IC Trading Review 2025

Pros

- IC Trading offers unusual flexibility in its accounts, enabling traders to open up to 10 live and 20 demo accounts, meaning you can run separate profiles for different activities, such as manual trading and algo trading.

- The simplified and digital account opening process saves time and effort, allowing traders to start trading sooner without extensive paperwork, taking just minutes during testing.

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

Cons

- Customer support performed woefully during testing with multiple attempts to connect via live chat and no one available to assist, plus unanswered emails, raising concerns about its ability to address urgent trading concerns.

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

IC Trading Review

This review of IC Trading offers a detailed examination of the day trading experience, based on firsthand testing and comparisons with appropriate alternatives sourced from our extensive database comprising around 500 online brokers.

Regulation & Trust

2.8 / 5IC Trading operates independently from the highly trusted IC Markets but falls under the same company — Raw Trading Ltd.

While IC Markets is regulated by multiple ‘green tier’ authorities, notably the ASIC in Australia and the CySEC in Europe, and is a member of the Financial Ombudsman Service (FOS), IC Trading is solely registered with the Financial Services Commission of Mauritius (FSC) – a ‘red-tier’ regulator. This distinction removes some layers of protection that traders should be aware of.

Trading with a well-regulated broker is paramount, as I’ve learned firsthand. Regulation ensures adherence to legal frameworks, safeguarding your funds and rights. Moreover, tightly regulated brokers undergo regular audits and oversight, promoting transparency and accountability.

Additionally, IC Trading is not listed on any stock exchange, and there’s a lack of public disclosure of financial information. This contrasts with our most trusted broker, IG, which is listed on the London Stock Exchange (LSE).

IC Trading

Dukascopy

Interactive Brokers

Regulation & Trust Rating

Regulators

FSC

FINMA, JFSA, FCMC

FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Accounts & Banking

3.5 / 5Live Accounts

IC Trading provides two account types to suit various trading styles: Standard and Raw Spread.

While each account offers unique features, they essentially provide the same functionalities, with lot sizes starting from just 0.01 and leverage up to 1:500.

The Raw Spread account, with its lower spreads and commissions, caters well to scalpers, although spreads remain highly competitive in the commission-free, Standard account.

IC Trading’s True ECN Connectivity facilitates institutional-grade liquidity sourced from up to 50 different providers concurrently, including leading investment banks, hedge funds, and dark pool liquidity execution venues worldwide.

The flow of Executable Streaming Prices (ESP) from IC Trading’s liquidity providers to its ECN environment ensures you can day trade without encountering a dealing desk, price manipulation, or re-quotes.

The account opening process, which I personally went through, is swift and fully digital, typically taking just a few minutes.

That said, approval may take up to 24 hours due to time zone differences.

Demo Accounts

IC Trading’s demo account offers a valuable opportunity to hone trading skills.

I particularly appreciate that IC Trading provide a risk-free demo account compatible with both the MetaTrader 4/5 and cTrader platforms. This allows me to use it without any restrictions from its initial setup, enabling thorough strategy testing before risking real capital.

Deposits & Withdrawals

IC Trading offers diverse deposit options across 10 different currencies, depending on your account jurisdiction. This surpasses many brokers like eToro, which typically only offer USD or EUR as the base currency.

Choosing your preferred base currency helps avoid conversion fees when funding your trading account or trading assets in the same currency.

In my own experience, deposits are usually processed promptly, even when using different currencies and payment methods. However, withdrawals tend to be slower, with funds only transferable to accounts in your name using the same methods as deposits until the initial deposit is surpassed.

Debit card and e-wallet withdrawals are typically processed within the same business day, free of charge, but may take up to 3-5 business days. Bank transfers are slower and may incur a $20 charge, prompting me to avoid them whenever possible.

IC Trading

Dukascopy

Interactive Brokers

Accounts & Banking Rating

Payment Methods

Credit Card, Debit Card, Mastercard, Neteller, PayPal, Visa, Wire Transfer

Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer

ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer

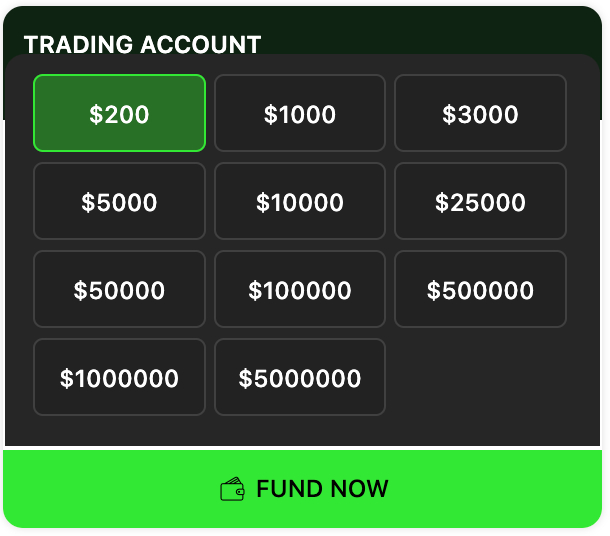

Minimum Deposit

$200

$100

$0

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Assets & Markets

3 / 5IC Trading specializes in forex and CFDs, which means it doesn’t offer popular asset classes like real stocks, ETFs, or options.

However, the broker does provide a reasonable range of products, notably over 60 currency pairs, as well as CFDs in precious metals, commodities, indices, futures, stocks, bonds, and cryptocurrencies.

However, I’ve noticed that IC Trading falls short in providing passive income options, such as earning interest on unused account balances. This contrasts with a growing number of competitors like eToro and XTB, which offer this feature, providing returns of up to 5.3% and 5.2%, respectively.

IC Trading

Dukascopy

Interactive Brokers

Assets & Markets Rating

Trading Instruments

CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures

CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options

Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies

Margin Trading

Yes

Yes

Yes

Leverage

1:500

1:200

1:50

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Fees & Costs

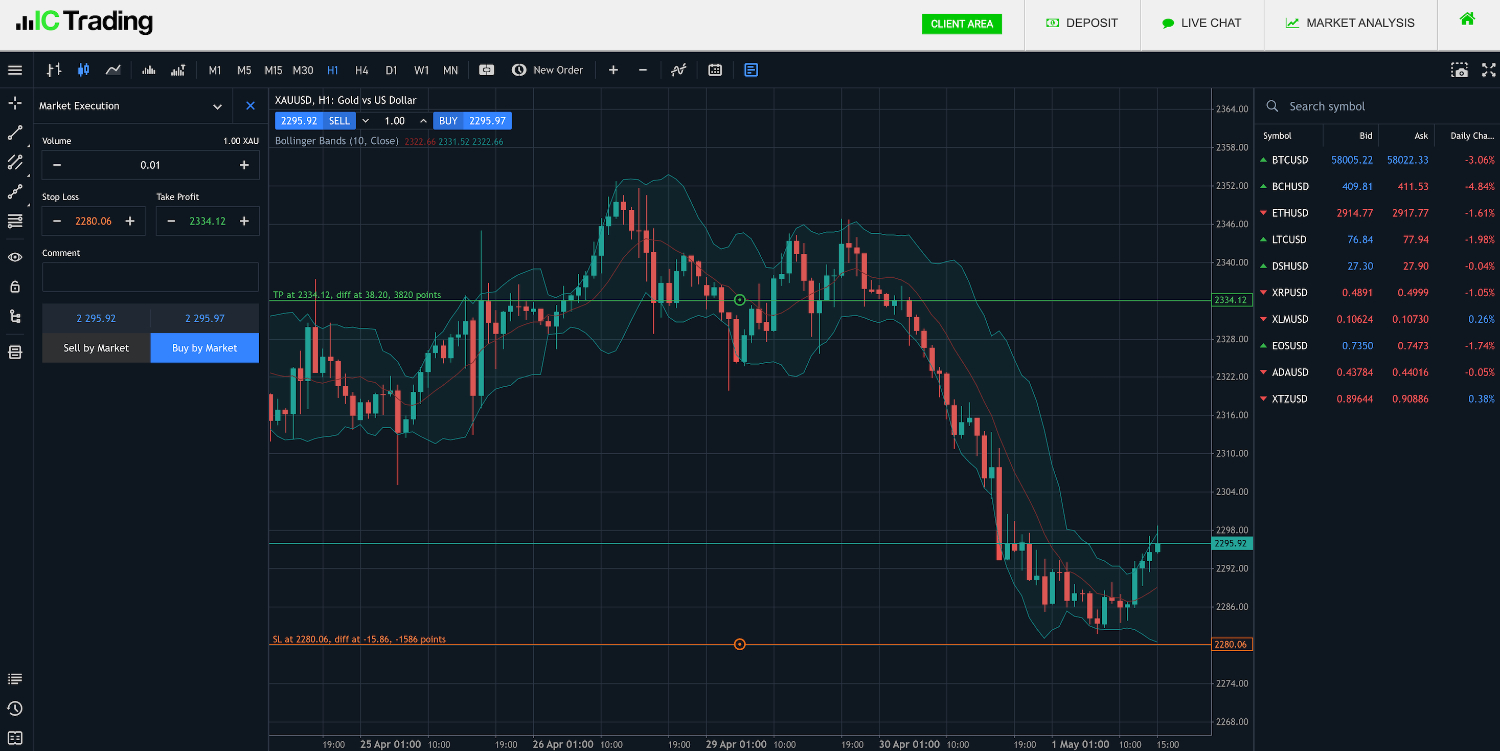

4 / 5Pricing is where IC Trading performs best, with tight spreads and low trading fees – making it a strong contender for day traders. That said, spreads may vary depending on factors such as your chosen trading platform and account type.

For major currency pairs like EUR/USD, I’ve seen spreads starting as low as 0.0 pips on the Raw Spread account, with an associated commission of $3.50 per standard lot traded. The average spreads, such as 0.1 pips for EUR/USD, are also excellent and can significantly impact day trading profitability.

Additionally, when trading stock index CFDs, fees are included in the spreads. Also, overnight fees are minimal, and there is no monthly inactivity fee.

| IC Trading | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.1 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 2.133 | 100 | 0.005% (£1 Min) |

| Oil Spread | 0.028 | 0.1 | 0.25-0.85 |

| Stock Spread | Variable | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

4 / 5IC Trading doesn’t have its own proprietary trading platform, which might be a consideration for beginner traders looking for a slick, web-accessible solution.

Unfortunately, unlike IC Markets, trading from within the excellent and increasingly popular TradingView charting platform is not currently supported, which is disappointing.

That said, they make up for this to some degree by supporting leading third-party platforms: MetaTrader 4, MetaTrader 5 and cTrader.

Despite its outdated interface, MetaTrader is widely favored by active traders for its extensive customization options, a plethora of technical indicators, advanced charting tools, Expert Advisors, and robust back-testing capabilities.

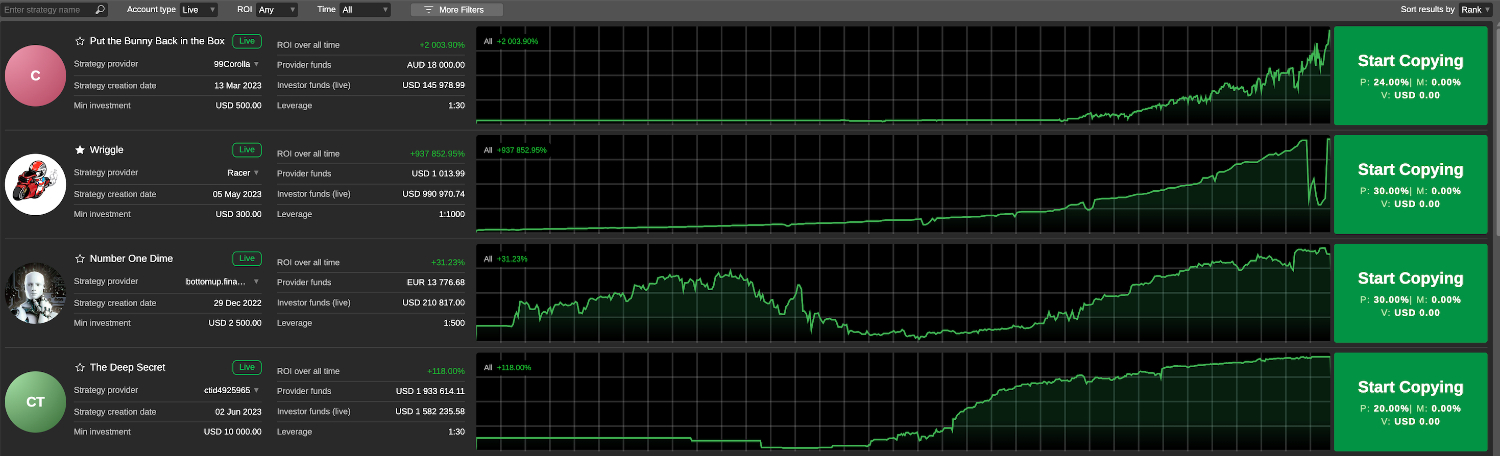

On the other hand, cTrader boasts impressive charting capabilities and is my personal preference due to its sleek interface that facilitates quick and seamless trading, and its easy-to-use built-in economic calendar that highlights important events which could affect market prices.

Both MetaTrader and cTrader come with default indicators and support additional algorithmic plugins. cTrader also includes copy trading features for replicating trades of successful traders.

IC Trading

Dukascopy

Interactive Brokers

Platforms & Tools Rating

Platforms

MT4, MT5, cTrader, AutoChartist, TradingCentral

JForex, MT4, MT5

Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower

Mobile App

iOS & Android

iOS & Android

iOS & Android

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Research

3 / 5While IC Trading offers some commendable research tools, including trading ideas and technical analysis from third-party providers like Trading Central and Autochartist, it lacks in-house research.

On IC Markets’ site, several articles are published daily on its blog, covering technical and fundamental forecasts. Although the quality of this content is satisfactory, it doesn’t match the depth offered by industry leaders, notably IG.

The highlight really is the technical analysis and trading ideas from Trading Central and Autochartist, accessible from your account page or within supported charting tools like cTrader.

This feature enables you to view trade setups and even execute trades based on automated setups with just a few clicks, including setting take profit and stop loss parameters.

Additionally, I’ve signed up for daily market forecasts via email, which has proven useful for potential trade ideas. I also regularly refer to the economic calendar, which highlights important economic events for the next eight hours.

| IC Trading | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

2.2 / 5IC Trading itself lacks basic educational resources, necessitating beginner traders to visit the IC Markets site for learning materials.

Even then, the diversity and presentation of these materials fall short compared to leading brokers like eToro, CMC Markets, and XTB. Additionally, accessing these resources from a blog rather than directly from your account page is inconvenient, potentially causing traders to overlook their existence.

In my opinion, IC Trading should replicate the educational resources published by IC Markets and enhance its offerings by introducing courses with progress tracking, quizzes, and the ability to filter content based on your experience level.And making all this content accessible from the account page would greatly improve the user experience.

| IC Trading | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

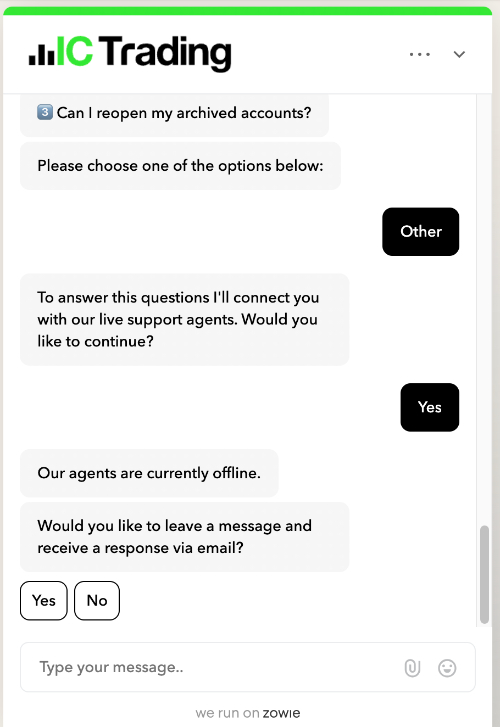

Customer Support

2.8 / 5IC Trading seriously trails the best brokers in the support department. The main concern is the absence of localized phone numbers, which means you have to call the broker’s office in Mauritius for immediate assistance.

Additionally, I’ve encountered difficulties communicating with a real agent on the live chat – consistently receiving a message stating that no agents are available and that I should send an email instead, despite there supposedly being 24/7 assistance.

In an attempt to resolve this issue, I tried using the live chat function on the IC Markets’ website, only to be informed that they couldn’t assist me as IC Trading is a separate entity.

Despite sending emails to IC Trading, I received no replies. This has been the worst support experience I’ve encountered with a broker, and it is imperative for IC Trading to address its customer support shortcomings before its brand suffers irreparable damage.

IC Trading

Dukascopy

Interactive Brokers

Customer Support Rating

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Should You Trade With IC Trading?

For seasoned traders in search of the tightest spreads and support for powerful charting tools and trading algorithms, IC Trading is a reasonable option.

However, deciding between IC Trading and IC Markets depends on various factors, including your trading preferences, regulatory considerations, and the specific features offered by each platform. As of our latest tests, IC Markets is the much better overall choice.

FAQ

Is IC Trading Legit Or A Scam?

IC Trading’s global counterpart, IC Markets, is a credible broker known for its consistent delivery of transparent trading services to its clients. Supported by robust regulatory supervision and commitment to industry norms, it’s a dependable choice for forex and CFD traders.

Although IC Trading has been set up to attract European traders and has less stringent regulation, there is no reason to believe the company is a scam.

Is IC Trading A Regulated Broker?

IC Trading is regulated by the Financial Services Commission of Mauritius (FSC), a regulatory authority responsible for overseeing financial services in Mauritius.

Regulation in Mauritius is not as strict as regulation in some other jurisdictions, so traders might want to research the FSC’s reputation and compare it to the regulatory body in their own country.

Is IC Trading Suitable For Beginners?

IC Trading is not the ideal choice for novice traders as it lacks a proprietary trading platform and offers limited educational and research resources. It caters primarily to seasoned traders who prioritize low trading costs and seek support for their preferred third-party charting tools.

For complete beginners, trading platforms like eToro and Plus500 are more suitable.

Does IC Trading Offer Low Fees?

Fees are highly competitive at IC Trading. The broker commonly applies minimal spreads, such as 0.0 pips on major currency pairs, positioning it among the industry’s most competitive options.

IC Trading also offers commission-based pricing alternatives, affording you the flexibility to select the fee structure that aligns with your trading preferences.

Is IC Trading A Good Broker For Day Trading?

IC Trading is an exceptional broker for day trading, thanks to its competitive pricing, rapid execution speeds, and commendable selection of tradable assets.

The broker also grants access to advanced trading platforms such as MT4/MT5 and cTrader, each equipped with robust charting tools, technical indicators, and order types ideally suited for implementing short-term trading strategies.

Top 3 Alternatives to IC Trading

Compare IC Trading with the top 3 similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

IC Trading Comparison Table

| IC Trading | Dukascopy | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| Rating | 4 | 3.6 | 4.3 | 4.4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $200 | $100 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FSC | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | – | 10% Equity Bonus | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | 1:500 | 1:200 | 1:50 | 1:50 |

| Payment Methods | 7 | 11 | 6 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by IC Trading and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| IC Trading | Dukascopy | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | No | Yes | Yes |

| Options | No | No | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | No |

IC Trading vs Other Brokers

Compare IC Trading with any other broker by selecting the other broker below.

The most popular IC Trading comparisons:

Customer Reviews

2 / 5This average customer rating is based on 1 IC Trading customer reviews submitted by our visitors.

If you have traded with IC Trading we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of IC Trading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Abrir uma conta é muito fácil, porem não exigem de inicio suas comprovações, quando vc vai fazer primeiro saque, ai sim, exigências ultrapassadas, tipo, extrato colorido com logo do banco, não aceitam extratos de aplicativos do banco, NÃO GOSTEI. BOM, DEPOIS DE CUMPRIR COM TODAS E EXIGENCIAS, SAQUE REALIZADO, DEBITADO NA IC E NÃO PAGO EM MINHA CONTA. PROCESSO DE DEPOSITO TODOS VIA PIX, 2 SEGUNDOS PARA ENTRAR NA CONTA, PORQUE O SAQUE NÃO É DO MESMO JEITO?

ESTOU COM PROBLEMAS COM MEUS SAQUES. PEDI SAQUE DO MEU SALDO E NADA. SUPORTE TUDO ROBOT.

Opening an account is very easy, but they don't require proof at the beginning, when you go to make your first withdrawal, oh yes, outdated requirements, like, colored statements with the bank's logo, they don't accept statements from bank applications, I DIDN'T LIKE IT. GOOD, AFTER COMPLYING WITH ALL THE REQUIREMENTS, WITHDRAWAL MADE, DEBITED TO IC AND NOT PAID INTO MY ACCOUNT. DEPOSIT PROCESS ALL VIA PIX, 2 SECONDS TO ENTER THE ACCOUNT, BECAUSE THE WITHDRAWAL IS NOT THE SAME WAY?

I'M HAVING PROBLEMS WITH MY WITHDRAWALS. I ASKED TO WITHDRAW MY BALANCE AND NOTHING. SUPPORT ALL ROBOT.