Day Trading in Ghana

Day trading is experiencing a surge in Ghana, offering traders the opportunity to capitalize on dynamic financial markets and potentially achieve significant gains.

Ghana’s robust economy, with a GDP of approximately $76.37 billion, is one of Africa’s fastest-growing. Fueled by sectors like oil and gas, mining, and telecommunications, the nation attracts significant foreign investment, contributing to a steady annual growth rate.

The economic landscape is supported by a stable banking sector regulated by the Bank of Ghana. The Ghana Stock Exchange (GSE), overseen by the Securities and Exchange Commission (SEC), offers a platform for trading equities, bonds, and other financial instruments.

This guide is designed to equip Ghanaians with the essential knowledge to make informed trading decisions.

Quick Introduction

- While day trading in Ghana falls under the SEC’s jurisdiction, its oversight is limited, and broker licensing is relatively scarce. Instead, Ghanaians should use platforms regulated by reputable authorities such as the FSCA in South Africa.

- The GSE is the principal securities market in Ghana, providing a platform for trading stocks, bonds, and other financial instruments.

- Ghana doesn’t have capital gains tax. However, profits from online trading are often considered part of overall income and may be taxed at regular income tax rates up to 35%.

Top 4 Brokers In Ghana

These 4 trading platforms stand out as the best for active traders in Ghana following our exhaustive testing:

What Is Day Trading?

Day trading involves buying and selling stocks or other financial instruments to profit from short-term price fluctuations within the same day. It’s a high-risk, high-reward activity that requires deep market knowledge and effective risk management.

Active trading opportunities in Ghana include a range of diverse instruments, from GSE-listed stocks, for example Scancom, to export commodities like oil and gold.

Investors also have access to diverse currency pairs through forex trading in Ghana, offering opportunities to profit from fluctuations in both African and global markets. That said, currency pairs involving the Ghanaian Cedi, such as USD/GHS and EUR/GHS, can be limited in availability.

Is Day Trading Legal In Ghana?

Day trading is legal in Ghana and regulated by the SEC, which oversees the securities industry to ensure fair practices and investor protection.

You can participate in the GSE and various derivatives markets, provided you comply with local regulations, including anti-money laundering (AML) requirements and know-your-customer (KYC) protocols.

The SEC has warned about fraudulent investment schemes targeting the public through various media channels. These scams often promise unrealistically high returns, sometimes as much as 840% annually.

How To Start Day Trading

Let’s explore the key steps you need to follow to get started:

- A strong foundation for online trading starts with a broker authorized to do business in Ghana. This ensures your Ghanaian cedis are better protected, allowing you to concentrate fully on developing winning trading strategies.

- Choosing a top day trading broker in Ghana simplifies the account setup process. Verification is often straightforward, requiring your Ghana Card and a recent utility bill. Once approved, you can fund your account conveniently using wire transfers, debit cards, or potentially even local options like GhanaPay.

- Ghanaian markets aren’t as liquid as those in more established countries. Still, stock traders may be able to speculate on large-cap companies, such as Standard Chartered Bank Ghana and Guinness Ghana Breweries, and currency traders could potentially capitalize on fluctuations in Ghana’s official currency with forex pairs like GHS/NGN and GHS/ZAR. In addition, CFD trading in Ghana is popular with short-term traders, offering a flexible instrument to speculate on African and global markets.

Example Trade

To understand how short-term trading works in Ghana, let’s explore a scenario involving GSE-listed Scancom (MTNGH), the country’s leading telecommunications supplier.

Event Background

Scancom announced a significant partnership with a leading technology firm to expand its 5G network infrastructure across Ghana. This news followed its quarterly earnings report, which showed earnings increased by 31.6% to GHS 2.1 billion.

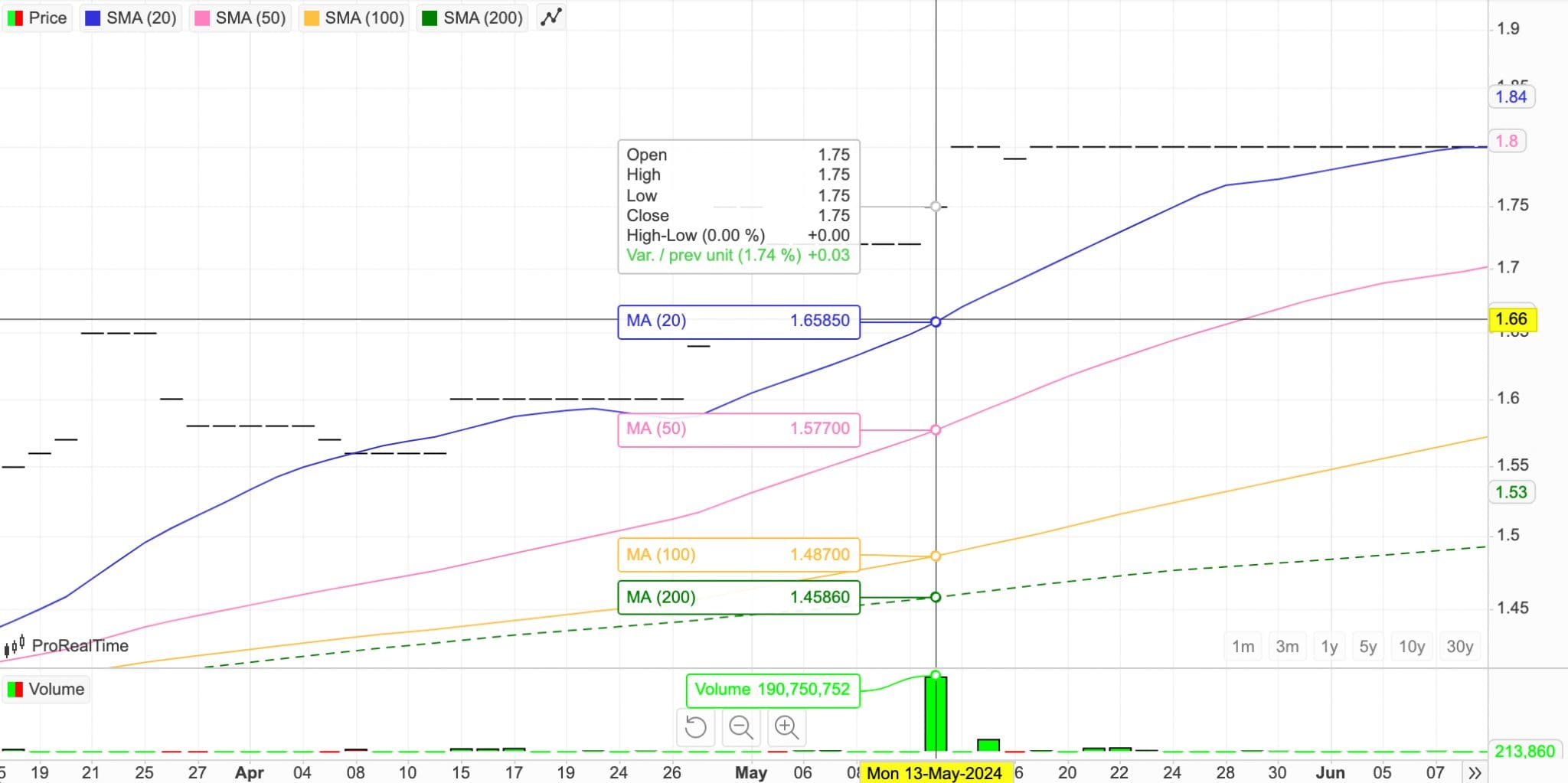

The previous day’s closing price for Scancom was ₵0.72 per share. I analyzed the stock’s recent performance and noticed it had been trading within a range of ₵1.56 to ₵1.75 over the past month.

The stock also traded above its 20, 50, 100, and 200 moving averages, suggesting bullish momentum. There was also a massive spike in bullish volume.

Trade Entry

Based on this positive news and my analysis, I anticipated an upward movement in Scancom’s stock price. I opened a long (buy) position at ₵1.75 when the market opened. To manage my risk, I set a stop-loss order at ₵1.66 (-5.14% ROI), the current 20-day moving average.

Trade Exit

As the day progressed, the stock continued to climb, supported by increased trading volume and positive market sentiment surrounding the partnership announcement.

Soon after, the price reached ₵1.80, and I closed my trade for a 2.86% ROI.

How Is Day Trading Taxed In Ghana?

In Ghana, short-term trading is subject to taxation under the general income tax framework. Profits are considered part of your taxable income and are subject to income tax rates as defined by the Ghana Revenue Authority (GRA).

While Ghana does not specifically levy capital gains tax on day trading, any gains realized are included in the taxable income and thus subject to the standard income tax rate of up to 35%, depending on your income bracket.

Bottom Line

Active trading in Ghana is a growing activity with potential due to the country’s economic growth. The Ghana Stock Exchange offers a platform, though with limitations.

However, the regulatory environment is underdeveloped, with limited oversight of brokers. Due to prevalent investment scams, high-risk, high-reward day trading requires careful platform selection and in-depth market knowledge.

Recommended Reading

Article Sources

- Ghana GDP - Trading Economics

- Bank of Ghana

- Ghana Stock Exchange (GSE)

- SEC Warning Notice On Unlicensed Entities

- Ghana Revenue Authority (GRA)

- Securities and Exchange Commission (SEC)

- Scancom Quarterly Earnings Report 2024

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com