Forex Trading In Japan

Trading forex is big business in Japan. In fact, the country’s yen is the third-most traded currency, taking one side of approximately 17% of trades in the global foreign exchange market, reflecting the critical role the Asian currency plays in global commerce.

This guide explains how to trade currencies online in Japan. It reveals the best hours to trade, how traders are taxed and walks through an example short-term trade on a major currency pairing involving the yen.

Quick Introduction

- The Japanese yen (JPY) is one of the most frequently traded currencies in the world; only the US dollar (USD) and the euro (EUR) have higher dealing volumes.

- The USD/JPY is one of the most popular major pairings, reflecting the economic strength and importance of the US and Japanese economies.

- Currency pairings can be especially volatile when the Asian trading session overlaps market opening in Europe.

- Trading forex in Japan is supervised by the country’s Financial Services Agency (FSA) – a widely respected financial agency.

Top 4 Forex Brokers In Japan

Our personal tests reveal these 4 platforms are the best for trading currencies in Japan:

How Does Forex Trading In Japan Work?

Japan’s yen is the most-traded currency in Asia, which means that the opportunities for day traders to make a profit with pairings involving this unit are immense.

Retail investors have dozens of different combinations to choose from that include the yen. They fall into the following brackets:

- Majors: The USD/JPY is the only major involving Japan’s currency.

- Minors: These include the EUR/JPY and GBP/JPY.

- Exotics: Among these are the INR/JPY and SGD/JPY.

As in other territories, Japanese traders also have the option to deal in pairings that exclude the national unit.

When you’re ready to start doing business, you can register for an account with an online brokerage and deposit funds. This financial intermediary will then provide you with the tools (like a trading platform, charting tools and educational material) to start trading currencies online.

Is Forex Trading Legal In Japan?

Currency trading is legal and regulated in Japan by the Financial Services Agency (FSA). The body sets policy and establishes the frameworks in which banks, insurers, financial services intermediaries, other financial bodies, and traders, must operate.

The FSA’s Securities and Exchange Surveillance Commission (SESC) was established “to secure fairness and transparency in markets and protect investors.” Brokers who wish to facilitate forex trading in Japan must be properly licensed and adhere to the organization’s rules.

Following the 2008 financial crisis, the FSA decided to cap the amount of leverage available to forex traders. It stands at 1:25, meaning you can control a ¥250,000 position with ¥10,000 in your trading account.

Is Forex Trading Taxed In Japan?

Any earnings made from forex trading are considered taxable income, and they must be reported to the country’s National Tax Agency (NTA).

Profits come under the bracket of miscellaneous income, and are subject to a flat tax rate of 20.315%. This comprises of national tax at 15.315% and a 5% local resident’s tax.

Japan’s tax year runs from 1 January to 31 December, and final tax returns must be submitted between February 16 and March 15 of the following year.

When Is The Best Time To Trade Forex?

Forex trading is available 24 hours a day, five days a week, regardless of where you happen to be based.

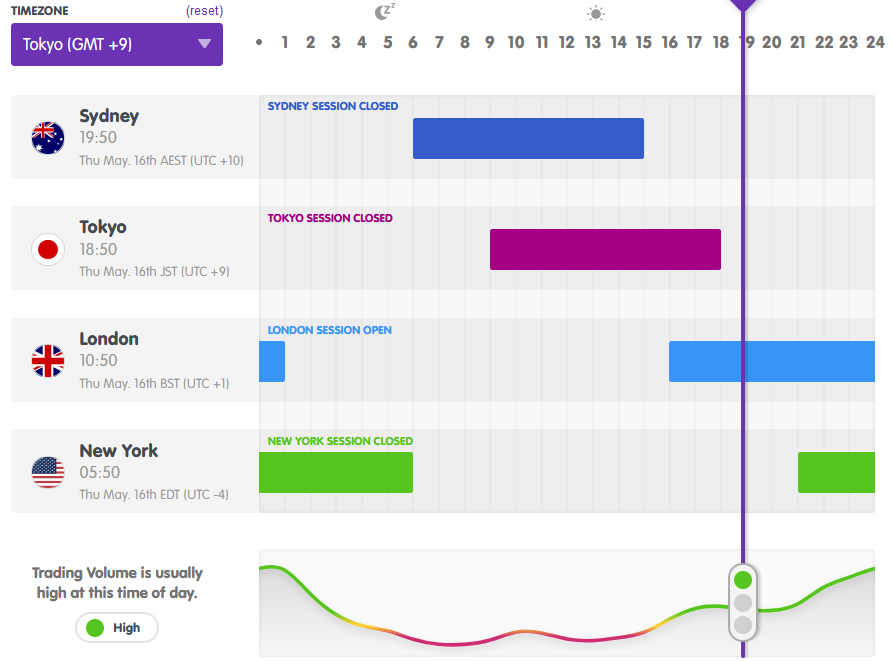

However, transaction volumes and liquidity are higher at particular times of the day, which can lead to improved short-term trading opportunities. In the Japanese Standard Time (JST) timezone, the best time to do business is arguably between the hours of 9:00 am and 6:00 pm.

The start of the Tokyo trading session at 9:00 am also marks the beginning of the broader Asian session.

As the chart below shows, the Asian trading session overlaps dealing hours in Australasia, and later in the day crosses over with markets in Europe. The improvement in liquidity and volatility that these time zone convergences provide can give forex day traders added chances to book a profit.

A Forex Trade In Action

But how do you actually go about placing a forex trade? Here’s a hypothetical example showing how a trader like me could potentially capitalize on the release of key economic data.

Pick A Pairing

There are multiple currency pairings for Japanese traders to deal in. I think the USD/JPY – which involves trading the US dollar against Japan’s yen – is an attractive pair for me to speculate on.

This forex combination is the second-most traded pair on the market, behind the EUR/USD. This lofty status reflects the colossal trade flows between both countries.

According to CME Group, more than $250 billion of goods and services are exchanged between Japan and the US each year.

As mentioned earlier, the USD/JPY is categorized as one of the world’s major pairings. Major pairings are especially popular with traders as their high trading volumes result in deep liquidity and narrow bid and ask prices.

This can reduce dealing costs and make it easier to enter and exit trades, especially for fast-paced strategies like forex day trading.

Doing My Research

I plan to capitalize on movements in the currency pairing when Japan’s gross domestic product (GDP) data is released at 8.50 am Tokyo time.

After doing some detailed homework, I expect that the growth figure will come in better than expected.

During my research, I also look at the charts for the USD/JPY pairing, using technical analysis to identify key trends and indicators, including support and resistance levels and moving averages.

Making The Trade

Having completed my research, I decide that the USD/JPY pairing may fall from its current price of 155.30. At this level, ¥1 is worth $155.30.

My prediction is that the better-than-expected data I’m forecasting will boost the Asian currency against its North American counterpart.

To profit from this movement, I’ll need to enter a short position at the current price of 155.30. This will involve simultaneously selling the US dollar, which in this case is the base currency, against Japan’s yen, which is the quote currency.

When executing the trade, I place a stop-loss order at 156.30 to manage my risk and limit losses if the yen unexpectedly falls against the buck. I also set up a take profit instruction at 153.30, which will automatically close out my position and lock in my gains if the pairing hits this level.

As predicted, the GDP data surpasses analyst estimates, driving the yen higher in the process. After several few hours, the USD/JPY has dropped to my take profit level of 153.30, giving me a 200-pip gain.

Bottom Line

Forex trading is incredibly popular in Japan. The market is extremely well-developed and regulated, and day traders have a wide variety of pairings they can deal in through a large selection of brokerages.

Japanese investors can choose to trade currencies at any time of the day. However, doing business when the Asian trading session crosses over with those of Australasia and Europe can be especially attractive due to higher trading volumes.

Recommended Reading

Article Sources

- Foreign Exchange Turnover - Bank of International Settlements

- Forex Currency Pairs – CMC Markets

- Japanese Yen – CME Group

- Top 10 Most Traded Currency Pairs – IG Group

- Japan: Individual – Income Determination - PwC

- Notes on foreign currency deposits - SMBC Trust Bank

- Final Tax Return – National Tax Agency

- Financial Services Agency Pamphlet – Financial Services Agency

- Margin Regulations – The Financial Futures Association of Japan

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com