Elliott Wave Theory

The Elliott Wave Theory makes use of fractal, repetitive patterns to predict future market movements. It was developed in the 1930s by Ralph Nelson Elliott. Elliott recognized the fact that investors’ psychology gives rise to certain “wave” patterns in asset price action.

The Best Brokers For Trading Using Elliott Wave Theory

-

1

FOREX.comActive Trader Program With A 15% Reduction In Costs

FOREX.comActive Trader Program With A 15% Reduction In Costs

Ratings

$1000.01 Lots1:50NFA, CFTCForex, Stocks, Futures, Futures OptionsMT4, MT5, TradingView, eSignal, AutoChartist, TradingCentralWire Transfer, Credit Card, Debit Card, Visa, Mastercard, Skrill, Neteller, ACH TransferUSD, EUR, GBP, CAD, AUD, JPY, CHF, PLN -

2

RedMars

RedMars

RatingsTrust Platform Assets Mobile Fees Accounts Research Education Support 3.8

€2500.01 Lots1:30 (Retail), 1:500 (Pro)CySEC, AFMCFDs, Forex, Stocks, Indices, Commodities, CryptosMT5Credit Card, Wire Transfer, Debit Card, Sticpay, FasaPay, Bitcoin Payments, Trustly, PayPal, Skrill, Neteller, Klarna, Mastercard, VisaUSD, EUR -

3

Dukascopy10% Equity Bonus

Dukascopy10% Equity Bonus

RatingsTrust Platform Assets Mobile Fees Accounts Research Education Support 3.6

$1000.01 Lots1:200FINMA, JFSA, FCMCCFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary OptionsJForex, MT4, MT5Neteller, Wire Transfer, Mastercard, Skrill, Visa, Maestro, Credit Card, Debit Card, Apple Pay, Bitcoin Payments, Ethereum PaymentsUSD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN -

4

xChief$100 No Deposit Bonus

xChief$100 No Deposit Bonus

RatingsTrust Platform Assets Mobile Fees Accounts Research Education Support 3.9

$100.01 Lots1:1000ASICCFDs, Forex, Metals, Commodities, Stocks, IndicesMT4, MT5Wire Transfer, Bitcoin Payments, Credit Card, UnionPay, Skrill, Neteller, WebMoney, Perfect Money, Debit Card, Ethereum Payments, FasaPay, VoletUSD, EUR, GBP, JPY, CHF

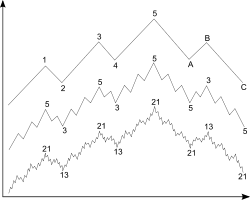

A typical Elliott Wave consists of a 5-wave move in the direction of the predominant trend. This is followed by a 3-wave, correction move.

The Nature Of Elliott Waves

Ralph Nelson Elliott was not the first one to notice that stock prices tend to move in waves. The Dow Theory spells out the very same conclusion. Elliott was however the first one to also recognize the fractal nature of these waves.

What exactly does that mean?

As far as trading goes, a fractal is defined as a simple price pattern that occurs relatively frequently. In geometry, its definition also covers the fact that fractal patterns repeat themselves on ever smaller scales, ad infinitum. The same is valid for Elliott Waves.

Price Prediction Using Elliot Waves

In general, a fractal indicator points out a potential turning point on the price chart. It then confirms the existence of a pattern.

Elliott realized that his waves came with certain characteristics, which he deemed reliable. Namely, patterns usually consist of an impulse wave, which moves in the direction of the prevailing trend, and a correction wave, which moves in the opposite direction.

Each impulse wave contains 5 smaller waves. Each correction wave consists of 3 smaller waves. Traders call such patterns the 5-3 move.

Due to the fractal nature of the pattern, everything described above repeats on a smaller scale.

Dissecting the correction wave described above, one will find that it consists of two moves in the direction of the correction and one in the opposite direction.

Zooming in solely on this section of the pattern however, the prevailing direction will be the one in which the two waves move. Each of them can thus be broken up into 5 more waves. The single wave moving in the opposite direction, consists of 3 smaller waves, in accordance with the Elliott Wave Theory.

Thus, it is clear that the 5-3 pattern pops up every time, regardless of time frame. It is important to point out that the 5-wave sequence of the pattern always follows the direction of the prevailing trend. It can be upward or downward. The three-wave sequence always points in the direction of the correction.

Various degrees of Elliott Waves

Elliott named some 9 degrees of wave patterns, though due to the fractal nature of the concept, all of this carries little practical significance. The 9 wave degrees are:

– Sub-minuette

– Minuette

– Minute

– Minor

– Intermediate

– Primary

– Cycle

– Supercycle

– Grand supercycle

Using The Theory In Practise

Simple: if a trader spots the beginnings of an impulse wave, he can go long on the asset. Then, as the 5-segment of the 5-3 moves completes, he can go short. Again, as the correction completes its three waves, he can go long again.

Strategies based on the Elliott Wave Theory work on all time frames.

Conclusion

While there certainly is some scientific backing behind the theory, for beginners, it can be subjective to pinpoint an actual pattern. Sometimes, the pattern itself might fail. It certainly does not make the market easily predictable.

That said, it has been used to great effect throughout the history of trading. In the 1908s, A.J. Frost and Robert Precher used it to predict the bull market of the 80s, as well as the subsequent crash of 1987.