Iron Brokers 2025

Trading iron ore is a popular choice for commodities investors. It is both a widely traded commodity with liquid markets and a highly volatile asset, demonstrated through price fluctuations between a peak of $161 and a low of $80 from April to November 2022. This guide to trading iron ore will detail the instruments available, factors that influence its price and strategy tips. Our experts have also reviewed and ranked the best iron brokers.

Best Brokers For Trading Iron

These are the 3 best brokers for trading Iron:

Iron Trading Basics

Iron ore is the raw material used to create metallic iron and its by-products – mainly steel. Iron is one of the most important metals in the world, as commodities expert and research analyst Jeffries Christopher LeFemina put it in 2009: “iron ore may be more integral to the global economy than any other commodity”. As a demonstration of its importance to the world, the Business Research Company valued the global iron ore market at 405 billion USD in 2022.

The biggest producers of iron ore are Australia, Brazil and China, which contributed to 67% of the world’s global production in 2020, according to the U.S. Geological Survey published in 2022. That year, Australia produced 912 million metric tons, Brazil produced 338 million metric tons and China produced 360 million metric tons of the metal ore.

Look for the 62% Fe symbol when trading iron ore.

History

After the end of World War Two, iron ore prices were agreed upon at the beginning of the calendar year each January in closed meetings between miners and steelmakers, who set out a benchmark price for the year. This is generally how the pricing model worked for decades, until the 21st century when many stakeholders in the supply chain demanded more transparency.

Alongside demands for more frequent pricing agreements, this led to an impetus for change, and the introduction of iron ore swaps clearing on several international exchanges. At the same time, several of the world’s largest iron ore producers switched from the annual benchmark to a quarterly index-based pricing system.

Price Chart

What Influences The Price Of Iron?

Two key factors impact iron ore trading today:

China’s Economy

Even though China produces the third-largest volume of iron ore in the world, it still needs to import vast amounts to meet demand. According to World’s Top Exports, China alone accounted for 70% of the world’s iron imports in 2021.

As China is so important to the iron ore market, changes in demand and the country’s economy can lead to large swings in the metal’s spot price. For instance, China’s five-year plan that was released in 2022 announced the desire to complete 102 major infrastructure projects. This higher demand for iron to produce steel to be used for these projects could lead to an increase in iron ore value and stock prices of companies in the iron ore supply chain.

Supply Chain Impacts

When evaluating the price of iron ore, you should also consider the impact that changes to the supply chain can have. One example of this is the Russian and Ukrainian conflict in 2022. Russia and Ukraine have the third- (25 billion tonnes) and fifth- (6.5 billion tonnes) largest iron ore reserves in the world, respectively, and are the biggest producers in Europe. This conflict restricted exports, causing the spot price of iron ore to increase – within just two weeks of the beginning of the Russian invasion, it jumped by approximately 15%.

You should also look out for Australia and Brazil as production in both countries can be affected by adverse weather such as storms or cyclones. For instance, in February 2021, heavy rain in Brazil meant that production in certain regions came to a halt, reducing export shipments by around 10%. Because of this reduction, the price of iron ore increased to $174 by 1 March, a $19 increase from 1 February.

Iron Trading Instruments

Compared to other commodities, there are fewer ways to invest in iron ore. Below are some of the most popular trading vehicles with retail investors.

Iron Ore Futures

Iron ore futures are a relatively recent innovation. A futures contract is a derivative where the two parties agree to complete a transaction at a set price at a later date. Iron ore futures contracts are available in a range of contract lengths that can range up to years.

The Chicago Mercantile Exchange and others offer cash-settled contracts, meaning that the buyer is not required to take physical possession of the commodity on contract expiry. Many exchanges allow traders to close their contracts on any day up to and including the last trading day of the contract.

Iron Ore Options

Iron ore options work in a similar way to futures, the key difference being that you have the choice of whether or not you trigger the contract. Because of this, investors are not necessarily obligated to complete the transaction, which makes iron ore options attractive for hedging.

Iron ore options are ultimately derivatives that allow you to profit from both increases and decreases in price. If you think the price of iron ore will increase, you would open a call contract and if you think the price will decrease, you would open a put contract.

Iron Ore CFDs

CFDs (contracts for difference) are a popular derivative among day traders and are widely available from online brokers. They allow speculation on a wide range of assets’ price movements without requiring the actual purchase of the underlying assets.

CFDs usually require a small amount of capital compared to futures and options, and they can be traded with leverage, meaning you can greatly increase your trading power with relatively small stakes.

For instance, a stake of $100 with 1:10 leverage means that the value of the trade is $1,000, rather than just $100 – though it is important to note that this also multiplies losses to the same degree.

Iron Ore Stocks

If you do not want to invest directly in iron ore, you can trade stocks of companies that mine iron ore or are involved in the supply chain. Rio Tinto, Vale and BHP are three of the biggest producers of iron ore in the world. Another example is Glencore, which markets iron ore globally.

These companies’ stock prices are influenced by the same factors that affect iron ore prices, though they are also likely to be affected by other factors. For example, Rio Tinto has investments in the production of other commodities including copper and aluminium.

Stock prices can be impacted by factors relating to how they operate. For example, quarterly earnings reports, revenue forecasts and changes in leadership.

Iron Ore ETFs

Through ETFs (exchange-traded funds) investors can trade multiple assets related to iron ore at once. A good example is the iShares MSCI Global Metals and Mining Producers ETF with stocks such as BHP Group and Rio Tinto.

One key benefit of investing in an ETF is that it is made up of several securities and so may be less susceptible to large price swings. For example, in the instance that iron ore decreases in trade value, the other assets that make up the ETF may stay the same or even increase. In that situation, because the fund is diversified, the overall value of the ETF may not change that much.

On the flip side, if the price of iron ore soars but the other assets that make up the ETF do not, you will not see as much benefit. For this reason, many use ETFs as long-term investments.

Iron Trading Strategies

Fundamentals

Iron ore’s price movements are influenced to a large degree by fundamental aspects and news events. For instance, news about a poor weather forecast that could impact iron ore production is likely to lead to increases in trading iron prices. It can be hard to judge these events as it is not always clear how certain news or announcements will impact the price, if at all, and there may be numerous events with conflicting impacts.

Even so, you should consider subscribing to a news publication or following commodities trading experts on social media as a good way to stay informed.

Scalping

Scalping is a high-frequency day trading strategy where you capitalize on small movements over a short period. As you are looking for very small changes in iron ore’s value and as you make so many trades, the small profits begin to add up and make the strategy viable.

To have a better chance of success, it is important to trade with low slippage and high liquidity as margins are tight and execution delays could cut into or even wipe out profits.

Trade On Momentum

This iron ore trading strategy involves looking for periods where either positive or negative trends have enough momentum that they break past a typical price range.

For example, if an iron ore instrument has strong positive momentum as it approaches a resistance level, you can open a long CFD trade assuming the price trend will continue. Close the contract in good time to lock in profits before there is a reversal.

How To Start Trading Iron Ore

Pick An Instrument

Your first step should be determining how you want to start trading iron ore. When choosing a trading vehicle, look at all the available options and play to your strengths. For example, if you struggle with the elevated risk that comes with the high volatility of iron ore, it may be better to stick with an ETF. As exchange-traded funds are diversified with many different assets, their prices are less likely to see a massive swing if iron ore rapidly increases or decreases in price.

Alternatively, for active day traders, leveraged CFDs are a good way to capitalize on sharp price fluctuations.

Select A Broker

The next step is to choose iron brokers that offer the trading vehicle you are interested in. Consider several factors before settling on an iron broker – the trading platform, fees, mobile app download, login security, registration process, and overall investing experience.

Many brokers such as IG which offers iron ore CFDs, allow their clients to register for a free demo account. These paper trading accounts are a great way to test out the broker’s platform and practice trading iron ore risk-free before using real capital.

Comparing Iron Ore Brokers

- Fees – look for online iron ore brokers with low or zero commissions and a tight spread. Also keep an eye out for additional costs in the form of account maintenance or inactivity fees, withdrawal charges, currency exchange fees and so on.

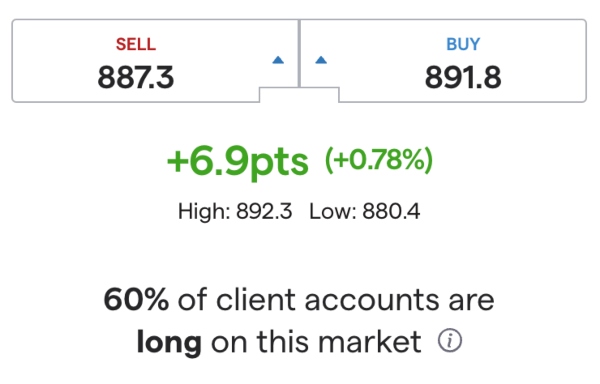

- Trading platform – Sign up with iron brokers that offer a third-party trading platform you are happy using, or a proprietary platform that is user-friendly, responsive and feature-rich. Some brokers including IG also offer insights into whether traders are long or short on the metal, as shown below.

- Range of assets – Most traders will not only want to deal with trading iron ore. Look for a broker that has a range of commodities or assets in other classes to ensure you are not limited and can build a diverse portfolio.

- Customer service – If you have an issue with your account or one of your trades, a fast and competent customer service department can make a big difference. The best iron ore brokers should have a hotline open at least during working hours, as well as live chat and informative FAQ sections.

Execute A Trade

Once are comfortable with your broker and have researched relevant iron trading strategies, it is time to open a position. The steps to do this will depend on your iron ore broker’s platform – you should be able to find step-by-step walkthroughs on your broker’s website, on YouTube or the platform developer’s site.

Importantly, mitigate risks whenever possible, so try to find a brokerage with negative balance protection and implement stop loss and take profit orders if you are trading iron ore on margin.

Your platform may also offer additional tools such as expert advisors (EAs). These are trading robots that complete technical analysis and trading on your behalf so you do not need to spend as much time reviewing charts to identify suitable entry and exit positions. EAs can be particularly useful for high-frequency iron ore investing strategies where many trades are opened and closed in a short space of time.

Pros Of Trading Iron

- A highly volatile asset with profit potential

- Variety of iron trading instruments available to retail investors

- Multiple iron trading strategies are viable at the best brokers

Cons Of Trading Iron

- Lack of transparency on spot prices due to trade agreements being made behind closed doors

- Price can be greatly affected by global events that are hard to predict

- Limited legit brokers offer iron ore trading

Trading Hours

Iron ore trading hours depend on the commodity exchange that you are using. Iron ore futures contracts from CME Group, for example, can be traded between Sunday at 6:00 pm and Friday at 5:00 pm EST with a one-hour break at 5 pm each day.

However, there is a great degree of variation between exchanges, and iron brokers often set their own hours for commodities trading.

Final Word On Trading Iron

Iron ore trading is a potentially lucrative investment opportunity. With such large and frequent price swings, there are many instruments and companies that you can trade on and turn a profit with. If you are new to iron or commodities in general, it is worthwhile taking the time to review strategies and gain a thorough understanding of iron ore market economics.

Head to our table of the best iron brokers to get started.

FAQs

What Is Iron Trading?

Trading iron involves investing in the price of iron ore either through instruments such as futures and CFDs or through iron ore companies and related stocks. Iron is one of the most important metals in the world today as it forms a vital part of infrastructure projects with around 98% of all iron used to produce steel.

What Instruments Can I Trade Iron Ore With?

You can start trading iron ore using derivatives like CFDs, which are used to make speculative trades directly on the metal’s price movements. Alternatively, you can invest in iron ore mining companies or iron ETFs, though these are influenced by factors not purely related to iron ore so you need to be careful to take these into account.

Where Can I Complete Iron Ore Technical Analysis?

Platforms such as TradingView are good resources for conducting technical analysis and plotting trades. Other popular platforms include MetaTrader 4 and MetaTrader 5, which have a range of charts and indicators to support with trading iron ore.

Where Are Iron Ore Trading Companies Based?

There are iron ore trading companies in many countries around the world. While it is common to find companies in countries where iron ore is most produced, for example, Australia and China, it is possible to find them in diverse countries across the globe, including India, Kenya, Uganda, Singapore and the USA.

Is Iron Ore The Best Metal To Trade?

Iron ore can be a good commodity to trade with wide price swings providing opportunities to generate profits. However, because of its volatility, iron ore trading can be difficult to get right, so it is worth taking time to study the metal. This could be through online resources such as books, ebooks, tutorial PDF guides and videos.

You may also be able to find and sign up for online classes detailing the economics of iron ore and teaching helpful tips and tricks to keep in mind when investing. Another option is to join online groups that discuss how they profit from trading iron ore on social media.