How To Day Trade IPO Stocks

An initial public offering (IPO) is the process by which a private company becomes publicly traded on a regulated stock exchange. Trading can be volatile during the first hours, days, and even weeks of a company going public. This in turn provides opportunities for short-term traders.

This guide will explain what public offerings are and how day traders can make money by dealing in these newly minted shares.

Quick Introduction

- An initial public offering (IPO) is the process whereby a company floats its shares on a stock exchange to raise funds.

- Trading of these shares can be extremely choppy at the beginning, which makes them popular with short-term traders like day traders.

- You can participate in IPOs through the grey, primary, and secondary markets.

Best Stock Trading Brokers

These 4 stock brokers offer low fees, reliable execution and excellent analysis tools for traders interested in IPOs:

What Are IPOs?

IPOs are the process by which companies attempt to raise money on stock exchanges for the first time.

Businesses do this by issuing shares that represent ownership of the company, which they then offer on an exchange for retail, professional, and institutional investors to purchase.

There are no rules that specify what percentage of these shares need to be made available to the market.

Companies primarily go public to raise capital. This can be to fund expansion, capitalize on a new growth opportunity, or pay down debt, for example.

Flotations also provide a way for a firm’s existing owners or investors (such as venture capitalists) to reduce or liquidate their holdings.

Why Trade IPOs?

Demand for shares can be intense following an IPO, and their price can therefore rocket in the first few hours or days of flotation.

But after this initial burst, many shares fall below the offer price and languish there for some time. Certain companies never bounce back to their IPO.

Having said that, the price of new issues can also plummet within moments of the opening bell. This can reflect the market’s view that the stock may have been overvalued during the flotation process, for instance, or bad news on the company on the day of the IPO.

This potential for extreme volatility means that beginners need to be extremely careful trading IPOs.

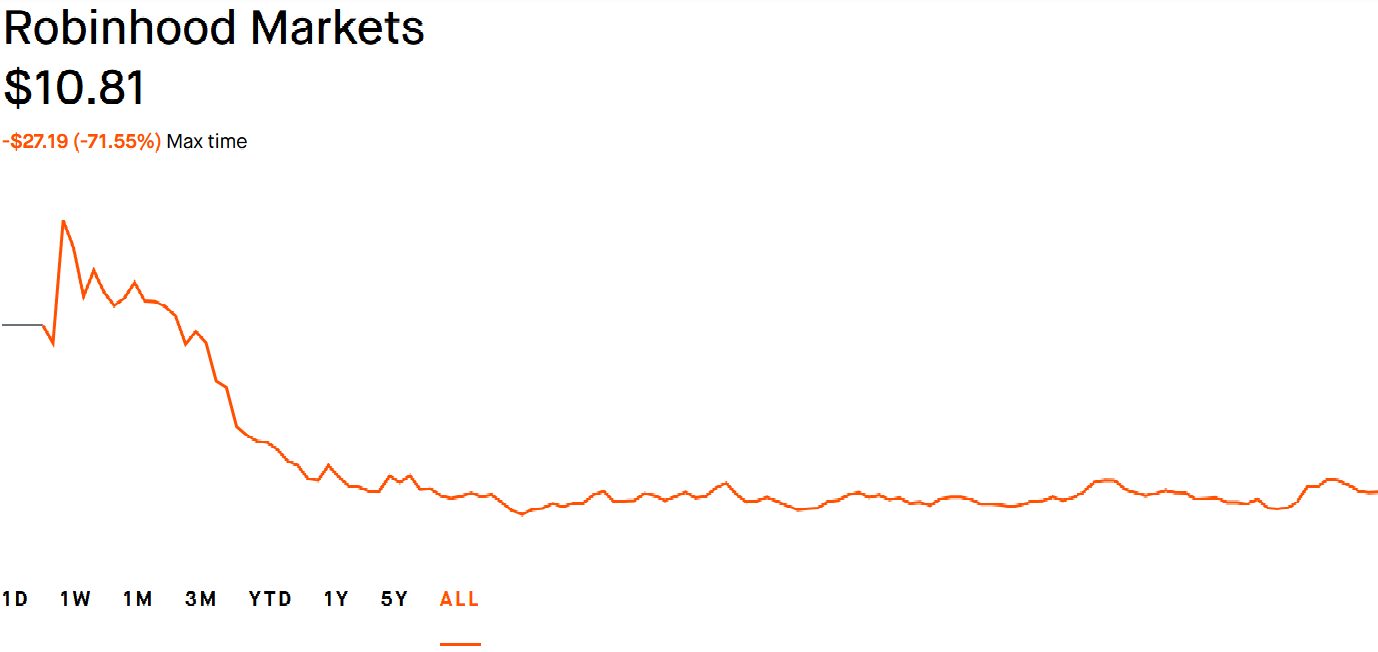

Robinhood falls and rises… and falls again

Financial services company Robinhood’s fortunes since it listed in the summer of 2021 illustrate the often-wild nature of IPOs. Indeed, the Nasdaq company’s flotation is considered to be one of the most turbulent in recent decades.

After floating at $38 apiece on 29 July 2021, Robinhood shares plummeted within minutes of launch. They hit $33.35 at one point on the first day before closing at $34.82.

But the stock then surged in the following volatile week, rising as high as $85 per share at one stage. It closed at $50.97 on 5 August, a 34% premium to its IPO value.

However, the buzz around Robinhood stock was short-lived: it plummeted from those heights and closed at $9.05 exactly one year after listing.

While this example shows the perils of investing at the IPO stage, Robinhood’s volatility early on also illustrates the enormous potential for me as a short-term trader to generate a profit.

Where Can I Find News On Upcoming IPOs?

Traders can find information on future IPOs through a variety of sources. These include:

- Specialist IPO websites – Sources like IPO Scoop, The IPO Specialist, and Renaissance Capital’s IPO Center look at public offerings of all sizes and provide news, analysis, and information on launch dates.

- Financial news websites and TV – Print and online resources like Financial Times and Reuters, along with television channels such as Bloomberg and CNBC, typically report on the most anticipated IPOs.

- Stock exchanges – Exchange websites can provide a wealth of reliable information on past and present IPOs. Nasdaq, for instance, publishes a calendar of up-and-coming offerings, company profiles, and news on the broader IPO landscape.

- Company websites – The official websites of soon-to-be-listed businesses should include timely updates on the IPO process, as well as other useful material like financial reports and the IPO prospectus.

How Can I Participate In IPOs?

There are three markets through which you can trade IPOs:

- The grey market

- The primary market

- The secondary market

The Grey Market

This is where shares that have been authorized but not yet issued are traded. It is available to market makers, institutional investors (such as hedge funds and pension funds), and sophisticated retail traders.

It helps traders get an idea as to what kind of price investors are prepared to pay for a share, and how much market interest there is.

The term ‘grey market’ refers to three types of trading. When-issued (WI) trading takes place on a stock exchange, with buy orders settled when the shares are officially issued and listed.

The second type of trading is considered the ‘real’ grey market. This is where traders sign contracts with brokers to buy or sell unissued shares at a set price. Neither the buyer nor the seller knows each other’s identity, and the broker will take a commission to set up the trade.

The third type of grey market trading takes place with the use of derivatives like contracts for difference (CFDs) and spread betting. Traders can speculate on where the price of an IPO will be without having to acquire actual shares in the company.

Trading with brokerages like City Index can help me build a larger position through the use of leverage.

But beware: short-term trading with borrowed funds could also see you rack up large losses if the market moves in an unexpected direction.

The Primary Market

This is where freshly created shares are sold directly to investors by the issuer via the stock exchange. The price at which they change hands is determined by the investment bank that underwrites the stock.

It is influenced by the valuation of the company, and the level of anticipated market demand for its shares.

Participation in the primary market is typically restricted to institutional investors, high-net-worth individuals (through private banking services and brokerages), and other small groups like the company’s employees.

However, certain brokers provide a service for retail investors to purchase shares at this stage. IG, for instance, allows me to buy stock in UK companies through the PrimaryBid platform.

The Secondary Market

Once shares are offloaded by the issuer, they can then be traded between investors on the stock exchange through the secondary market. These equities can be traded for as long as the company remains publicly traded.

Trading on the secondary market is subject to the trading hours of the specific exchange where the stock is listed.

In the US, the Nasdaq and New York Stock Exchange are open for business between 9.30 am and 4 pm, except on weekends and public holidays.

As with the primary market, traders can choose to acquire the shares themselves at this stage. Alternatively, they can choose to speculate on a stock’s price movements with the use of short-term trading products like CFDs.

How To Day Trade IPO Stocks

As with any sort of trading, there are several key principles that day traders need to remember when speculating on IPO stocks. Following certain steps can help you maximize profits and reduce the chances of making a wrong move:

- Understand the company

- Study the IPO details

- Beware the lock-up period

- Stay disciplined and manage risk

Understand The Company

It is important to thoroughly research the stock I’m thinking of buying and understand what is going on under the hood. Armed with this knowledge, I can get an idea of what the company is worth and identify entry and exit points for trades.

Some of the things I would look at before buying shares in and around the IPO stage include:

- The company’s business model

- The industry in which the firm operates, and its market position

- The experience and quality of the management team

- The company’s financial health

- The regulatory environment in which the stock operates

Study The IPO Details

You can find a lot of the above information in the company prospectus. This is a formal document required by the regulator, such as the UK Financial Conduct Authority (FCA) or the US Securities and Exchange Commission (SEC).

This text will provide information about the company, the people who run it, and important risk factors that could affect its profitability.

It will also include key details on the IPO itself including the number of shares to be issued, the flotation price price, the financial institution in charge of underwriting the IPO, and information on how the company will use the raised funds.

I would restrict myself to looking at IPOs that are underwritten by large, reputable financial institutions. Although not always the case, investment banks tend to steer clear of poor-quality companies, which helps provide me with peace of mind.

Beware The Lock-Up Period

One critical thing to check for in the IPO prospectus is the ‘lock-up’ period. This is a pre-determined length of time in which traders will be unable to sell their shares in the company.

These periods can last from a few weeks to several months, and are designed to provide stability to the share price after the public offering.

Inexperienced traders seeking to sell their shares shortly after the IPO can often be caught out by this restriction. However, this is not the only reason why traders need to pay close attention.

As you may expect, a wave of trader selling usually accompanies the end of the lock-up period. As a day trader, I would seek to capitalize on any volatility and try to book a profit.

Stay Disciplined And Manage Risk

The volatile nature of post-IPO share dealing means traders need to come up with a tight trading plan and stick with it. This is where having a firm grip on technical analysis can prove invaluable.

This form of analysis involves studying charts and indicators to inform trading decisions. By studying price and volume data I can get an idea as to where the share price may be heading.

One thing I’d do is set clear entry and exit points and stick with them. It can be easy to get carried away when you’re winning and hold a position for too long, or to cling on when you’re losing in the hope that things will turn around.

It can also be a good idea to set stop-loss orders when placing a trade. These instructions automatically sell an asset when its price reaches a certain level, thus limiting my loss.

At the other end of the scale, take-profit orders allow gains to be locked in by selling the security when it rises to a particular level.

Pros And Cons Of Trading IPO Stocks

Pros

- Extreme volatility – Stocks can experience severe price choppiness in their first minutes, hours, and days of listing. This in turn can provide ample opportunities for day traders to make a profit.

- Market buzz – Upcoming IPOs can be extensively covered in the media which, in turn, creates excitement in the investment community and amid the broader public. As a result, traders can book significant share price gains at the beginning.

- Deep liquidity – The wide publicity that offerings often attract can supercharge interest from short-term traders and long-term investors. As a result market liquidity can jump, making it easier for individuals to enter and exit positions.

Cons

- High risk – Price volatility in the immediate aftermath of an IPO presents risks as well as opportunities. Market movements can be hugely unpredictable, and day traders can rapidly rack up large losses.

- Factfinding limits – Obtaining information and data on private (in other words pre-IPO) companies can be extremely difficult for regulatory and practical reasons. This can make it more difficult for short-term traders to make a rational decision on how to trade.

- Greater trading costs – Dealing in shares tends to attract higher fees than with other types of trading like forex and derivatives like futures. This can significantly eat into an individual’s profits.

Bottom Line

The volatile price action that often follows IPOs can make trading newly created shares a highly profitable pursuit. While it is not without risk, day traders who do their homework and establish a risk management plan can be successful in this arena.

To start trading IPOs, open an account with one of our top-rated stock brokers.

Article Sources

- IPO Scoop

- The IPO Specialist

- Renaissance Capital’s IPO Center

- Financial Times - IPOs

- Reuters - IPOs

- Nasdaq - IPO Calendar

- Bloomberg - TV

- CNBC - TV

- PWC - Global IPO Watch and Outlook

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com