Forex Trading in Ireland

Ireland has a large forex trading community, one which has grown in recent years as financial companies have relocated from the UK following Brexit.

This guide explains how traders in the Emerald Isle can make money dealing currencies online. It discusses the regulatory landscape, tax rules, the best time to trade, and explains how a short-term forex trade could work.

Quick Introduction

- Ireland has a vibrant forex market that has grown following the UK’s 2016 Brexit referendum and is closely regulated by the Central Bank of Ireland (CBI) and European Securities and Markets Association (ESMA).

- Currency crossings involving the euro – and especially the EUR/USD and EUR/GBP – are traded in substantial volumes across Ireland.

- Irish forex traders may need to pay income tax of between 20% and 40%, and also make Universal Social Charge (USC) and Pay Related Social Insurance (PRSI) contributions.

Top 4 Forex Brokers in Ireland

Our experts have found these 4 platforms are the best for forex traders in Ireland:

How Does Forex Trading In Ireland Work?

Thanks to its stable economy, robust digital infrastructure and tight regulatory environment, Ireland is home to a large forex trading community. Currency volumes have risen due to Brexit, too, with many financial institutions relocating some or all of their operations across the Irish Sea.

According to New Financial, 135 companies set up shop in Dublin between mid-2016 and early 2021 alone. This equated to 25% of all moves out of Britain to European Union countries, putting Ireland’s capital comfortably ahead of second-placed Paris (which claimed 19% of total migrations).

The most popular forex pairings involve the country’s official currency, the euro (EUR). These include the EUR/USD (US dollar) and the EUR/GBP (British pound).

Is Forex Trading Legal In Ireland?

Yes. Currency trading is regulated by the Central Bank of Ireland (CBI), which is responsible for maintaining the integrity and stability of all financial markets in the country.

All firms that operate in the forex market must be authorized to do business by the CBI. They must meet strict standards to ensure that consumers are protected, and that the financial system remains robust.

Companies are closely supervised, and ones that fall short of regulatory requirements can be hit by enforcement action (which can include fines and disqualification from forex trading). A list of authorized financial services providers can be found here on the CBI’s website.

The CBI has established the Investor Compensation Scheme (ICS) to protect traders if an authorized firm is unable to meet its financial obligations. It provides compensation of 90% of the investor’s total eligible investment, subject to a maximum of €20,000.

As a member of the European Union, Ireland must also adhere to frameworks established by the European Securities and Markets Association (ESMA). This includes the Markets in Financial Instruments Directive II (MiFID II), which was established to boost market efficiency and improve trader protections.

MiFID II has specific implications for traders that use forex contracts for difference (CFDs). These include limits on leverage (1:30 on major forex pairings and 1:20 on others), the provision of negative balance protection, and establishing margin close-out rules. Such measures are designed to reduce the chances of traders racking up large losses.

Is Forex Trading Taxed In Ireland?

Yes, currency traders are required to pay tax on their profits. Earnings must be declared to Ireland’s Revenue Commissioners, the government agency tasked with assessing and collecting taxes.

The profits that professional traders make are subject to income tax at a rate of 20% to 40%. The exact amount of tax payable depends on an individual’s relationship status – for instance if they are single or married – and whether they have children.

A single person with no children will pay tax at 20% of their first €42,000 of annual profit, and 40% on the remaining balance. This individual will also receive a tax allowance of €1,875. Details on tax thresholds and allowances can be found here on the Revenue Commissioners website.

In most cases, forex traders will also have to pay the Universal Social Charge (USC) if their total income exceeds €13,000. The rate on this tax ranges from 0.5% and 8%, details on which can be found here.

Individuals who earn more than €5,000 a year will typically make Pay Related Social Insurance (PRSI) contributions, too. This is applied at a flat rate of 4% of gross earnings, with a minimum payment of €500.

Forex traders are required to submit their previous year’s tax return to the Revenue Commissioners by 31 October. Like most European Union countries, Ireland’s tax year runs from 1 January to 31 December.

When Is The Best Time To Trade Forex?

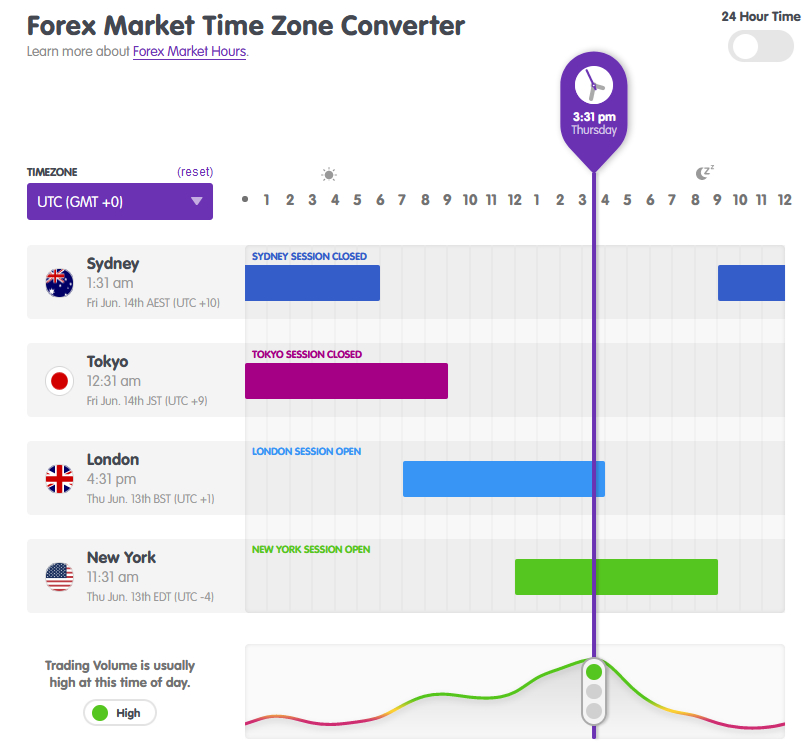

Currency traders are free to place trades 24 hours a day, except for when financial markets are closed around the weekend. They can start dealing when Sydney opens at 10:00pm Greenwich Mean Time (GMT) on Sundays, and cease trading at 9:00pm on Fridays when New York closes out the trading week.

The Irish trading session enjoys high levels of liquidity and frequent volatility, which in turn can make it easier for forex day traders to generate a profit. This is because Ireland shares a time zone with London, the world’s biggest currency trading venue.

Dealing volumes pick up even further at 12:00pm GMT when the Dublin trading session crosses over with the opening of US markets. Volumes peak between at around 3:30pm GMT before gradually declining as the end of Ireland’s session approaches.

A Forex Trade In Action

With all this in mind, let’s think about how a currency trade might play out in the real world.

In this theoretical example, we’ll use a major forex pairing and execute the trade at a busy time of the day, a scenario that could maximize my chances of booking a tidy profit.

The Strategy

My plan is to trade the euro against the US Dollar with the EUR/USD pairing. This is a currency cross with deep liquidity – according to the Bank for International Settlements’ (BIS) latest triennial survey, this pair accounted for 22.7% of daily forex turnover in 2022.

I plan to execute my trade around the time of the next European Central Bank (ECB) interest rate announcement. This is a significant economic event that tends to attract lots of interest from forex traders.

What’s more, with the release due at 3.15pm, trading volumes should be especially high as markets in London, Dublin and New York are all open.

The Research

Having studied recent economic data, I decide that the ECB is likely to keep interest rates on hold. My theory is at odds with that of most traders: indeed, the market is pricing in a rate cut of around 25 basis points.

If I’m correct, the euro is likely to strengthen against other currencies like the dollar. So if I decide to go long – a play that will see me buy Europe’s single currency while simultaneously selling the buck – I could find myself ‘in the money.’

The Trade

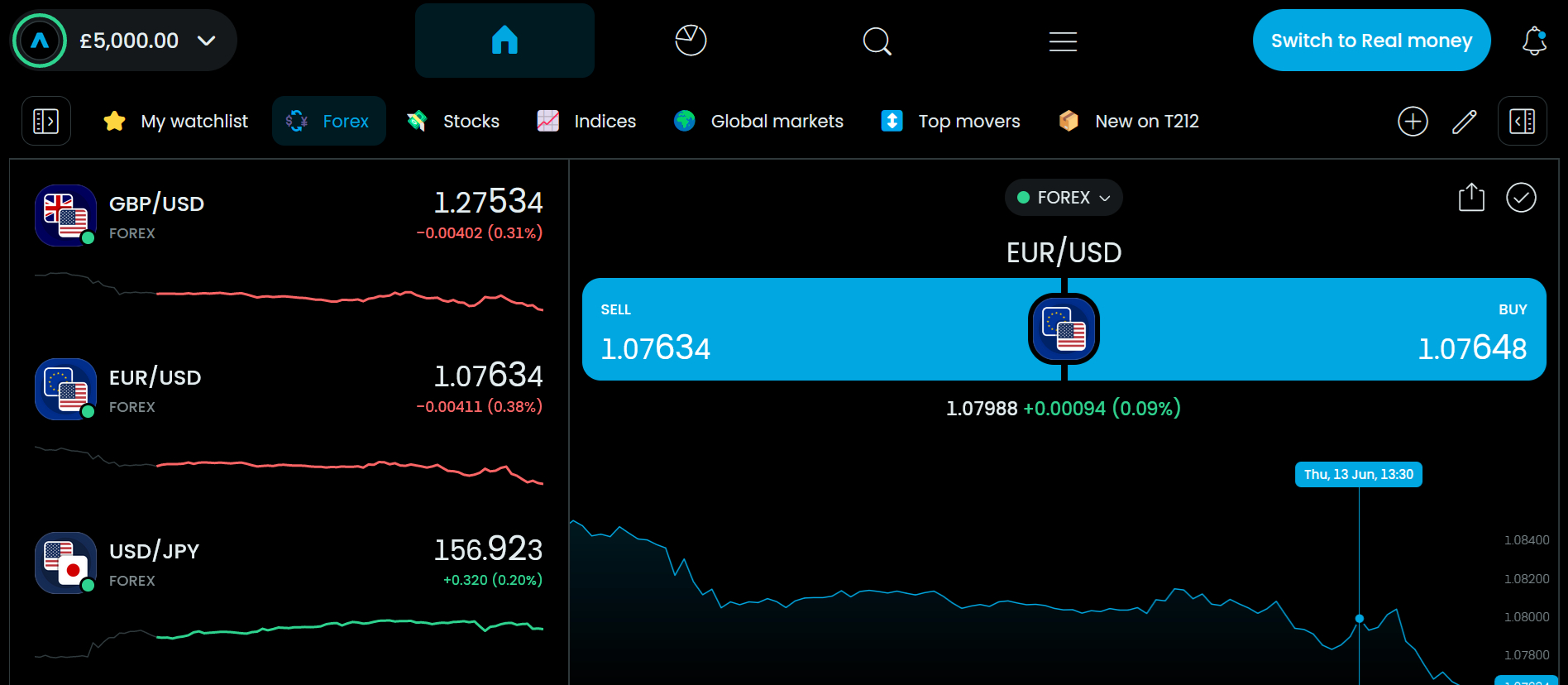

Having done my homework, I’m ready to place the forex trade. At 3:10pm GMT, my terminal indicates that the EUR/USD is trading at 1.0765, which means I can get €1 for $1.0765.

I don’t just jump in and hit the ‘buy’ button, though. To mitigate risk, I place a ‘take profit’ order at 1.0785, which locks in any gains should the pairing rise to this level by automatically closing my position.

I also put in a ‘stop loss’ instruction at 1.0745, which acts in the opposite way to limit any losses if the euro unexpectedly falls against the dollar.

After placing my trade, I wait for the interest rate announcement. Within a few minutes, the ECB advises that its benchmark will remain unchanged, causing the euro to gain value.

And within a further five minutes, the EUR/USD exchange rate crosses 1.0785, triggering my take profit order and automatically closing my position. As a result, I realise a profit of 20 pips.

Bottom Line

Ireland boasts a large forex market that has been expanding since the UK’s Brexit referendum. With its strong economy and advanced technological infrastructure, Ireland is a great destination for currency trading.

Stringent oversight by Irish and European regulators means that traders are well protected. However, despite a comprehensive regulatory framework, some fraudulent actors continue to prey on forex traders, so it’s crucial that individuals check the forex broker they choose is properly regulated by the authorities.

Recommended Reading

Article Sources

- The post-Brexit landscape in the EU – New Financial

- Explainer - What compensation schemes protect consumers of authorised firms? – Central Bank of Ireland (CBI)

- Tax rates, bands and reliefs – Revenue Commissioners

- Universal Social Charge (USC) – Revenue Commissioners

- A guide to self-assessment – Revenue Commissioners

- Triennial Central Bank Survey, OTC foreign exchange turnover in April 2022 – Bank for International Settlements (BIS)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com