CFD Trading In Kenya

Curious about trading CFDs in Kenyan and global financial markets? In this beginner’s guide, we’ll break down the basics of CFD trading in Kenya: what they are, how they work, and their unique opportunities and risks.

Quick Introduction

- With CFDs, you can trade the price shifts of various assets, such as Kenyan stocks like ABSA Bank, agricultural commodities (particularly vital in Kenya’s economy), forex, and indices.

- You go “long” (buy) if you think prices will rise or go “short” (sell) if you expect prices to drop. This flexibility opens up profit opportunities in bullish and bearish markets.

- CFDs allow you to use leverage, meaning you can control a larger position with fewer Kenyan shillings. This allows for potentially higher returns, although it also increases risk.

- Unlike traditional share dealing, CFD trading doesn’t involve ownership of the underlying asset. This can lead to tax benefits like no stamp duty in many regions, including Kenya.

Best CFD Brokers In Kenya

Through our hands-on tests, we’ve determined that these 4 CFD providers are the best for day traders in Kenya:

How Does CFD Trading Work?

CFD trading allows you to trade global markets without incurring the extra expense and administration needed to own specific assets.

Leverage is a unique and potent tool that is an attractive element of CFD trading when used carefully. With leverage, you can control and open bigger positions but only need to commit a fraction of the total value (or margin) required to buy an equivalent number of, say, shares listed on Kenya’s stock market, the Nairobi Securities Exchange (NSE).

To show you this works, let’s discuss a potential CFD trading opportunity on the Nairobi Securities Exchange 20 Share Index NSE20. The NSE20 is a primary stock market index that tracks the performance of 20 of the best-performing companies listed on the Nairobi Securities Exchange.

If you believe the NSE20 will rise, you’d buy a CFD position in the Index. If each contract is valued at 1,900, and your brokerage requires a 30% margin, then to take a position on 100 contracts, you’d need a margin of Kenyan shilling (KES) 57,000 (1,900 per contract x 100 contracts x 30%).

If the NSE20 rises to KES 2,000, the price increase will yield KES 100 per contract. By closing your position, you would bank a total profit of KES 10,000 (100 contracts x KES 100), excluding broker fees. But, if the index falls to 1,800, you will lose KES 10,000.

This example highlights the risk of CFD trading; you control significant size with leverage, but both the gains and losses are amplified.

It’s critical that you spend some time understanding how margin and leverage work. If you are new to CFD trading, I’d consider starting with a demo trading account.Almost all brokers provide them free of charge, and it’s a brilliant introduction to CFD trading. You can practice strategies and build confidence before risking your Kenyan shillings in the markets.

What Can I Trade?

Trading CFDs offers many opportunities in various financial markets worldwide and in Kenya:

- Stock CFDs – You can trade some of the most active and high-value Kenyan stocks listed on the NSE, like Portland Cement and KPLC. Alternatively, consider trading some of the thousands of shares hosted in US, European, and other African stock markets.

- Index CFDs – You may be able to trade the NSE20 as a CFD in Kenya and globally. Some active traders prefer trading market indices to capitalize on a stock exchange’s overall performance rather than trade individual stocks/shares. You might also want to consider trading global index CFDs like the Dow Jones or NASDAQ for their superior liquidity and trading costs.

- Forex CFDs – The Kenyan shilling (KES) can be traded in the foreign exchange market. Popular KSE currency pairs include USD/KES and EUR/KES, which relate to Kenya’s major trading partners. These currency pairs provide opportunities for short-term currency traders interested in trading KES. However, the spreads are considerably higher than those for major USD and EUR pairs.

- Commodity CFDs – Critical global commodities such as precious metals like gold and silver, crude oil, and agricultural products key to Kenya’s economy can be traded as CFDs, allowing you to speculate on price movements often linked to macroeconomic events.

- Crypto CFDs – The fascination surrounding trading digital assets has grabbed the attention of Kenyan traders. You can trade cryptocurrency CFDs like Bitcoin and Ethereum for rapid access to the volatile world of crypto.

Is CFD Trading Legal In Kenya?

While CFD trading is legal in Kenya, it operates in a bit of a “grey zone.”

The Capital Markets Authority (CMA), which is the leading financial regulatory body in Kenya, hasn’t yet created specific regulations for CFDs. This means that, technically, CFD trading is unregulated locally. However, that doesn’t mean it’s illegal or completely unprotected.

Many international brokers who offer CFD trading to Kenyan residents are regulated by financial authorities in other jurisdictions, such as:

- UK’s Financial Conduct Authority (FCA): Known for strict oversight, FCA-regulated brokers often have strong client protection measures, including negative balance protection and segregated client funds.

- Australian Securities and Investments Commission (ASIC): Another well-regarded regulator, ASIC also enforces client protections like leverage caps and transparency requirements.

For Kenyan traders, using a broker regulated by one of these authorities can offer a level of protection, even if the CMA doesn’t directly oversee CFD trading.

A word of caution: since local consumer protections aren’t in place, Kenyan traders must be extra diligent when choosing a provider.Going with a regulated broker from a reputable jurisdiction can add peace of mind, ensuring that even though the CMA does not explicitly regulate CFDs, you still operate within a framework that prioritizes trader protection.

Is CFD Trading Taxed In Kenya?

CFD trading is generally subject to taxes in Kenya, but the specific tax treatment can vary depending on how the Kenyan Revenue Authority (KRA) categorizes profits from CFD activities.

- Capital Gains Tax: In Kenya, CFD trading profits could fall under capital gains tax. The KRA imposes a capital gains tax of 5% on the net gain from property sales, which may include certain financial assets. However, because CFDs are derivative products rather than physical ownership of an asset, some traders consider them exempt from this tax.

- Income Tax: For active traders like day traders, especially those who treat CFD trading as a primary source of income, the KRA may consider the profits as regular income, which would be subject to income tax. Individual income tax rates in Kenya are progressive, ranging from 10% to 30%, depending on total annual income.

- Withholding Tax (for Foreign Brokers): If you’re using a foreign broker, there may be withholding tax implications in the broker’s country, depending on its policies. However, this generally doesn’t apply directly to Kenyan traders and wouldn’t affect your local tax obligations.

Trade Example

To show you how CFD trading in Kenya works in practice, let me walk you through a detailed trade I made.

Background

I used a stock screener to find active stocks to trade on the Nairobi Stock Exchange (NSE).

I also used filters to ensure that stocks I’m considering trading are well-capitalized. I believe avoiding low-liquidity stocks that may have higher trading fees or be subject to sudden whipsaws because of thin trading conditions is essential.

I settled on Safaricom PLC (SCOM). It’s Kenya’s largest telecommunications company and a major player in East and Central Africa. SCOM is traded on the Nairobi Stock Exchange (NSE) under the ticker SCOM.

Fundamental Analysis

When I’m looking to trade an individual stock in an unfamiliar market, I always do my homework on the company’s recent performance, as evidenced by the available data.

I consider metrics like EPS (earnings per share), 52 WK range (high and low), P/E ratio (price to earnings ratio), market capitalization, 12-month revenue growth, etc. I also consider my peer group’s sentiment and that of analysts and fellow traders before moving on to the technical analysis.

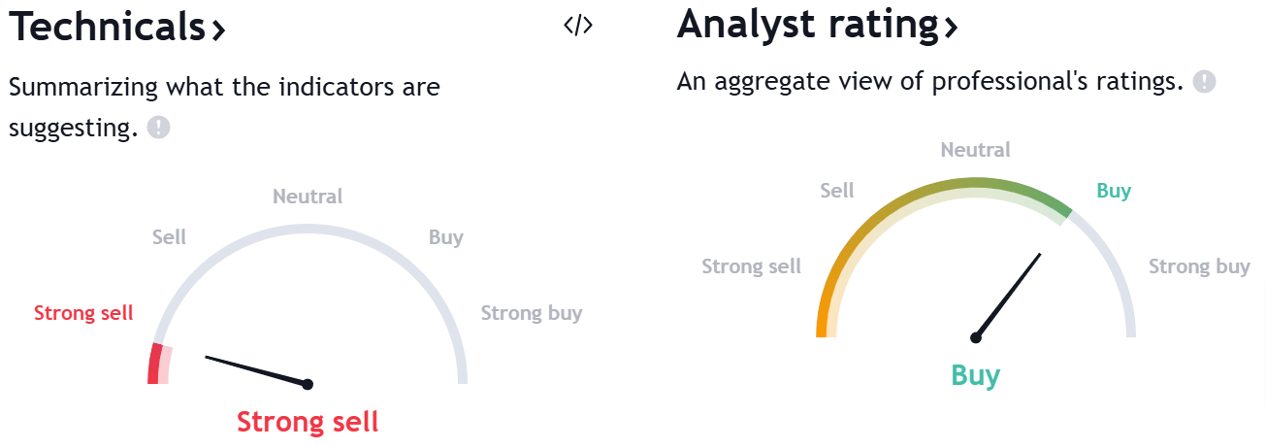

Below is an example of how sentiment can be displayed and the apparent and fascinating contradiction; technical analysis is a strong sell, whereas analysts in my community think it is a buy.

I always consider which might be the leading or lagging indicators in terms of a stock’s technicals and fundamentals. For example, analysts might think the fundamentals are still good for SCOM and that it’s oversold, so it’s time to get in now, whereas my technical analysis is screaming sell and stay short.

Technical Analysis

Depending on your preferred technical analysis, you can choose from up to 100 technical indicators on specific platforms like ProRealTime and TradingView.

You need to comb through the weeds of the indicators, particularly if you’re new to trading, experiment with combos, practice, and settle on technical indicators that work best for beginner day traders.

I have a small library of indicators I’ve developed trust in due to over 15 years of trading fast-moving markets as a day trader.However, remember that no indicator-based strategy is infallible; if you develop a trading plan and methods with positive expectancy, you’ll win more than you lose, and that’s as good as it gets.

Indicators can be superb for generating entry and exit signals, illustrating oversold and overbought conditions, highlighting trends and momentum, etc.

I chose the PSAR as my principal indicator for this swing trade opportunity.

- Technical traders like me use the parabolic SAR (stop and reverse) indicator to spot trends and reversals.

- The indicator uses a system of dots superimposed onto a price chart.

- A reversal occurs when these dots print (above or below price), but a reversal signal in the SAR doesn’t always mean a reversal in the price.

I combined PSAR with the Heikin Ashi candlestick, which gives candlesticks a smoother appearance. This makes the formations easier to translate into my price action decisions.

Daily Timeframe

I’ll often defer to the daily timeframe (D1) only for swing and position trading opportunities, as there’s little to be learned from analyzing lower timeframes like the 1HR if you’re considering holding a trade position for days.

My price action analysis of the HA revealed that the bullish trend and momentum were exhausted. Price failed to make higher highs, and the stock entered a ranging period over three daily sessions, which culminated in the formation of two hammer candlesticks.

The following daily candle signalled my opportunity to enter. The PSAR flipped to appear above price, indicating bearish conditions and a change in market sentiment.

I entered short using a CFD and was filled at a price of 16.75. I set my stop loss order at 17.15 and only risked 1% of my account size and needed a margin of 30%.

I’ve moved my fixed stop loss to 16.50 so I’ve locked in a modest profit.Rather than set a profit limit order, I will let the trade run until the trading conditions are reversed or my stop is triggered. This may involve the PSAR flipping to appear below price.

Bottom Line

CFD trading offers Kenyan traders a unique way to explore global markets with flexibility in both rising and falling markets.

While it’s legal and increasingly popular, make sure to use a reputable broker, understand the risks, and stay aware of tax responsibilities.

To get moving, turn to DayTrading.com’s selection of the best CFD day trading platforms.

Recommended Reading

Article Sources

- ABSA Bank - TradingView

- Safaricom Ltd - TradingView

- Portland Cement - TradingView

- KPLC - TradingView

- Nairobi Securities Exchange (NSE)

- Nairobi Securities Exchange 20 Share Index NSE20 - Trading Economics

- USD/KES - Financial Times

- Kenyan Capital Markets Authority (CMA)

- Kenya Revenue Authority (KRA)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com