Forex Trading in Indonesia

Indonesia is a small player in the world’s forex markets. According to the Bank for International Settlements’ latest triennial report, daily trading volumes in the Asian country totalled $12 billion in 2022.

However, Indonesia’s FX market is growing as its economy booms and interest in financial trading rises. Better access to the internet – especially through smartphones – is also making trading platforms more accessible.

This guide equips beginners with everything they need to begin forex trading in Indonesia.

Quick Introduction

- Indonesia’s FX market is modest compared with Asian nations like Hong Kong and Singapore, but it’s growing as one of the fastest-growing economies with improving financial education.

- You can trade the Indonesian rupiah (IDR) in currency pairs like IDR/USD and IDR/EUR. However, low liquidity and scarce availability on forex apps are drawbacks for active traders.

- Forex trading is chiefly regulated by the Commodity Futures Trading Regulatory Agency (BAPPEBTI), while Bank Indonesia plays a role in managing currency flows.

Top 4 Forex Brokers in Indonesia

From our hands-on tests and analysis, these 4 platforms are the obvious choices for forex traders in Indonesia:

How Does Forex Trading Work?

Forex trading involves simultaneously buying and selling two currencies, known as a currency pair, to profit from fluctuations in exchange rates.

- You buy a currency pair if you expect the base currency (the first currency in the pair) to appreciate.

- You sell a currency pair if you expect the base currency (the first currency in the pair) to depreciate.

Indonesia’s forex market remains relatively small by global standards. In 2022, it accounted for 0.1% of all foreign exchange turnover, according to the BIS. Meanwhile, bets involving Indonesian rupiah (IDR) accounted for 0.4% of all foreign currency turnover that year.

However, the turnover of pairings involving the Asian currency is soaring as more locals get involved. Average daily trading volumes of rupiah pairings trebled between 2016 and 2022, to $29 billion.

Common forex crosses featuring the IDR include:

- IDR/USD (against the US dollar)

- IDR/EUR (versus the euro)

- IDR/GBP (against the British pound)

- IDR/AUD (versus the Australian dollar)

- IDR/CAD (against the Canadian dollar)

Still, low trading volumes and limited availability on forex trading platforms mean many Indonesians focus on major pairs like EUR/USD and USD/JPY.

Is Forex Trading Legal In Indonesia?

Yes. Currency dealing is chiefly regulated by the Commodity Futures Trading Regulatory Agency (also known as the Badan Pengawas Perdagangan Berjangka Komoditi, or BAPPEBTI).

The organization’s job is to ensure that the forex market operates in a fair, transparent and efficient way. It acts to safeguard traders against fraud or malpractice.

BAPPEBTI also oversees commodity and cryptocurrency dealing, including through the use of derivatives.

Bank Indonesia – the country’s central bank – doesn’t have a role in regulating currency trading. However, it works with BAPPEBTI to ensure the overall stability of financial markets, including foreign exchange.

The bank also influences the forex market through monetary policy, as well as by buying and selling currencies to reduce exchange rate volatility.

Is Forex Trading Taxed In Indonesia?

Yes. Profits from trading currencies may be subject to income tax and must be declared to Indonesia’s Directorate General of Taxes (DJP).

The country’s tax year runs from 1 January to 31 December, and tax returns must be submitted by 31 March the following year.

Forex traders typically pay tax at the following progressive rates:

| Taxable Income (in IDR) | Tax Rate |

|---|---|

| Up to 60 million | 5% |

| Between 60 million and 250 million | 15% |

| Between 250 million and 500 million | 25% |

| Between 500 million and 5 billion | 30% |

| Above 5 billion | 35% |

Given the evolving tax landscape in Indonesia, I recommend consulting a local tax professional who can help ensure you meet your obligations and simplify reporting.

When Is The Best Time To Trade Forex In Indonesia?

Currency traders can do business 24 hours a day, five days a week. But trading conditions vary at different times, and certain periods can be more profitable than others.

As a trader, I’m looking for periods when forex transactions are especially high. At these times, there’s a greater chance for price volatility. It can also be easier to enter and exit positions, and often cheaper too thanks to tighter bid and ask spreads.

In Indonesia, the best time to do business varies according to where one happens to be based. The country is split into three time zones:

- Western Indonesia Time (WIB), which is GMT + 7 hours.

- Central Indonesia Time (WITA), which is GMT + 8 hours.

- Eastern Indonesia Time (WIT), which is GMT + 9 hours.

In Jakarta, which sits in the WIB time zone, the best hours to trade are generally between 19:00 and 00:00. This period overlaps London’s afternoon session and pre-lunch trading in New York.

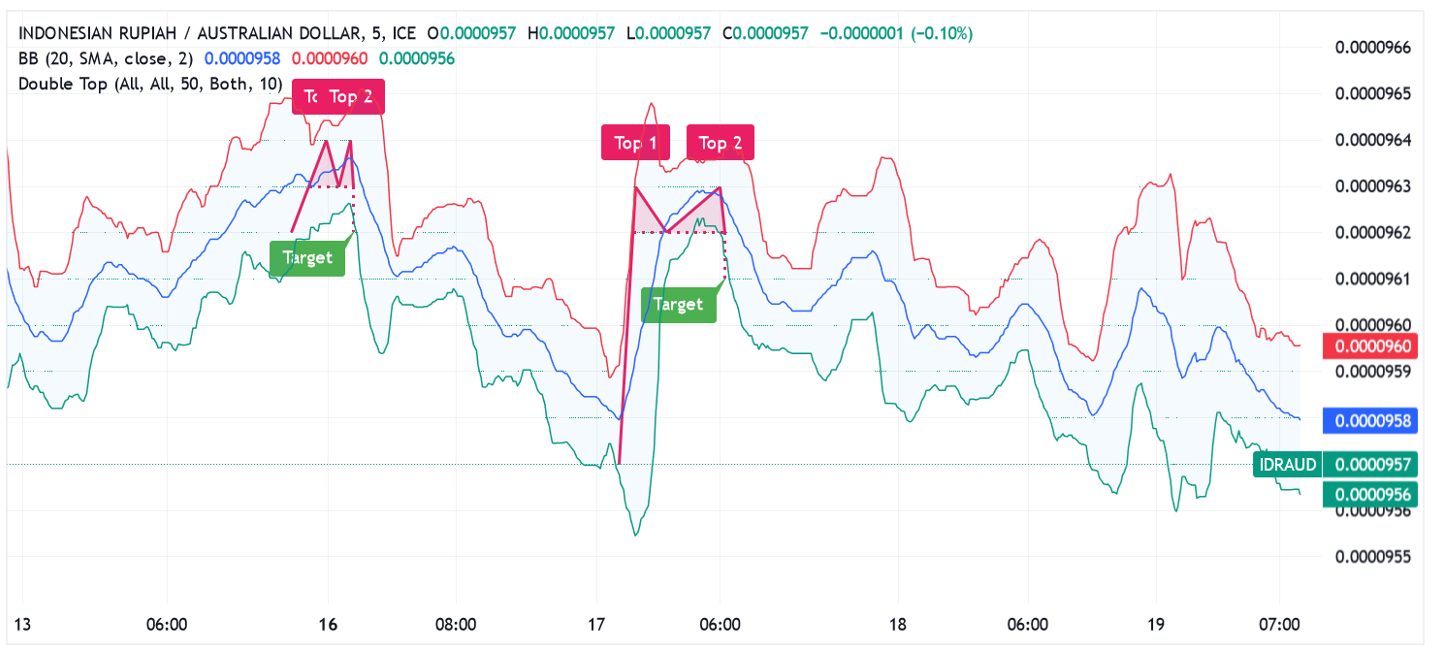

An IDR/AUD Trade

Let’s think about how a forex trade in Indonesia might occur. In this example, I’ll demonstrate how a trader like me could potentially make a profit from the IDR/AUD pairing following an important economic announcement.

The Background

My plan is to go long on the pairing, which involves buying Indonesia’s rupiah (the base currency) and simultaneously selling the Australian dollar (the quote currency).

I’m expecting Bank Indonesia to announce a freeze in interest rates – at 5.75% – at its latest meeting. This differs from analyst consensus, which means the market is pricing in a rate cut of 25 basis points, to 5.5%.

The Setup

I come to this conclusion after looking at recent economic data, including fresh inflation numbers, labor market statistics and GDP data.

I’m especially swayed by last month’s Consumer Price Inflation (CPI) figure of 3.4%, which remained at the top end of the central bank’s 1.5% to 3.5% target.

Before placing the trade, I also carry out technical analysis to get a better understanding of where the IDR/AUD cross may move to.

Studying historical price movements and volume data is critical for short-term trading strategies. Being able to successfully identify chart patterns (such as ‘double tops/bottoms’), trend lines, and indicators (like Bollinger Bands) can help you better identify potential entry and exit points.

The Trade

Bank Indonesia is set to make its interest rate announcement at 14:00 WIB. So I sit down ten minutes beforehand and prepare to key in my IDR/AUD trade.

At this time, the pairing is trading at 0.0000953. This means that I can get approximately 10,493 Indonesian rupiah for one Australian dollar.

My trade involves me setting a ‘take profit’ order at 0.0000965 and a ‘stop loss’ instruction at 0.0000945. These orders help me manage trading risk by automatically closing my position if the IDR/AUD rises to the former level or falls to the latter.

Shortly afterwards, Bank Indonesia announces that it’s kept interest rates on hold at 5.75%, as I’d predicted. The IDR rises as a result, including against the AUD, and within half an hour has triggered my ‘take profit’ instruction at 0.0000965.

This gives me a profit of 12 pips.

Bottom Line

Strong economic growth, rising financial literacy, and improving access to trading platforms have led to an explosion in forex volumes across Indonesia.

Regulatory improvements also make Indonesia a more attractive place for active traders to do business.

Still, individuals need to remain vigilant against being targeted by forex scams. Before depositing rupiahs, ensure that the provider you’ve chosen is licensed by BAPPEBTI, and/or by a respected body abroad.

Recommended Reading

Article Sources

- Triennial Central Bank Survey, OTC foreign exchange turnover in April 2022 – Bank for International Settlements (BIS)

- Commodity Futures Trading Regulatory Agency (BAPPEBTI)

- Bank Indonesia

- Directorate General of Taxes (DJP)

- Indonesia - Individual - Taxes on personal income - PwC

- Time Zones in Indonesia – timeanddate.com

- Indonesia's inflation stays within central bank range in Aug - Reuters

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com