Interac Brokers 2025

Interac e-Transfer is a trusted Canadian payment solution that allows traders to move funds securely and quickly between their bank and brokerage accounts – without needing wire transfers, credit cards, or third-party wallets.

It’s an excellent payment method for Canadian day traders thanks to its fast settlement times, low to zero transaction fees, and bank-level security.

Explore DayTrading.com’s expert-compiled list of the best brokers that support Interac e-Transfer deposits.

Best Interac Brokers For 2025

After our hands-on tests, these are the 4 top-rated trading platforms accepting Interac e-Transfer deposits:

Why Are These The Top Brokers That Support Interac Deposits?

Here is why we think these are the top Interac brokers:

- Fusion Markets is the best broker accepting Interac deposits and withdrawals in 2025 - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

- VT Markets - Founded in 2015, VT Markets maintains its position as a top Australian multi-asset CFD broker. With 1000+ tradeable instruments and support for the MetaTrader 4 and MetaTrader 5 platforms, this broker delivers a wide range of day trading opportunities to over 400,000 clients worldwide. VT Markets is regulated by the ASIC, FSCA, and FSC.

- Qtrade - Qtrade is an award-winning Canadian financial services firm that offers a selection of investing accounts with $8.75 and $6.95 stocks, mutual fund trades and 100+ commission-free ETFs. This is a long-running brand that is well regarded in Canada, where many investors choose it to build their savings account or pension pot. QTrade is also highly trusted and authorized by the Canadian Investment Regulatory Organization (CIRO).

- Global Prime - Global Prime is a multi-regulated trading broker offering 150+ markets. Traders can get started with a $200 minimum deposit and trade with leverage up to 1:100. The firm also has a high trust score and a good reputation with a license from the ASIC.

Compare The Best Interac Trading Providers On Key Attributes

Use our side-by-side comparison of key features that are important to traders looking to move funds with Interac:

| Broker | Minimum Deposit | Instruments | Platforms | Leverage | Regulators |

|---|---|---|---|---|---|

| Fusion Markets | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, cTrader, TradingView, DupliTrade | 1:500 | ASIC, VFSC, FSA |

| VT Markets | 50 - 500 USD | CFDs, Forex, Commodities, Stocks, Indices | VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral | 1:500 | ASIC, FSCA, FSC |

| Qtrade | $0 | Stocks, ETFs, Bonds, Mutual Funds, Options, GICs | TradingCentral | - | CIRO |

| Global Prime | A$200 | Forex, indices, commodities, cryptocurrencies, shares, bonds | MT4, TradingView, AutoChartist | 1:200 | ASIC, VFSC, FSA |

How Safe Are These Interac Brokers?

See how the top Interac brokerages protect your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Fusion Markets | ✘ | ✔ | ✔ | |

| VT Markets | ✘ | ✔ | ✔ | |

| Qtrade | ✘ | ✘ | ✘ | |

| Global Prime | ✘ | ✔ | ✘ |

Mobile Trading Comparison

See how good these brokers accepting Interac e-Transfer are for trading on mobile after our app tests:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Fusion Markets | iOS & Android | ✘ | ||

| VT Markets | iOS & Android | ✘ | ||

| Qtrade | iOS & Android | ✘ | ||

| Global Prime | iOS & Android | ✘ |

Are The Top Brokers With Interac Deposits Suitable For Beginners?

Beginners should use brokers that allow trading with virtual money alongside other key features:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Fusion Markets | ✔ | $0 | 0.01 Lots | ||

| VT Markets | ✔ | 50 - 500 USD | 0.01 Lots | ||

| Qtrade | ✔ | $0 | Variable | ||

| Global Prime | ✔ | A$200 | 0.01 Lots |

Are The Top Brokers With Interac Deposits Suitable For Advanced Traders?

See how these top-rated Interac brokers support experienced traders:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Fusion Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | ✘ | ✘ | 1:500 | ✔ | ✘ |

| VT Markets | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:500 | ✘ | ✘ |

| Qtrade | - | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| Global Prime | ✔ | ✔ | ✔ | ✘ | 1:200 | ✔ | ✘ |

Compare The Ratings Of Top Interac e-Transfer Brokers

Discover how the top Interac brokers stack up in core areas from our expert ratings:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Fusion Markets | |||||||||

| VT Markets | |||||||||

| Qtrade | |||||||||

| Global Prime |

Compare Trading Fees

The cost of making a deposit to your trading account with Interac may be low, but trading fees add up so here's how the top providers measure up on pricing:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Fusion Markets | ✘ | $0 | |

| VT Markets | ✘ | $0 | |

| Qtrade | ✘ | - | |

| Global Prime | ✘ | - |

How Popular Are These Interac Trading Providers?

Many traders prefer the most popular brokers with Interac deposits, i.e those with the most users:

| Broker | Popularity |

|---|---|

| VT Markets | |

| Fusion Markets |

Why Choose Fusion Markets For Interac e-Transfer Deposits?

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Fusion Markets offers best-in-class support with very fast, friendly and helpful responses during tests and no frustrating automated chatbot to navigate.

- Fusion Markets continues to impress with its pricing that provides tight spreads with below-average commissions that will appeal to active day traders.

- The range of charting platforms and social trading features is excellent, with MT4, MT5, cTrader and more recently TradingView, catering to a wide range of trader preferences.

Cons

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

- While the selection of currency pairs trumps most rivals, the broker's alternative investment offering is average with no stock CFDs beyond the US.

Why Choose VT Markets For Interac e-Transfer Deposits?

"VT Markets is a great choice for regular traders who are looking for very tight spreads and powerful charting software. The broker's share CFD offering is particularly strong, with hundreds of commission-free assets spanning multiple global markets."

Tobias Robinson, Reviewer

VT Markets Quick Facts

| Bonus Offer | 50% Welcome Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Commodities, Stocks, Indices |

| Regulator | ASIC, FSCA, FSC |

| Platforms | VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral |

| Minimum Deposit | 50 - 500 USD |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Spreads are competitive based on tests, coming in at 0.2 pips for EUR/USD in the ECN account, aligning with top brands like Pepperstone

- There’s a strong range of payment methods, including bank wire, credit cards and e-wallets, plus 5 base currencies to choose from

- A proprietary copy trading service, VTrade, is available on two platforms, with access to 100+ providers

Cons

- Unlike similar brands like Fusion Markets, VT Markets does not offer crypto trading

- The broker’s bonus schemes have stringent terms and conditions, including restrictions on minimum deposits and payment methods used

Why Choose Qtrade For Interac e-Transfer Deposits?

"Qtrade is a good match for Canadian traders who are looking for a reputable and regulated broker to make longer-term investments as well as leveraged trades."

William Berg, Reviewer

Qtrade Quick Facts

| Bonus Offer | $150 sign-up bonus, up to 5% cash back, unlimited free trades |

|---|---|

| Demo Account | Yes |

| Instruments | Stocks, ETFs, Bonds, Mutual Funds, Options, GICs |

| Regulator | CIRO |

| Platforms | TradingCentral |

| Minimum Deposit | $0 |

| Minimum Trade | Variable |

| Account Currencies | USD, CAD |

Pros

- Alongside 100+ commission-free ETFs, Qtrade has slashed its options fees, now coming in at $0.75 per options contract (down from $1.00).

- Qtrade’s new Options Lab, built with Trading Central provides trading ideas that match your goals, risk level, and experience - head to Investment Tools > Options Lab.

- Qtrade has teamed up with PersonaFin to launch “My News” - an AI-powered, personalized newsfeed built around your interests. Get timely insights from premium sources, discover trending topics fast, and explore smarter with AI-driven search.

Cons

- Qtrade doesn't offer trading opportunities on forex or crypto markets, potentially limiting its appeal if you're looking to build a diverse portfolio.

- The transfer out fee is a nuisance and traders should be wary of the CAD to USD exchange charge.

- Although Qtrade has added support for Interac e-Transfer, it still offers relatively limited funding options with no credit/debit card deposits.

Why Choose Global Prime For Interac e-Transfer Deposits?

"Global Prime is suitable for both beginners and seasoned traders with excellent market access, low fees and a range of tools including copy trading."

Tobias Robinson, Reviewer

Global Prime Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, indices, commodities, cryptocurrencies, shares, bonds |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, TradingView, AutoChartist |

| Minimum Deposit | A$200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, SGD |

Pros

- Full range of investments with 150+ assets including crypto

- Segregated client funds

- Wide range of deposit options with zero fees

Cons

- Clients from US and Canada are not accepted

- Narrow range of account options

- No MetaTrader 5 integration

How Did We Choose The Top Interac Trading Brokers?

To identify the top Interac e-Transfer brokers, we:

- Filtered our database of 223 trading platforms to find those supporting Interac e-Transfer

- Confirmed deposit and withdrawal functionality via Interac with each broker directly

- Evaluated each platform using over 200 criteria, including speed, cost, and trading tools

- Prioritized platforms registered with top-tier regulators like the CIRO in Canada

What To Look For In An Interac Broker

Choosing a brokerage with Interac deposits is ultimately a personal decision. Still, drawing on our years of robustly testing forex and CFD brokers, we believe active traders should prioritize the following:

Trust

Interac is backed by Canada’s largest banks and follows rules for clearing and settlement laid down by Payments Canada, making it one of the most secure payment systems globally.

Its fraud detection system is robust, using email and SMS-based authentication, bank-grade encryption, and real-time alerts.

We only recommend brokers with strong regulatory oversight and transparent operations. The best Interac brokers, such as QTrade, are also members of the Canadian Investor Protection Fund (CIPF) or equivalent, offering peace of mind.

Markets

Day traders using Interac should seek brokers with access to a broad range of markets for diverse trading opportunities, such as:

- Forex assets like USD/CAD

- Indices like the Canada Stock Market Index (TSX)

- Commodities like oil given that Canada is among the largest oil producers globally

- US and Canadian equities like shares in the Bank of Montreal, which is listed on the Toronto Stock Exchange

Tools

The best Interac brokers offer advanced trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView. Look for:

- Custom indicators

- Real-time news feeds

- Level II market depth

- One-click order execution

What Is Interac e-Transfer?

Interac e-Transfer is a peer-to-peer payment system developed in Canada that allows users to send money securely between personal and business bank accounts via email or phone number.

- Established: 1984 (Interac Corp)

- Regulated by: FINTRAC

- Used by: 300+ Canadian financial institutions

Most Canadian banks – including RBC, TD, BMO, Scotiabank, and CIBC – offer seamless Interac integration through their web and mobile banking platforms.

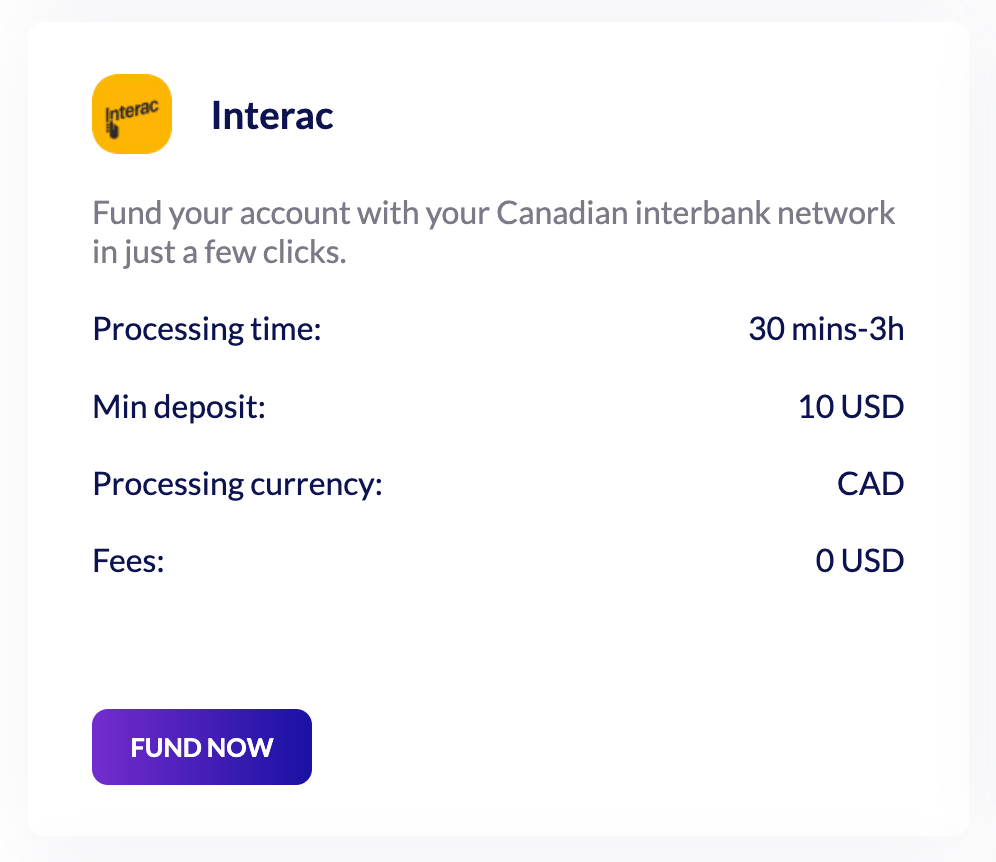

How Much Does It Cost To Fund My Trading Account With Interac?

Interac is known for its low fees:

- Sending Fee: Often $0–$1.50 CAD depending on the bank

- Receiving Fee: Typically free

- Broker Charges: Most top-tier brokers do not add extra Interac fees

How Fast Is Interac For Trading Deposits?

Interac e-Transfer is fast for deposits to trading accounts, typically processing within a few hours, while withdrawals may take 1–2 business days, depending on the broker’s verification process.

Auto-deposit also eliminates the need for password entry, while real-time notifications via SMS/email allow you to track transfers instantly.

Opting for a broker with a CAD account helps minimize conversion fees and ensures a quick and hassle-free trading experience for Canadians.

How To Deposit Using Interac

To deposit funds to your trading account with Interac, follow these simple steps:

- Log in to your trading account and go to the ‘Funding’ section

- Select Interac e-Transfer as your payment method

- Enter the broker’s recipient email and deposit amount

- Log into your online banking platform

- Complete the Interac e-Transfer to the broker’s details

- Wait for email confirmation from your bank and broker

Pros & Cons Of Using Interac For Trading

Pros

- Increasingly accepted by Canadian-regulated brokers with QTrade adding it in 2025

- No need to share credit card or banking details with brokers

- Low to zero fees for both deposits and withdrawals

- Fast transaction speeds – often under 30 minutes

- Backed by Canadian banks and highly secure

Cons

- Primarily available to traders with Canadian bank accounts

- Daily transfer limits may apply (usually $3,000 – $10,000 CAD)

- Not supported by all international brokers from our investigations

- Withdrawals can take longer if broker verification delays occur

Is Interac Good For Day Trading?

Yes – Interac e-Transfer is one of the best payment options for Canadian day traders.

Its speed, low cost, and excellent security features make it ideal for frequent trading strategies where fast capital movement is key. Combined with a responsive mobile app and bank-level integration, Interac ensures you stay in control of your funds at all times.

Get started by reviewing our top-rated Interac brokers.

FAQ

Is Interac Safe For Trading Deposits?

Yes. Interac is a Canadian payment network backed by major financial institutions and regulated under national financial laws. It uses 2FA, real-time monitoring, and bank-grade security protocols.

Can I Use Interac With International Brokers?

Interac is primarily supported by Canadian brokers from our research. However, a few international platforms with a Canadian presence may also accept it, one such top provider is Fusion Markets.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com