Fresh Ways to Trade Dubai’s Top Stocks with eToro

eToro has partnered with the Dubai Financial Market (DFM), giving traders access to 10 liquid stocks in Dubai spanning sectors like banking, transport, and real restate.

The value of your investments may go up or down. Your capital is at risk.

Key Takeaways

- Traders at eToro can now deal in leading companies in the UAE, including Emirates NBD, Air Arabia, and Emaar Properties.

- The move gives traders opportunities to capitalize on the region’s vibrant economy, built on trade, tourism, and finance, with Dubai the second wealthiest Emirate, trailing only Abu Dhabi.

- eToro offers a suite of tools to inform trading decisions, including financial metrics, expert analysis, and related news, while users can set up price alerts and add stocks to watchlists in a few clicks.

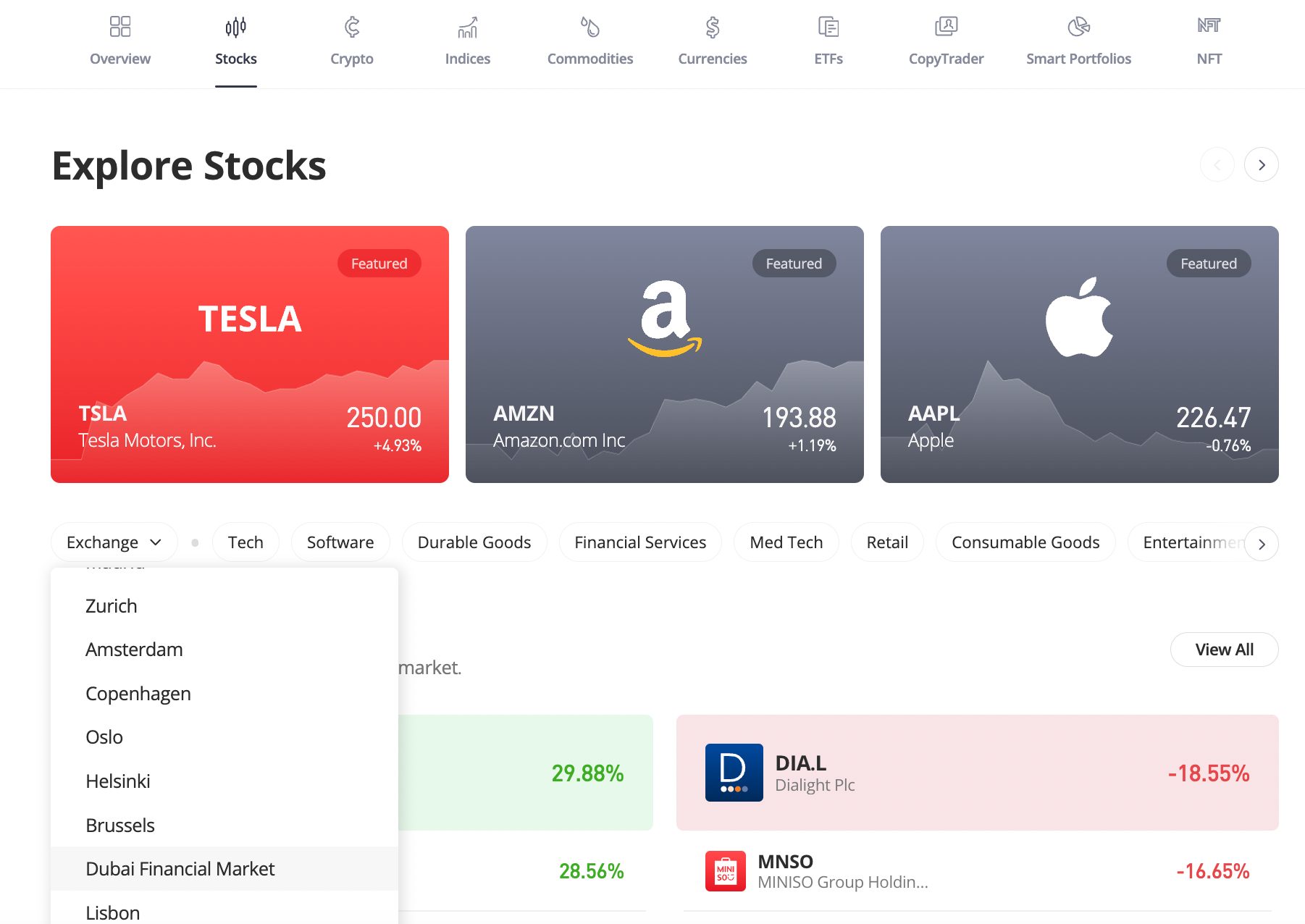

You can find the new UAE stocks on eToro’s platform by selecting ‘Discover’, ‘Stocks’, ‘Exchange’ and then selecting ‘Dubai Financial Market’ from the dropdown.

Amongst the leading Dubai stocks now available are:

- Dubai Electricity & Water Authority – A vital energy and water provider, shaping Dubai’s modern infrastructure.

- Dubai Islamic Bank – A leading Shariah-compliant financial institution, catering to investors seeking ethical banking.

- Gulf Navigation Holding – A key player in shipping and logistics, benefiting from Dubai’s strategic port presence.

- Salik – The principal tollgate operator, offering insight into Dubai’s fast-evolving transport network.

- Air Arabia – The region’s top budget airline, meeting the growing demand for affordable air travel.

About eToro

eToro is one of the best-known brokers, now sporting a client base of 38+ million traders on its intuitive trading platform and social investment network.

Regulated in multiple regions, including the US, UK, Europe and Australia, eToro has also secured authorization in the Middle East with approval from the Financial Services Regulatory Authority (FSRA) in Abu Dhabi.

Users can deal in over 6,000 instruments, from stocks to currencies, ETFs, indices, commodities, and cryptos. Fractional shares are also provided, lowering the entry barrier to high-value stocks.

New traders can get started with a $100 minimum deposit.