CFD Trading In Italy

Italy’s small but dedicated retail trading community capitalize on the country’s burgeoning service, agricultural and manufacturing sectors by trading contracts for difference (CFDs) with high leverage and large portfolios compared to their EU neighbors.

To join the growing class of active traders in Italy and speculate on the price movements of the euro, stocks like Ferrari and other global financial markets, dive into our beginner’s guide to CFD trading in Italy.

Quick Introduction

- CFDs allow traders to speculate on rising and falling prices of Italian and global stocks, forex pairs, commodities, indices, ETFs, cryptocurrencies and more without owning the assets.

- Traders turn to leverage to boost the size of their CFD position using borrowed funds. The amount of leverage available in Italy is limited by European regulations to a maximum of 1:30 – meaning you need to stake 3.33% of the total position size.

- Italy’s CFD trading sector is overseen by the Commissione Nazionale per le Società e la Borsa (CONSOB), a green-tier organization in DayTrading.com’s Regulation & Trust Rating.

- Profits from CFD trading in Italy are considered capital gains and are usually taxed at a flat rate of 26%. CFDs based on some Italian shares and indices may incur a separate Italian Financial Transactions Tax (IFTT) known as the Tobin Tax.

Best CFD Brokers In Italy

Through in-depth tests and analysis, we've identified these 4 providers as the best for CFD traders in Italy:

How Does CFD Trading Work?

Contracts for difference are simply that – agreements in which one party pays the other the difference in the price of an asset between the start and end of the contract.

Suppose you think that Italy’s main stock index, FTSE MIB (Milano Indice de Borsa) will rise in value. You could place a bet on this by opening a CFD on an ETF that follows that index, such as the iShares FTSE MIB UCITS ETF.

The ETF is worth EUR 20, so you buy 10 shares worth EUR 200. If the price rises by 10% to EUR 22 and you end the contract, you will earn around EUR 20 (22-20=EUR 2 per share, the difference between buy and sell price; minus any brokerage fees) without actually buying and selling the stock – the profit is based entirely on the price difference at the start and end of the contract.

But if the price were to fall by 10% when you end the contract, you lose EUR 20. However, it is possible to profit from downward price movements by opening a short position with a ‘Sell’ CFD.

A great advantage of CFDs for day traders in Italy is the use of leverage, which boosts the size of your trading position using borrowed funds.

By depositing EUR 200 and using 1:5 leverage (Italy’s maximum for ETFs), you can open a position worth EUR 1000. A 10% price rise would net you EUR 100 in profit (minus brokerage fees), five times higher than the gains you’d make without using leverage.

Is CFD Trading Legal In Italy?

CFD trading is legal in Italy, where it is regulated by the Commissione Nazionale per le Società e la Borsa (CONSOB), the country’s financial regulatory authority.

CONSOB is responsible for overseeing and enforcing regulations for trading service providers operating in the Italian market, ensuring a fair and transparent environment for CFD traders.

As an EU member, Italy also falls under the regulatory framework of the European Securities and Markets Authority (ESMA). This provides Italian CFD traders with additional protections, as well as extending protections by other European regulators that are covered by ESMA.

ESMA has strict rules for trading CFDs, including leverage restrictions. The leverage for major currency pairs is capped at 1:30, while lower leverage limits apply to more volatile assets.Leverage of 1:20 is available on minor currency pairs, gold and major indices; the limit for commodities and non-major indices is 1:10; stocks and ETFs are limited to 1:5 and cryptocurrency leverage is capped at 1:2.

CFD providers are also required to provide negative balance protection, ensuring that clients can’t lose more money than they have deposited in their accounts through leveraged trading.

Other rules around CFD trading include a ban on incentives, restrictions on marketing CFDs, and standardized risk warnings. These measures are designed to prevent reckless trading and ensure traders are well-informed.

Is CFD Trading Taxed In Italy?

Profits from CFD day trading are generally considered as capital gains in Italy, and are taxed at a flat rate of 26%.

Additional taxes may be levied on stock trades of Italian companies with a market capitalization of EUR 500 million or more.

The tax will usually be applied by the broker when the trade is executed. It incurs a flat fee based on the size of the trade, starting at EUR 0.25 for trades worth EUR 0–2500, and rising progressively to EUR 200 on trades worth EUR 1 million or more.

Getting Started

These are the essential first steps that every trader in Italy should make to ensure a flying start:

- Find a trustworthy broker: You need to know your money is in reliable hands and the broker you use isn’t tipping the scales against you. Sign up with a CFD provider recommended by our experts that’s licensed by CONSOB or another top EU regulator.

- Register and fund your account: Choose a firm with a solid presence in Europe and you will have no trouble signing up – just supply valid ID such as your carta di identità elettronica (CID), as well as proof of address and anything else required. Many excellent firms in Italy accept euro payments through convenient e-wallets – the most popular is PayPal – or you can use your debit card or bank transfer.

- Choose your markets: Whether you want to take advantage of Italy’s industrial strength through a stock like Enel, or to trade a famous brand like Hermes or Ferrari, you’ll need to study your chosen markets carefully to trade successfully. Turn to an excellent charting platform and research tools to get going.

Example Trade

Let’s dive straight into CFD trading in Italy with an example of how a trade might play out.

CFD traders look for indications that there will be significant short-term price movements – be that an upcoming earnings report or a signal gleaned through technical analysis.

In this case, I am awaiting the Q2 earnings call of Italian banking conglomerate UniCredit (BIT: UCG), which I expect to have performed strongly – perhaps even better than forecasts.

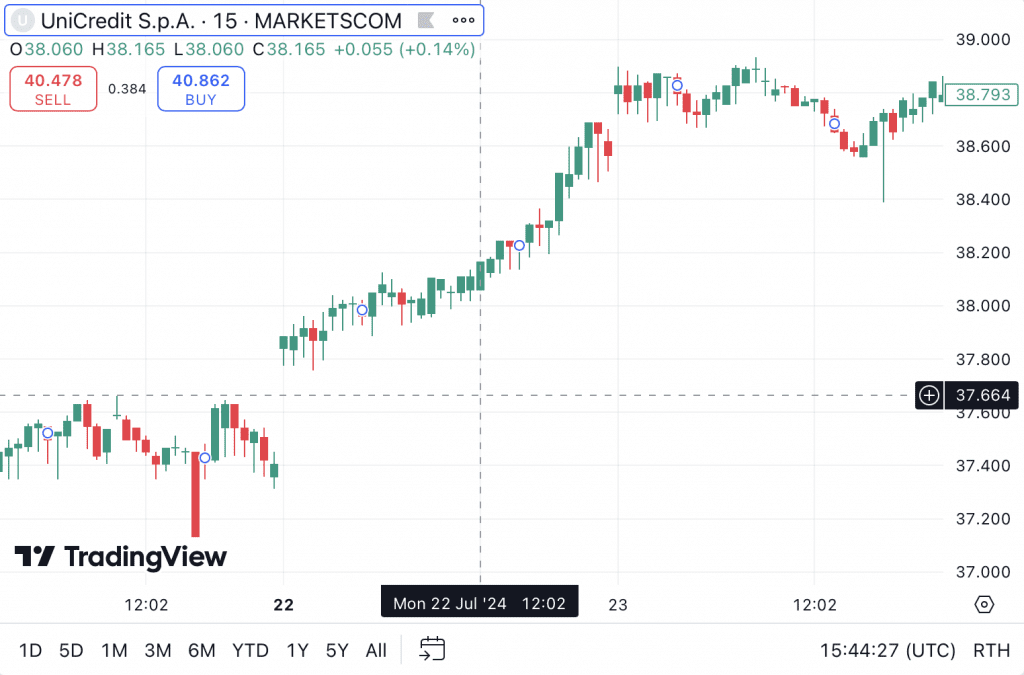

However, I am not alone in this prediction. The stock has performed well in the run-up to the earnings call, rising by nearly EUR 1.4 to around EUR 38.8. This long interest indicates that many people agree with my prediction that UniCredit’s earnings will be positive.

When you’re day trading CFDs, the economic factors behind an asset’s performance are not the only thing that influences the price: fluctuations are driven by the decisions of institutions and individuals who are choosing to buy or sell the asset.

This can lead to a lot of volatility in advance of an expected event as traders look to beat the market by closing trades early or by opening counterintuitive positions.

Traders may, for example, sell in advance of or just after a positive earnings call because they want to lock in profits gained in the run-up to that event; this is sometimes described as “buying the rumor and selling the news.”

That’s why I wait to see how the market reacts on the morning before the earnings call. As predicted, there’s a good deal of volatility and the price dips by around EUR 1, wiping out most of the gains made over the last week.

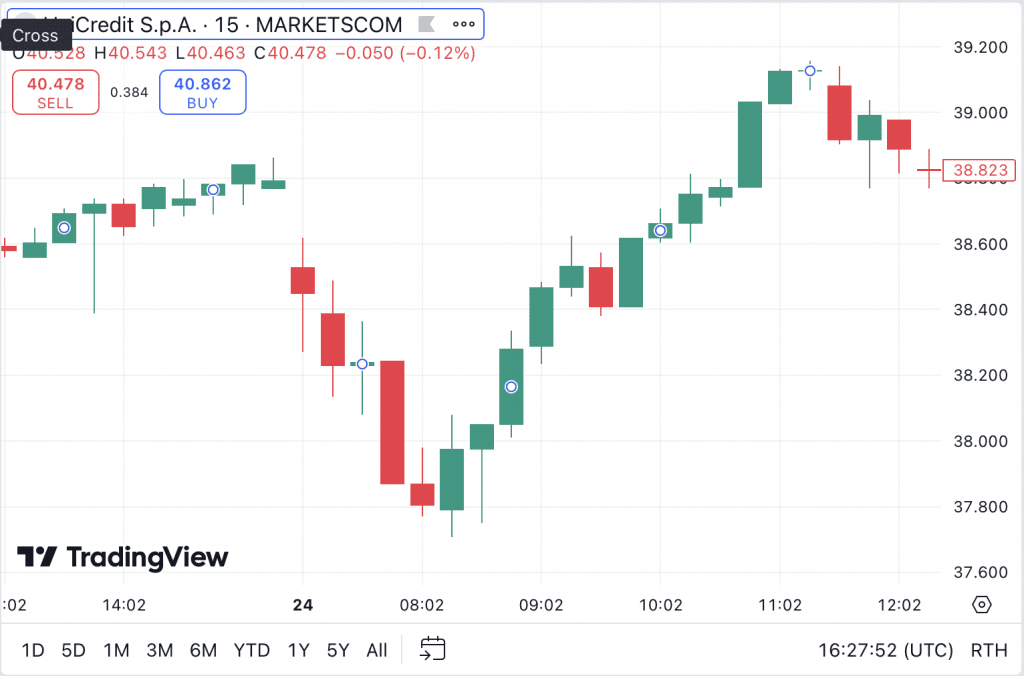

But I’m still upbeat on this stock and the earnings call, which is scheduled for 10:00AM. Aiming to profit from a reversal, I’ve set a limit order that fills at EUR 38. The stock continues to drop to around EUR 37.8, but this is still some way off the stop-loss order that I’ve set at EUR 37.6.

This is a tight risk management strategy that I prefer when day trading CFDs as it minimizes losses I can take on any one position, protecting my overall trading funds.

Within two hours, and before earnings have even been announced, the price reverses and hits my take profit order of EUR 38.4, netting me a profit of EUR 0.4 per share – a modest profit, but one that fits into my preferred cautious trading style.

Bottom Line

Italy is a fantastic location to trade CFDs because of the retail-trader-friendly regulatory environment, with oversight provided by the trusted CONSOB and the option to trade with brokers that are regulated by equally strong European bodies.

Italy’s diverse and well-established markets are an added benefit for CFD traders, who will have their pick of strong stocks, highly liquid EUR pairs and major indices as well as the full range of global assets.

To get started, turn to DayTrading.com’s choice of the best CFD trading platforms.

Recommended Reading

Article Sources

- Commissione Nazionale per le Società e la Borsa (CONSOB)

- European Securities and Markets Authority (ESMA)

- Italian Financial Transactions Tax (IFTT)

- UniCredit (BIT: UCG)

- Italian traders favor high leverage and large portfolios – Finance Magnates

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com