Global GT Review 2024

Pros

- Six live account types with various trading conditions

- Dynamic and auto-adjusting leverage up to 1:1000

- Hybrid broker supporting both fiat and crypto investing and payments

Cons

- Some country restrictions including the USA, Canada, and member states of the European Union

- No proprietary trading platform or mobile app

- Mutual funds, options, and futures trading are unavailable

Global GT Review

Global GT is a South African forex and CFD broker. The group provides access to an array of instruments including forex, stocks, commodities, and indices on six account types with competitive trading conditions. This review of Global GT will cover deposit and withdrawal methods, the firm’s regulatory status, how to register for a live account, minimum funding requirements, and more.

Company Details

Global GT was established in 2019. It was the first regulated hybrid broker to offer trading, deposits, and withdrawals in both fiat and cryptocurrencies.

Part of the GT Group, the broker operates from its headquarters in South Africa. The company operates through two key subsidiaries:

- GT IO Markets (Pty) Ltd – Regulated by South Africa’s Financial Sector Conduct Authority (FSCA)

- 360 Degrees Markets Ltd – Regulated by Seychelles Financial Services Authority (FSA)

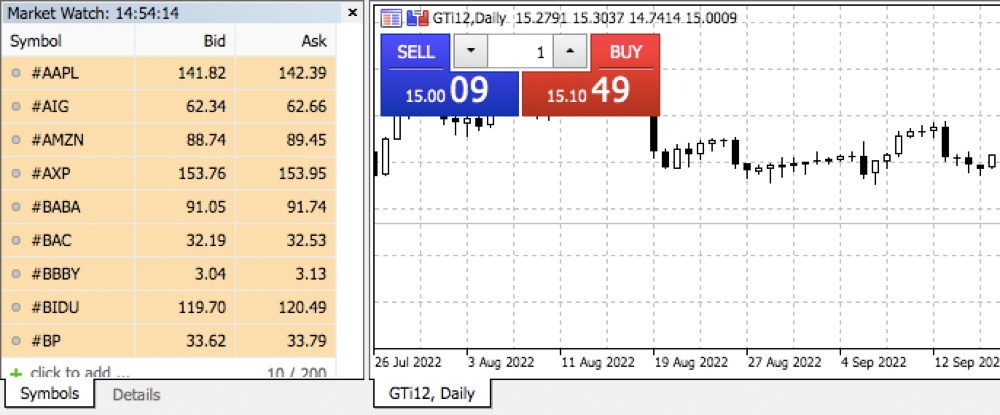

Platform

Global GT offers the MetaTrader 5 (MT5) platform. The terminal is available to download to desktop devices or can be used as a web trader.

Although there is no proprietary terminal, MT5 offers multi-asset trading with advanced tools, technical analysis features, and customizable charts and graphs. The user-friendly layout and intuitive design provide a stable and reliable investing environment.

Platform features include:

- 21 timeframes

- 22 analysis tools

- One-click trading

- 46 graphical objectives

- Integrated economic calendar

- 38 built-in technical indicators

- Six pending order types and trailing stops

- MQL5 Wizard to create auto-trading robots

- Up to 100 charts can be opened at any time

Together with access to the broker’s tier-one liquidity providers and Liquidity Aggregation Engine, retail investors can access competitive pricing and superior market execution speeds.

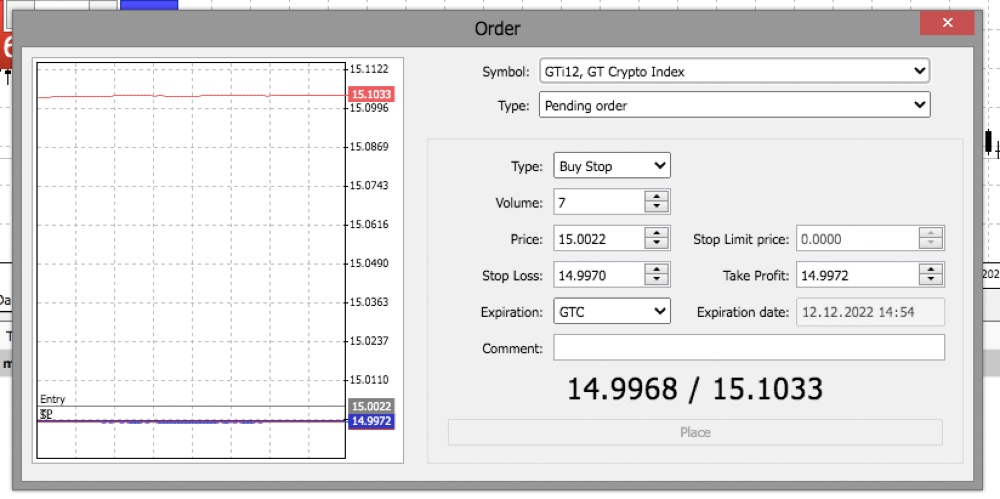

How To Place A Trade

- Log in to the Global GT client portal

- Download the MT5 platform or log in via the WebTrader

- Search for an asset

- Select ‘New Order’ via the icon in the top navigation bar

- Complete the required trade details including volume, order type, and risk parameters

- Select ‘Buy’ or ‘Sell’

- Review and confirm the order

MQL5 Signals

Retail investors can also subscribe to MQL5 signals. The program offers access to a range of strategies which can be connected to MT5 with no additional installation requirements. The system will then copy and execute market movements within your assigned terminal.

The automated service offers low-latency execution with no commission fees.

How To Install

- Register for an MQL5 profile via the website (MQL5.com)

- Create a Global GT account and log in to the MetaTrader 5 platform

- Select Tools > Options in the top navigation bar

- Add your MQL5 credentials to the pop-out

- Tick ‘Signals’ then ‘Ok’

- Select the ‘Signals’ icon in the toolbox window

- View the available signals alongside their specific details and performance statistics

- Select ‘Subscribe’ below the signal’s name

- Review the terms and conditions of the signal and select ‘Ok’

Assets & Markets

3 / 5Global GT offers access to 100+ instruments:

- Invest in 50+ global company stocks including Google, Meta, Tesla, Visa, and McDonald’s

- Trade 50+ major, minor and exotic currency pairs including EUR/USD, GBP/AUD, and USD/GBP

- Trade nine of the world’s largest equity indices such as the S&P 500, FTSE 100, VIX 75, and CAC 40

- Speculate on the price of two precious metals and three energies including US Crude Oil, Gold, and Silver

A major benefit of trading with Global GT is access to exclusive crypto instruments. This includes the proprietary GTi12 Index comprised of 12 of the most popular cryptocurrencies, alongside unique synthetic crypto pairs such as BTCXAU, BTCUSO, BTCXAG, and BTCSP.

Note, access to asset classes varies between account types. Details can be found in the Accounts section below.

Spreads & Fees

Fees and spreads vary by live account. All profiles except the ECN account offer commission free-trading. Spreads apply instead, with the Pro Account offering the tightest spreads from 0.5 pips. The Cent solution offers spreads from 1.2 pips.

The ECN profile provides direct market access with raw spreads from 0.0 pips. A commission fee of up to $6 per round lot turn applies.

Swap fees apply for positions held overnight. For forex and stocks, swaps are applied daily at 23:59, GMT +3.

Global GT does not charge any fees for deposits and withdrawals.

Leverage Review

Global GT offers leverage up to 1:1000 on a dynamic, tier-based scale. This means a balance of $100 could provide buying power of $100,000.

The Standard FX profile is subject to equity-based leverage only.

The broker has a margin call of 70% and a stop-out level of 40%.

Dynamic Leverage

A dynamic leverage tool is offered on all accounts except Standard FX. It adjusts the level of leverage required based on volume tiers and associated risks.

Below is an example using major forex pairs:

- Tier 1 – Volume of $0 to $300,000, maximum leverage 1:1000, margin 0.1%

- Tier 2 – Volume of $300,000 to $1,000,000, maximum leverage 1:500, margin 0.2%

- Tier 3 – Volume of $1,000,000 to $2,000,000, maximum leverage 1:200, margin 0.5%

- Tier 4 – Volume of $2,000,000 to $3,000,000, maximum leverage 1:100, margin 1%

- Tier 5 – Volume of $3,000,000 to $5,000,000, maximum leverage 1:50, margin 2%

- Tier 6 – Volume of more than $5,000,000, maximum leverage 1:20, margin 5%

Global GT Mobile App

The MetaTrader 5 (MT5) platform is available for free download to mobile and tablet devices. Day traders can access all account management features, open and close positions, and view charts and graphs while on the move.

It is a shame that Global GT does not offer a bespoke mobile app, however, our experts are confident that retail investors have access to all they need with the MT5 mobile terminal.

Payment Methods

Deposits

While using Global GT, day traders have access to various funding methods.

All accounts have a minimum deposit requirement of $5 or equivalent currency. However, some payment methods have separate starting thresholds.

There are some local payment methods that accept alternative currencies such as VND and MYR, though traders could be liable for currency conversion charges to USD and EUR accounts.

The broker does not charge fees to deposit to a trading account, however third-party charges may apply.

- Sticpay -$5 minimum deposit, instant funding

- Fasapay – $10 minimum deposit, instant funding

- Neteller & Skrill – $5 minimum deposit, instant funding

- Perfect Money – $50 minimum deposit, instant funding

- Pay Retailers (LATAM) – $10 minimum deposit, instant funding

- LuqaPay – $10 minimum deposit, up to one hour processing time

- Transact 365 – $20 minimum deposit, up to 15 minutes processing time

- Visa & MasterCard Credit/Debit Cards – $10 minimum deposit, instant funding

- Cryptocurrency – 25 USDT minimum deposit via Binance wallet, instant funding (blockchain dependent)

- Local Bank Wire Transfer – VND/THB/MYR/IDR currency accepted, $20 minimum deposit, instant funding

Withdrawals

Before making withdrawal requests, GT Global clients must have completed the relevant account verification requirements.

Similar to deposits, the broker does not charge any fees and processing times vary:

- Fasapay – $10 minimum withdrawal, instant processing

- Neteller & Skrill – $5 minimum withdrawal, instant processing

- Perfect Money – $50 minimum withdrawal, instant processing

- Sticpay – $10 minimum withdrawal, up to 48 hours processing time

- LuqaPay – $10 minimum withdrawal, up to one hour processing time

- Local Bank Wire Transfer – $20 minimum withdrawal, instant processing

- Transact 365 – $20 minimum withdrawal, up to 20 minutes processing time

- Pay Retailers (LATAM) – $25 minimum withdrawal, up to 72 hours processing time

- Visa & MasterCard Credit/Debit Cards – $10 minimum withdrawal, two working days processing time

Note, withdrawal requests via debit/credit cards must be equal to the initial deposit value. Additional funds can be processed via e-wallets or bank wire transfers.

Demo Account

A free demo account is available to Global GT day traders. You can practice trading risk-free on all six account types with flexible leverage, a choice of account denomination, and virtual funds.

When we tested Global GT’s paper trading profile, it was quick and easy to register via the client dashboard. You can also switch between live and demo accounts at the click of a button.

Deals & Promotions

Global GT offers several bonuses, competitions, and other promotions to new traders. This includes a 40% welcome bonus of up to $1500 based on your first deposit.

Loyalty bonuses are also available for existing retail traders based on consecutive deposits to live accounts. Additionally, unlimited trading credits are offered to clients who have redeemed the welcome and loyalty bonuses. Customers are rewarded based on the volume traded. Examples include a $7.50 credit per GLot of forex pairs traded on the Standard FX account.

Note, always review the terms and conditions of promotions as unrealistic requirements may be set. Also, access may vary by entity due to regulatory restrictions.

Regulation & Licensing

Global GT operates through two entities, both with regulatory oversight:

- GT IO Markets (Pty) Ltd – A registered company in South Africa with a license from the Financial Sector Conduct Authority (FSCA), number 48896

- 360 Degrees Markets Ltd – A registered company in Seychelles with a license from the local Financial Services Authority (FSA), securities dealer number SD019

Extra Features

GTLot

The GTLot tool is unique to the broker to support day-to-day trading. The feature is designed to create a common unit for trading volumes across all instruments.

The GTLot function works by exchanging the total volume of an account for US Dollars by regulating 1 GTLot to be equivalent to $100,000. Retail investors can use the function for benchmarking purposes and it is available in the client portal.

VPS Loyalty Service

The VPS sponsorship program offers a free MetaTrader virtual hosting program that can be installed onto your MT5 platform. Global GT will cover all associated monthly costs in return for loyalty to the brand.

Eligibility requirements:

- Hold minimum account equity of $3000

- Maintain a monthly volume of 5 GTLots

- Must have an existing Mini, Standard FX, Standard+, Pro or ECN live account

GT Inner Circle

A private Telegram channel for Global GT traders. The network offers access to daily trading tips and expert knowledge on market predictions and upcoming events. The brand’s analysts essentially host a platform of like-minded day traders, with encouragement to share ideas and success stories.

A request must be made to access the channel. A minimum monthly volume requirement of 3 GTLots must also be met.

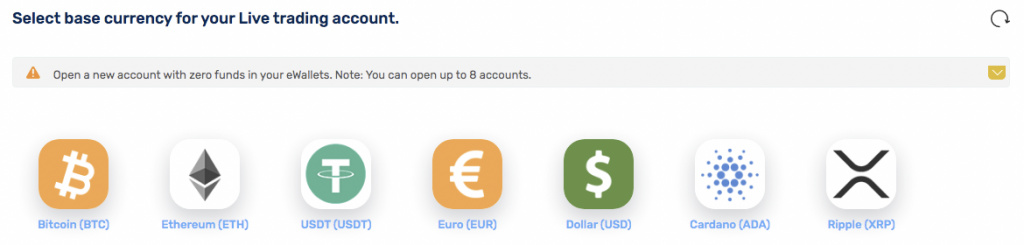

Account Types

Global GT offers six account types for retail clients; Cent, Mini, Standard FX, Standard+, Pro, and ECN. The suite of account options means that you can find a profile that suits your trading style and goals.

You can open all accounts in either USD or EUR fiat currencies or five cryptos including Bitcoin, Ethereum, and Ripple. All accounts offer access to the MT5 terminal, leverage up to 1:1000, a minimum deposit requirement of $5, and a minimum trade size of 0.01 lots. A halal swap-free account is also available on request.

Cent

Ideal for beginners with a contract size of 1000 lots (micro).

- Commission-free

- Access to bonuses

- Spreads from 1.2 pips

- Maximum trade size of 500 lots

- Maximum number of positions; 150

- Maximum number of pending orders; 50

Note, this account offers access to major and minor currency pairs, gold and crude oil trading only.

Mini

Suitable for retail investors trading fractional CFDs with a maximum contract size of 10,000 lots.

- Commission-free

- Access to bonuses

- Spreads from 1 pip

- Maximum trade size of 200 lots

- Maximum number of positions; 150

- Maximum number of pending orders; 50

Trade major, minor and exotic currency pairs, indices, metals, and energy CFDs.

Standard FX

A profile for foreign exchange trading alongside metals, indices, energies, and stock investments. Maximum contract sizes of 100,000 lots.

- Commission-free

- Access to bonuses

- Spreads from 1 pip

- Maximum trade size of 100 lots

- Maximum number of positions; 100

- Maximum number of pending orders; 100

Standard+

An all-round account with access to all instruments and a maximum contract size of 100,000 lots.

- Commission-free

- Access to bonuses

- Spreads from 1 pip

- Maximum trade size of 100 lots

- Maximum number of positions; 100

- Maximum number of pending orders; 100

Pro

Ideal for retail investors trading in large volumes. Access all instruments with competitive conditions and a maximum contract size of 100,000 lots.

- Commission-free

- Spreads from 0.5 pips

- Maximum trade size of 200 lots

- Maximum number of positions; 200

- Maximum number of pending orders; 200

- Restricted access to bonuses and promotions

ECN

A raw spread profile with direct access to real market conditions. Access all instruments with a maximum contract size of 100,000 lots.

- Raw spreads from 0.0 pips

- Maximum trade size of 200 lots

- Maximum number of positions; 200

- Commissions up to $6 per round turn

- Maximum number of pending orders; 200

- Restricted access to bonuses and promotions

How To Open An Account

Our experts were impressed with how quick and easy it is to register for a new Global GT live account. The client portal is easy to use.

- Select ‘Start Trading’ or ‘Try Demo’ found in the top right of each webpage

- Complete the online registration form (email, contact number, country of residence, and password creation)

- Verify your profile with an email confirmation

- Log in to the client portal

- Select ‘Trading Accounts’ from the top menu nav bar

- Click on the ‘Open Trading Account’ icon in the center of the screen

- Select ‘Live Account’ or ‘Demo Account’

- Choose the account type

- Select currency and leverage

- Make a deposit

- Start trading

Note, account verification is required to make a withdrawal. This includes providing residency information, identity confirmation, and details of previous trading experience. The broker aims to verify all documents within 24 hours.

This process is initiated automatically once total deposits reach $2000 or equivalent currency. The information must be submitted within 14 days or your account may be suspended.

Opening Hours

Global GT trading hours operate on a GMT+3 server time. Trading times will vary by instrument. For example, forex and stocks can be traded 24 hours a day, five days a week (Monday to Friday).

A holiday calendar is published on the broker’s website with upcoming market closures by asset class.

Customer Service

Retail investors can be reassured by 24/7, multilingual customer support. This includes via live chat and email.

Contact details:

- Email – support@globalgt.com

- Live Chat – Icon located at the bottom right of each webpage

Although there is no telephone contact number, the FAQ section in the help center is adequate, with plenty of questions and answers with step-by-step guidance and resolutions to common queries. Topics include how to claim the Global GT no-deposit bonus, new profile registration requirements, and login security support.

Security & Safety

Global GT complies with both KYC and AML protocols. Traders can also implement two-factor authentication (2FA) as an additional security layer.

All client funds are segregated from business money and held by top-tier financial institutions. Retail traders also benefit from negative balance protection. Additionally, the broker imposes a stringent capital reserves ratio of 40%.

Global GT Verdict

Global GT is a multi-asset broker offering 100+ instruments with a low minimum deposit and competitive trading conditions. The brand is reliable and traders should be assured of a stable platform in MT5. It would be good to see some more instruments and educational content added in the future to strengthen the broker’s offering.

FAQs

Is There A Minimum Deposit Requirement For A Global GT Trading Account?

All Global GT trading profiles have a minimum deposit of $5. This is ideal for beginners.

Some payment methods also have their own funding requirements. See our full review for details.

Is Global GT A Legit Trading Broker?

Global GT is a legitimate brokerage. The group has regulatory oversight from the Seychelles Financial Services Authority (FSA) and South Africa’s Financial Sector Conduct Authority (FSCA).

Retail investors also benefit from negative balance protection and segregated client funds.

What Trading Platform Does Global GT Offer?

Global GT offers day traders access to the MetaTrader 5 (MT5) terminal. The globally recognized platform can be downloaded to desktop devices or used as a webtrader. The platform is also available on mobile devices through a free app.

What Assets Can I Trade With Global GT?

Day traders can invest in forex, commodities, indices, cryptocurrencies, and stocks. We break down asset classes, spreads and commissions in our expert review of Global GT.

Top 3 Alternatives to Global GT

Compare Global GT with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Global GT Comparison Table

| Global GT | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 4 | 4.7 | 4.3 | 4 |

| Markets | Forex, Metals, Energies, Indices, Stocks | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $5 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FSCA, FSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | 40% tiered welcome bonus up to $1500 | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT5 | Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:1000 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 11 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Global GT and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Global GT | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | No | No |

Global GT vs Other Brokers

Compare Global GT with any other broker by selecting the other broker below.

The most popular Global GT comparisons:

Customer Reviews

There are no customer reviews of Global GT yet, will you be the first to help fellow traders decide if they should trade with Global GT or not?