Day Trading in Hungary

Hungary boasts a developed economy and an educated workforce that contributes to large manufacturing, agricultural and services sectors, and a burgeoning class of aspiring traders.

Hungary’s status as a significant exporter to Germany and other EU countries also often equates to a current account surplus, leading to interesting trading possibilities in the Hungarian forint, as well as shares listed on the Budapest Stock Exchange (BSE).

This guide to day trading in Hungary breaks down all the basics for the country’s active traders.

Quick Introduction

- Hungary is home to a skilled workforce and is among the most 20 complex economies – a key criterion for economic development that also presents short-term trading opportunities.

- The National Bank of Hungary (MNB) primarily regulates the country’s financial markets. As an EU member, Hungary also adheres to European standards such as ESMA and MiFID II, providing ‘green-tier’ protections as per DayTrading.com’s Regulation & Trust Rating.

- Short-term trading profits are typically taxed by the Hungary National Tax and Customs Administration as capital gains at a flat 15% – one of the lowest rates in Europe.

Top 4 Brokers in Hungary

After testing 223 brokers, these 4 platforms are our top-rated options for active traders in Hungary:

Day Trading Platforms in Hungary

What Is Day Trading?

At the most basic level, day trading involves buying and selling instruments, such as shares in a publicly traded Hungarian company, within the course of a single business day to profit from short-term price differences.

It offers opportunities for significant profits but is also one of the hardest trading systems to master and brings substantial risks – you could lose your entire investment.

The most common assets for short-term trading include:

- Shares trading, e.g. those listed on the Budapest Stock Exchange like oil and gas giant, MOL Group

- Indices trading, e.g. the BUX Index which contains around 15 of Hungary’s most traded stocks

- Forex trading in Hungary, e.g. currency pairs containing the forint like USD/HUF, EUR/HUF and GBP/HUF

- Commodities trading, e.g. corn and wheat as Hungary is a major producer of grains

- ETF trading, e.g. VanEck Oil Refiners ETF which has notable exposure to Hungary

- Cryptocurrency trading, e.g. Bitcoin and Ether though these are extremely risky investments

Is Day Trading Legal In Hungary?

There’s no restriction against day trading in Hungary, as long as you follow the country’s laws. For most individuals, that will mean signing up with a regulated brokerage and complying with its terms.

The Hungarian Financial Supervisory Authority (HFSA) and the National Bank of Hungary (MNB) are robust bodies that take active measures against brokers that breach consumer protection rules.

The country’s EU membership also means retail traders should have protections afforded by the European Securities and Markets Authority (ESMA) according to the strong MiFID II framework.

For example, active Hungarian traders should receive safeguards like negative balance protection, while leverage is limited to a maximum of 1:30 on major currency pairs with lower limits for other assets, such as 1:20 on non-major currency pairs and 1:5 on stocks.

How Is Day Trading Taxed In Hungary?

Day trading profits are typically counted as capital gains in Hungary, meaning traders may need to pay a flat rate of 15%, though this could rise to 28% if certain conditions are not met.

A flat tax of 15% can be a significant advantage, as many countries count gains from short-term trading towards personal income at a much higher rate.

However, there is always a level of complexity to tax regulations in any country, and it’s your responsibility to ensure you comply with the latest rules from the National Tax and Customs Administration (NAV).

I strongly recommend speaking to an accountant with knowledge of Hungary’s tax system before filing your returns.

It’s the best way to make sure there’s nothing missing and you meet your tax in full, as well as benefiting from any advantages the Hungarian system offers.

Getting Started

These simple steps will help you set off running when you start your day trading journey in Hungary:

- Choose a broker you can trust: For a secure trading environment, Hungarians should want a platform that’s authorized by the MNB and HFSA, or by a regulator in another EU country, such as the Cyprus Securities & Exchange Commission (CySEC).

- Activate your account: To complete registration, you’ll need to verify your account. This usually involves uploading proof of address such as a bill as well as a valid ID like a passport or your Hungarian e-identification card. Opting for a broker with a HUF account may result in a convenient trading experience.

- Deposit forints: Before you can make a trade, you’ll need to fund your account using a traditional method like wire transfer or card transaction, or a fast digital payment method. In Hungary, e-wallets like PayPal and Apple Pay have taken off in recent years and are accepted by a growing number of platforms.

A Trade In Action

Let’s take a look at how you might plan and execute a short-term trade in Hungary…

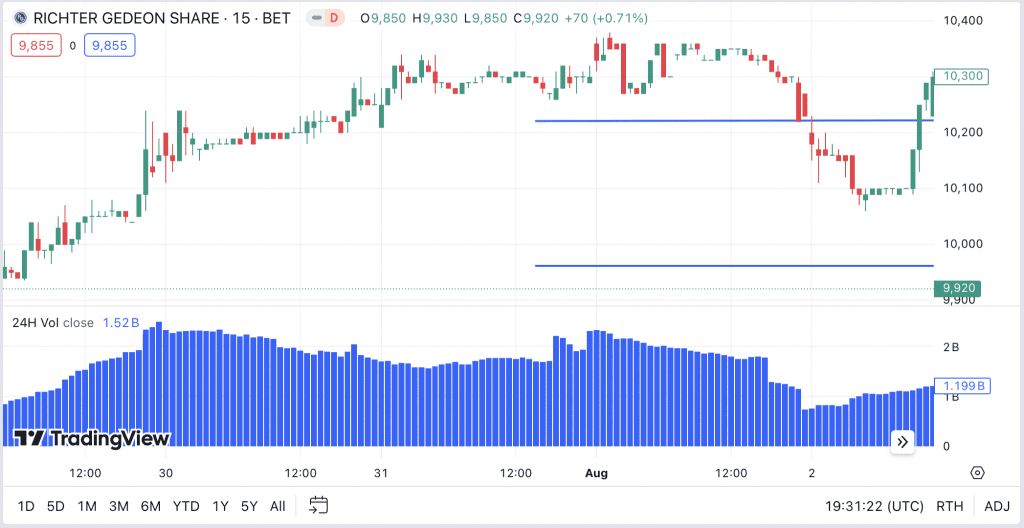

For this trade, I’ve decided to look at pharmaceutical company Richter Gedeon (RIG2), one of the largest market-cap stocks on the BSE and the largest company of its kind in Central and Eastern Europe.

I’ve been impressed by Richter’s performance, with the company’s double-digit growth forecast and high dividend combining with some promising acquisitions to lure investors.

Having watched the stock’s price fall to just below a previous support level at HUF10,080 on Thursday, I decide to perform further technical analysis to weigh up a possible trade.

I note that the price had been on an uptrend since bouncing back from a similar level on Tuesday, and since I could not find any negative news to scare off traders, I am considering opening a long position.

Given that the high over the past week has been HUF10,380, and the price at HUF10,080 is closer to the weekly low of around HUF9,940, I predict that a reversal on Friday morning could bring significant potential for upside.

I identify the 38.2% Fibonacci retracement level at around HUF10,220 and use this to set my take profit order, as well as setting a stop loss just above the weekly low at HUF9,960.

After opening my trade at HUF10,080, it doesn’t take long to discover that this time my prediction has come off, as Richter makes significant gains on Friday, morning, hitting my take profit before midday and bringing profits of HUF140 per share.

Bottom Line

Day trading in Hungary presents varied opportunities to online traders thanks to the country’s geopolitical situation and demographics.

You’ll also benefit from access to some of the world’s best brokers thanks to EU membership and the passporting scheme for regulators across Europe.

Check DayTrading.com’s list of the top day trading brokers in Hungary to find a platform that best meets your needs.

Recommended Reading

Article Sources

- National Bank of Hungary (MNB)

- Budapest Stock Exchange (BSE)

- National Tax and Customs Administration (NAV)

- European Securities and Markets Authority (ESMA)

- Summary of tax obligations in Hungary - PwC

- Hungary's Current Account - Trading Economics

- Richter Gedeon Acquires Belgium-Based Biotech Company - Hungary Today

- Countries by Economic Complexity - Wikipedia

- Richter Gedeon Predicts Double-Digit Growth - Hungary Today

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com