Best Brokers For Index Funds 2026

When it comes to trading index funds, not all brokers are created equal. That’s why we’ve carefully selected five providers, standing out for their broad list of index funds, user-friendly platforms, and the value they bring to active traders across different experience levels and regions.

List Of Top 5 Brokers With Stock Indices

Here’s a sneak peek at why these providers made the cut:

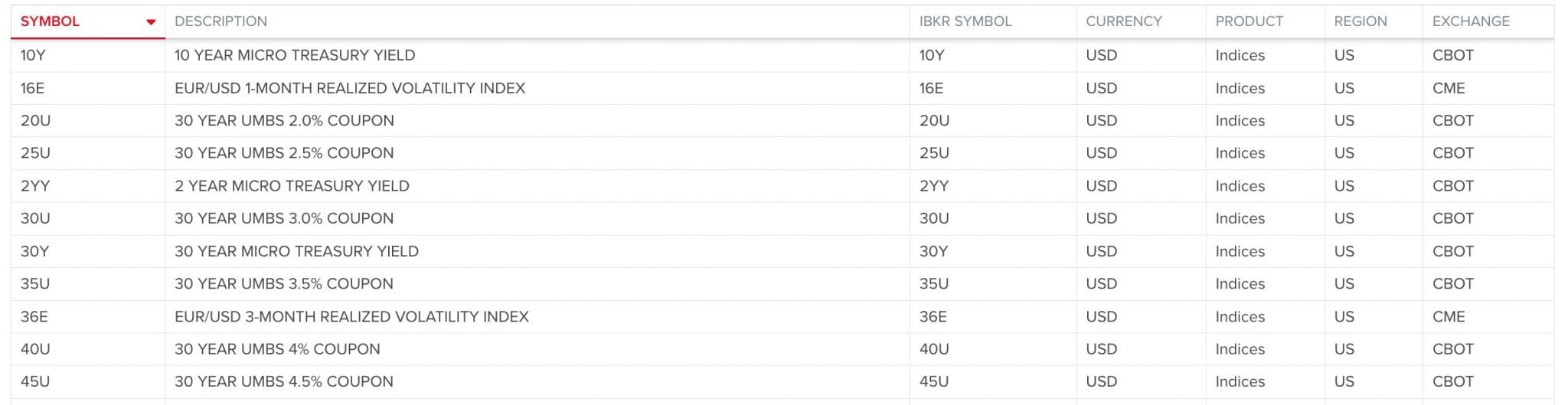

- Interactive Brokers: This powerhouse is a favorite for serious traders. It offers low fees, a massive selection of index funds, and professional-grade research tools.

- IG: Known for its extensive global reach, IG excels with a wide range of tradable indices on a platform that combines simplicity with advanced tools.

- Saxo: A premium choice, Saxo offers a sophisticated platform, competitive fees, and access to a broad selection of indices and funds worldwide.

- IC Markets: With a focus on low spreads and high-speed execution, IC Markets is a top contender for short-term index fund traders.

- Spreadex: A unique pick, Spreadex blends traditional trading with spread betting options, making it versatile and appealing for index fund enthusiasts in specific regions.

Trading indices involves significant risk regardless of the broker you choose, including the potential loss of your entire investment; ensure you fully understand the risks before trading.

How We’ll Analyze These Brokers

To help you pick the right broker for trading index funds, we’ll evaluate them using the following key metrics:

- Number of Tradable Index Funds: The more indices and index funds a broker offers, the more opportunities you have to diversify and trade according to your strategy. We’ll highlight the range and variety available on each platform.

- Geographical Coverage: Trading index funds isn’t always a one-size-fits-all approach. We’ll look at the brokers’ global reach, focusing on their availability in key markets and their support for traders in different regions.

- Fees and Costs: From trading fees to spreads and overnight charges, we’ll break down the costs involved so you can avoid hidden surprises. Affordable trading is a must, and we’ll call out brokers with budget-friendly options.

- Research and Tools: Whether it’s real-time market analysis, charting tools, or educational resources, we’ll assess how each broker supports your decision-making process.

- Unique Features: We’ll explore what makes each broker stand out. Whether it’s cutting-edge technology, flexible trading options, or excellent customer support, we’ll highlight the extras that set them apart.

Below is an in-depth analysis of why Interactive Brokers, IG, Saxo, IC Markets, and Spreadex are our top brokers for index funds in 2026.

1. Interactive Brokers

Why We Chose Interactive Brokers

Interactive Brokers (IBKR) is a trading powerhouse catering to professionals and serious retail traders alike.

Its inclusion on our top five list was a no-brainer, thanks to its unparalleled market access, low fees, and a platform loaded with sophisticated tools.

Interactive Brokers is unmatched in its breadth of index funds and ultra-low costs, making it a perfect choice for both retail and professional traders.

Pros

- Largest Fund Selection: IBKR offers access to funds such as the Vanguard S&P 500 ETF, iShares MSCI Emerging Markets ETF, and Schwab US Broad Market ETF, which cater to global and niche markets.

- Low Fees: Zero-commission trading on select index funds and competitive pricing for active traders help reduce costs.

- Global Accessibility: Available in over 135 markets, IBKR supports traders from diverse regions with top-tier regulation like SEC (US), CIRO (Canada), and FCA (UK).

- Sophisticated Platform: The Trader Workstation (TWS) provides customizable dashboards, portfolio analysis tools, and integrations with third-party research platforms.

- Deep Research Resources: Access to market data, screeners, and professional-grade analysis tools support well-informed trading decisions.

Cons

- Steep Learning Curve: The platform’s depth and complexity may overwhelm new traders exploring index funds.

- Minimum Deposits: Some accounts require higher initial deposits, which may deter casual traders.

- Minimum Activity Requirements: Interactive Brokers charge a small monthly fee if traders don’t meet certain activity thresholds, which could be a drawback for less frequent traders.

Overall, Interactive Brokers stands out as a top choice for experienced traders who prioritize market access, low fees, and professional tools.While it may require some effort to get comfortable with its platform, the rewards are worth it, especially for those looking to trade index funds seriously.

2. IG

Why We Chose IG

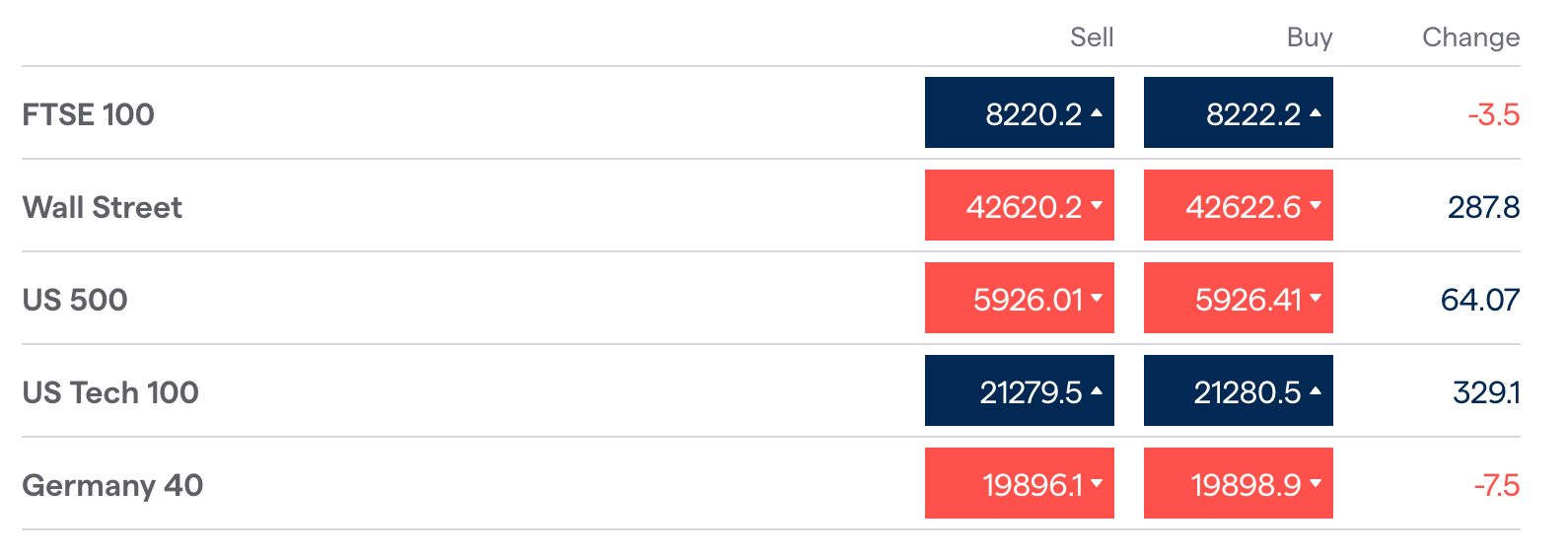

IG earns its spot on our top five list for its exceptional range of tradable index funds, cutting-edge platform, and global presence.

It’s a go-to brokerage for active traders seeking flexibility, transparency, and professional-grade tools.

Pros

- Extensive Fund Range: IG offers access to index funds covering global and regional markets, such as the Vanguard Total Stock Market ETF (VTI), the iShares Core MSCI World ETF, and the SPDR Dow Jones Industrial Average ETF.

- Global Availability: IG operates in over 200 countries and is regulated by 11 ‘green tier’ authorities in DayTrading.com’s Regulation & Trust Rating such as the FCA (UK) and ASIC (Australia).

- Low Costs: IG offers commission-free trading on many index funds and no inactivity fees. Competitive spreads reduce trading costs for short-term fund investors.

- Excellent Research Tools: Real-time data, advanced charting, and expert market commentary provide invaluable insights for informed fund trading.

- Educational Resources: IG’s extensive webinars, tutorials, and guides make it an excellent starting point for beginners exploring index funds.

- User-Friendly Platform: IG’s web-based platform strikes the perfect balance between ease of use and sophistication. Beginners will appreciate its clean interface, while advanced traders can tap into customizable charting tools, over 28 technical indicators, and seamless integration with platforms like ProRealTime. Testing showed no lag even during peak trading hours, ensuring a smooth trading experience.

Cons

- Limited Customization: While IG’s platform is intuitive, I find it offers fewer customization options for advanced traders seeking more tailored experiences.

- Overnight Costs: Holding positions beyond trading hours incurs fees, which can add up for active traders.

Overall, IG excels with its wide selection of indices and robust platforms catering to a wide range of traders.While there are minor drawbacks, these don’t overshadow the broker’s strengths, making it an excellent choice for index fund trading.

3. Saxo

Why We Chose Saxo

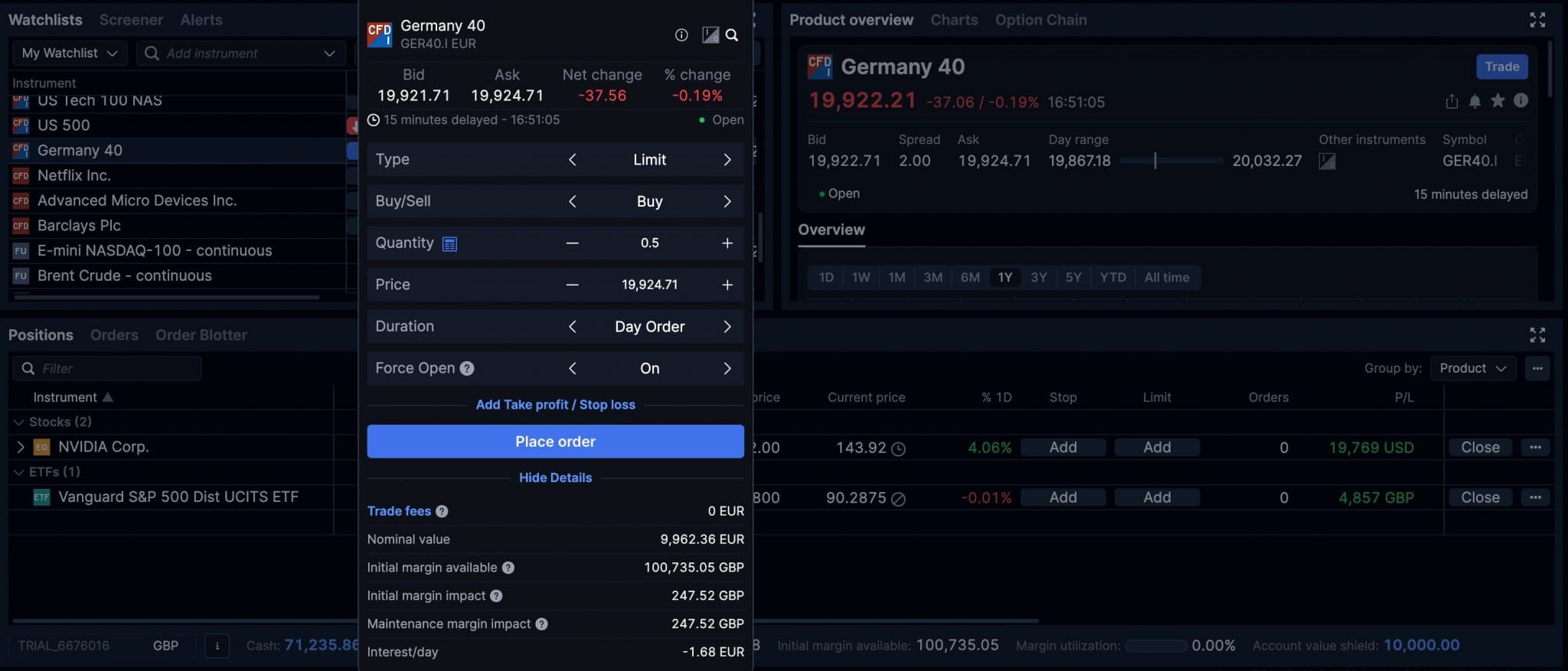

Saxo’s premium platform offers professional-grade tools and an extensive range of index funds, making it ideal for traders seeking a top-tier experience.

Pros

- Wide Fund Availability: Saxo provides access to funds like the SPDR MSCI World ETF, Vanguard FTSE 100 ETF, and iShares Core MSCI Europe ETF, which cover major global markets and sector-specific strategies.

- Premium Research Tools: Advanced analytics, comprehensive charts, and proprietary research reports help traders make data-driven decisions.

- Account Tiers: Saxo’s tiered structure rewards active traders with lower costs and enhanced services, making it a good choice for high-volume investors.

- Transparency: A transparent fee structure with no hidden charges builds trust among users.

- Sophisticated Trading Platforms: SaxoTraderGO and SaxoTraderPRO deliver an exceptional user experience. SaxoTraderGO, designed for ease of use, is ideal for retail traders, while SaxoTraderPRO offers advanced features like algorithmic trading, multi-screen setups, and detailed analytics for professional traders.

Cons

- High Fees: Saxo’s costs are higher than competitors, particularly for less active traders.

- Complex Platform: Designed for experienced users, Saxo’s platform may feel overwhelming for beginners.

Overall, Saxo is an excellent choice for traders who value premium tools, a seamless platform, and reliable market access.While its higher costs might not suit all traders, those prioritizing quality and advanced features will find it a standout option for trading index funds.

4. IC Markets

Why We Chose IC Markets

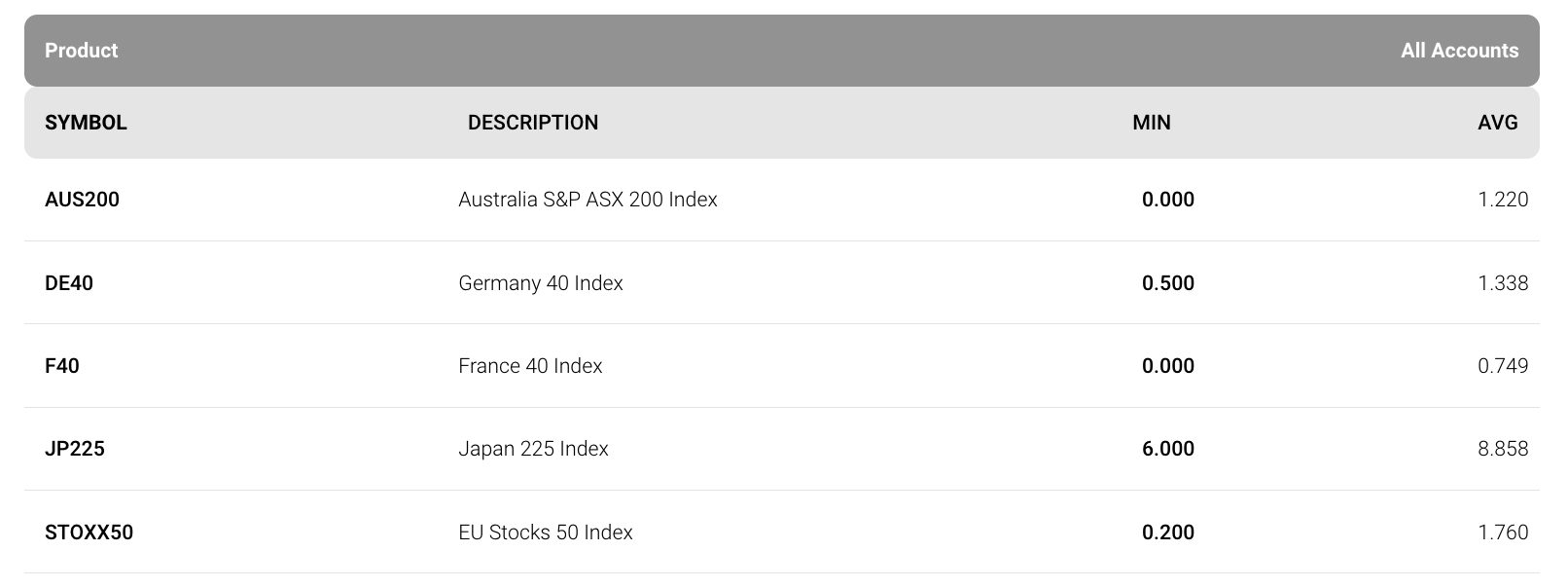

IC Markets is a favorite among short-term traders for its low-cost structure, ultra-tight spreads, and lightning-fast execution speeds.

It’s particularly well-suited for those who trade index funds actively or employ high-frequency strategies.

Pros

- Cost-Effectiveness: IC Markets boasts tight spreads starting from 0.0 pips and offers commission-free options for standard accounts, reducing trading expenses.

- Fast Execution: High-speed order processing ensures minimal slippage, which is critical for short-term trading strategies.

- Global Reach: It is available in Europe, Asia, and Australia and is regulated by ASIC (Australia) and CySEC (Cyprus).

- Integrated Platforms: Seamless compatibility with MetaTrader 4, MetaTrader 5 and cTrader gives traders access to technical analysis tools and trading automation.

- User-Friendly: IC Markets’ platform is simple yet effective for traders focused on a smaller selection of funds.

Cons

- Limited Fund Selection: Compared to IG and Interactive Brokers, IC Markets offers fewer index funds, focusing on popular options like Vanguard Growth ETF and iShares Russell 2000 ETF.

- Basic Research Tools: While adequate, its research offerings are less comprehensive than competitors like Saxo or IBKR.

- Limited Educational Resources: Compared to brokers like IG or Saxo, IC Markets offers fewer educational materials for new traders. I found the content basic during testing, making it less appealing for beginners looking to build their knowledge base.

Overall, IC Markets excels in cost efficiency, speed, and platform variety, making it a top choice for active and professional traders focused on index funds.While its range of indices and research tools may need to catch up for some, its superior execution and competitive pricing more than make up for these gaps. It’s an excellent option for traders who value precision and affordability.

5. Spreadex

Why We Chose Spreadex

Spreadex stands out for its unique blend of traditional CFD trading and spread betting, making it an attractive option for traders in regions where spread betting offers tax advantages.

With competitive pricing, a user-friendly platform, and strong support for index fund trading, Spreadex is a versatile broker worth considering.

Pros

- Tax-Free Spread Betting: Clients in regions such as the UK can trade index funds like Vanguard S&P 500 ETF and iShares FTSE 100 ETF without paying capital gains tax.

- Competitive Fees: Spreadex offers tight spreads, and commission-free spread betting accounts, keeping costs low.

- Beginner-Friendly: A simple interface and straightforward account setup make it accessible to new traders exploring index funds.

- Regulated and Reliable: FCA oversight adds a layer of trust and security for traders.

- Integrated Tools and Resources: Spreadex offers in-platform tools like real-time charts, customizable watchlists, and technical indicators. While less extensive than some competitors, these tools were adequate for basic index fund trading strategies during testing.

Cons

- Narrow Fund Range: Spreadex provides access to popular funds but lacks the depth and variety of IG or IBKR.

- Limited Tools: Research and analytics capabilities are basic, with fewer advanced charting tools and reports.

- Overnight Fees: Holding positions overnight can lead to significant costs, especially for leveraged accounts.

Overall, Spreadex is an excellent choice for traders who value the tax advantages of spread betting and straightforward access to index funds.While it may offer a limited breadth of indices or advanced tools some competitors provide, its user-friendly platform, competitive spreads, and flexibility make it a solid option for beginners and casual traders.

Scoring Chart

Below is our compiled ranking and scoring chart for the five brokers based on key criteria such as the number/range of index funds, trading costs, research tools, platform features, and account types.

Each broker is scored out of 10 for each factor, with a total score out of 50.

| Number/Range of Index Funds | Costs for Trading Indices | Research Tools | Platform Features | Account Types | Total Score | |

|---|---|---|---|---|---|---|

| Interactive Brokers | 10/10: 300+ (eg Vanguard Total Market, Schwab US Broad Market) | 9/10 | 8/10 | 9/10 | 9/10 | 45/50 |

| IG | 9/10: 100+ (eg Vanguard S&P 500, iShares MSCI World) | 8/10 | 9/10 | 9/10 | 8/10 | 43/50 |

| Saxo | 9/10: 200+ (eg SPDR MSCI World, iShares FTSE 100) | 8/10 | 9/10 | 9/10 | 8/10 | 43/50 |

| IC Markets | 7/10: 50+ (eg Vanguard Growth ETF, iShares Russell 2000) | 10/10 | 7/10 | 8/10 | 8/10 | 40/50 |

| Spreadex | 6/10: 30+ (eg Vanguard S&P 500, iShares FTSE 100) | 9/10 | 7/10 | 7/10 | 7/10 | 36/50 |

Explanation Of Scoring Metrics

- Number of Index Funds Available: This is crucial for traders focusing on index funds. Brokers offering a diverse selection of index funds, such as Vanguard and iShares ETFs, scored higher as they provide regional and global market exposure flexibility.

- Costs: This includes trading commissions, spreads, and any additional fees (eg overnight charges). Brokers with low or zero commissions on index fund trades received better scores.

- Research Tools: This measures the quality and accessibility of tools tailored explicitly for index fund traders, including real-time data, fund performance reports, and market analysis.

- Platform Features: This assesses usability, customization, and advanced tools for evaluating and managing index fund portfolios, such as portfolio trackers and comparison tools.

- Account Types: This evaluates the flexibility of account offerings, including options for margin accounts, tax-efficient accounts, and benefits for active fund traders.

Key Takeaways From The Scores

- Interactive Brokers scored highest, thanks to its vast selection of index funds, low costs, and premium research tools.

- IG is a strong all-rounder with an extensive fund range and user-friendly features ideal for beginners.

- Saxo offers a premium experience but has higher costs, which might deter less active traders.

- IC Markets provides affordability and fast execution but has a smaller fund range compared to top competitors.

- Spreadex is best for traders interested in tax-efficient spread betting but lacks depth in fund variety and advanced tools.

Bottom Line

Choosing the right broker can make all the difference in trading index funds, especially for short-term strategies.

After an in-depth analysis, Interactive Brokers emerged as the top choice for its unbeatable range of index funds, low costs, and versatile account options.

IG and Saxo closely follow, offering exceptional platforms, robust research tools, and extensive market access.

For those prioritizing low costs and fast execution, IC Markets is a standout option, while Spreadex caters well to active traders seeking the tax benefits of spread betting.

Each of these brokers has its strengths, and the best one for you depends on your specific trading style and needs:

- If you want access to the broadest selection of index futures and advanced features, go with Interactive Brokers.

- For a well-rounded experience with top-tier research tools, consider IG or Saxo.

- If you’re a cost-conscious trader focused on precision, IC Markets is hard to beat.

- UK traders seeking simplicity and tax-efficient trading should explore Spreadex.

Sign up with the broker that aligns with your goals.

FAQ

What Is An Index Fund?

When it comes to trading, index funds often get overshadowed by high-profile tech stocks or volatile cryptocurrencies, but index funds can be a hidden gem, even for short-term traders.

These funds track the performance of a specific market index, like the S&P 500 or Nasdaq 100, offering a diversified and steady way to play the market.

While they’re typically viewed as long-term investments, some savvy traders also know how to leverage their stability and trends for short-term gains.

This makes them a go-to option for traders looking to capitalize on broader market trends without risking the unpredictability of single-stock trading.

Whether riding a market rally or hedging against dips, index funds provide a balanced and dynamic way to meet your trading goals.

Still, trading indices remains high-risk. You could lose any capital you invest.

Which Is The Best Broker For Index Funds?

Following our thorough evaluations, Interactive Brokers stands out as the leading option in 2026 due to its unmatched selection of indices, competitive pricing, and flexible account offerings.