FXTM Review 2025

Awards

- Best Trading Experience 2021 - World Finance Awards

- Best Online Leveraged Trading Services 2021 - Global Business Awards

- Best Forex Education Partner Nigeria 2021 - World Business Outlook

- Best Trading Experience 2020 - World Finance Awards

- Best ECN Broker 2020 - DayTrading.com

Pros

- FXTM emerges as a top MetaTrader broker with custom MT4 add-ons, including a Pivot Point Indicator, Pip Value Calculator, and Spread Indicator, for more precise trading.

- FXTM’s UK entity offers excellent client protections, notably industry beating coverage up to $1 million per client and segregated accounts, enhancing security for traders with large balances.

- FXTM supports a terrific range of payment methods, especially local options in Africa and Asia like M-Pesa and TC Pay Wallet. And with e-wallet withdrawals processed in as little as 30 minutes, this suits traders who require quick access to funds.

Cons

- FXTM’s strong UK regulation doesn’t extend globally, so despite negative balance protection, non-British traders may have limited recourse options in case of disputes.

- FXTM only offers MetaTrader 4/5 for desktop trading, with no proprietary platform like eToro for a customized trading experience. MT4/5 is feeling increasingly outdated for active traders.

- FXTM's educational offerings have come a long way, notably its informative e-books, but they are often tailored to beginners, making them less appealing to experienced traders.

FXTM Review

Regulation & Trust

Established in 2011 and headquartered in Mauritius, FXTM is a trusted broker, operating under multiple regulatory authorities:

- Exinity UK Ltd is regulated by the Financial Conduct Authority (FCA) with license number 777911. A ‘green tier’ body in DayTrading.com’s Regulation & Trust Rating.

- Exinity Capital East Africa Ltd is regulated by the Capital Markets Authority (CMA) of the Republic of Kenya as a non-dealing online foreign exchange broker, with license number 135. A ‘yellow tier’ body in DayTrading.com’s Regulation & Trust Rating.

- Exinity Limited is regulated by the Financial Services Commission (FSC) of the Republic of Mauritius, license number C113012295. A ‘red tier’ body in DayTrading.com’s Regulation & Trust Rating.

Reassuringly, all client funds are held in segregated accounts away from the company’s funds in case of solvency. Negative balance protection also guarantees that you cannot lose more than your account balance, even if the market unexpectedly makes a massive move.

Most impressively, Exinity UK Ltd offers a compensation scheme that protects up to $1 million of a client’s funds if FXTM becomes insolvent.

Depending on the region, FXTM’s maximum leverage ranges from 1:30 (Exinity UK Ltd ) through 1:400 (Exinity Capital East Africa Ltd) and 1:3000 (Exinity Ltd).

FXTM could improve transparency by publishing more detailed reports on its financial health and operational practices, including annual audits and compliance checks.

Developing a robust client education program focused on regulatory protections and what they mean for traders could also empower clients and reinforce FXTM’s commitment to their safety.

| FXTM | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, FSC, CMA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.8 / 5Live Accounts

FXTM offers two primary accounts:

- Advantage: Designed with low-cost CFD trading in mind, featuring floating spreads from 0.0 pips and a variable commission rate of $0.80–$4 per standard lot. This account uses ECN execution and is ideal for active traders focused on cost-efficiency and precision, such as high-frequency traders and scalpers.

- Advantage Plus: Commission-free CFD trading with floating spreads from 1.5 pips, making it suitable for those who prefer simpler cost structures without per-trade commissions, typically newer traders. This account operates under a market maker model and still provides the same range of instruments and leverage options as the Advantage account.

It also offers a swap-free Islamic account for clients adhering to Sharia law.

All accounts have an accessible minimum deposit of $/€/£200 and support USD/EUR/GBP base currencies. NGN accounts are also available exclusively to clients in Nigeria.

The Advantage and Advantage Plus accounts are different in that they have ‘traditional’ trading parameters such as 80% margin call, 50% stop out, and a minimum trading lot size of 0.01 pips. Both accounts also offer all available instruments.

I found the account opening process (which is fully digital) intuitive and it can be completed in less than 10 minutes. However, verification for a live account can take up to 24 hours, which is fairly standard in my experience.

Demo Accounts

FXTM also provides demo accounts on MT4, MT5, and the FXTM Trader mobile app.

The demo accounts are great for testing new strategies because they offer real-time quotes and simulate live market conditions for all available assets.

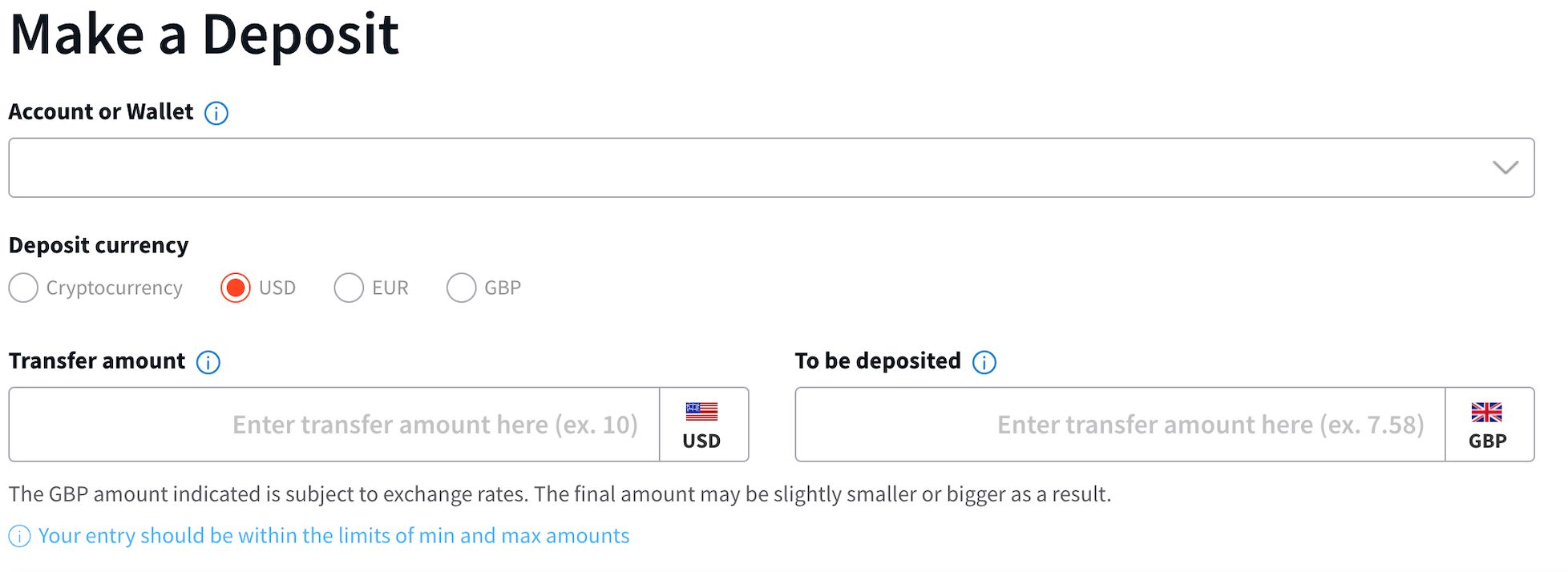

Deposits & Withdrawals

FXTM offers a great selection of deposit and withdrawal options.

Depending on your location, these can include credit and debit cards (Visa, Mastercard, and Maestro), bank wire transfers, cryptocurrencies, and popular e-wallets like Skrill and Neteller.

It also supports several local payment methods tailored for regions in Africa, Asia, and the Middle East, such as M-Pesa in Kenya, local bank transfers in Ghana and Nigeria, and TC Pay Wallet in parts of Asia.

Processing times are generally quick, with most withdrawals completed within 30 minutes (except bank wire transfers, which can take 3-5 days), and deposits are typically processed instantly.

While many e-wallet withdrawals are fee-free, bank wire and credit card withdrawals may incur charges. For example, you may be charged a €/£/$3 or ₦ $2,500 fee for any deposit under €/£/$30, and withdrawals to a bank card may also incur a €/£/$3 fee.

Currency conversion fees also apply if funds are withdrawn in a different currency, which could affect overall costs.

Ultimately, the mix of international and localized options makes FXTM suitable for traders seeking accessible and varied payment options across different regions.

| FXTM | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Credit Card, Debit Card, M-Pesa, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $200 | $100 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3.5 / 5FXTM offers a modest range of CFDs compared to many brokers we’ve evaluated.

These include 50+ currency pairs, 300+ stocks, 17+ global indices, 10+ commodities, and 11+ cryptocurrencies. You can also trade 500+ real shares from US exchanges.

Where it stands out from the majority of brokers is its six forex indices, which provide an alternative vehicle to speculate on prominent currencies like USD, EUR and JPY.

Yet while this selection is succinct and may adequately cater to forex and equity-focused traders, brokers like eToro and Blackbull Markets offer a considerably larger product portfolio, specifically stocks and cryptocurrencies.

FXTM doesn’t support ETFs, mutual funds, bonds, options, or futures, and the range of available assets can vary depending on the regulatory requirements of the subsidiary you are trading with.

FXTM also lacks passive income opportunities, such as interest on uninvested cash, and while it did have its own copy trading feature called ‘FXTM Invest’, that was discontinued in 2024.

| FXTM | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Commodities, Indices, Stocks, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:3000 | 1:200 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3.5 / 5FXTM’s fee structure is generally competitive, especially since its spreads have been lowered, though it varies by account type, making it suitable for different trading needs.

For those using the Advantage Plus account, spreads on major pairs like EUR/USD are typically around 1.9 pips, higher than industry averages of around 1.2 pips.

Spreads on some indices, like the Dow 30 (around 1.8 pips), are better than the industry average. It’s worth noting that these floating spreads may widen for less liquid instruments or during volatile market conditions.

However, Advantage account holders can benefit from spreads as low as 0.0 pips, with a commission rate starting at $3.5 per round lot, competitive with other brokers, especially for high-volume day traders.

Additionally, the broker’s fee transparency and a range of account options provide flexibility for new traders and advanced users, allowing you to select accounts based on trading frequency and cost efficiency.

For beginners, I’m slightly disappointed with FXTM’s minimum deposit of $200, especially compared to other brokers like Deriv and XM, which have just $5 minimum deposit requirements.

| FXTM | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.0 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 0.8 | 100 | 0.005% (£1 Min) |

| Oil Spread | 5.0 | 0.1 | 0.25-0.85 |

| Stock Spread | 0.1 | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

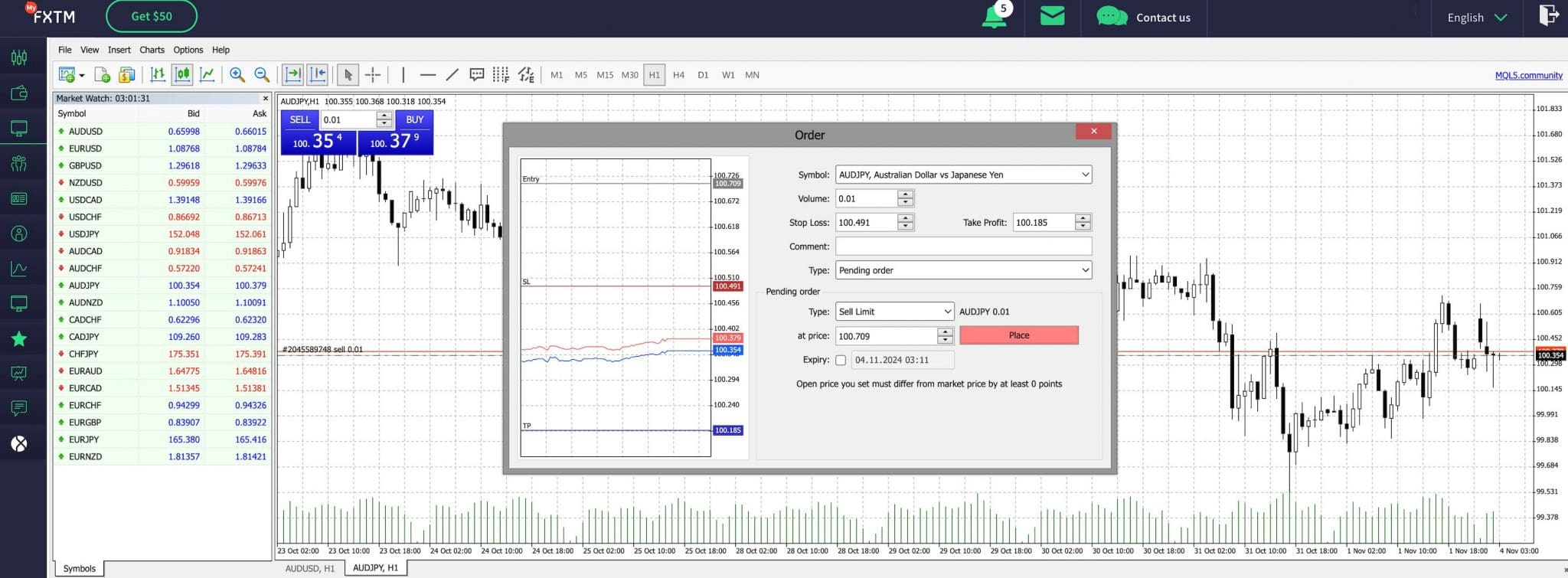

3 / 5FXTM provides access to industry-standard platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms can be used directly through a web browser or downloaded for desktop use on Windows, MacOS and Linux devices.

Although I find the interface a little dated, MT4 is one of the forex market’s most widely used trading platforms. It offers various features, including advanced charting tools, automated trading through Expert Advisors (EAs), and a comprehensive library of technical indicators.

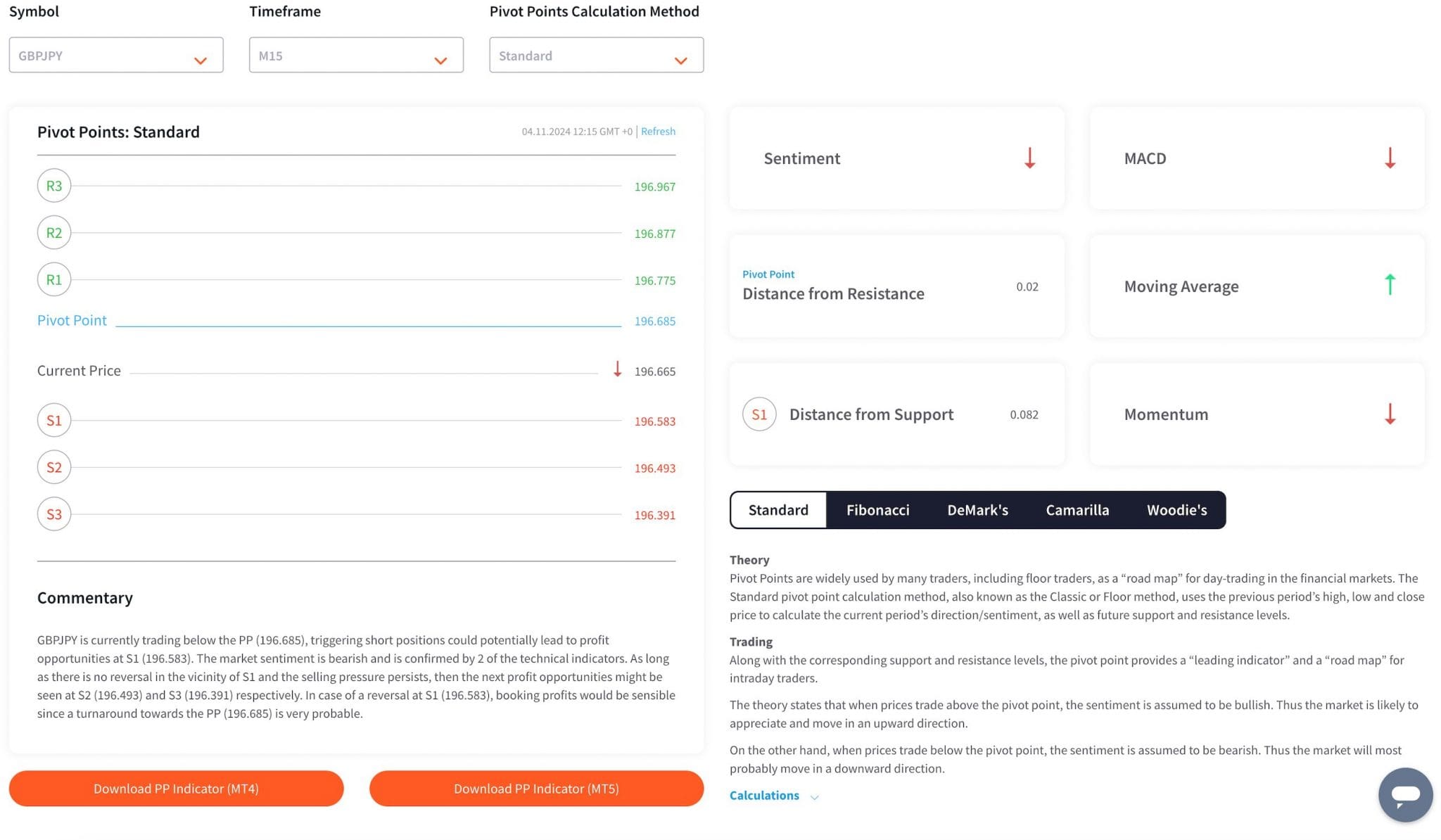

FXTM even provides a few custom indicators, including an MT4 Pivot Point Indicator, Pip Value Calculator and Spread Indicator. The Pivot Point Indicator is an exceptionally versatile tool that’s a great companion to the FXTM Pivot Points Strategy.

MT4 also offers features like price alerts, customizable watchlists, one-click trading for swift order execution, and the ability to trade directly from charts, enhancing trading efficiency.

Various order types are available, including market orders for immediate execution at the best available price, limit orders for buying or selling at a specified price or better, and stop-loss orders for automatic exit when a predefined price level is reached. There’s also support for trailing stop-loss orders to secure profits while allowing for potential price fluctuations.

MT5 is an upgrade from MT4 and includes additional features such as more timeframes, an expanded set of technical indicators, and support for trading in various asset classes beyond forex, including stocks and commodities. It also offers improved functionalities for algorithmic trading capabilities.

FXTM has also introduced its own mobile Trader App. The slick app allows trading on the go and provides access to your accounts, real-time quotes, and market analysis.

Watch my video walkthrough of the FXTM app below to get a real feel for the design and features.

To improve its platform choice, FXTM could consider expanding the variety of trading platforms it offers to meet the diverse needs of its clients. One option FXTM might explore is cTrader, a platform I really enjoy using for its intuitive interface and advanced charting tools.

cTrader is particularly favored by algorithmic traders due to its extensive API support and advanced trading functionalities, such as market depth and customizable indicators.

Many brokers offering cTrader, such as IC Markets and Pepperstone, have successfully attracted active traders prioritizing speed and functionality.

Another potential addition is TradingView, probably the best web-based charting and analysis platform in my opinion due to its robust community features and user-friendly interface.

TradingView is increasingly popular among traders for its extensive charting capabilities and a wide range of technical indicators, allowing users to perform in-depth market analysis.

FXTM could also consider offering proprietary trading platforms. Some brokers I use, like eToro, have developed platforms that incorporate social trading features, enabling users to follow and copy the trades of experienced traders. This could attract novice traders looking for more guidance and community engagement.

For traders who employ automated trading strategies, especially on MT4, FXTM offers a Virtual Private Server (VPS) service for continuous, high-speed connections.

However, the broker does not provide API access, which would enable you to create custom trading applications and bypass traditional platforms.

| FXTM | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | FXTM Trader, MT4, MT5 | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

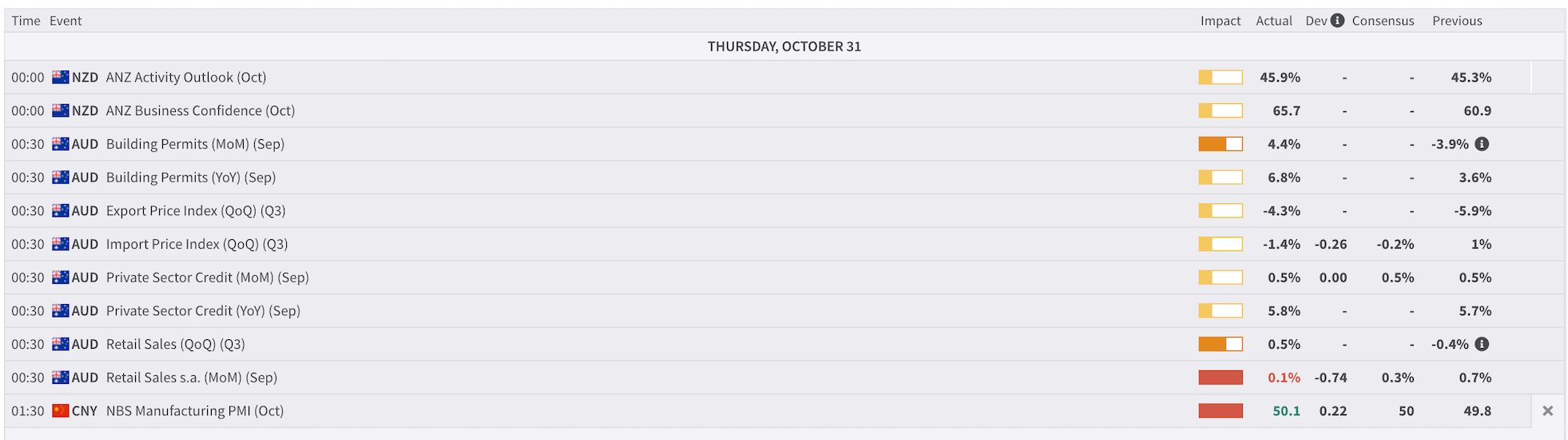

Research

3.8 / 5FXTM offers a range of research resources designed to support informed trading, which includes daily market analysis, an economic calendar, and occasional insights from professional analysts.

FXTM’s market analysis delivers updates on key markets, including forex, commodities, indices, and cryptocurrencies. I find this resource really useful for monitoring market movements. It will help support all trading levels, from beginners to experienced traders.

The only limitation I have found with FXTM’s in-house material is that it is not as frequent or comprehensive as the third-party resources found in some other brokers.

For example, Exness uses live feeds from the active FXStreet, and IG offers a unique video channel that broadcasts live sessions thrice daily. These sessions provide pre-market updates, real-time chart analysis, and forward-looking market insights.

It would be a terrific improvement if FXTM integrated a robust, multi-platform newsfeed or insights section directly into its trading apps.This would allow me to get real-time market updates and expert analysis without leaving my trading platform, similar to tools offered by some leading competitors.

Expanding the scope and depth of these research tools would also provide me with a richer, more actionable research experience.

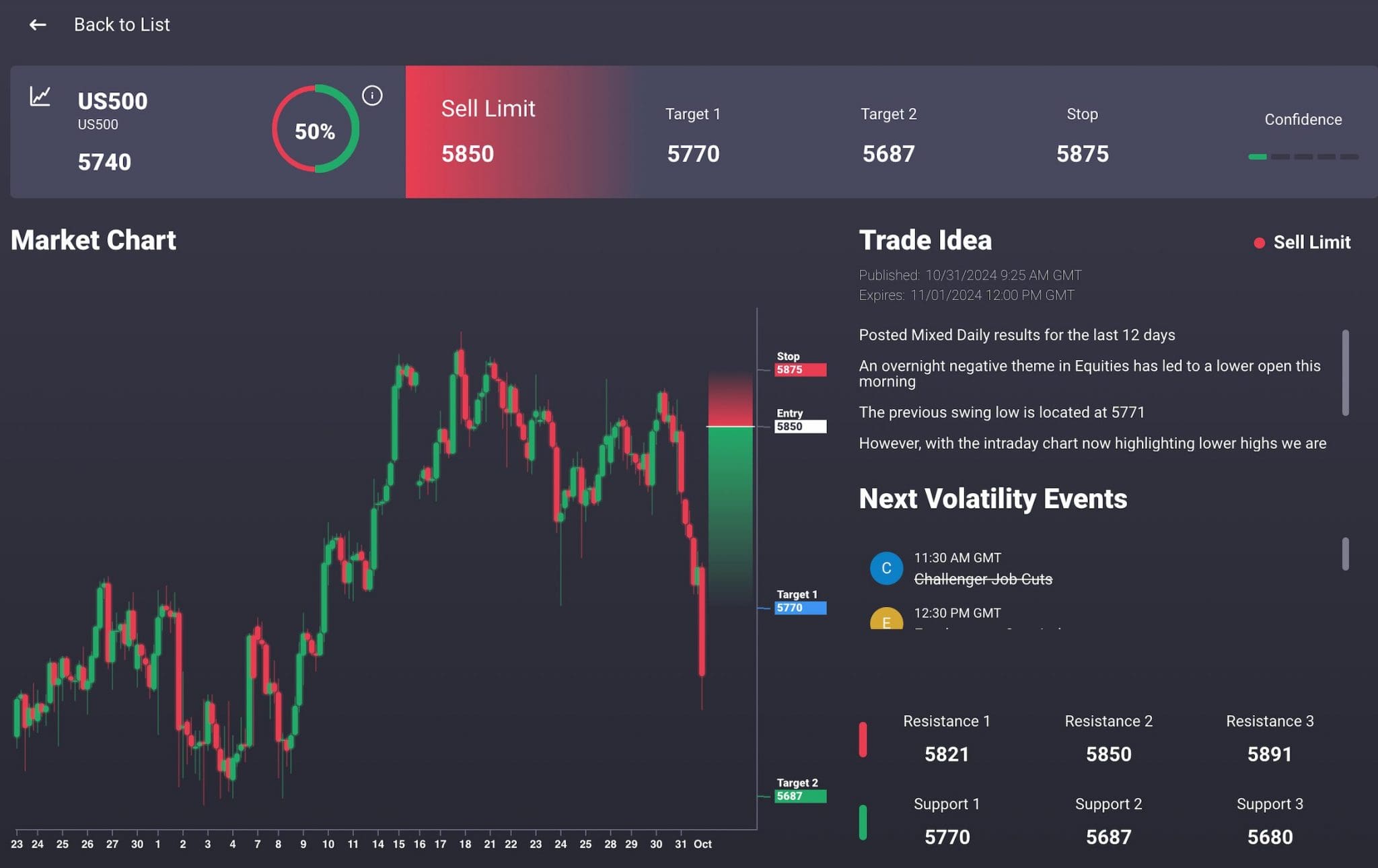

A handy feature for active day traders, however, is Signal Centre. Powered by Acuity, an FCA-regulated provider of technical analysis and trading plans, and accessible from the client dashboard, Signal Centre delivers multiple trade ideas daily, each specifying entry, take-profit, stop-loss, and confidence levels.

Although not conveniently integrated into a trading platform like Trading Central or Autochartist, I’ve observed that these signals are well presented and span various markets, including forex, indices, stocks, and commodities. Thus, they offer plenty of opportunity for specialization (eg indices only) and diversification (eg all major currency pairs).

FXTM provides two additional third-party MetaTrader add-ons. FX Blue helps seasoned traders conduct detailed price analyses using technical indicators for advanced charting, and Trading Central offers a range of tools, from economic calendars to market sentiment and stock ratings, to help traders find opportunities or inform their decisions.

| FXTM | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.8 / 5FXTM’s educational offerings are comprehensive and provide a solid foundation for short-term traders at different experience levels, featuring various resources covering essential trading topics.

FXTM’s detailed articles, introductory videos, and e-books on fundamental trading concepts and market analysis can benefit beginners. There’s also a useful Glossary of Terms for complete beginners.

The broker’s daily market analysis is a significant advantage, offering updated insights on market trends, news, and events – a feature often not provided with such depth by other brokers I’ve traded with.

Beginners can start with introductory guides to forex trading and CFDs, while more experienced traders can delve into advanced resources on specific trading styles like scalping. I particularly appreciated the in-depth guides on particular instruments, such as the Nasdaq-100.

Although less comprehensive than IG or Interactive Brokers, FXTM offers a good range of well-written educational resources, supported by an in-house team of analysts to help traders stay better informed.

FXTM provides beneficial basics and intermediate resources, but adding advanced-level courses would appeal to experienced traders looking for deeper insights.

Another improvement would be incorporating hands-on learning tools, like trading simulators or quizzes, that allow users to practice strategies within the educational content, helping reinforce learning in real-time.

FXTM might also consider creating a more structured learning path, where traders can progress through beginner, intermediate, and advanced levels with certification options, similar to structured courses offered by brokers like IG and XM.

| FXTM | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

3.3 / 5FXTM provides seven day customer support in English, Chinese, Spanish and Arabic, with limited weekend access through live chat, email contact form, WhatsApp, and Telegram.

I was pleased to see that I can also contact you through social media platforms like Facebook, X, LinkedIn, and YouTube, and that every client is assigned an account manager.

However, I have been disappointed with the lack of a contact phone number in the event of an urgent issue. While this limited availability is adequate for many traders, it can be a drawback for those who might need assistance outside of business hours.

Conversely, some brokers like EagleFX and Plus500 offer 24/7 support, allowing traders to access help around the clock. This can be crucial for day traders who need immediate assistance during fast market movements.

Despite the limited hours, FXTM’s support team have generally offered me quick and reliable responses, with live chat response times often under a minute, providing thorough answers to various trading inquiries.

The FAQ Help Center is also comprehensive and easy to navigate, and I usually find answers here without contacting customer support.

To improve, FXTM could consider expanding its customer service to full 24/7 coverage, making it more competitive and accessible to clients across different time zones.

| FXTM | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With FXTM?

FXTM presents a compelling option for day traders due to its solid FCA regulatory framework, which UK-based traders, in particular, should find reassuring.

The broker provides simplified account options that cater to short-term trading styles, notably an ECN account with tight spreads and a VPS to run automated trading strategies.

However, desktop trading is limited to MetaTrader, and FXTM’s research tools and educational resources are less comprehensive than some competitors.

Ultimately, FXTM can be a strong choice for those seeking a reliable broker with competitive spreads. However, it’s important to weigh the associated costs and limitations based on your trading needs.

FAQ

Is FXTM Legit Or A Scam?

FXTM is generally considered a legitimate broker. It has offices all over the world, including Dubai, London, Hong Kong, Cyprus, Nigeria, Kenya, Mexico, Colombia and Chile, housing over 500 staff.

Client funds are also held in segregated accounts, and the UK entity has an impressive compensation scheme with Lloyds of London that protects up to $1 million of a client’s funds.

Is FXTM A Regulated Broker?

FXTM is a regulated broker that operates under multiple licenses, adding security and trust for traders. The main regulatory body overseeing FXTM is the top-tier UK-based FCA.

However, an offshore entity in Mauritius raises some concerns, as its regulatory environment is less stringent than those in the UK and EU.

Is FXTM Suitable For Beginners?

FXTM is a suitable option for beginner traders due to its helpful features, including a demo account that allows risk-free practice, a variety of educational resources such as webinars and e-books, and a commission-free account option.

Its FXTM Trader App, which I downloaded and used, also helps to simplify the trading process if you’re new to the financial markets.

Top 3 Alternatives to FXTM

Compare FXTM with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

FXTM Comparison Table

| FXTM | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Commodities, Indices, Stocks, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $200 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, FSC, CMA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | 30% up to $100 via Exinity Ltd | – | 10% Equity Bonus | Active Trader Program With A 15% Reduction In Costs |

| Education | Yes | Yes | Yes | Yes |

| Platforms | FXTM Trader, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | 1:3000 | 1:50 | 1:200 | 1:50 |

| Payment Methods | 10 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by FXTM and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FXTM | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

FXTM vs Other Brokers

Compare FXTM with any other broker by selecting the other broker below.

The most popular FXTM comparisons:

- FXTM vs Binomo

- RoboForex vs FXTM

- FXTM vs Exness

- JustMarkets vs FXTM

- FXTM vs Fusion Markets

- Pepperstone vs FXTM

- Alpari vs FXTM

- FXTM vs Deriv.com

Article Sources

- FXTM Website

- FXTM - FCA License

- FXTM - FSC Mauritius License

- FXTM - CMA Kenya License

- FXTM Spread Indicator

- FXTM MT4 Pivot Point Indicator

- FXTM Pip Value Calculator

- FXTM Market Analysis

- FXTM Economic Calendar

- FXTM Glossary

- FXTM Education

- FXTM Help Centre

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of FXTM yet, will you be the first to help fellow traders decide if they should trade with FXTM or not?