Forex Trading in India

Forex trading in India has witnessed rapid growth, with the Indian rupee (INR) ranking among the world’s top 20 most traded currencies.

But you must adhere to strict rules from the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI). Notably, retail investors can mainly only trade currency pairs involving INR, such as USD/INR.

Are you ready to start forex trading in India? This guide unpacks the essentials every beginner should know.

Quick Introduction

- Forex trading involves buying a currency and selling another to profit from exchange rate movements. In the EUR/INR, you profit if the euro appreciates against the rupee or vice versa.

- According to the latest BIS triennial survey, the INR accounts for about 1.6% of daily global forex transactions, particularly in emerging markets, down from 1.7% previously.

- The best times to trade INR in India are during high-liquidity periods like the London and New York overlap, which typically runs from 17:30 to 20:30 IST (Indian Standard Time).

Best Forex Brokers in India

We have evaluated 223 brokers as of April 2025 and found these to be the top 4 platforms for Indian traders:

How Does Forex Trading Work?

Forex trading involves the exchange of currencies through a decentralized market where participants trade currency pairs.

You speculate on the rise or fall of one currency against another. For example, you might sell JPY/INR, hoping the yen falls against the rupee.

To begin forex trading in India, you’ll need to:

- Open an account with a forex broker: Consider a SEBI-regulated firm to adhere to Indian regulations.

- Deposit funds: Use an INR trading account to minimize currency conversion fees.

- Execute trades: Your broker should provide a desktop, web, and increasingly a forex app.

Is Forex Trading Legal In India?

Forex trading is legal in India but is regulated under very strict guidelines set by the Reserve Bank of India (RBI) and the Foreign Exchange Management Act (FEMA), 1999.

Legal forex trading in India requires using a SEBI-registered broker authorized by the RBI.

These providers must meet specific regulatory standards, such as having a minimum net worth and maintaining a physical presence in India with a qualified compliance officer.

Also, residents in India can primarily only deal in currency pairs that include the INR, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR.

The exception to this is if you deal in certain derivatives like currency futures and options on the National Stock Exchange of India (NSE), which may not directly involve the INR.

Is Forex Trading Taxed In India?

In India, forex trading income can be classified as business or capital gains.

If your trading is frequent, substantial, and done with the intent to profit, it’s considered business income and taxed at 5% to 30%.

If your forex trading income is considered short-term capital gains, it’s added to your total income and taxed at your regular income tax rate, just like business income. Short-term gains are typically from holdings of 36 months or less.

You need to maintain detailed records of your forex trades for tax purposes and declare both profits and losses in your income tax returns.Failure to comply with tax regulations can result in penalties or legal action by India’s Income Tax Department.

When Is The Best Time To Trade Forex?

Here are the key times to consider:

- London & New York Session Overlap (17:30 to 20:30 IST): This time frame captures the overlap between the New York and London trading sessions, providing peak market activity. The increased participation from European and US traders enhances liquidity and volatility, making it a good time for trading currency pairs involving the INR.

- Domestic Trading Hours (09:00 to 17:00 IST): During these hours, Indian exchanges like the National Stock Exchange of India (NSE) and Bombay Stock Exchange (BSE) are active, which can lead to significant price movements in INR-based currency pairs due to domestic economic data releases and news.

A Trade In Action

To illustrate how forex trading in India actually works, let’s break down a day trade I made on USD/INR:

Event Background

I noticed a significant positive economic announcement from India regarding its GDP growth rate, which was reported to have exceeded market expectations.

This announcement indicated that India’s economy grew faster than anticipated, primarily due to increased manufacturing output and robust consumer spending.

This favorable economic sentiment would likely boost investor confidence in India, so I considered a day trade on the USD/INR currency pair.

Trade Entry & Exit

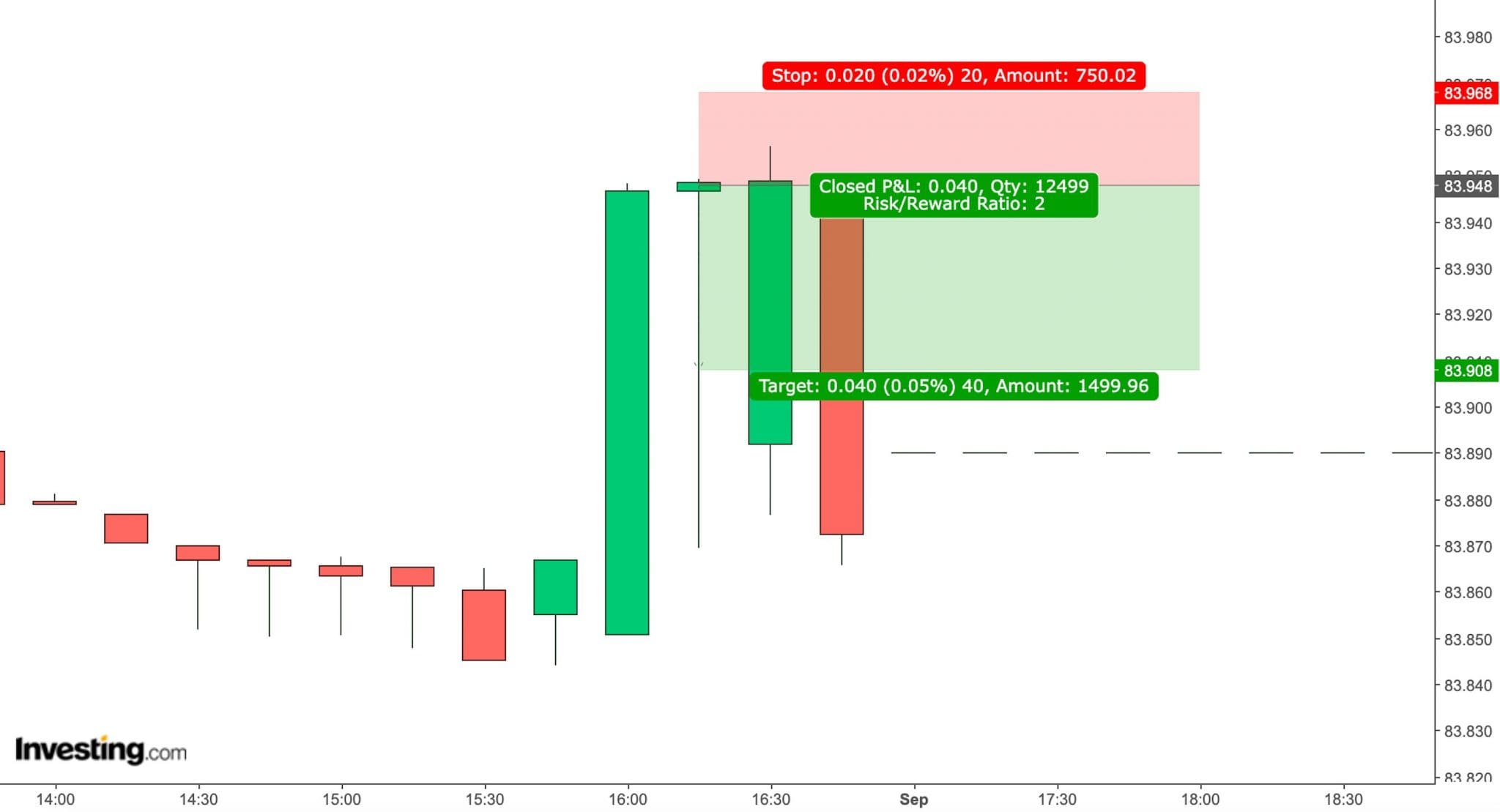

With the economic announcement raising the INR, I entered a short (sell) position on the USD/INR pair. I executed my trade shortly after the news release to capitalize on the initial surge in the INR’s strength.

I placed my trade at an exchange rate of 83.948, confident that the momentum from the positive news would continue to push the USD lower in the short term.

I set a stop-loss order 20 pips above my entry point at 83.968 to limit potential losses, as I understood the importance of risk management in day trading.

Throughout the trading session, I monitored the price movements closely, watching for any signs of a reversal or weakening momentum.

As the market reacted positively to the economic news, the USD/INR pair gradually moved in my favor. I decided to exit my position when the exchange rate reached 83.908, securing a 40-pip profit for a 1:2 risk/reward trade.

After exiting the trade, I reflected on my decision-making process and the importance of staying informed about market news and economic indicators.This successful day trade reaffirmed my trading strategy and highlighted the potential for forex trading in response to real-time economic developments.

Bottom Line

Forex trading in India has gained traction in recent years, driven by a growing interest in currency markets and the increasing participation of retail investors.

While forex trading is legal in India, it is subject to strict regulations to ensure compliance with FEMA.

Additionally, profits from forex trading may be taxed as business income, requiring you to maintain accurate records for tax purposes.

Start trading currencies by opening an account with one of DayTrading.com’s trusted Indian forex brokers.

Recommended Reading

Article Sources

- Most Traded Currencies - Wikipedia

- Triennial Central Bank Survey - BIS

- Reserve Bank of India (RBI)

- Securities and Exchange Board of India (SEBI)

- Foreign Exchange Management Act (FEMA), 1999

- Forex Fines In India - Tap Invest

- Income Tax Department

- India Taxes on Personal Income - PwC

- Cross Currency Pairs - Zerodha

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com