IC Markets Faces Lawsuits In Australia Over CFDs

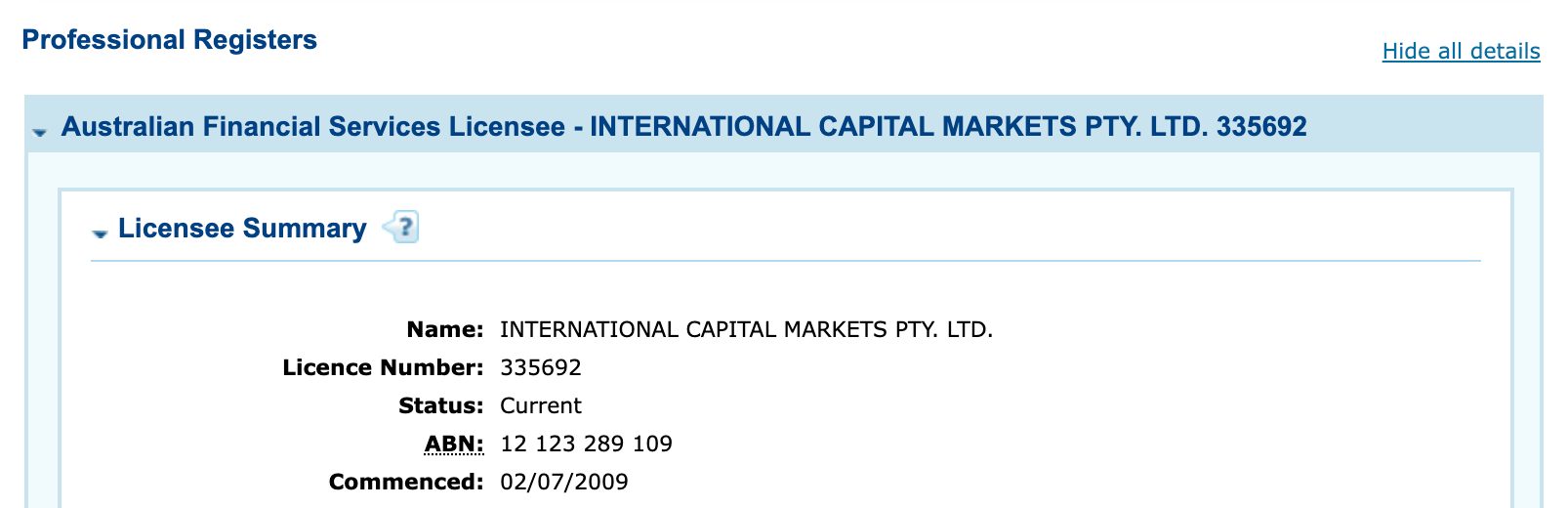

Piper Alderman and Echo Law are coordinating class actions that take aim at IC Markets for selling contracts for difference (CFDs) to retail investors between September 2017 and March 2021.

This follows Australian lawsuits against other established brokers, notably IG, Plus500 and CMC Markets.

Key Takeaways

- The class actions allege IC Markets did not sufficiently assess retail investors’ aims and circumstances nor sufficiently disclose the risks of CFD trading.

- The Australian Securities & Investments Commission (ASIC) introduced new conditions on CFDs in March 2021, prior to which, traders’ losses could exceed their initial investment due to high leverage.

- IC Markets has strongly denied the claims and plans to defend itself.

Australian Brokers Find Themselves In Legal Crosshairs

IC Markets isn’t the first ASIC-regulated broker to face lawsuits relating to its marketing and sale of CFDs, and it likely won’t be the last.

Piper Alderman filed a similar suit against IG in 2022, while Johnson Winter Slattery lodged a suit against CMC Markets in 2022 and Plus500 in 2023.

Trading CFDs is legal in many countries, including Australia, though it doesn’t mean there aren’t risks.

Why Are CFDs Risky?

CFDs allow traders to speculate on rising and falling prices without owning the underlying asset, for example, shares listed on the Australian Stock Exchange.

What makes them particularly risky is that they are commonly traded with leverage, enabling investors to amplify their buying power and potential profits or losses, in return for a small outlay, known as margin.

The ASIC’s intervention in 2021 helped limit the losses retail investors can face trading CFDs to their initial deposit, however significant losses remain a possibility.

Although these recent cases are likely big business for the law firms handling them, they underscore the importance of retail traders adopting a sensible approach to risk management and investing only what they are prepared to lose.