Best Brokers With Fractional Shares 2025

Want to own a slice of Amazon or Tesla but feel the price tag is too steep? Enter brokers with fractional shares, letting you buy a portion of a stock, so you can invest in big-name companies without a big-name budget.

Let’s dive into the best trading platforms that make fractional stock trading easy, affordable, and fun.

Top 5 Brokers With Fractional Shares Ranked

These 5 trading platforms, carefully selected and tested by our experts, are the best:

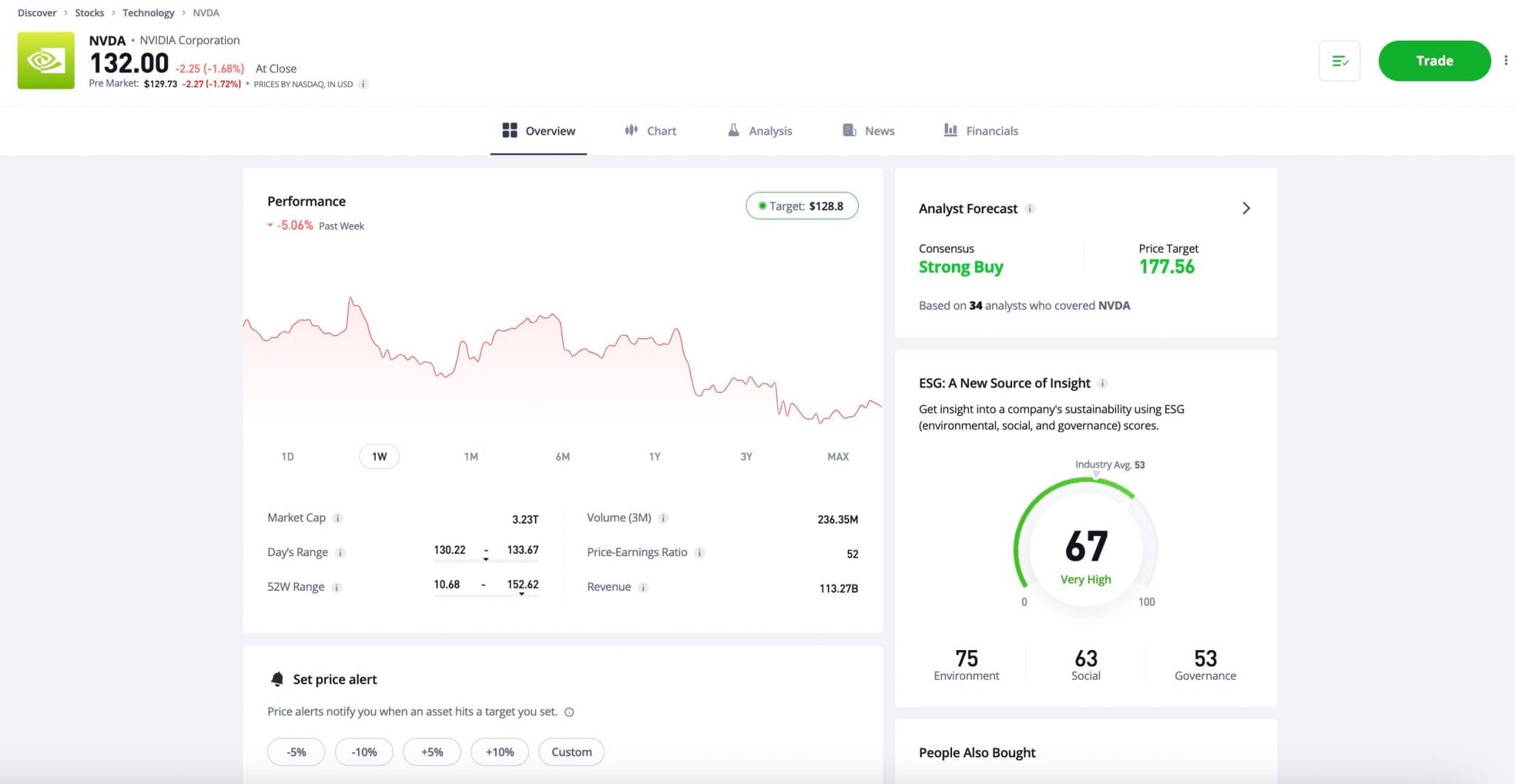

- eToro: Great for beginners looking for easy access to fractional shares with social trading features.

- Interactive Brokers: Perfect for advanced traders interested in fractional US stocks with extensive research.

- Firstrade: Terrific for budget traders with DRIP reinvesting dividends to acquire more fractional shares.

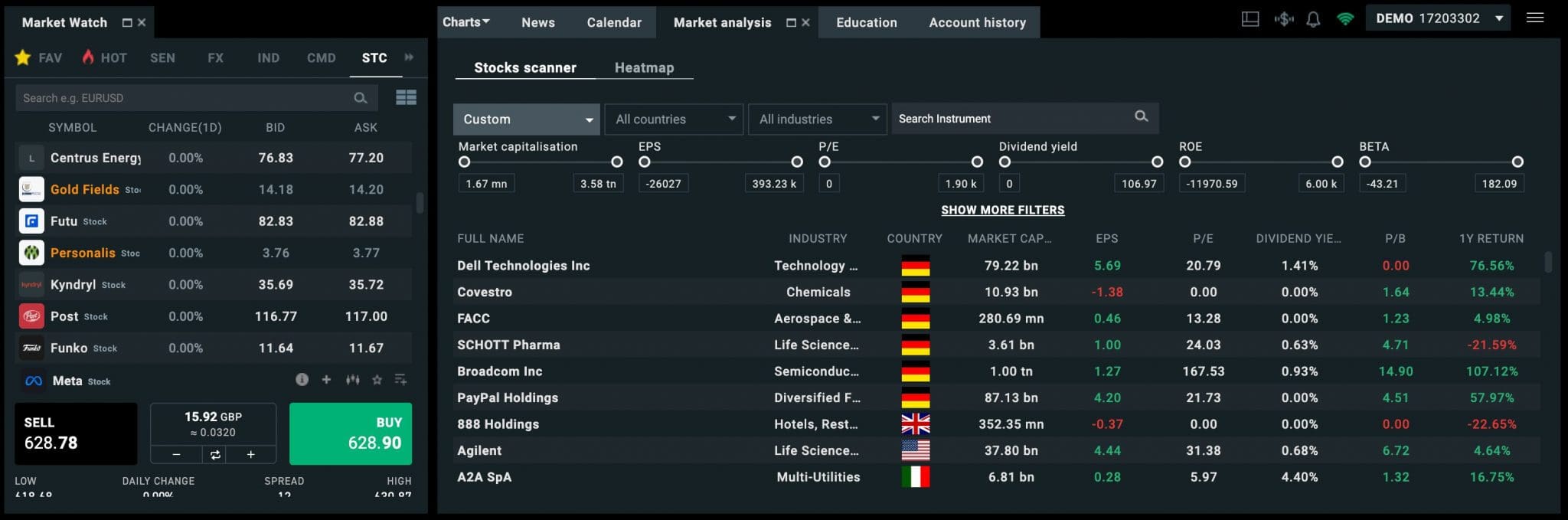

- XTB: Ideal for beginners seeking an intuitive platform to trade a small but valuable list of fractional shares.

- ActivTrades: Best for active CFD traders who want to diversify their portfolios with fractions of stocks.

Top 5 Brokers With Fractional Shares Comparison

| eToro | Interactive Brokers | Firstrade | XTB | ActivTrades | |

|---|---|---|---|---|---|

| Fractional Shares Rating | 4.8/5 | 4.6/5 | 4.4/5 | 4.2/5 | 3.9/5 |

| Minimum Deposit | $100 | $0 | $0 | $0 | $0 |

| Trading Platforms | eToro Web, CopyTrader, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Firstrade App, Options Wizard | xStation | ActivTrades, MT4, MT5, TradingView |

| Regulators | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA | FCA, CySEC, KNF, DFSA, FSC | FCA, CMVM, CSSF, SCB |

1. eToro

Why We Chose eToro

eToro has become our top broker for fractional share trading due to its world-class social trading features and genuinely intuitive web platform.

Whether you’re looking to buy small portions of popular stocks or explore international markets, eToro provides a user-friendly experience.

eToro provides access to a wide range of fractional shares in US stocks and international equities, making it an ideal choice for those seeking to diversify their portfolio without committing large sums of money.

eToro ranks highest for its social trading tools and beginner-friendly workspace, making fractional trading accessible for novice and casual traders.The only drawback is the fees for withdrawals and currency conversions, but its features outweigh these minor inconveniences in my opinion.

Pros

- Offers fractional shares for a wide variety of stocks and ETFs.

- Social trading tools for copying successful traders’ fractional strategies.

- Zero-commission trading for stocks (in supported regions).

Cons

- $5 fee for withdrawals plus currency conversion charges.

- Limited traditional research tools compared to second-place Interactive Brokers.

- Tests show fractional stock fees trail alternatives, notably third-place Firstrade.

2. Interactive Brokers

Why We Chose Interactive Brokers

Interactive Brokers dominate fractional share trading with unbeatable market access and tools, especially for more advanced traders.

The platform offers fractional shares in US stocks and ETFs and provides access to over 150 international markets, making it a strong option for traders seeking to diversify their portfolios globally.

Interactive Brokers impresses with its low commissions, which are particularly advantageous for high-volume traders or those looking to trade fractional shares at a lower cost.

Its highly customizable platform and access to global markets make it the ideal choice for experienced traders who want to engage in fractional investing while benefiting from top-tier analytics and trading resources.

I found Interactive Brokers a powerhouse for fractional share trading, offering low fees, access to global markets, and professional-grade tools.However, the platform’s complexity makes it less accessible for beginners, keeping it just below eToro in our rankings.

Pros

- Access to fractional shares for US stocks and ETFs.

- Low fees, especially for high-volume traders.

- Superior research tools and global market coverage.

Cons

- Platform complexity might intimidate beginners, especially compared to eToro.

- Only certain orders like market and limit orders work for fractional shares.

- Limited support for fractional shares outside the US.

3. Firstrade

Why We Chose Firstrade

Firstrade is a commission-free broker that will appeal to those who prioritize low-cost investing in fractions of US stocks and ETFs.

During testing, the platform excelled in its usability and offers a wealth of educational resources, making it a strong choice for new investors.

They offer zero-commission trading, flexible trading options, and diverse investment choices in over 4,000 US stocks and ETFs for fractional share trading.

You can also opt for the dividends from your fractional shares to be automatically reinvested through their DRIP feature, acquiring additional whole and fractional shares of a company’s stock, thus fueling your portfolio’s growth.

What I love is that Firstrade offers commission-free trading and access to fractional shares, making it a top choice for those prioritizing affordability.While its offerings lack the global reach and advanced tools of some of our top-ranked brokers, it compensates with an easy-to-use platform and substantial education.

Pros

- Commission-free trading for fractional stocks, including big names like Nvidia.

- Low entry barrier with fractional stocks and ETFs from $5.

- User-friendly iOS and Android app with helpful watchlists.

Cons

- Only market and limit orders allowed for fractional shares and no short selling.

- Limited trading support out of the US, reducing its appeal to global investors.

- Fractional shares are excluded from Firstrade’s Securities Lending Income Program, reducing income potential.

4. XTB

Why We Chose XTB

XTB impressed during testing with its strong platform capabilities and educational resources, making it an excellent choice for traders who want to delve into fractional share trading through a reliable service.

XTB’s advanced charting tools, research capabilities, and real-time data benefit traders who want to analyze the market while dabbling in fractional share trading.

However, XTB’s limited offerings for US, EU, and UK fractional shares and focus on forex and CFDs mean it is not as comprehensive in this area as brokers that specialize in stock trading.

Still, its professional tools and reliable customer support make it a good choice for experienced traders interested in a hybrid approach that includes fractional shares.

XTB just missed out on a podium spot, but still surprised me with its robust platform and focus on education and analysis, ideal for forex and CFD traders expanding into fractional equities.However, its limited selection of fractional shares and emphasis on other asset classes simply make it less attractive for investors focused solely on fractional stock trading.

Pros

- Intuitive platform with strong analytical tools to help identify opportunities.

- Commission-free access to certain stocks and ETFs in some regions.

- Fractional stocks come with proportional dividends.

Cons

- Limited selection of fractional shares compared to firms like Interactive Brokers.

- Primarily focused on CFDs and FX, making for a less complete user experience.

- XTB removed MT4, a platform popular with active traders like day traders.

5. ActivTrades

Why We Chose ActivTrades

ActivTrades is best known for its strong forex and CFD offering and is not particularly renowned for fractional share trading.

However, it still offers fractional shares for a limited range of stocks and is a solid option for experienced traders who want to include equities in their portfolio alongside more traditional assets.

The platform’s reliable infrastructure, real-time data, and advanced charting tools make incorporating fractional shares into your broader trading strategies easier.

Still, since fractional share trading is not the platform’s main focus, it may not be as appealing to investors whose primary interest lies in fractional equity investments.

ActivTrades rounds out our rankings with its stable infrastructure and ability to trade fractional shares in a limited range of equities.While I’ve found it a reliable option for existing users who primarily trade forex and CFDs, it falls short in the depth of its fractional offerings.

Pros

- Intuitive, fast and dependable ActivTrader platform with strong analytical tools.

- Commission-free access to certain stocks and ETFs in some regions.

- Low trading fees based on analysis.

Cons

- Small suite of fractional shares compared to brokers like Interactive Brokers.

- Education needs improving to match eToro’s accessibility for beginners.

- Primarily focused on CFDs and forex.

Bottom Line

When selecting a brokerage for fractional share trading:

- eToro leads the pack with its ease of use and innovative features.

- Interactive Brokers stands out for professionals seeking global access and advanced tools.

- Firstrade is unbeatable for budget-friendly, commission-free trading.

- XTB and ActivTrades cater to more specialized traders who want a hybrid approach or tools for other asset classes.

Your choice will depend on whether you prioritize beginner-friendly tools, global market access, or low-cost trading – each of these brokers offers distinct advantages based on your trading preferences and goals.

FAQs

How Do Fractional Shares Work?

Fractional shares work by splitting a full share of a stock into smaller, more affordable portions.

They have proven popular in recent years, with an increasing number of trading platforms introducing fractional stocks in recent years, from Swisssquote in 2024 to Admiral Markets in 2023.

Where Are Fractional Shares Traded?

Fractional shares aren’t traded on traditional stock exchanges like the NYSE or NASDAQ. Instead, they’re handled off-exchange by the broker you use.

Each broker operates as a middleman, buying full shares from the market and dividing them into fractions for its customers.

While fractional shares don’t trade on standard exchanges, brokers may execute trades behind the scenes over-the-counter (OTC) or as part of internal inventory management. They aggregate client orders and match buys with sells internally or externally.

Can You Transfer Shares Between Brokerage Accounts?

Unlike full shares, fractional shares usually aren’t transferable. If you want to switch brokers, you may need to sell your fractional shares and repurchase them at the new platform – so keep that in mind.

While fractional shares aren’t technically “traded” in the open market, I’ve discovered that brokers make it seamless for investors to buy, sell, and grow my portfolio.

Which Is The Best Trading Platform That Allows Fractional Shares?

Following our hands-on tests and analysis, eToro is the top choice for fractional share trading, offering a beginner-friendly platform with easy access to a wide range of US and international stocks, allowing users to invest with as little as $10.

Its social trading features are the best we’ve seen, enhancing the experience by enabling aspiring investors to learn from and copy successful traders, also making it perfect for beginners and casual investors.

Trading fractional shares is high-risk, regardless of the broker you choose. You could lose any money you invest.

Article Sources

- eToro - Fractional Shares Information

- Interactive Brokers - Fractional Shares Information

- Firstrade - Fractional Shares Information

- XTB - Fractional Shares Information

- ActivTrades - Fractional Shares Information

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com