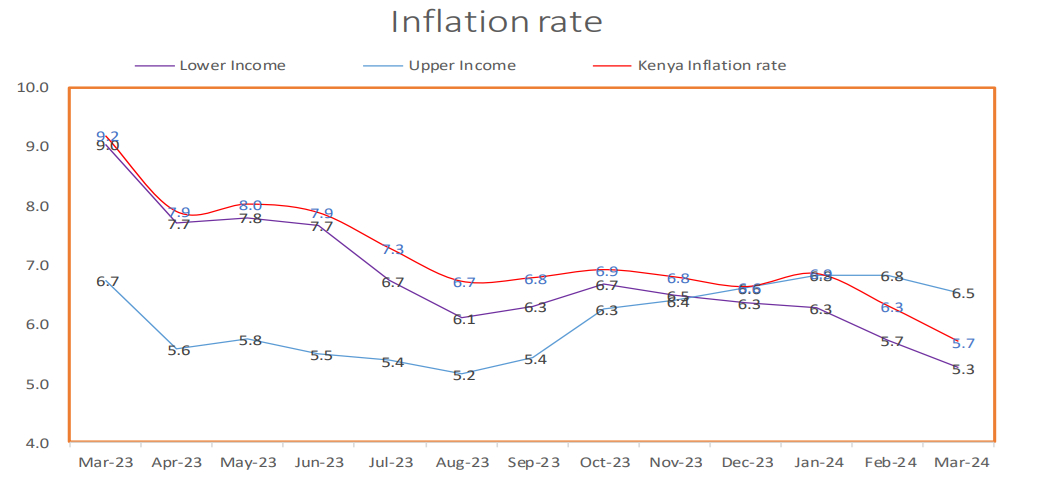

My plan is to profit from a shift in the pairing following Kenya’s next consumer price inflation (CPI) release. This instrument trades the shilling, or the base currency, against the quote currency of the British pound.

My expectation is that last month’s inflation will come in below the 5.5% rate that the market is predicting. If I’m right, the African currency could rise against the pound.

The Setup

After looking at recent economic data, I take the view that CPI for last month will likely have stood at around 5.2% last month. I come to this conclusion by studying recent Leading Economic Indicator reports from Kenya’s National Bureau of Statistics (KNBS), as well as by looking at local news websites and reading economist notes.

To profit from this, I plan to take out a long position on the KES/GBP pair. This involves buying the shilling at the same time as selling the pound.

Before placing any forex trade, it’s important that I carry out technical analysis on the pair I plan to deal in. Studying price and volume data on the charts gives me a better chance to identify the potential scale of market movements.

Technical analysts use a range of tools such as chart patterns (like the ‘head and shoulders’ pattern), trend lines, and indicators (such as the Relative Strength Index) to identify repetitive market movements and better predict where prices might be heading.

The Trade

The KNBS is scheduled to release that inflation data at 10:00am EAT. So I prepare to place my buy trade around five minutes before.

At this time, the KES/GBP pair sits at 0.006125. This means I can buy 163.27 Kenyan shillings for every £1.

I decide to set up a ‘take profit’ order at 0.006135, and a ‘stop loss’ instruction at 0.006112. This will automatically close out my position if the cross rises to the former level, or falls to the latter level, thus enabling me to manage risk effectively.

Shortly afterwards, the CPI report is released. And it’s good news for me, showing a less-than-forecast 5.4% rise in inflation for last month.

While this is still above what I had estimated, the KES still rises as a result, triggering my ‘take profit’ instruction and giving me a profit of 10 pips.

Bottom Line

Recent regulatory and technological changes mean that Kenya’s appeal as a forex hub has improved considerably. However, it’s important that traders remain vigilant, as legislative frameworks are less strict than they are in many European, North American and Asian trading venues.

Kenya’s central bank says that the “financial landscape has experienced considerable and positive transformation” over the years. But it concedes that “weaknesses have also emerged as well as risks.”

Forex trading in the country can be profitable, helped by the high levels of leverage that are available. But traders need to be aware of and vigilant to any risks.

The first step to choose a trusted forex broker in Kenya.

Recommended Reading

Article Sources

- Kenya’s First Licensed Forex Broker Begins Operations – Kenyan Wall Street

- Kenya Foreign Exchange Code – Central Bank of Kenya (CBK)

- Capital Markets Online Foreign Exchange Trading Regulations - Capital Markets Authority (CMA)

- A Structural Analysis of Foreign Exchange Markets in Sub-Saharan Africa – European Investment Bank

- Leading Economic Indicators – Kenya National Bureau of Statistics

- What is Income Tax? – Kenya Revenue Authority

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com