Joint Brokerage Accounts

Joint brokerage accounts allow multiple individuals to contribute funds and make trades using the same profile. This review ranks the best joint brokerage accounts. Our experts also unpack the different types of joint trading accounts, their benefits, drawbacks, plus rules on taxes. Find out how to compare joint brokerage accounts in 2025.

Best Joint Brokerage Accounts

What Is A Joint Brokerage Account?

A joint brokerage account is a type of trading account that allows two or more people to pool their money and invest it in stocks, bonds, and other securities.

Importantly, all account holders have equal ownership and control over the investments made in the account. They can be used by couples, business partners, parents and children, and other family members.

Compared to an individual brokerage account, which is owned and managed by a single person, a joint account allows users to spread trading risk and combine resources for larger investments.

How Does A Joint Brokerage Account Work?

Joint accounts allow traders to combine their funds and trade together. However, each account holder has the ability to make their own trading decisions within the account. This means that one account holder can buy and sell securities without the approval or consent of the others.

In terms of fees, joint brokerage accounts generally operate like individual trading accounts, including at IG and Saxo. However, some brokers may charge additional fees for joint accounts, including for account maintenance or additional account holders. E-Trade, for example, charges a $25 fee for each person added to an existing account.

There are also different types of joint brokerage accounts in some countries, including Joint Tenants with Rights of Survivorship (JTWROS) and Tenants in Common (TIC):

- JTWROS accounts are commonly used by spouses or domestic partners, and they provide each account holder with an equal share of the account. If one account holder dies, their share automatically passes to the surviving account holder(s).

- TIC accounts can be used by non-spouses, business partners, or family members. Each account holder has a specific percentage of ownership in the account, which can be unequal. If one account holder dies, their share of the account passes to their designated beneficiary rather than automatically transferring to the other account holders.

How Do Taxes Work On Joint Brokerage Accounts?

An important consideration when opening a joint brokerage account is the tax implications. The Internal Revenue Service (IRS) in the US treats joint brokerage accounts as shared property, meaning that all income and capital gains earned on investments are split equally between the account holders.

This can have an impact on each account holder’s tax and gift liability, so it’s important to be aware of laws in your jurisdiction. You can also consult a local tax professional for guidance.

How To Compare Joint Brokerage Accounts

With multiple brokers offering joint trading accounts, it can be difficult to identify the best provider. Here are the key factors to consider when comparing joint brokerage accounts:

- Investment products: Do you want to trade stocks, bonds, mutual funds, or ETFs? Do you want to speculate on other instruments like forex? Fidelity does not offer forex products, for example, while IG and Zerodha offers dozens of currency pairs.

- Fees: Compare account minimums, trading fees and any additional costs that may be charged to operate joint brokerage accounts. Saxo offers joint accounts with low minimums and no annual fees. However, Vanguard charges a $20 annual service fee for brokerage accounts with balances under $10,000.

- Trading tools: Compare the online platforms and trading tools offered by each broker. Good features to look out for are customizable charts, technical indicators and drawing tools, instant and pending order types, plus a mobile-compatible app. Tip: a demo account can be a good way to try a new platform.

- Managed account options: If you are interested in having your joint capital managed for you, compare the managed account solutions available. IG, Fidelity, and Charles Schwab all offer managed accounts, including IG’s Smart Portfolios, Fidelity’s Portfolio Advisory Services and E-Trade’s Adaptive Portfolio, which use robo-advisors to manage investments for a fee.

- Customer service: The best brokers with joint brokerage accounts offer hassle-free access to their customer support team, either 24/5 or 24/7. IG and Saxo both offer live chat, email assistance and a telephone helpline.

How To Open A Joint Brokerage Account

- Choose a trading firm: Compare brokers with joint trading accounts to find a provider that aligns with your goals and requirements. Alternatively, choose from our list of the best brokerage accounts.

- Gather personal information: Collate personal information for all the account holders, including their full name, social security number, date of birth, and contact information. This will be needed to complete KYC verification so you can gain access to all benefits and features of the account.

- Complete application: Fill out the brokerage’s application form, providing all the required information. Submit any requested documentation, such as identification or proof of address, for all account holders.

- Fund the account: Deposit money into the account using the payment methods accepted by your broker, such as wire transfer or cheques. Some brokers with joint trading accounts also accept the Automated Customer Account Transfer Service.

- Trade: It may take up to two business days for the broker to process and accept your application. Once this is done, you can all sign into the platform and start trading from the account.

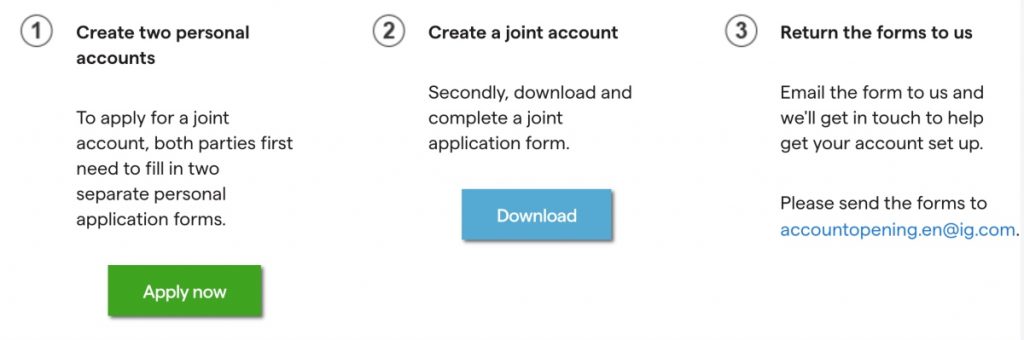

Note, the specific steps and requirements may vary by brokerage, as demonstrated by the registration process at IG below. You can always check with customer service for more information.

Benefits Of Joint Brokerage Accounts

There are several reasons why traders may feel a joint brokerage account best meets their needs:

- Shared ownership and responsibility: With a joint trading account, individuals can pool more money for investing. Additionally, each account holder has an equal say in trading decisions, which also means combining skills and experience.

- Asset/property planning: For married couples or domestic partners, a joint brokerage account can be a useful tool for estate planning. With most joint brokerage accounts, ownership of the account passes automatically to the surviving account holder if one dies, which can simplify the process of transferring assets.

- Ease and transparency: For families or business partners who share financial responsibilities, a joint brokerage account can simplify record-keeping and make it easier to track investment activity and tax reporting.

Drawbacks Of Joint Brokerage Accounts

There are also potential drawbacks to joint brokerage accounts:

- Agreement: Joint account holders must agree on certain investment decisions, which can lead to disagreements if all parties do not have similar financial goals or risk tolerance.

- Trust: Joint accounts typically require all account holders to have access to personal information and trading history, which may be a drawback for those who prefer to keep information private.

- Liability: In a joint trading account, all users are jointly liable for any losses or potential legal issues related to the account. This means that if one account holder makes a risky investment that results in losses or faces legal action, all account holders may be impacted.

- Disentanglement: In the event of a breakup or divorce, dividing assets held in a joint account can be complex.

Final Word On Joint Brokerage Accounts

Joint trading accounts allow two or more people to make investment decisions together, or separately, using one account. This can work well for couples, business partners, or other family members looking to expand their assets together. Joint brokerage accounts also offer transparency and ease for those who don’t want to keep their finances and personal information separate.

Head to our ranking of the best brokerage accounts to start trading.

FAQs

Can Joint Brokerage Accounts Have Beneficiaries?

Yes, joint brokerage accounts can have beneficiaries. In the event of the death of one or more account holders, the surviving account holder(s) or designated beneficiary can take ownership of the assets in the account.

What Is The Best Joint Trading Account?

The top brokerage accounts offer easy account management between the various users, low trading fees, access to multiple assets such as stocks, bonds and ETFs, plus reliable customer support in the event of any issues. Use our reviews of the best joint brokerage accounts to compare trading firms.

Can I Transfer Joint Brokerage Account To An Individual Account?

Yes, it is possible to transfer a joint brokerage account to an individual trading account. However, the process varies depending on the broker, and there may be tax implications for doing so.

What Happens To A Joint Brokerage Account In The Event Of Divorce?

In the event of divorce, the joint brokerage account may be divided according to the divorce settlement agreement. If the account is not divided, it will continue to be owned jointly by the former spouses, unless one spouse removes themselves from the account or closes it entirely. The specifics will need to be decided by the couple.

Are There 3 Way Joint Brokerage Accounts?

Yes, it is possible to have a joint brokerage account with three or more account holders. With ETrade for example, to have three account holders, you open an individual account, and then pay $25 for each additional person, which in this case would be $50 in total.

How Are Joint Brokerage Accounts Taxed?

Specific taxation laws differ between countries and jurisdictions. However, joint brokerage accounts are typically taxed as a “joint tenancy with right of survivorship.” This means that each account holder is responsible for paying taxes on their portion of the account, and if one account holder passes away, their portion of the account transfers to the surviving account holder(s).