IBKR Becomes First International Broker To Offer Foreign Traders Access To Saudi Exchange

Interactive Brokers has inked a historic deal with Saudi National Bank Capital, giving foreign retail traders access to stocks, exchange-traded funds (ETFs) and real estate investments trusts (REITs) on the Saudi Stock Exchange, known as Tadawul.

Key Takeaways

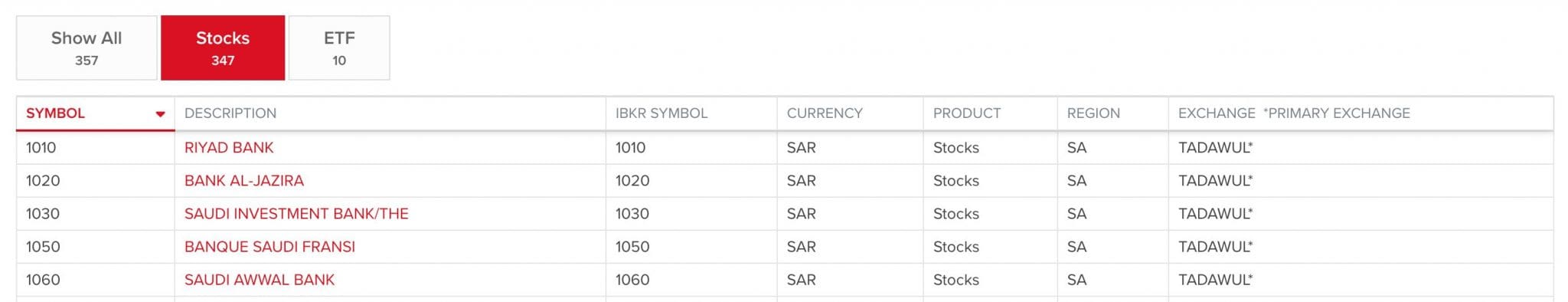

- Clients of IBKR can deal in the Middle East’s biggest stock exchange, home to 234 companies spanning 21 sectors, including Al Rajhi Bank and Saudi Aramco.

- View the latest tradable assets by navigating IBKR’s Products Search and selecting ‘Saudi Arabia’ under ‘EMEA’ in ‘Regions’.

- The total market cap on Saudi Exchange Main Market is around SAR 10.05 trillion with an average daily trading volume of around SAR 10.64 billion, according to Saudi Tadawul Group.

- Saudi Arabia is the Persian Gulf’s leading economy and is poised for more change after regulatory developments that have enabled foreign retail investors access to Saudi equities.

Existing IBKR users can start trading Saudi securities within 24 hours by following these steps:

- Sign in to the Portal

- Select ‘User’ under ‘Settings’

- Choose ‘Trading Permissions’

- Choose ‘Stocks – Add/Edit’

- Choose ‘Saudi Arabia’ and press ‘Continue’

- Review the legal documents and press ‘Continue’

About Interactive Brokers

Interactive Brokers is one of the industry’s longest-standing providers, serving serious traders since 1978.

It’s listed on the NASDAQ and regulated by ‘green tier’ bodies under DayTrading.com’s Regulation & Trust Rating, including the SEC and CFTC in the US, FCA in the UK, and MAS in Singapore.

It delivers in the tooling department with its recent IBKR Desktop platform in addition to features such as Option Lattice and Screeners with MultiSort, plus a reliable, real-time market data feed.

New traders can open an IBKR account with no minimum deposit.