Best Unregulated Forex Brokers in 2025

Some traders want an unregulated forex broker to access:

- Higher leverage: Trade FX with 1:1000+ leverage compared to 1:30 in regulated regions like Europe.

- Trading promotions: Get free trading credit bonuses which are typically prohibited by financial regulators.

- Easier account opening: Sign up in minutes with fewer identity checks than regulated FX platforms require.

However, these features come with significant risks, notably zero investor protection and increased exposure to forex scams. Your choice of brokers is also restricted – only around 12% of the brokers we’ve evaluated are unregulated. For these reasons, we normally recommend regulated trading platforms.

For those willing to take the risk, dive into DayTrading.com’s top-rated non-regulated forex brokers.

Top 6 Unregulated Forex Platforms

After assessing 223 platforms, these 6 unlicensed brokers are a cut above for trading currencies:

Here is a summary of why we recommend these brokers in April 2025:

- Videforex - Videforex offers trading on 35 currency pairs through leveraged CFDs with spreads from 0.1 pips. Alternatively, traders can use binaries to speculate on upward/downward price movements with payouts up to 98%. Integrated technical analysis, economic calendars, and market news, all available within the platform, help support FX trading decisions.

- Plexytrade - Plexytrade presents major, minor, and exotic forex pairs for trading, with leverage reaching 1:2000 and raw spreads starting from 0.0 - an enticing proposition for advanced traders seeking gains from minor price shifts. However, the downside lies in the limited selection, with only 41 currency pairs available, significantly fewer than the 100+ forex assets at IG.

- RaceOption - RaceOption offers 25+ major and minor currency pairs on a no-frills, web-accessible platform with 30+ indicators and built-in copy trading opportunities for a hands-off investment approach.

- Binarium - Binarium offers just 20 currency pairs, focusing on majors like EUR/GBP and USD/GBP, alongside a few minors. Currency trading is supported on a web-based platform with payouts up to 80% through the broker's binary options.

- PrimeXBT - PrimeXBT offers forex trading on over 50 majors, minors and exotics with margin opportunities and zero commissions. The forex platform is fast, reliable and feature-rich based on our latest tests with 3 charts, 10 timeframes, and 91 technical studies - ideal for active trading strategies.

- IQ Option - IQ Option offers CFD trading on 24 forex assets, including major pairs and some minors. EU traders can access a maximum of 1:30 leverage in line with local regulations. The broker offers commission-free trades but spreads are on the high side so the brand does not excel in this area.

Best Unregulated Forex Brokers in 2025 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Platforms | Minimum Deposit |

|---|---|---|---|---|---|

| Videforex | 35+ | 0.1 | / 5 | TradingView | $250 |

| Plexytrade | 40+ | 0.7 | / 5 | MT4, MT5 | $50 |

| RaceOption | 25+ | Variable | / 5 | TradingView | $250 |

| Binarium | 20+ | Variable | / 5 | Own | $5 |

| PrimeXBT | 45+ | 0.1 | / 5 | Own | $0 |

| IQ Option | 60+ | 14 pips | / 5 | Own | $10 |

Videforex

"Videforex will serve traders looking for a no-frills, easy-to-use platform to speculate on the direction of popular financial markets through binaries. With a sign-up process that takes a matter of minutes and a web-accessible platform, getting started is a breeze. "

William Berg, Reviewer

Videforex Quick Facts

| Bonus Offer | 20% to 200% Deposit Bonus |

|---|---|

| GBPUSD Spread | 0.1 |

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.1 |

| Total Assets | 35+ |

| Leverage | 1:500 |

| Platforms | TradingView |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Pros

- Videforex regularly runs trading contests, offering practice opportunities and cash prizes to beginners and experienced traders, with position sizes from just ¢0.01.

- Traders can earn up to 98% payouts on 100+ assets with the broker’s binary options, bringing it in line with competitors like IQCent.

- Videforex is one of the few brokers with 24/7 multilingual video support, providing comprehensive assistance for active traders.

Cons

- The client terminal needs improvements based on our latest tests, sporting sometimes slow and unresponsive widgets which could dampen the experience for day traders.

- The absence of any educational tools is a serious drawback for newer traders who can find blogs, videos and live trading sessions at category leaders.

- Videforex lacks authorization from a trusted regulator, meaning traders may receive little to zero safeguards like segregated client accounts.

Plexytrade

"Plexytrade is a newcomer in the brokerage scene with attention-grabbing features like 1:2000 leverage, zero spreads on select instruments and fast execution speeds of less than 46 milliseconds. However, the absence of regulation is a significant concern, while the non-existent research and educational tools place it far behind industry frontrunners."

Christian Harris, Reviewer

Plexytrade Quick Facts

| Bonus Offer | 120% Cash Welcome Bonus |

|---|---|

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.7 |

| EURGBP Spread | 1.1 |

| Total Assets | 40+ |

| Leverage | 1:2000 |

| Platforms | MT4, MT5 |

| Account Currencies | USD, EUR |

Pros

- Despite lacking regulation, Plexytrade provides negative balance protection and reinforces safety protocols by holding client funds in segregated accounts.

- Plexytrade offers among the highest leverage we’ve seen, up to 1:2000, catering to advanced traders willing to forego regulatory protections.

- Plexytrade accommodates a range of trading methods and short-term strategies, including scalping, hedging, and automated trading.

Cons

- With around 100 instruments, Plexytrade restricts the flexibility of investors who prefer to trade across various assets, especially compared to Blackbull with its 26,000 securities.

- Deposits and withdrawals are exclusively facilitated through cryptocurrencies, as Plexytrade does not support bank cards, bank wire transfers, or e-wallets.

- There are no research and educational materials, falling short of alternatives like IG, while access to the economic calendar is restricted to clients with balances of $500.

RaceOption

"RaceOption will appeal to investors looking for a feature-rich binary options trading experience with regular contests, account-based perks, and copy trading. The catch is its unregulated status, with little to zero investor protections available based on our investigations."

William Berg, Reviewer

RaceOption Quick Facts

| Bonus Offer | 20% - 200% Deposit Bonus |

|---|---|

| GBPUSD Spread | Variable |

| EURUSD Spread | Variable |

| EURGBP Spread | Variable |

| Total Assets | 25+ |

| Leverage | 1:500 |

| Platforms | TradingView |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Pros

- RaceOption makes account funding a breeze with fee-free and near-instant deposits via bank cards and cryptos, plus guaranteed withdrawals processing within 1 hour.

- Payouts on popular underlying assets like EUR/USD can reach 95%, beating out most alternatives based on our evaluations, and increasing potential returns, while the first 3 trades are risk-free in Silver and Gold accounts.

- RaceOption is in the less than 1% of brokers that offers video chat, available 24/7 in multiple languages, although the knowledge of agents about trading and regulatory issues needs improvement from our direct experience.

Cons

- RaceOption is an unregulated, high-risk broker that doesn’t provide investor compensation or legal recourse options should you run into trading or withdrawal issues.

- RaceOption is one of the only brokers not to offer a demo account, which when considered alongside the absence of education, makes this broker a poor choice for beginners.

- While still affordable for many retail investors, the $250 minimum deposit raises the entry barrier, especially compared to Deriv and World Forex who are designed for budget traders.

Binarium

"Binarium has been designed with simplicity in mind, featuring a fast, fully digital sign-up process and an intuitive platform and app with 4 chart types and 12 indicators. With binaries spanning 5 minutes to 3 months, it caters to short- and medium-term traders."

William Berg, Reviewer

Binarium Quick Facts

| GBPUSD Spread | Variable |

|---|---|

| EURUSD Spread | Variable |

| EURGBP Spread | Variable |

| Total Assets | 20+ |

| Platforms | Own |

| Account Currencies | USD, EUR, AUD, RUB |

Pros

- Binarium claims to segregate client funds with EU banks, meaning traders’ money should not be misused and providing an important layer of protection, which is especially relevant given its offshore status.

- Binarium has the best education centre we’ve seen amongst binary options brands, complete with information on core topics like trading basics and account options, plus professional video guides to using the platform.

- The $10,000 demo account, deposit-doubling welcome bonus, smooth sign-up, and 24/7 support make for an attractive onboarding experience.

Cons

- Binarium has some way to go to match the investment offering of binary firms like Quotex, with a particularly weak selection of around 20 currencies and 3 cryptocurrencies.

- Payouts of up to 80% are on the low side of binary options platforms based on our evaluations, which may deter traders looking for the possible best returns, though you can get back up to 15% of losing trades.

- Despite being operational since 2012, Binarium is an unregulated broker with limited transparency on its website, raising safety concerns and potentially putting your capital at risk.

PrimeXBT

"PrimeXBT is perfect for aspiring traders looking for crypto derivatives alongside traditional markets like forex and indices, all tradable on an intuitive, web-based platform. The copy trading solution is also ideal for hands-off traders with 5-star ratings and performance graphs to help you find the right trader."

William Berg, Reviewer

PrimeXBT Quick Facts

| Bonus Offer | $100 Deposit Bonus |

|---|---|

| GBPUSD Spread | Variable |

| EURUSD Spread | 0.1 |

| EURGBP Spread | Variable |

| Total Assets | 45+ |

| Leverage | 1:1000 |

| Platforms | Own |

| Account Currencies | USD, EUR, GBP |

Pros

- Ultra-fast execution speeds, averaging 7.12ms, make PrimeXBT an excellent option for day traders looking to secure the best prices in volatile markets.

- PrimeXBT has added fresh opportunities with new tokens for exchanging and funding, including 1Inch, Aave, and Injective.

- 24/7 customer support, available via live chat, proved excellent during testing, while the extensive help centre is perfect for self-help.

Cons

- Despite improvements, the selection of around 100+ instruments still seriously trails competitors, notably OKX with its 400+ assets.

- The lack of integration with established platforms like MT4 will be limiting for traders familiar with the world’s most popular forex trading software.

- While common in the crypto industry, PrimeXBT lacks authorization from a trusted regulator, seriously elevating the risk for retail traders.

IQ Option

"IQ Option is a good broker for beginners with a slick platform and low minimum investment. New users can also open an account in three easy steps."

William Berg, Reviewer

IQ Option Quick Facts

| GBPUSD Spread | 5 pips |

|---|---|

| EURUSD Spread | 14 pips |

| EURGBP Spread | 15 pips |

| Total Assets | 60+ |

| Leverage | 1:500 |

| Platforms | Own |

| Account Currencies | USD, EUR, GBP, ZAR |

Pros

- Excellent range of payment methods

- Access to IQ Option community

- iOS & Android compatible app

Cons

- €10 inactivity fee after 90 days

- No MetaTrader 4 integration

Our Methodology

We analyzed our extensive database of online brokers:

- We identified approximately 70 that aren’t regulated.

- We extracted the around 60 platforms that offer forex trading.

- We sorted the remaining forex firms based on their rating, which takes into account more than 100 data points and the personal observations of our experts during hands-on tests.

Comparing Non-Regulated Forex Providers

There are the key areas we recommend considering when choosing an unlicensed forex platform:

Trust

Find a legitimate broker that you can rely on. This is paramount, especially when oversight from a credible regulator is normally the primary driver of DayTrading.com’s Regulation & Trust Rating.

In its absence, look for these other indications that the forex firm can be relied on:

- Length of service: Legitimate brokers have usually been operating for many years, upwards of five, building an established client base. For example, Amega has been operational since 2018 with 140,000+ traders, while Plexytrade only launched in 2024 and remains relatively unproven.

- Track record: Legitimate brokers do not have a history of lawsuits and fines. For example, SageFX has not been the subject of any lawsuits based on our investigations, while EverFX has been exposed as running a “billion-dollar scam” by encouraging traders to invest their funds through offshore entities.

- Reviews: Legitimate brokers have positive reviews from their forex traders and industry experts. For example, EagleFX has received over 4/5 in user reviews on our website, while 7Bforex scored below 2/5 in user reviews.

- NordFX is the most legitimate unregulated forex broker that we’ve evaluated, with an extensive history stretching back to 2008, multiple industry awards, and it advertises more than 2 million users.

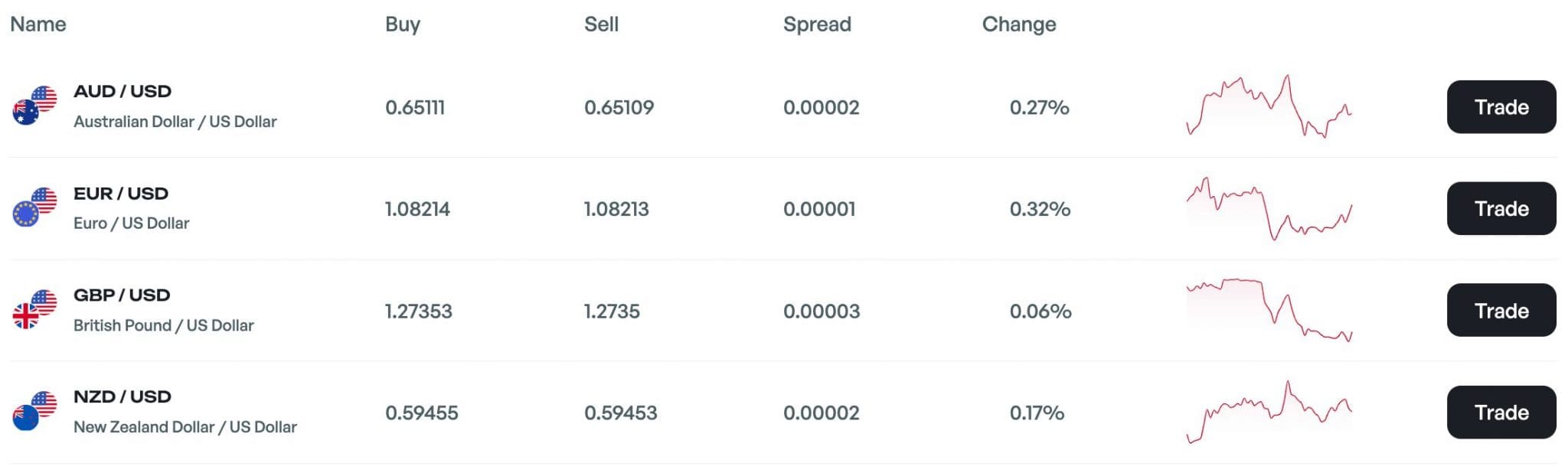

Currency Pairs

Choose a broker with access to the currency pairs you’re interested in trading, for example, majors like EUR/USD, GBP/USD and USD/JPY.

However, it’s important to keep in mind that if you opt for unregulated forex brokerages, you may find a more limited selection of assets.

For instance, while multi-regulated CMC Markets offers over 330 currency pairs (the most we’ve seen), the vast majority of non-authorized platforms we’ve analyzed support between 20 and 60.

- Amega is a stand-out choice if you want extensive access to the forex market with over 70 currency pairs spanning majors, minors and exotics with high leverage up to 1:1000.

Pricing

Choose a broker with transparent, competitive pricing. This is especially important for active traders where a large volume of trades can incur significant costs.

As a retail trader, the average spread on major currency pairs, notably the EUR/USD, often ranges from around 0.5 pips to 2.0 pips based on our evaluations.

However, this can vary depending on the platform you use and market conditions. For instance, ECN brokers tend to offer tighter spreads from 0.0 pips but charge a commission, often $6-$7 per lot ($100K).

Spreads can also widen during volatile markets or if you’re trading a currency pair with lower trading volumes, such as USD/TRY.

- PrimeXBT has some of the best pricing we’ve seen among unregulated forex platforms with a transparent fee schedule featuring spreads from 0.1 pips on FX pairs like EUR/USD with zero commissions.

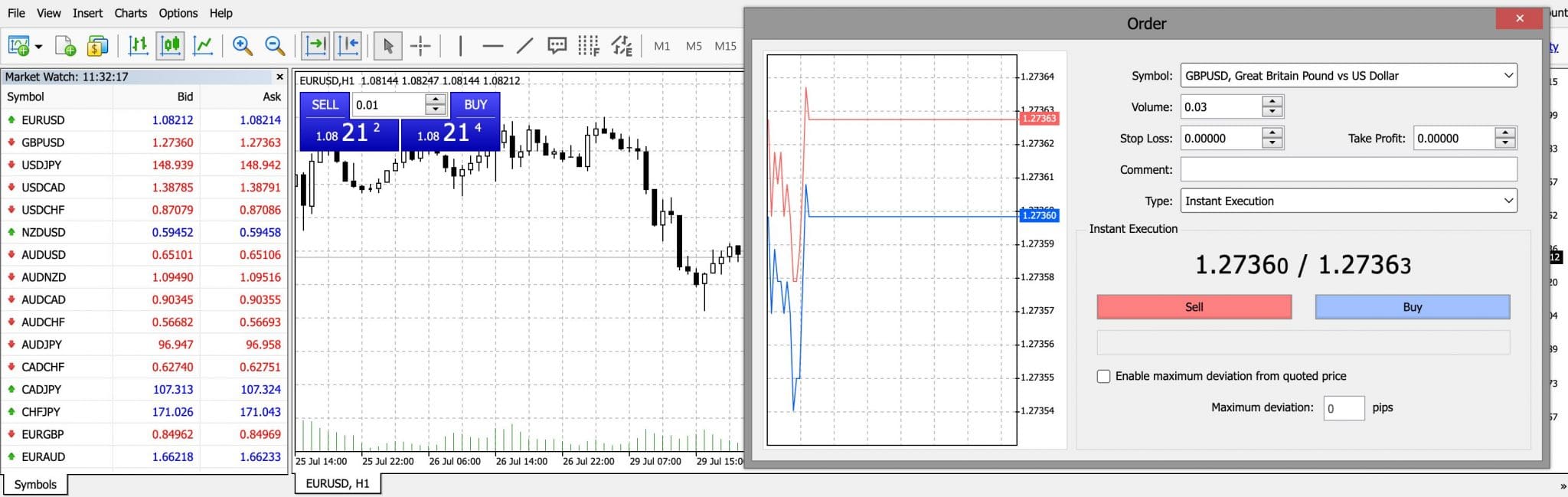

Trading Tools

Choose a broker with a user-friendly platform or forex app where you can analyze the markets and execute trades with confidence.

Unlike regulated brokers, most unlicensed providers we’ve evaluated offer a much slimmer choice of trading software, with often just one third-party solution, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

In-house platforms are rarer, and when they do exist, they often don’t match the speed, usability and reliability of those provided by regulated brokers, who typically have bigger budgets to pour into development.

- LMFX supports the most popular forex platform – MetaTrader 4, available for desktop download, through web browsers and on mobile (iOS, Android and Huawei). It performed without a glitch during testing and delivers in the charting department with 3 chart types, 30 indicators 9 timeframes.

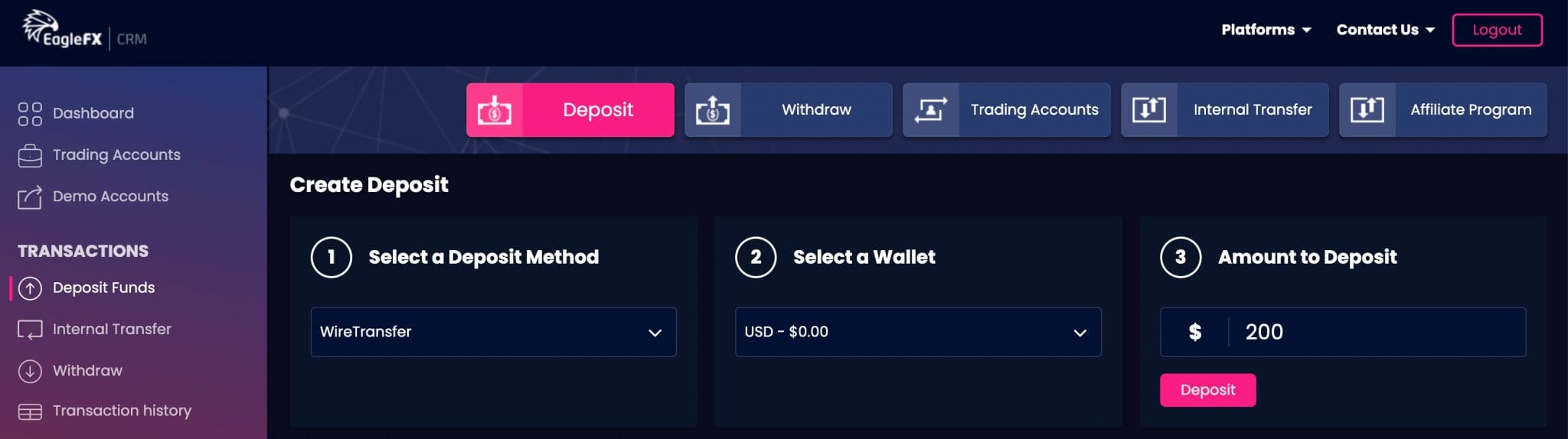

Account Opening

Choose a broker with fast, hassle-free account opening, with an increasing number of firms supporting fully digital sign-ups.

This is one of the benefits of using an unlicensed FX broker – you often don’t need to provide the same level of personal information and documentation to satisfy the know-your-customer (KYC) and anti-money-laundering (AML) checks required by some regulators.

- EagleFX has an extremely smooth sign-up process. It took us just four minutes to provide the required details (name, email, date of birth, password) and verify our email address.

Support

Choose a broker with customer support you can depend on.

We’ve witnessed a sharp decline in the quality of support provided when you go down the unauthozied route. Normally gone are the 24/7 customer service agents available via live chat, email, and telephone. So too are dedicated account managers.

Instead, you’ll often be met with an automated chatbot or a slow-to-respond agent with poor English skills and a limited understanding of trading products.

Or even worse, you can’t get through to someone at all. For example, FxPlayer’s live chat team weren’t online during our latest tests (despite it being during forex trading hours), while ForexStart doesn’t offer live chat at all and despite submitting a query to the team about its forex offering we never received a response.

- LonghornFX is refreshingly good in the support department, with around-the-clock assistance via email, live chat, and a callback form. During testing, we got through to an agent within two minutes and they adequately answered each of our three queries about forex trading conditions.

What Protections Will I Lose Using An Unregulated FX Broker?

The table below highlights the safeguards you may lose if you opt for an non-licensed FX broker.

| Protection | Regulated FX Brokers | Unregulated FX Brokers |

|---|---|---|

| Investor Compensation | Yes | No |

| Negative Balance Protection | Yes | No |

| Dispute Resolution Service | Yes | No |

| Responsible Leverage Limit | Yes | No |

| Segregated Client Accounts | Yes | No |

| Ban On Trading Bonuses | Yes | No |

| Transparent Trading Conditions | Yes | No |

| Guaranteed Best Order Execution | Yes | No |

This list is not exhaustive. Also note that some unauthorized forex platforms may still provide some of these safeguards, but they may not be legally required to and will be subject to less scrutiny.

Bottom Line

Some traders are willing to forego regulatory protections in return for highly leveraged trading opportunities of 1:000 and above, promotions that offer additional trading credit, and near-instant account opening with little to no documentation required.

There is no universal ‘best unregulated forex trading platform’ – this will depend on your individual needs. See DayTrading.com’s pick of the top unlicensed forex brokers to find the right provider for you.

We do not typically recommend trading currencies with an unauthorized broker. You may receive limited legal protections, representing a significant risk to your capital. Only risk what you can afford to lose.

FAQ

Is It Safe To Trade Forex With An Unregulated Brokerage?

There’s no getting around it, trading forex with an unlicensed provider is extremely risky.

Not only does high leverage increase the potential for thumping losses, but you may also lose safeguards like negative balance protection and investor compensation that you can expect from well-regulated trading platforms.

Am I Protected If I’m Scammed By An Unregulated Forex Platform?

Probably not. While brokers authorized by ‘green tier’ regulators like the Financial Conduct Authority (FCA) in the UK or the Securities & Exchange Commission (SEC) in the US offer fund protection through the Financial Services Compensation Scheme (FSCS) with £85,000 per client and the Securities Investor Protection Corporation (SIPC) with $50,000 per client, respectively, unregulated brokers do not typically provide such protection.

Additionally, you may not have access to an independent body, such as the Financial Ombudsman Service in the UK, which can help resolve disputes between traders and brokers.