Financial Sector Conduct Authority (FSCA) Brokers 2025

Based in South Africa? Use a broker regulated by the Financial Sector Conduct Authority (FSCA) for safety.

After stepping up its oversight of brokers in recent years with tougher penalties for non-compliance resulting in stronger trader protections, FSCA has earned ‘yellow tier’ status in DayTrading.com’s Regulation & Trust Rating.

Check out our pick of the top FSCA-regulated platforms to find the perfect provider for your trading needs.

Best FSCA Brokers

Based on our latest hand-on tests in March 2025, these are the 6 best FSCA-regulated trading platforms:

Here is a short summary of why we think each broker belongs in this top list:

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

- easyMarkets - Established in 2001, easyMarkets has made for a name for itself as a trusted, fixed spread broker. Improvements to its tools over the years, from adding the MetaTrader suite and TradingView to enhancing its exclusive risk management tools like dealCancellation, mark it out from the competition.

- Vantage - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

- FxPro - Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

FSCA Brokers Comparison

| Broker | FSCA Regulated | ZAR Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| AvaTrade | ✔ | - | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| Exness | ✔ | ✔ | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited |

| Trade Nation | ✔ | ✔ | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Cryptos (Bahamas Entity Only) | MT4 | 1:500 (entity dependent) |

| easyMarkets | ✔ | ✔ | $25 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | easyMarkets App, Web Platform, MT4, MT5, TradingView, TradingCentral | 1:2000 |

| Vantage | ✔ | - | $50 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds | ProTrader, MT4, MT5, TradingView, DupliTrade | 1:500 |

| FxPro | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Futures | FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro), 1:1000 (Via Prime Ash Capital Limited) |

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Exness was the first brokerage to pass the $1 trillion and $2 trillion marks in monthly trading volumes, highlighting its legitimacy.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US and the UK, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Bonus Offer | 200 Sign-Up Reward Points |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- The trading firm offers tight spreads and a transparent pricing schedule

- Multiple account currencies are accepted for global traders

- Trade Nation is a multi-regulated and respected broker that previously operated as Core Spreads

Cons

- Fewer legal protections with offshore entity

easyMarkets

"easyMarkets provides fixed spreads starting at 0.7 pips, making it an excellent choice for beginners seeking predictable trading costs. After adding a Bitcoin-based account, it’s also a stand-out option for crypto-focused traders who want to deposit, trade, and withdraw in digital currencies."

Christian Harris, Reviewer

easyMarkets Quick Facts

| Bonus Offer | 50% Deposit Bonus Or Up To A $2000 Tradable Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, ASIC, FSCA, FSC, FSA |

| Platforms | easyMarkets App, Web Platform, MT4, MT5, TradingView, TradingCentral |

| Minimum Deposit | $25 |

| Minimum Trade | 0.01 lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, CZK, MXN, CNY |

Pros

- easyMarkets takes risk management seriously, with negative balance protection plus guaranteed stop losses and its dealCancellation (enhanced in 2024 to include periods of 1, 3, or 6 hours) in the Web Trader.

- Unlike variable spreads offered by 90%+ of brokers we've tested, easyMarkets provides fixed spreads from 0.7 pips. This makes trading costs predictable, a significant advantage for beginners and those trading in volatile markets.

- easyMarkets added Bitcoin as a base currency in 2019. This marks it out against most of the market and eliminates the need to convert crypto to fiat, reducing conversion fees and simplifying management for crypto-focused traders.

Cons

- easyMarkets does not offer a zero-spread account like Pepperstone, which can be a drawback for day traders and high-frequency traders who require minimal transaction costs.

- While easyMarkets provides solid educational resources for beginners, they fall short for advanced traders. The Academy offers well-structured courses and engaging gamification, but the overall content lacks depth.

- easyMarkets is falling behind by not providing the copy trading features you get at category leader eToro, which are popular among beginners looking to follow the strategies of experienced traders.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Bonus Offer | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Regulator | FCA, ASIC, FSCA, VFSC |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage caters to hands-off investors with beginner-friendly social trading via ZuluTrade & Myfxbook

- There are no short-term strategy restrictions with hedging and scalping permitted

- Vantage has bolstered its algorithmic trading tools for advanced traders with AutoFibo EA identifying reversal opportunities

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

FxPro

"FxPro is a stellar option for day traders, sporting exceptionally fast execution speeds under 12ms, competitive fees that were lowered in 2022, and terrific charting platforms in MT4, MT5, cTrader and FxPro Edge."

Christian Harris, Reviewer

FxPro Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Futures |

| Regulator | FCA, CySEC, FSCA, SCB, FSA |

| Platforms | FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro), 1:1000 (Via Prime Ash Capital Limited) |

| Account Currencies | USD, EUR, GBP, AUD, JPY, ZAR, CHF, PLN |

Pros

- FxPro's Wallet is a standout feature that allows traders to manage funds securely. By segregating unused funds from active trading accounts, the Wallet provides additional protection and convenience.

- FxPro offers four reliable charting platforms, notably the intuitive FxPro Edge, with over 50 indicators, 7 chart types and 15 chart timeframes.

- FxPro operates under a 'No Dealing Desk' (NDD) model, ensuring fast and transparent order execution, often under 12 milliseconds, ideal for short-term trading strategies.

Cons

- There are no passive investment tools like copy trading or interest paid on cash. While active traders may not miss these, competitors like eToro catering to active and passive investors have more comprehensive offerings.

- Despite a growing Knowledge Hub and a $10M funded demo account, FxPro is geared towards advanced traders, with beginners potentially finding the account and fee structure complex.

- While FxPro provides 24/5 customer support through multiple channels that performed well during testing, it lacks 24/7 availability, which can disadvantage traders needing assistance outside traditional market hours.

Methodology

To list the best brokers authorized by the FSCA, we:

- Took our evolving directory of 219 trading providers to identify those claiming FSCA authorization.

- Ran their details through the FSCA’s List of Regulated Persons and Entities for verification.

- Combined the results of our personal tests with 200+ data points to rank the very best FSCA-regulated firms.

How Can I Check If A Broker Is Regulated By The FSCA?

Here’s a step-by-step guide to verifying a broker’s FSCA status, with a practical example using IG, a well-known CFD and forex broker operating in South Africa.

If you’ve traded in our industry, you’ll know of IG. They’re a quoted firm on the UK FTSE and have a solid reputation as a fair, honest, and competitive brokerage that prides itself on compliance and efficacy.

I expect IG to get a clean bill of financial health from any financial authority’s database I search.However, I’m using IG to highlight the diligence you should engage in before depositing your hard-earned funds into any broker’s account, even if they have a stellar reputation for integrity.

You should absolutely conduct such diligence if you’re considering trading with a smaller, less-known broker. A search only takes a few minutes of research.

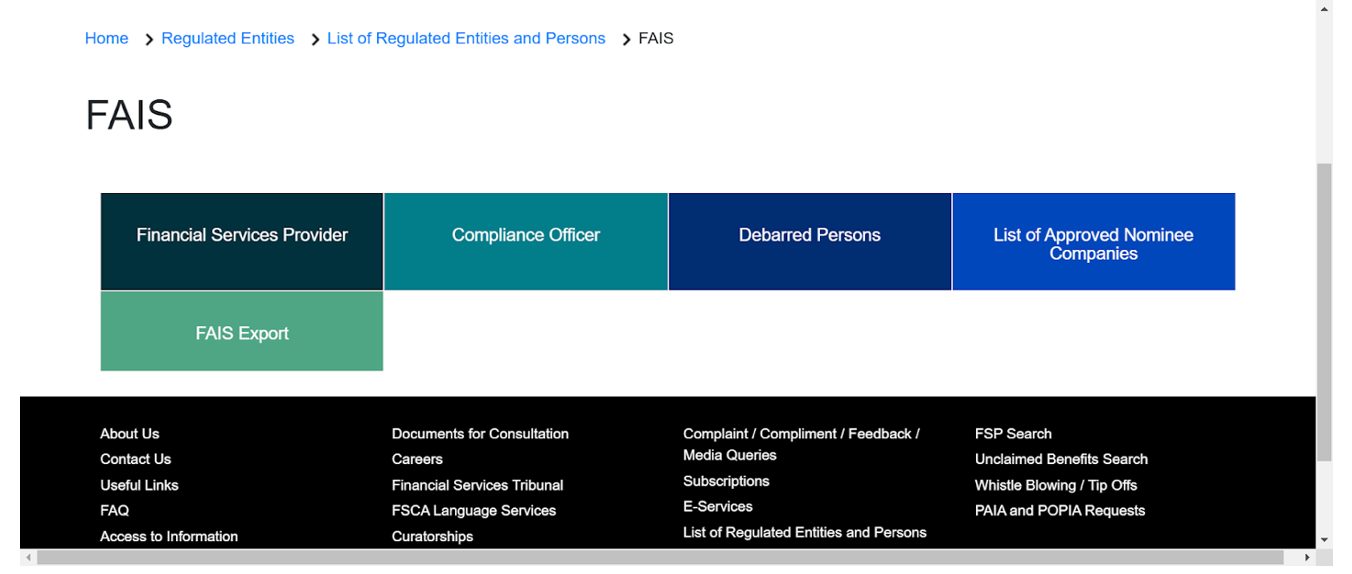

Step 1. Visit The FSCA’s Official Website

Go to the official FSCA website.

The FSCA maintains an online database of licensed Financial Services Providers (FSPs).

Step 2. Access The “Search For An FSP” Section

You’ll discover the page you need, “Search for a Financial Service Provider” after you click the “Regulated Entities” tab and press the “List of Regulated Entities and Persons“.

This facility allows you to search for registered brokers by name, licence number, or other details.

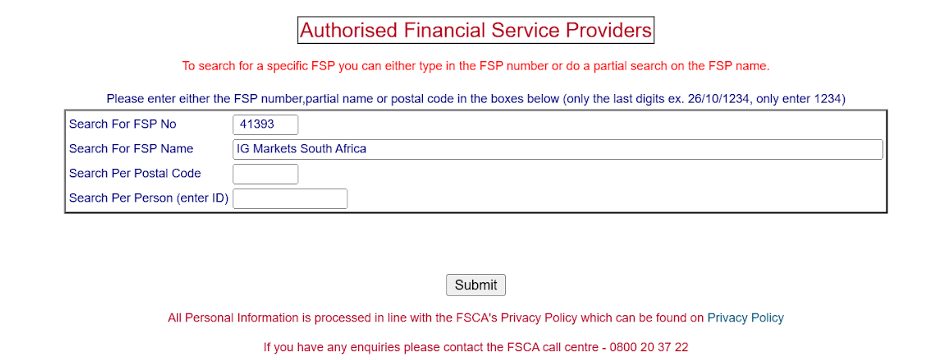

Step 3. Enter The Broker’s Details

Input the broker’s name or their advertised FSP number in the search facility.

These are often found on their website or promotional materials. For example, the IG website lists its FSCA licence number.

You can see below I typed “IG Markets South Africa”. I also entered the FSP number associated with IG Markets South Africa —FSP No 41393.

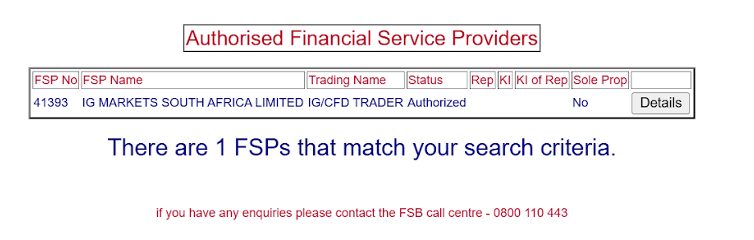

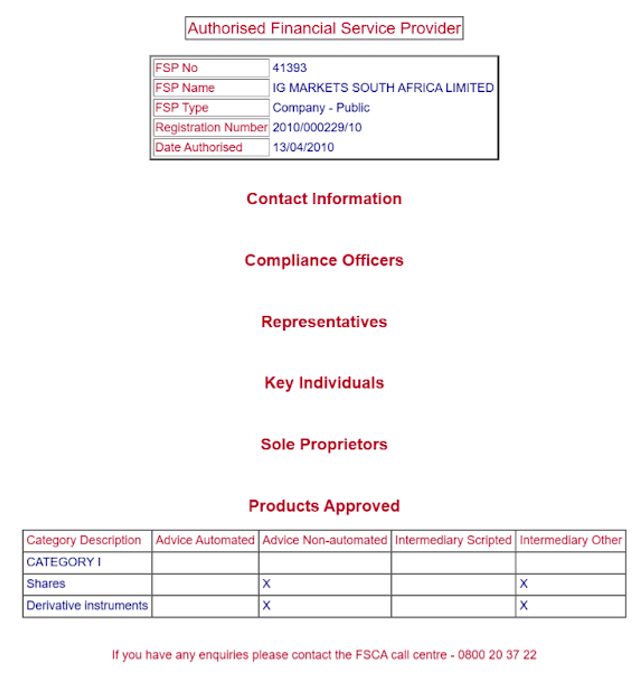

Step 4. Review The Search Results

Once you’ve entered the details:

- Confirm that the broker appears in the search results.

- Check the broker’s FSP status to ensure it is active and valid.

- Review the services they are licensed to offer (eg CFDs and forex are common at day trading brokers in South Africa).

For IG, I clicked on “details” on the right of the search result rows to confirm that the licence is active and covers the services offered (including CFD and FX trading).

As you’d expect with a company such as IG with an excellent compliance record, the search confirms that IG Markets South Africa is licensed and operating legally within the South African jurisdiction.

Step 5. Verify Contact Details

While all above board for IG, if you’re using a lesser-known trading provider, compare the contact details listed on the FSCA website with those on the company’s official site.

Discrepancies could indicate a fraudulent entity impersonating a regulated brokerage.

Step 6. Look For Public Warnings

The FSCA occasionally issues warnings about unregulated or suspicious brokers. In fact, we’ve seen the volume of these increase in recent years as it’s improved its oversight of online brokers.

So check the Warnings and Alerts section of their website to ensure the provider isn’t flagged.

Step 7. Contact The FSCA (If Needed)

If you’re unsure about the search results or need further assistance, you can:

- Call: +27 (0)12 428 8000

- Email: info@fsca.co.za

Red Flags To Watch For

- The broker claims to be FSCA-regulated but isn’t listed in the database.

- The broker’s FSP licence is inactive, suspended, or does not cover the services they are offering.

- They avoid sharing their FSP number or providing proof of regulation.

By verifying a broker’s FSCA registration, you can ensure you’re dealing with a legitimate provider and help protect yourself from potential fraud or scams targeting South African traders.

What Is The FSCA?

The Financial Sector Conduct Authority (FSCA) exists to oversee and regulate South Africa’s financial services sector to ensure it operates fairly, transparently, and in the best interest of consumers like us active traders.

Before the Financial Sector Conduct Authority was formed in 2018, South Africa’s primary regulator was the Financial Services Board (FSB).

Unfortunately, the FSB was unable to prevent a number of scandals, especially in the pension funds industry. These issues led to investigations and the subsequent signing of the FSR Act, which among several changes, dissolved the FSB and led to the creation of the FSCA.

The FSCA’s core focus is on market conduct – how financial institutions and service providers interact with their customers and the integrity of the financial markets overall.

Key Objectives:

- Protect Consumers: The FSCA ensures that financial services providers treat customers like day traders fairly, provide transparent information, and adhere to ethical practices.

- Promote Market Integrity: It works to maintain trust and confidence in South Africa’s financial markets by enforcing compliance with laws and addressing misconduct.

- Ensure Financial Stability: By regulating the conduct of financial institutions, the FSCA helps maintain stability in the financial system, reducing the risk of systemic crises caused by misconduct or mismanagement.

- Educate And Empower Consumers: The FSCA actively promotes financial literacy to help consumers, such as the growing class of online traders in South Africa, make informed decisions, understand their rights, and recognize potential risks.

- Monitor And Regulate Service Providers: The FSCA oversees entities such as banks, insurance companies, retirement funds, trading firms, and financial advisors, ensuring they meet required standards.

In short, the FSCA exists to foster a healthy financial ecosystem where businesses can thrive, consumers and traders like us are protected, and trust in the system remains strong.

Who Does The FSCA Answer To?

The FSCA is answerable to the South African government, specifically through its alignment with the National Treasury.

It operates under the oversight of the Minister of Finance, who is responsible for ensuring that the FSCA fulfils its mandate following national financial legislation and policy objectives.

Governance Structure:

- The FSCA Commissioner And Deputy Commissioners: The FSCA is led by a Commissioner and a team of Deputy Commissioners, who oversee its operations and ensure compliance with its regulatory duties.

- The Financial Stability Oversight Committee (FSOC): The FSCA collaborates with this committee, which includes representatives from the South African Reserve Bank (SARB) and other regulators, to ensure systemic stability across the financial sector.

- Parliamentary Accountability: The FSCA is ultimately accountable to South Africa’s Parliament. It must submit annual reports and provide updates on its performance and activities to relevant parliamentary committees.

What Powers Does The FSCA Have?

The Financial Sector Conduct Authority has extensive powers to regulate and oversee South Africa’s financial markets and online trading providers.

Key Powers:

- Regulatory And Supervisory Authority – The FSCA regulates a wide range of financial institutions, including investment firms. It sets and enforces rules on market conduct, ensuring compliance with South Africa’s financial laws and standards.

- Licensing And Registration – The FSCA has the power to issue, renew, suspend, or revoke licences for financial services providers (FSPs), including brokers. It ensures that only qualified and compliant entities operate within the financial sector.

- Investigation And Enforcement – The FSCA can investigate misconduct, fraud, or breaches of financial laws and regulations. It has the authority to impose penalties, fines, or administrative sanctions on entities and individuals who violate the rules and can initiate legal proceedings against offenders when necessary.

- Market Surveillance And Oversight – The FSCA monitors market activity to identify and address unfair practices, insider trading, or market manipulation. It oversees the conduct of trading platforms and other financial infrastructure.

- Consumer Protection And Education – The FSCA develops and enforces policies to ensure that consumers are treated fairly by financial service providers. It conducts awareness campaigns and financial literacy programs.

- Rule-Making Authority – The FSCA can issue directives, guidelines, and regulations to clarify financial legislation and promote best practices across the sector.

- Collaboration With Other Regulators – It works with bodies like the South African Reserve Bank (SARB) and Prudential Authority to ensure financial stability and address cross-sector issues.

Enforcement tools:

The FSCA can take decisive actions, such as:

- Freezing bank accounts or assets linked to misconduct

- Issuing public warnings about unregistered or fraudulent trading providers

- Suspending trading activities in cases of severe breaches

What Rules Must An FSCA Broker Follow?

Brokers regulated by the Financial Sector Conduct Authority (FSCA) must adhere to a comprehensive set of rules designed to ensure transparency, fairness, and consumer protection.

These rules cover how brokers operate, interact with clients like you and me, and manage risk.

Key rules:

- Licensing And Registration – Before offering services, brokers must obtain a valid Financial Services Provider (FSP) licence. They must display their FSP licence number prominently on their website, communications, and marketing materials.

- Suitability Assessments – Brokers are required to assess whether their financial products and services are suitable for their clients’ needs, experience, and risk tolerance. This is especially important as a day trader, where the risk of incurring losses is high.

- Risk Disclosure – Brokers must disclose all risks associated with financial instruments, such as CFDs or forex trading, to ensure clients fully understand potential losses. Notably for short-term traders, brokers must inform retail investors about potential losses due to leverage trading.

- Segregation Of Client Funds – Client funds must be held in segregated accounts, separate from the broker’s operational funds. This protects your money in case the brokerage faces financial difficulties.

- Anti-Money Laundering (AML) Compliance – Brokers must implement strict Anti Money Laundering (AML) policies, including verifying the identity of clients (Know Your Customer/KYC checks) and reporting suspicious transactions to authorities.

- Transparent Pricing And Fees – All fees, commissions, spreads, and other charges must be disclosed clearly to clients. Traders are protected from undisclosed charges or deceptive pricing practices.

- Advertising And Marketing Standards – Marketing materials must be accurate, not misleading, and comply with FSCA guidelines. Claims of guaranteed profits or minimized risks are strictly prohibited.

- Regular Reporting And Audits – Brokers must submit regular compliance reports to the FSCA. They are subject to periodic audits to ensure adherence to regulatory requirements.

- Complaint Handling – Brokers must have an accessible and effective complaints resolution process to address client grievances. They must inform clients of their right to escalate unresolved complaints to the Ombud for Financial Services Providers (FAIS Ombud).

- Risk Management Practices – Brokers must maintain sufficient capital reserves to meet their financial obligations and safeguard clients’ funds. They must implement risk management systems to protect the business and their clients.

- Anti-Market Manipulation Oversight: Brokers must not artificially influence asset prices to disadvantage traders. They also oversee conflicts of interest, ensuring brokers do not trade against their clients unfairly.

- Capital and Operational Requirements – Brokerages must maintain adequate capital reserves to cover their financial obligations and protect traders. This reduces the risk of broker default, ensuring the safety of traders’ funds.

- Continuous Supervision and Updates – The FSCA monitors global trends and updates its regulations to protect active traders in South Africa in a fast-evolving market.

By regulating brokers, enforcing transparency, and monitoring market conduct, the FSCA provides us traders with a safer trading environment, reducing risks and empowering us to trade confidently.

Does The FSCA Have Teeth?

While it may not have the direct enforcement powers of a law enforcement agency, the FSCA is equipped with significant authority to maintain order, impose penalties, and take legal action against entities that break the rules.

And although it’s relatively young with limited enforcement actions under its belt compared to many leading regulators in our industry (the SEC in the US dates back to 1934), the FSCA’s “teeth” are increasingly coming into play.

Here are some notable examples:

- Kabelo Emanuel Mogale (2024): The FSCA imposed a significant penalty of R1,015,315.87 on Mogale, a forex trading signals provider, and debarred him for 10 years. This action was taken because Mogale provided forex trading signals via Telegram without a financial services provider license, which the FSCA considers a financial service requiring proper authorization.

- IFX Brokers Holdings (Pty) Ltd (2023): The FSCA imposed a penalty of R50,000 on IFX Brokers Holdings for contravening over-the-counter derivative provider (ODP) regulations. The company offered clients the means to trade CFDs without proper authorization as an ODP.

- JP Markets SA (Pty) Ltd (2023): The FSCA fined this forex broker R100,000 for contravening regulations governing over-the-counter (OTC) derivatives trading. JP Markets enabled clients to trade CFDs on forex pairs, shares, and indices without being suitably authorized.

Bottom Line

Verifying that the FSCA regulates a CFD or forex broker is crucial for South African traders to ensure they are dealing with a legitimate and compliant financial services provider.

By utilizing the FSCA’s FSP search function, you can confirm whether a broker, such as IG Markets South Africa, is authorized to operate and provide specific financial services.

For us traders, staying informed about a broker’s regulatory status is not just about compliance – it’s about safeguarding your investments.

To get started, see our pick of the best FSCA-regulated brokers for day traders.

Article Sources

- Financial Sector Conduct Authority (FSCA)

- List of Regulated Persons and Entities - FSCA

- Warnings and Alerts - FSCA

- National Treasury - Republic Of South Africa

- South African Reserve Bank (SARB)

- Ombud for Financial Services Providers (FAIS Ombud)

- IG Markets South Africa

- Kabelo Emanuel Mogale FSCA Fine - Finance Magnates

- JP Markets SA (Pty) Ltd FSCA Fine - Moonstone

- IFX Brokers Holdings (Pty) Ltd FSCA Fine - FSCA

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com