Best Day Trading Platforms and Brokers in the UK 2025

The best day trading brokers in the UK provide platforms that are easy to use with great charting tools, low costs, fast execution, and leverage trading.

They are also regulated by the UK’s Financial Conduct Authority (FCA) and tailored for British day traders, offering access to major markets such as the London Stock Exchange (LSE) and currency pairs like the GBP/USD. Many of the top day trading platforms also support accounts in the British Pound, simplifying deposits, withdrawals, and trade management.

Discover our pick of the best brokers for day trading in the UK. Each brokerage we recommend accepts traders from the UK, is authorised by the FCA, and was evaluated by British traders using real money or a test account.

Best 6 Brokers For Day Trading In The UK

Our analysis shows that these are the 6 top platforms for UK day traders:

-

1

Pepperstone75.1% of retail investor accounts lose money when trading CFDs

Pepperstone75.1% of retail investor accounts lose money when trading CFDs -

2

XTB

XTB -

3

CMC Markets70% of retail CFD accounts lose money.

CMC Markets70% of retail CFD accounts lose money. -

4

FxPro

FxPro -

5

IG70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

IG70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. -

6

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs

Here is a short overview of each broker's pros and cons

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring day traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

- FxPro - Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

- IG - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Eightcap - Eightcap is an award-winning, FCA-regulated broker offering industry-low day trading fees. They are also the highest-rated brand by TradingView’s 100 million-strong users, who can trade directly on the platform. UK traders can sign up for a live account with an accessible £100 minimum deposit.

Best Day Trading Platforms and Brokers in the UK 2025 Comparison

| Broker | GBP Account | FCA Regulated | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) |

| XTB | ✔ | ✔ | $0 | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | xStation | 1:30 |

| CMC Markets | ✔ | ✔ | $0 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting | Web, MT4, TradingView | 1:30 (Retail), 1:500 (Pro) |

| FxPro | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting | FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) |

| IG | ✔ | ✔ | $0 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime | 1:30 (Retail), 1:222 (Pro) |

| Eightcap | ✔ | ✔ | £100 | CFDs, Forex, Stocks, Indices, Commodities | MT4, MT5, TradingView | 1:30 |

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

XTB

"XTB stands out as a top choice for new day traders with the terrific xStation platform, commission-free pricing, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs |

| Regulator | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti |

| Platforms | xStation |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, PLN |

Pros

- XTB offers fast withdrawals with same-day payments if requested before 1 pm, ensuring day traders have quick access to their funds.

- With over 7000 instruments across CFDs on shares, Indices, ETFs, Raw Materials, Forex, Crypto, Real shares, Real ETFs, share dealing and more recently Investment Plans, XTB caters to both short-term traders and longer-term investors.

- First-class 24/5 customer support is available, including a friendly live chat with response times of under two minutes during testing.

Cons

- XTB discontinued support for MT4, limiting traders to its proprietary platform, xStation, potentially deterring advanced day traders familiar with the MetaTrader suite.

- Not being able to adjust the default leverage level of XTB products is frustrating, as manual adjustment can significantly mitigate trade risk, especially in forex and CFD trading.

- The research tools at XTB are good but could be great if they went beyond in-house features with access to leading third-party tools such as Autochartist, Trading Central and TipRanks.

CMC Markets

"With advanced charting tools and an extensive range of tradable CFDs, including an almost unrivalled selection of currencies and custom indices, CMC Markets provides a fantastic online platform for traders of all levels. "

Christian Harris, Reviewer

CMC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Regulator | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Platforms | Web, MT4, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SEK, NOK, SGD, PLN |

Pros

- The CMC web platform delivers a fantastic user experience with advanced charting tools for day trading and customizable features, catering to both beginners and experienced traders. MT4 (but not MT5) and TradingView (added in 2025) are also supported.

- CMC offers excellent pricing, including tight spreads and low trading fees for all but stock CFDs. The Alpha and Price+ schemes also offer perks for active traders with up to 40% discounts on spreads.

- CMC Markets is heavily regulated by reputable financial authorities and maintains its stellar reputation, helping to ensure a secure and trustworthy trading environment.

Cons

- An inactivity fee of $10 per month is applied after 12 months of inactivity, which may deter casual investors.

- Trading stock CFDs incurs a relatively high commission, especially compared to the cheapest brokers like IC Markets.

- The CMC Markets app offers the complete trading package but the design and user experience trails category leaders like eToro.

FxPro

"FxPro is a stellar option for day traders, sporting exceptionally fast execution speeds under 12ms, competitive fees that were lowered in 2022, and terrific charting platforms in MT4, MT5, cTrader and FxPro Edge."

Christian Harris, Reviewer

FxPro Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting |

| Regulator | FCA, CySEC, FSCA, SCB, FSA |

| Platforms | FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, AUD, JPY, ZAR, CHF, PLN |

Pros

- FxPro's Wallet is a standout feature that allows traders to manage funds securely. By segregating unused funds from active trading accounts, the Wallet provides additional protection and convenience.

- FxPro offers four reliable charting platforms, notably the intuitive FxPro Edge, with over 50 indicators, 7 chart types and 15 chart timeframes.

- FxPro operates under a 'No Dealing Desk' (NDD) model, ensuring fast and transparent order execution, often under 12 milliseconds, ideal for short-term trading strategies.

Cons

- Despite a growing Knowledge Hub and a $10M funded demo account, FxPro is geared towards advanced traders, with beginners potentially finding the account and fee structure complex.

- While FxPro provides 24/5 customer support through multiple channels that performed well during testing, it lacks 24/7 availability, which can disadvantage traders needing assistance outside traditional market hours.

- There are no passive investment tools like copy trading or interest paid on cash. While active traders may not miss these, competitors like eToro catering to active and passive investors have more comprehensive offerings.

IG

"IG continues to provide a comprehensive package with an intuitive web platform, best-in-class education for beginners, advanced charting tools bolstered by its recent TradingView integration, real-time data, and fast execution speeds for experienced day traders."

Christian Harris, Reviewer

IG Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Regulator | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Platforms | Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:222 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, ZAR, SEK, DKK, CHF, HKD, SGD |

Pros

- IG is amongst the best in terms of its range of instruments, which includes stocks, forex, indices, commodities, and cryptocurrencies, plus recently added US-listed futures and options as well as an AI Index, providing diversification opportunities.

- IG offers an extensive collection of professional and engaging educational resources, including webinars, articles, and analysis.

- The IG app offers a superb mobile trading experience with a clean design that helped it secure Runner Up at our 'Best Trading App' award.

Cons

- While there is negative balance protection in the UK and EU, there is no account protection or guaranteed stop losses for US clients.

- IG has discontinued its swap-free account, reducing its appeal to Islamic traders.

- Stock and CFD spreads still trail the cheapest brokers like CMC Markets based on tests.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | £100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, the innovative algorithmic trading platform Capitalise.ai, and more recently the 100-million strong social trading network TradingView.

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

Cons

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- Eightcap needs to continue bolstering its suite of instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

Choosing A Day Trading Broker In The UK

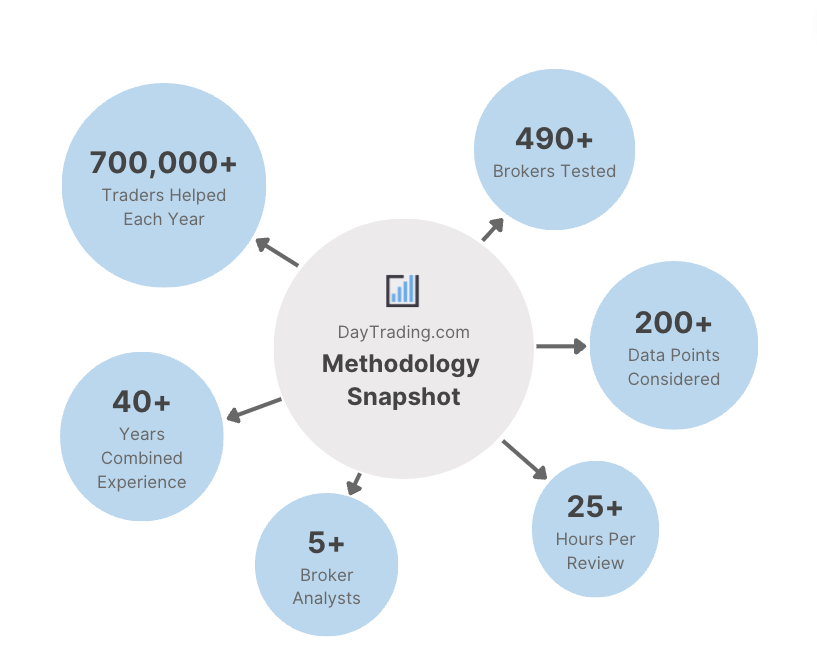

Our 40+ years of combined experience using UK brokers has shown us that several critical elements should be considered when deciding who to open an account with:

Choose A Trusted Broker

Picking a trusted broker will help safeguard you from unscrupulous trading practices, such as misleading promotions and price manipulation.

It will also help protect you from trading scams, many of which we’ve seen target retail investors in the UK. One notable example is EverFX, a brand that pressured victims to move sometimes tens of thousands of pounds to offshore firms where they lost money and had limited recourse options under UK law.

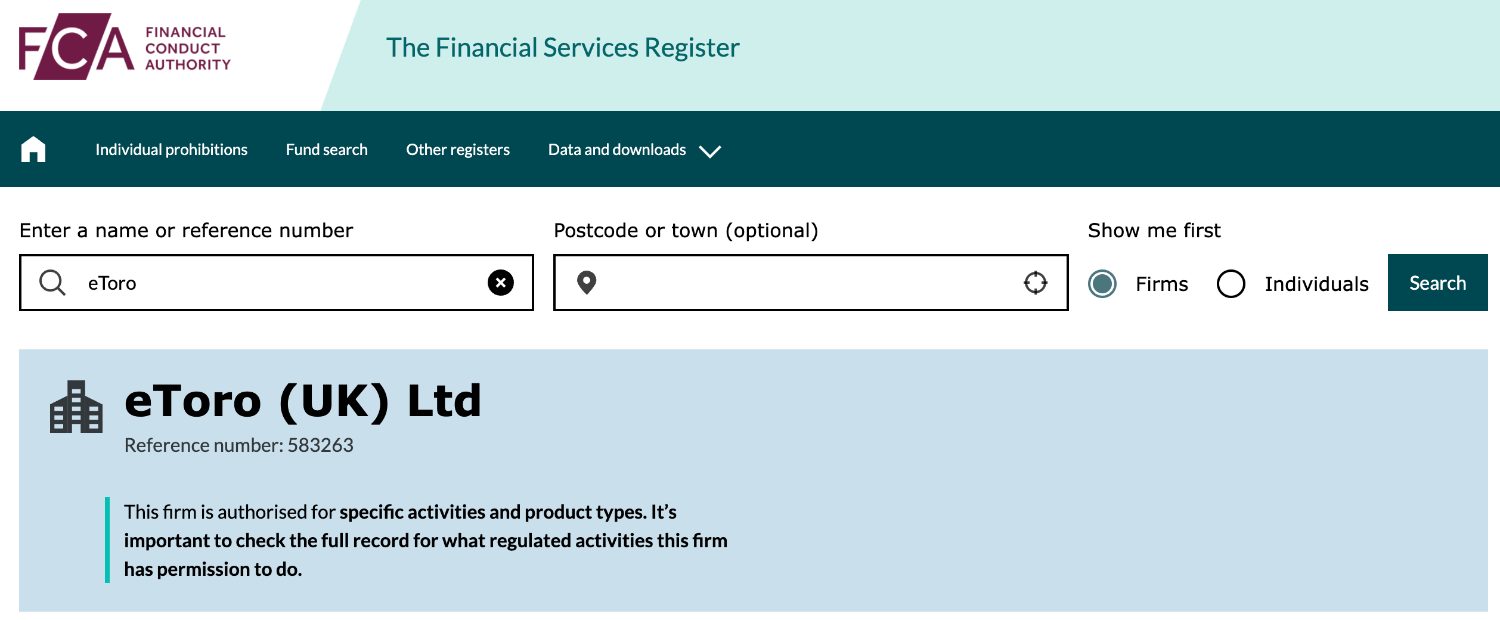

The hallmarks of a trustworthy day trading broker are authorization from a respected body, such as the UK Financial Conduct Authority (FCA), a long track record, excellent user reviews, and a good reputation in the industry. We prioritize day trading platforms that tick these boxes.

I recommend that British day traders sign up with an FCA-regulated broker. The FCA is hugely respected around the world for its robust investor protections, including providing up to £85,000 through the Financial Services Compensation Scheme (FSCS) in the event of broker insolvency.

- eToro is highly trusted. It’s regulated by the FCA, has been operating for over 15 years, and our UK experts have traded with it for several years using real money and praise the terrific user experience and best-in-class social trading network for beginners.

Choose A Broker With Low Fees For Day Trading

Selecting a platform with excellent pricing is critical for day traders because high transaction costs can rack up if you’re making a large volume of trades, impacting your profitability.

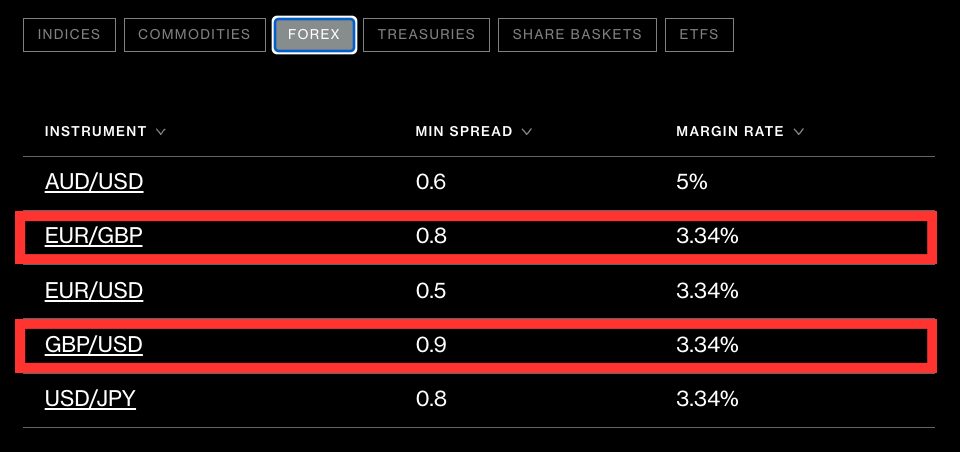

That’s why we evaluate the fees you can expect to incur day trading as part of our exhaustive broker reviews. This includes recording and comparing spreads and commissions on popular markets like the FTSE, EUR/GBP, and GBP/USD.

Importantly, we also balance costs with the broker’s overall offering, as we know it’s sometimes worth paying more for superior market data, sophisticated trading tools and faster order executions, especially for advanced day traders.

- CMC Markets is one of the cheapest day trading brokers based on our tests, particularly for forex trading. You can trade the GBP/EUR from 0.8 pips in the Standard account, the UK 100 from 1.0, and UK shares with a 0.1% commission. There are also no deposit or withdrawal fees.

Choose A Broker With An Excellent Charting Platform

Finding a platform with strong charting tools is important because day traders often use technical analysis to discover opportunities, while long-term investors tend to rely more on fundamental analysis.

Our experts always evaluate the platforms, mobile apps, and charting tools for day trading as part of our hands-on tests. We use the software to ensure it delivers an excellent user experience with an intuitive design and straightforward navigation.

We also check it comes complete with the charting tools essential for day traders at any skill level, including technical indicators, drawing features, and timeframes that cater to short-term trading strategies, from 1-minute to 60-minute charts.

- AvaTrade continues to excel in its platform offering with easy-to-use proprietary software for new traders alongside industry-leading third-party platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are great for advanced day traders and algo traders.

Choose A Broker With Access To The Markets You Want To Day Trade

Making sure the brokerage facilitates day trading on the assets you’re interested in is critical.

For traders in the UK, it’s often important to be able to speculate on shares listed on the London Stock Exchange (LSE), the value of the FTSE 100, and currency pairs that include the British Pound, such as the EUR/GBP and GBP/USD.

We always evaluate the range and depth of the investment offering while using day trading platforms, with a particular eye on access to UK markets for British traders.

The other element we look for is instruments built specifically for short-term trading strategies, notably contracts for difference (CFDs). These derivatives enable you to speculate on rising and falling prices from the same product without taking ownership of the underlying security, such as Barclays shares listed on the LSE.

- XTB excels with its 5,500+ instruments spanning stocks, indices, commodities, forex and ETFs, including the UK 100 and currency pairs with the GBP. It’s also one of the few day trading platforms in the UK to pay interest on unused cash up to 4.9%.

Choose A Broker With Fast Execution Speeds

Opening an account with a broker that offers fast execution is crucial for day trading strategies, especially in volatile markets. Delays in executing orders can lead to price slippage and even failure.

That said, execution quality is also an important consideration and concerns factors like speed, pricing, and the probability of order fulfilment.

That’s why we routinely evaluate brokers’ execution policies and execution speed data (where available), favouring platforms that meet our benchmarks of <100 milliseconds.

- Pepperstone maintains its position as one of the fastest day trading brokers, with most orders executed in less than 60 milliseconds. This makes it a stand-out option for short-term trading strategies like scalping.

Choose A Broker That Supports Leverage Trading With Clear Margin Requirements

Signing up with a firm that supports leverage trading is essential for many day traders, who often use leverage to control larger positions with a small outlay.

Essentially, leverage amplifies your purchasing power, and thus your returns and losses. Let’s say my day trading broker offers leverage of 1:30 on the GBP/EUR. This means a £100 outlay would give me £3,000 to trade with (30 x £100).

However, it’s crucial to understand that leverage trading also greatly increases risk. As a result, a risk management strategy is needed, alongside a solid grasp of your broker’s margin requirements, which outline the amount of capital required.

The FCA limits leverage for retail investors in the UK to between 1:2 and 1:30 depending on the market being traded.

You can day trade with higher leverage if you sign up with a brokerage registered in other jurisdictions, but this elevates the risk of large losses and I do not recommend it for beginners.

As part of our exhaustive reviews, we confirm whether margin trading is supported and the maximum leverage available.

We also make sure the broker is upfront about margin requirements and its margin call and stop-out levels, which determine how much capital you need to deposit to prevent positions from being automatically closed.

- Eightcap supports leverage trading with transparent margin requirements. Brits can day trade the GBP/USD with 1:30, the UK 100 with 1:20, and shares with 1:5.

Choose A Broker With An Accessible Minimum Deposit

Selecting a day trading platform that offers a deposit requirement within your budget is important to make sure you don’t risk more than you can afford to lose. This is especially important for beginners who might have a modest amount of capital for trading.

We’ve personally tested 223 brokers that support day trading using either real money or test accounts, and the vast majority require an initial investment of <£500. That said, some platforms cater specifically to beginner traders with low or even no minimum deposit.

- Interactive Brokers offers a GBP trading account with no minimum deposit and supports an almost unparalleled selection of instruments with advanced trading tools and deep market data for serious day traders.

Methodology

To find the best day trading brokers in the UK, we considered both quantitative data and qualitative insights from our comprehensive broker reviews, focusing on several aspects:

- We confirmed the brokerage accepts day traders from the United Kingdom.

- We chose brands we trust and that are regulated by the FCA.

- We favoured online brokers with competitive pricing for day trading.

- We prioritised platforms and apps with excellent charting tools for short-term strategies.

- We selected brokers with a good range of assets, favouring those with access to UK markets.

- We focused on brokerages with fast and reliable order execution.

- We checked leverage trading is supported with transparent margin requirements.

- We concentrated on day trading platforms with an accessible minimum deposit.

FAQ

Who Regulates Day Trading Brokers In The UK?

The Financial Conduct Authority (FCA) is the body responsible for overseeing and licensing brokers that offer day trading products to retail investors in the UK.

You can check whether a brokerage is authorised by the FCA by searching for their name or license number (usually found at the bottom of a broker’s website) on the regulator’s register.

How Much Money Do I Need To Start Day Trading In The UK?

Most top day trading brokers accept traders in the UK with a minimum deposit of between £0 and £500.

Beginners may want to open an account with a low minimum deposit broker, while advanced day traders may wish to invest more in return for the best trading tools and market data.

Which Brokers Do Day Traders In The UK Use?

We’ve compiled a list of the best day trading platforms and brokers in the UK. Many of our recommendations have millions of active traders, with a large user base in the UK.

Recommended Reading

Article Sources

- Financial Conduct Authority (FCA)

- Broker Warning List (FCA)

- Financial Services Compensation Scheme (FSCS)

- London Stock Exchange (LSE)

- Financial Times Stock Exchange (FTSE 100)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com