Best Forex Brokers In Jamaica 2025

Interest in trading currencies online has increased across Jamaica in recent years and is overseen by the Bank of Jamaica (BoJ) and the Financial Services Commission (FSC).

Explore our list of the best forex brokers in Jamaica, selected by our experts for their excellent range of currency pairs, competitive pricing, and convenient funding for deposits in the Jamaican Dollar (JMD).

5 Top Forex Brokers In Jamaica

We have exhaustively reviewed and compared brokers from our extensive database to find the best 5 forex platforms that accept traders from Jamaica:

Here is a short overview of each broker's pros and cons

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

- Pepperstone - Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

- Eightcap - Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

Best Forex Brokers In Jamaica 2025 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| XM | 55+ | 0.8 | / 5 | $5 | ASIC, CySEC, DFSA, IFSC |

| Vantage | 55+ | 0.0 | / 5 | $50 | FCA, ASIC, FSCA, VFSC |

| IC Markets | 75 | 0.02 | / 5 | $200 | ASIC, CySEC, FSA, CMA |

| AvaTrade | 50+ | 0.9 | / 5 | $100 | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Pepperstone | 100+ | 0.1 | / 5 | $0 | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Eightcap | 50+ | 0.0 | / 5 | $100 | ASIC, FCA, CySEC, SCB |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

|---|---|

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of <2 minutes and now a growing Telegram channel.

Cons

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- Although trusted and generally well-regulated, the XM global entity is registered with the weak IFSC regulator and UK clients are no longer accepted, reducing its market reach.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Bonus Offer | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme |

|---|---|

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:500 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- The low minimum deposit of $50 and zero funding fees make this broker a great choice for new traders

- The ECN accounts are very competitive with spreads from 0.0 pips and a $1.50 commission per side

- There are no short-term strategy restrictions with hedging and scalping permitted

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- Unfortunately, cryptos are only available for Australian clients

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| GBPUSD Spread | 1.5 |

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 100+ |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| GBPUSD Spread | 0.1 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.1 |

| Total Assets | 50+ |

| Leverage | 1:500 |

| Platforms | MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, the innovative algorithmic trading platform Capitalise.ai, and more recently the 100-million strong social trading network TradingView.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

Cons

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- Eightcap needs to continue bolstering its suite of instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

How We Rate Forex Brokers In Jamaica

Trust

The most important step when choosing a forex broker should always be to make sure it’s a legitimate outfit. This is especially important given that Jamaica’s FSC has warned of fraudulent investment schemes that promise “guaranteed high returns” but are built on shady operations.

That’s why we only recommend forex trading platforms we trust, after balancing their regulatory credentials with their years in the industry and our own observations during the testing process.

- AvaTrade stands out with a 4.9/5 trust rating owing to its 20-year track record of providing secure forex trading services and licenses from ‘Green-Tier’ regulators, notably the ASIC and CySEC.

Forex Markets

Jamaican Dollars are not commonly traded online, especially compared to leading currencies like the US Dollar and Euro.

However, the best forex brokers still provide a wide selection of forex pairs, providing short-term trading opportunities on a diverse range of currencies and economies, for example, those from nearby Latin America and North America.

Our minimum expectation for a good forex broker is 50 currency pairs, but you’ll find outstanding platforms with 70, 80 or more pairs, catering to advanced traders looking to speculate on volatile exotics, such as the USD/MXN.

- FOREX.com’s 80+ currency pairs remain the best range in our toplist for forex traders in Jamaica, including assets from Latin America, notably the USD/MXN, EUR/MXN and GBP/MXN.

Trading Fees

Choosing a forex broker with excellent pricing, notably tight spreads and low to zero commissions, is critical for short-term currency traders in Jamaica. Even small differences in fees will add up over time, impacting your overall profitability.

That’s why for every forex trading platform we test, we record and assess spreads on popular currency pairs, notably the EUR/USD, EUR/GBP and GBP/USD. Then we investigate non-trading fees, for instance, conversion charges if you fund your forex account in Jamaican Dollars.

Finally, we balance price with quality. This is because we’ve learned that sometimes it can be prudent to pay more for analyst insights and financial calendars that highlight economic releases that could affect the value of the Jamaican Dollar, for example.

- IC Markets maintains its position as one of the lowest-cost forex brokers in Jamaica, featuring consistently low spreads of 0.1 pips on the EUR/USD, alongside cash rebates up to $2.50 per forex lot for active traders.

Charting Platforms

Selecting a forex trading platform with well-designed, reliable charting tools is essential, especially for short-term trading strategies.

Powerful third-party options, such as MetaTrader 4 and MetaTrader 5, are our top picks for experienced forex traders because they provide sophisticated tools for planning and executing fast-paced strategies, including support for automated forex trading.

However, newer options like TradingView offer similarly powerful charting tools but with a more user-friendly design and a huge social investment network.

We test the trading platforms of every forex broker we recommend to Jamaican traders, evaluating their usability, analytical tools and the overall environment for day traders.

- Vantage stands out with MT4, MT5 and TradingView, plus its own ProTrader solution that sports a slick design we love using with an excellent charting package, integrated technical summaries, analyst views and financial news.

Account Funding

Most forex brokers do not support accounts in Jamaican Dollars (JMD), meaning you may need to transfer funds to an account based in the US Dollar (USD), for example. As such, it’s important to have access to secure and convenient deposit methods.

Despite cash remaining prevalent in Jamaica, Our Today reported growing interest in electronic payment methods and mobile wallets, with Lynk emerging as the most popular funding option.

As well as checking forex brokers support convenient deposits and withdrawals, we also verify that the minimum deposit is accessible. Our findings show most forex brokers accept traders from Jamaica with a minimum deposit up to 250 USD, around 40,000 JMD.

- Fusion Markets stands out with its 15+ payment methods, including convenient options for Jamaican forex traders like Jeton. There is also no minimum deposit, catering to budget traders.

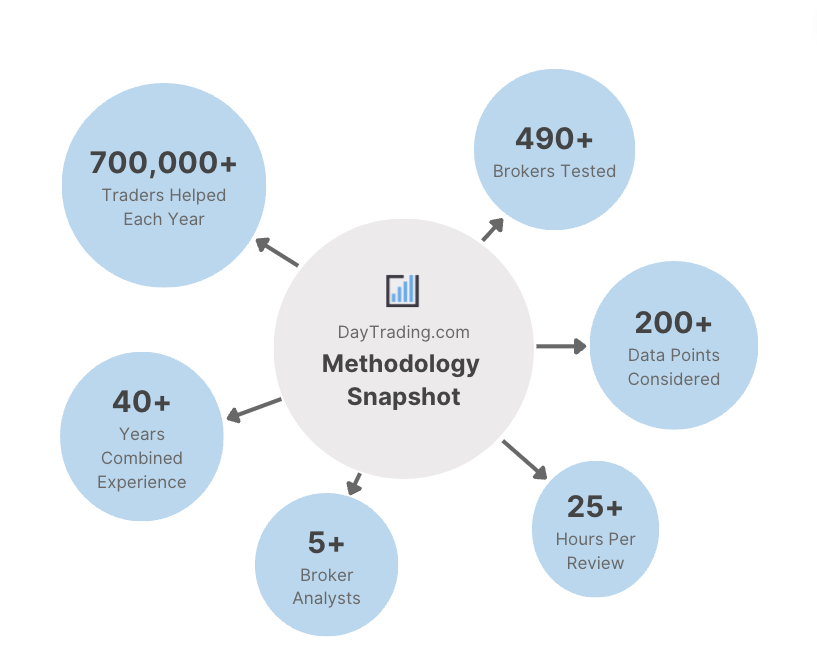

Methodology

To identify the top forex trading platforms in Jamaica, we first found all the brokers accepting Jamaican traders and then ranked them by their total rating, which considers key areas, notably:

- Licenses from trusted regulators, if not the BoJ or FSC then top-tier bodies in other jurisdictions.

- A great range of currency pairs, including those of interest to Jamaicans from Latin America and the US.

- Secure, hassle-free deposits for Jamaican forex traders, including accessible minimum investments of <$250.

- Easy-to-use charting platforms with analytical tools to help capitalize on short-term trading opportunities in the foreign exchange market.

- Excellent trading fees with tight spreads on popular currency pairs and no hidden charges.

FAQ

Is Forex Trading Legal In Jamaica?

Forex trading is legal in Jamaica. However, the country’s financial regulators are less active than many bodies, such as the FCA in the UK or ASIC in Australia. As a result, many Jamaicans sign up with international forex brokers.

Make sure you pay any taxes due on forex trading in line with the Tax Administration Jamaica.

Who Regulates Forex Trading In Jamaica?

Jamaica’s financial markets are overseen by the Bank of Jamaica (BoJ) and the Financial Services Commission (FSC), including brokers that offer retail investors access to the foreign exchange market.

How Much Money Do I Need To Start Day Trading Forex In Jamaica?

After years of reviewing forex brokers in Jamaica we’ve found that most reputable trading platforms have a minimum deposit of up to 250 USD, around 40,000 JMD.

That said, XM is one of the highest-rated forex brokers in Jamaica and only requires a $5 deposit, around 750 JMD, making it an excellent option for traders with less starting capital.

Recommended Reading

Article Sources

- Bank of Jamaica (BoJ)

- Jamaica's Financial Services Commission (FSC)

- Tips For Avoiding Investment Scams - FSC

- Tax Administration Jamaica

- Growing Payment Methods In Jamaica - Our Today

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com