Forex Trading In Hong Kong

Hong Kong is one of the biggest venues on the planet for forex trading. This befits its status as a major financial centre and a regional economic powerhouse.

According to the Bank for International Settlements’ (BIS) triennial report, Hong Kong is the second-largest forex market in Asia, and the fourth largest in the world, behind the US, UK and Singapore.

This guide describes how investors in Hong Kong can trade currencies online. It explains how the forex industry is regulated, how traders are taxed, and provides an example of a short-term trade involving a regional currency pair.

Quick Introduction

- Forex trading volumes in Hong Kong have soared since 2000, making the territory a major hub for currency dealing.

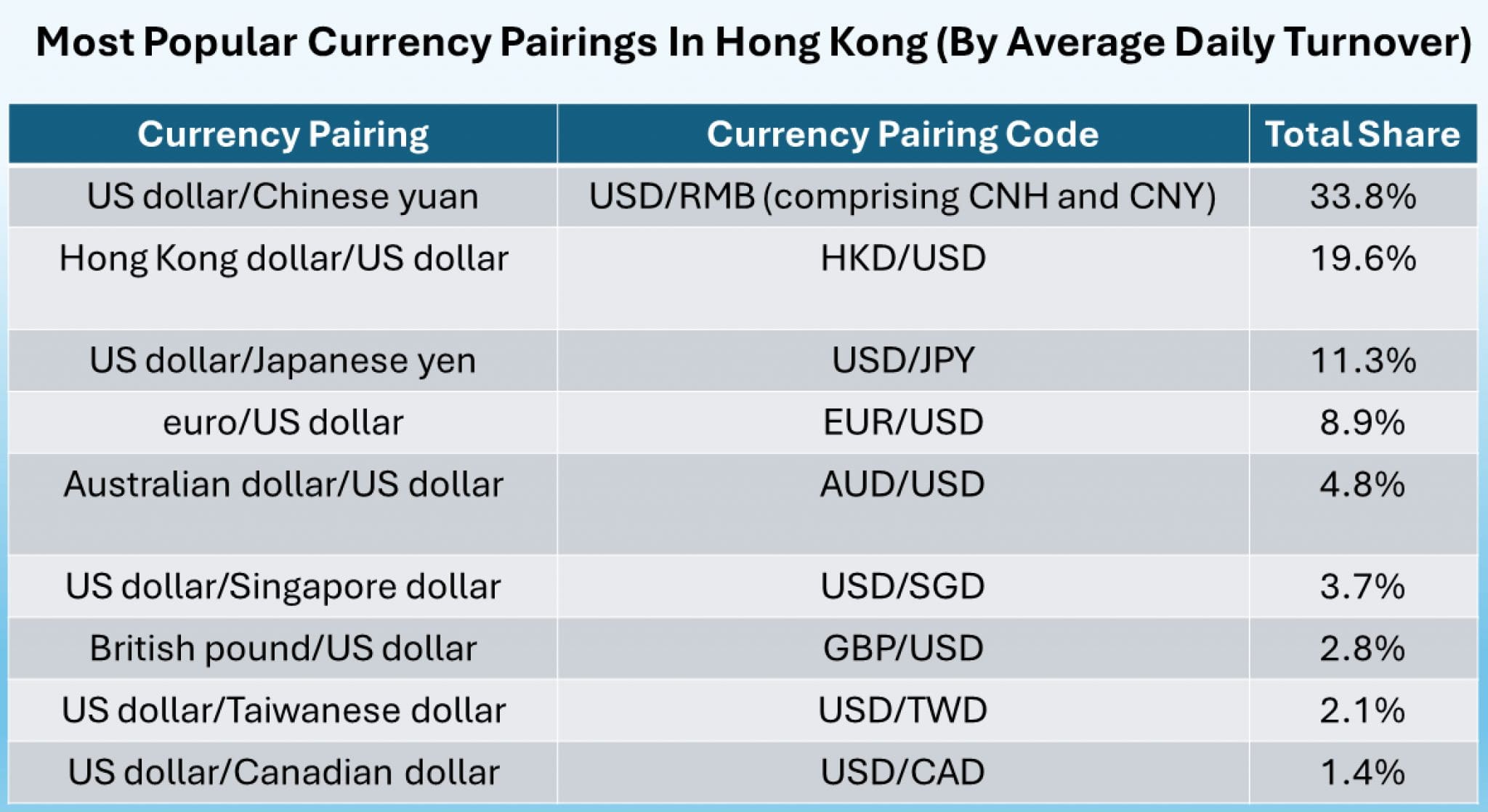

- Currency pairings involving the US dollar (USD) are most popular with the region’s traders, while China’s yuan (CNH) is also transacted in huge volumes.

- Forex traders typically pay 0% tax, making Hong Kong an attractive place to do business.

- The foreign exchange market is subject to strict regulation by the Securities and Futures Commission (SFC).

Top 4 Forex Brokers In Hong Kong

Our hands-on evaluations point to these 4 platforms as being the best for forex traders in Hong Kong:

How Does Forex Trading In Hong Kong Work?

Forex trading in Hong Kong is growing rapidly thanks to the region’s economic might, well-developed infrastructure, and strict regulatory oversight. According to BIS data, the average daily turnover of currency transactions rose 9.8% between 2019 and 2022, to $694.4 billion.

The sovereignty of Hong Kong was transferred to China from the UK in 1997. However, its classification as a Special Administrative Region (SAR) provides the territory with a high degree of autonomy when it comes to legal, political and economic frameworks.

As a consequence, the region has its own currency known as the Hong Kong dollar (HKD), which is separate from the Chinese yuan/renminbi (CNH or CNY). Despite this, Hong Kong remains the world’s foremost trading venue for China’s currency.

Hong Kong’s forex market is dominated by the US dollar (USD), the world’s reserve currency. More than three-quarters of all trades in the territory involve currency pairings featuring the buck.

But don’t be fooled: while they represent the same currency, CNH and CNY can have different exchange rates, which reflects reduced market access and tighter government controls on the mainland.

Is Forex Trading Legal In Hong Kong?

Dealing in foreign currencies is legal and regulated in Hong Kong by the Securities and Futures Commission (SFC), which ensures that brokerages operate in compliance with local laws and regulations.

The agency is responsible for establishing and enforcing rules in the territory’s securities and futures markets, and closely supervises individuals and organizations that come under its remit. These include market exchanges, clearing houses, banks, online brokers, forex traders, and other market participants.

All forex brokers have to be registered with the SFC to do business in Hong Kong. The list of regulated businesses is available for public viewing. The body also publishes an alert list to warn customers of financial services providers, including forex trading platforms, that are not authorized.

Yet while trader protections are high in Hong Kong, individuals should still be vigilant. As with other territories, fraudulent actors still operate in the region, and the forex space remains particularly attractive to scammers.

Is Forex Trading Taxed In Hong Kong?

Generally speaking, living and working in Hong Kong is considered very attractive from a tax standpoint compared with most other jurisdictions.

Those who trade forex are not liable to pay any tax on any profits they make. Capital gains tax does not exist in the SAR. And tax is only applicable to individuals whose income is sourced within the territory’s borders.

This means retail forex traders are typically exempt from paying a share of their profits to the region’s Inland Revenue Department (IRD).

What Is The Best Time To Trade Forex?

Regardless of where you live, you can trade the currency markets 24 hours a day, five days a week.

However, for those living in the Hong Kong Time (HKT) zone, the best time to deal forex is between the hours of 9:00 am and 5:00 pm. During this period, other regional trading hubs like Tokyo and Singapore are also highly active, resulting in deep liquidity and therefore more favorable market conditions.

The Asian trading session also overlaps the Australasian session early in the day, and the European session in the afternoon. During these times, trading volumes and price volatility can be even better due to the increased number of investors sitting at their desks, resulting in competitive fees for fast-paced day traders.

A Forex Trade In Action

Here I’ll walk you through a hypothetical example of trading the region’s most popular currency pairing, and showcase how I could capitalize on the release of key economic data.

Why The USD/CEH?

As described earlier, the US dollar/Chinese yuan pairing is by some distance Hong Kong’s most traded currency combination. It therefore has significant appeal for me: deep liquidity means that bid and ask spreads tend to be closer than with other pairings, which in turn helps me to keep trading costs down.

With more active buyers and sellers, I may also be able to open and close out positions more quickly than with alternative combinations, thus reducing the chances of price slippage.

Finally, price discovery is also better for more liquid pairings like this, as quotes are more reflective of true supply and demand dynamics.

Talking Tactics

I plan to day trade the USD/CNH following the Federal Reserve’s next announcement on interest rates. This is scheduled for 2.00 am local time (2.00 pm Eastern Seaboard Time in the US).

The consensus among market participants is that rates will be kept on hold. However, after doing some fundamental research, I believe the Fed will keep cutting rates in response to falling inflation, a scenario that could pull the value of the dollar lower.

Before placing my trade, I carry out technical analysis on the USD/CNH. This allows me to identify key trends and indicators, which in turn boosts my chances of accurately predicting possible price movements.

Placing The Trade

I expect the USD/CNH combination to fall from current prices of 7.2315. At this level, $1 can get me a little over ¥7.23.

To capitalize on any reversal in the greenback, I’ll need to open a short position. This process will involve me selling the USD (the base currency) against the CNH (the quote currency).

Whilst setting up the trade, I set up a ‘take profit’ instruction at 7.2290, as well as a ‘stop-loss’ order at 7.2330.

These instructions are effective and popular risk management tools. The former automatically exits my position – and thus locks in my profits – if the exchange rate falls to the target level, while the latter reduces my losses if the dollar rises, by exiting the position if it hits the stop-loss level.

A few minutes after I complete my trading instruction, the Federal Reserve cuts its benchmark rate as I’d hoped. The US dollar subsequently falls in value, and within half an hour has fallen to my take profit target of 7.2290, giving me a profit of 25 pips.

Bottom Line

Like Singapore, Hong Kong is an incredibly vibrant hub when it comes to forex trading. Its strong economy and favorable tax regime make it a haven for people looking to make money on the currency markets.

Forex traders in the SAR have the option to trade at whatever hours they choose. But doing business early in the morning or late in the afternoon can be especially attractive. At these times, the Asian trading session crosses over with core dealing periods in Australasia and Europe respectively.

To start trading currencies online, open an account with a top forex day trading broker.

Recommended Reading

Article Sources

- Trading - Investor and Financial Education Council (IFEC)

- Results of the Semi-annual Survey of Foreign Exchange Market Activity in Hong Kong (October 2023) - Treasury Markets Association

- Turnover of OTC foreign exchange instruments, by country – Bank for International Settlements (BIS)

- Turnover of OTC foreign exchange instruments – Bank for International Settlements (BIS)

- CNH vs CNY: Differences Between the Two Yuan - NASDAQ

- Alerts – Securities and Futures Commission (SFC)

- Public register of licensed persons and registered institutions - Securities and Futures Commission (SFC)

- Hong Kong Tax and Investment Guide 2023 - Deloitte

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com