ii’s New Managed ISA: Your Money Works, You Don’t Have To

interactive investor has introduced a brand-new Managed ISA. You’ll be matched to one of 10 portfolios depending on your goals and risk tolerance.

Investment values can fluctuate. You may lose the money you invest. Tax treatment varies depending on your circumstances. Consult HMRC or a tax professional for guidance.

Key Takeaways

- Two trading styles and five risk levels help users find a portfolio that matches their investment style.

- Money is invested into sustainable funds that align with ESG criteria, alongside cash and bonds.

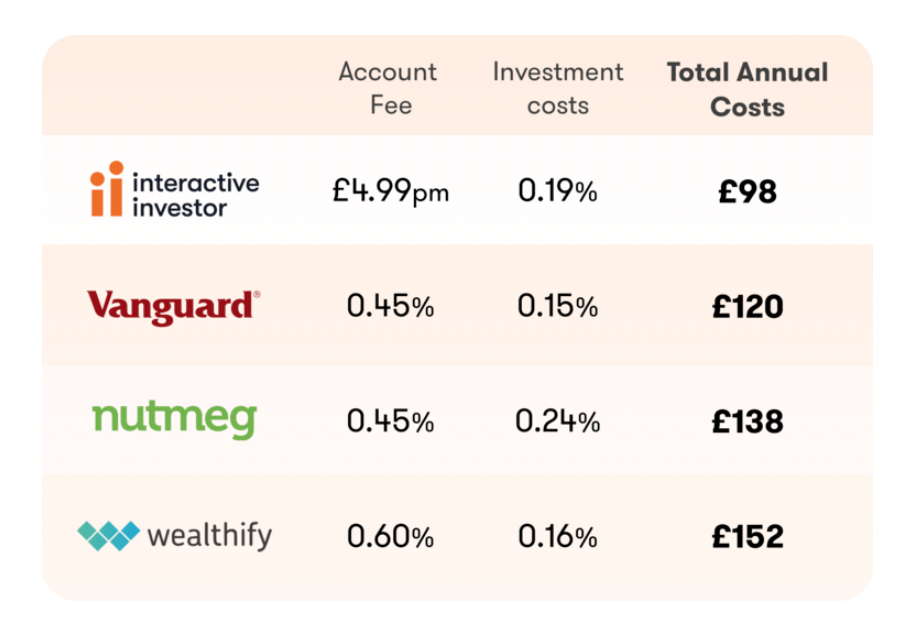

- A transparent, flat subscription is charged, starting from £4.99 per month alongside a portfolio fee ranging from 0.13% to 0.36%.

- The minimum initial investment is £250 or you can set up a monthly payment of £50.

ii’s Managed ISA may be suitable if you want a hassle-free way to invest your money with experts taking care of the granular investment decisions.

To get started, you’ll need to answer some questions about your investment pot and risk appetite. ii will then match you with the portfolio that best meets your investment profile.

The broker’s experts will manage and adjust your portfolio as needed and you can check in anytime or switch to a different investment plan.

- Remove the time burden associated with investing.

- Rest assured experts are picking and managing your investments.

- Pay a simple, low-cost fee that varies depending on your trading capital.

About interactive investor

Operating since 1995, interactive investor is an FCA-regulated brokerage with offices in Manchester, London and Leeds.

It distinguishes itself with its huge roster of investment products and tradable assets, including more than 40,000 US, UK and global stocks, trading accounts, self-invested personal pensions and individual savings accounts.

New clients can get started using the fully digital sign-up process, available through the web platform and mobile app.