CFD Trading in France

Contracts for difference (CFDs) are over-the-counter financial products that allow traders to profit from the price movements of French, other European, and global financial markets, with a modest initial investment.

The Autorité des Marchés Financiers (AMF) firmed up restrictions on CFDs in 2019, but some 30,000 retail traders still use these high-risk derivatives to speculate on various assets, turbocharging results with leverage.

This beginner’s guide to CFD trading in France will help kickstart your journey.

Quick Introduction

- CFDs are trading products where your profit or loss is determined by the difference in the price of an asset, such as the CAC 40 index, at the start and close of a contract. You don’t need to own the asset – you’re only speculating on the upward or downward price movement.

- Leverage is a key advantage of trading CFDs that lets you boost your positions using borrowed funds. This increases the profits on a small cash outlay, but losses are also multiplied so risk management through stop-loss orders and position sizing is vital.

- The Autorité des Marchés Financiers (AMF) is the French financial regulator that oversees CFD markets, imposing rules in accordance with the European Securities and Markets Authority (ESMA), including leverage limits of 1:30 and negative balance protection.

Best CFD Brokers in France

After extensive testing, our experts found these 4 providers were the best for CFD traders in France:

How CFD Trading Works

CFDs are financial derivatives that are popular among retail traders because they are widely available at online brokers, allow you to speculate on rising and falling markets, and can be traded on a range of asset classes.

You speculate on the price movements of an asset – this could be stocks of a French firm like Hermes, an index covering French markets like FR40, commodities like wheat (France is the world’s fifth-largest producer), forex pairs, cryptocurrencies and many others.

Crucially, with CFDs, you can speculate on these assets without actually buying and selling them. In France, this shields you from the Financial Transaction Tax you may otherwise pay, as well as avoiding the transport and storage costs of trading commodities.

Another key advantage of CFDs is the use of leverage – borrowed funds that help you increase your trading power. Since this can mean significant profits even from relatively small price movements, it’s a popular tool in day trading.

For example, 1:10 leverage will multiply my stake by 10. If I open a position with €1000 without leverage and make a 1% profit, I’ll earn €10; apply the leverage and I’ll earn €100 (less any brokerage fees).However, losses are also amplified, so it pays to use this tool carefully and to set stop loss limits and other forms of risk management.

Is CFD Trading Legal In France?

You can legally trade CFDs in France, where the Autorité des Marchés Financiers (AMF) licenses providers and actively oversees the retail trading sector.

The AMF is a highly trusted regulator that has earned a place on the ‘green tier’ of DayTrading.com’s Regulation & Trust Rating. Moreover, traders can also sign up and enjoy protections from numerous brokers regulated in Europe thanks to the EU “passporting” scheme.

As well as actively supervising brokers to ensure fairness, transparency and adherence to regulations, the AMF and other regulators in the same jurisdiction provide various consumer protections that are in line with ESMA’s rules:

- Leverage Restrictions: Leverage is limited to 1:30 on major forex pairs like EUR/USD or EUR/GBP, 1:20 on non-major forex pairs, gold and major indices including EUSTX50, 1:10 on commodities (non-gold) and minor indices, 1:5 on stocks, and 1:2 on cryptocurrencies.

- Negative Balance Protection: This safeguard will automatically close out a trade before the losses outstrip your account balance to prevent you from becoming indebted to your brokerage.

- Segregated Accounts: This important protection means that brokers must keep your Euros separate from business funds, protecting customers’ capital in the case of business insolvency.

Retail investors may also be covered by the Fonds de Garantie des Dépôts et de Résolution (FGDR) compensation scheme. This protects up to €70,000 of investor funds per institution up to a maximum of €100,000.However, short-term trading instruments like CFDs are not always protected in these schemes.

How Is CFD Trading Taxed In France?

Most French individuals who trade CFDs will need to pay capital gains tax at a flat rate of 30%, which combines income tax (12.8%) and national insurance (17.2%).

If CFD trading is one of your main sources of income, you may instead need to pay income tax at a progressive rate of between 0% and 45%, depending on how much you earn in a year.

You must declare any income from trading when you submit your tax return (usually May – June).

For the most accurate information about which type of tax you’re liable to pay and what can be deducted to reduce your tax burden, we recommend you speak to a qualified tax expert familiar with the latest regulations in France and how they apply to CFD trading.

A CFD Trade In Action

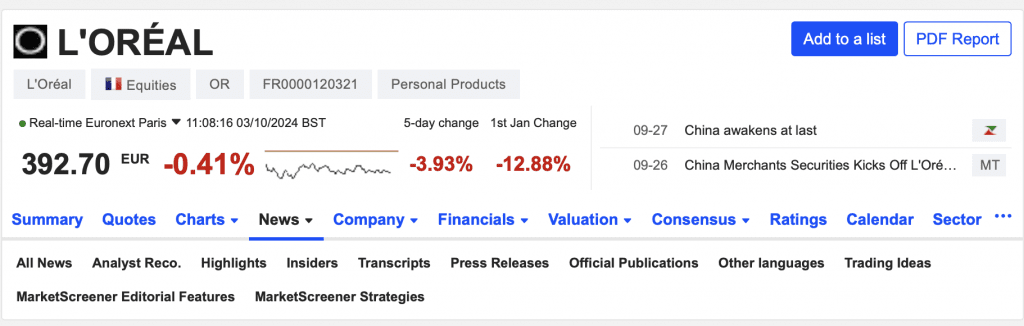

In this hypothetical example trade, I am looking at the cosmetics giant L’Oréal (EPA: OR), one of the world’s 50 most valuable companies by market capitalization and the sixth largest on the Paris Euronext.

Fundamental Analysis

L’Oréal is a huge global corporation that had an impressive performance over the previous year, and my fundamental analysis showed the stock has continued to perform well despite some slowdown in the previous quarter:

- Revenue: +7.52%

- Net Income: +8.83%

- P/E Ratio (diluted): +9.29%

Despite this, the stock had been on a downward trend for several months. It’s important to gain an understanding of the factors behind the recent performance of the stock. This can be difficult since it involves considering many variables from overall market dynamics to investor psychology.

In this case, I researched L’Oréal and the beauty market using the News functions in TradingView and MarketScreener.

I discovered that L’Oréal’s CEO, Nicholas Hieronimus, had warned in June of the year that a weak Chinese market could spell trouble for the beauty industry, and that this prediction had held up across the sector by September.

How I Plan My Trade

My short-term trading strategy combines evaluating news events and technical analysis.

L’Oréal is one of several companies I’ve been monitoring whose lagging performance is down to broader market dynamics rather than poor management, so I’m waiting for a positive news signal that I think will reverse the trajectory.

That signal comes with the People’s Bank of China’s announcement of a large stimulus package, which I’m betting will boost markets globally. L’Oréal’s stock promptly rises as investors bet on China’s large demand for luxury goods.

A few days later, the Chinese state-owned financial firm China Merchants Securities upgraded L’Oréal to a ‘buy’ rating with a price target of €461 – nearly €80 above the share’s price at the time.

I am betting that the stock will soar when the markets open the next day. So, I suspect it will be impossible for me to successfully fill a limit order I set in advance, and I will need to place a market order after observing how the stock performs the next day.

The Trade

As I expected, L’Oréal gaps up significantly on market open, climbing €10 to €392 on the 1-minute chart. I expect the rally to continue, so I place a market order immediately, and it fills at €393.

Risk Management

My approach to risk management always involves setting both stop loss and take profit orders. This prevents me from taking heavy losses in an unexpected price swing – a big risk when you’re trading CFDs with leverage. It also means I will lock in profits if the price movement goes my way.

I set my take profit at €397 and my stop loss at €389 – just over 1% of the stock price, and a 1:1 risk/reward ratio.

In this case, my planning pays off and the stock price hits my take profit level within the hour. It continues to rise and reaches €400 by the end of the day, but I’m satisfied with the profit I’ve earned – day trading is about consistency, and it’s important to stay disciplined and stick to your plan.

Bottom Line

CFD trading in France is legal and regulated by the AMF, which has stepped up its oversight of CFD providers in recent years, mandating risk disclosures and more responsible leverage limits.

However, it remains a high-risk financial product so never risk more than you can afford to lose. Also start with a demo account if you’re new to CFD trading.

When you’re ready to trade with real money, check out DayTrading.com’s choice of the best CFD day trading platforms.

Recommended Reading

Article Sources

- Autorité des Marchés Financiers (AMF)

- AMF Restrictions on CFDs

- Financial Transaction Tax - Societe Generale

- Fonds de Garantie des Dépôts et de Résolution (FGDR)

- European Securities and Markets Authority (ESMA)

- Euronext Market Capitalization Leading Companies - Statista

- China Economy Slows, 2024 - Calcalist

- Weak Chinese Economy Slow Beauty Market - Business of Fashion

- China Unveils Stimulus Measures To Revive Economy - VOA News

- L’Oréal Upgraded To Buy Rating - MT Newswires

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com