Forex Index Trading

Forex index trading allows investors to speculate holistically on the value of a currency rather than trading a single currency pair. This guide will compare trading currency pairs vs forex indices, popular strategies, and how to find the best brokers for currency index trading.

Currency Index Brokers

These are the 6 best brokers for trading currency indices and the indices they offer:

-

1

DukascopyCurrency index: USD

DukascopyCurrency index: USD -

2

AvaTradeCurrency index: USD

AvaTradeCurrency index: USD -

3

XMCurrency index: USD

XMCurrency index: USD -

4

ExnessCurrency index: USD

ExnessCurrency index: USD -

5

PepperstoneCurrency index: USD, EUR, JPY81.8% of retail investor accounts lose money when trading CFDs

PepperstoneCurrency index: USD, EUR, JPY81.8% of retail investor accounts lose money when trading CFDs -

6

EightcapCurrency index: USD71% of retail traders lose money when trading CFDs

EightcapCurrency index: USD71% of retail traders lose money when trading CFDs

Here is a short overview of each broker's pros and cons

- Dukascopy - Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- XM - XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC and CySEC and offers a comprehensive MetaTrader experience.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

Dukascopy

"If you’re an experienced trader, Dukascopy provides the tools you need: JForex for algorithmic strategies, competitive spreads from 0.1 pips, leverage up to 1:200, and the peace of mind of using a Swiss-regulated bank and broker."

Christian Harris, Reviewer

Dukascopy Quick Facts

| Bonus Offer | 10% Equity Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Regulator | FINMA, JFSA, FCMC |

| Platforms | JForex, MT4, MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN |

Currency Indices

Dukascopy only allows for trading on the USD currency index.

Pros

- Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA) as both a broker and a bank, ensuring top-tier financial security and adherence to strict standards.

- The proprietary JForex platform is highly advanced, offering tools for algorithmic trading, extensive charting, and access to deep liquidity for short-term traders.

- Dukascopy offers tight spreads starting from 0.1 pips, leverage up to 1:200 (depending on the jurisdiction), and volume-based commissions that reward high-frequency traders.

Cons

- Some account types, such as the MT4/MT5 accounts, require a higher minimum deposit of $1,000, which may not be ideal for traders with smaller budgets.

- While JForex is feature-rich, it has a steep learning curve, making it less suitable for beginner traders who might prefer simpler platforms.

- Dukascopy's withdrawal fees are higher than most competitors we’ve tested, particularly for bank wire transfers, which may deter traders who require frequent access to their funds.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Currency Indices

AvaTrade only allows for trading on the USD currency index.

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | ASIC, CySEC, DFSA, IFSC |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Currency Indices

XM only allows for trading on the USD currency index.

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

Cons

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Currency Indices

Exness only allows for trading on the USD currency index.

Pros

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US and the UK, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Currency Indices

Pepperstone offers trading on these 3 currency indices: USD, EUR, JPY

Pros

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Currency Indices

Eightcap only allows for trading on the USD currency index.

Pros

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, the innovative algorithmic trading platform Capitalise.ai, and more recently the 100-million strong social trading network TradingView.

Cons

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

What Are Indices In Forex Trading?

In finance, an “index” is a collection of assets bundled together to represent a particular market sector. A forex index aims to track the value of a single currency in relation to a number of other significant currencies, all bundled up into one single figure.

The forex indices achieve this by tracking a basket of individual currency pairs, which are weighted to provide a theoretically balanced value for the main currency. This reduces exposure to a single currency pair and aims to provide a trading vehicle based on a single currency.

For example, the US Dollar Index is calculated by combining a basket of currencies from major global nations, including the UK, Canada and Switzerland. The weighting of the individual currency pairs is:

- 57.6% – Euro/US Dollar (EUR/USD)

- 13.6% – US Dollar/Japanese Yen (USD/JPY)

- 11.9% – British Pound/US Dollar (GBP/USD)

- 9.1% – US Dollar/Canadian Dollar (USD/CAD)

- 4.2% – US Dollar/Swedish Krona (USD/SEK)

- 3.6% – US Dollar/Swiss Franc (USD/CHF)

Major forex indices include the aforementioned US Dollar Index, the Euro Currency Index and the Swiss Franc Index. However, there are also forex currency indices available for minor and exotic currencies, such as the Swedish Krona Index and Norwegian Krone Index.

Forex Index Trading vs Forex Pair Trading

The main difference between trading forex pairs and indices is diversification. When trading forex pairs, investors are speculating on the price relationship between two currencies. This relationship is often more volatile than a forex index and the major assets such as USD/EUR are more liquid. On the other hand, forex index trading provides a more balanced value of a single currency.

Another difference is available assets. While there are hundreds of currency pairs, there are far fewer forex indices. Trading forex pairs vs indices, therefore, is a good way to speculate on minor or exotic currencies.

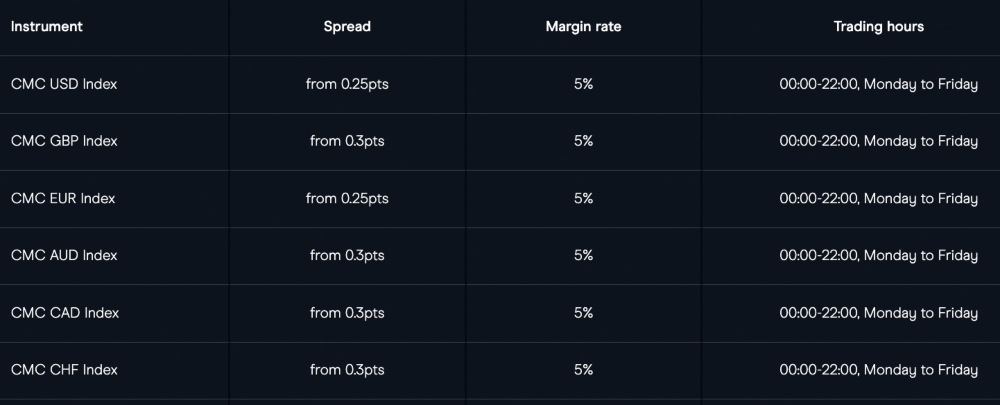

Markets & Instruments

When it comes to forex index trading, as outlined above, there are not as many markets to choose from as traditional indices or currency pairs. While non-major currencies such as the Swedish krona and Singapore dollar are available to trade, investors are limited to tens, rather than hundreds of markets.

However, there is no shortage of available trading instruments for forex indices. For example, the US Dollar Index can be traded through forex-style CFDs, futures, options, and spread betting.

Trading Fees

Fees are a key consideration for investors, as high charges and commissions can quickly eat into profits.

Investors will be pleased to know that for forex index trading, generally fees are competitive. In fact, for US Dollar Index trading and other major FX indices, many leading forex day trading platforms offer zero commission or low-spread CFD trading.

When looking to trade major forex indices through more traditional methods such as mutual funds or ETFs, costs are also low. This is because these instruments are passive tracker funds rather than actively managed funds that command higher commissions.

Pros Of Forex Index Trading

- Single Currency Trading – While forex pairs allow investors to pit two currencies against each other, forex index trading allows investors to speculate on a more balanced overall value of a single currency.

- Simple – When trading forex pairs, investors are very exposed to fluctuations in two currencies, rather than one. For example, a trader that believes the Euro will weaken can speculate on EUR/USD, but shall be vulnerable to USD changes as well. However, the balanced basket of currencies used in forex indices helps reduce exposure to base currency changes.

- Low Costs – Forex indices tend to have competitive spreads and commissions from forex day trading platforms, whether these are for forex-style CFD trades or other vehicles.

- Range Of Instruments – From CFDs to spread bets and futures, forex index trading is available through a range of vehicles, suiting various trading styles and strategies.

Cons Of Forex Index Trading

- Low Volatility – When trading leveraged derivatives such as options and CFDs, volatility can send profits spiralling. The more balanced values of forex indices can curtail this profit potential due to comparatively lower volatility.

- High Single Pair Exposure – The component forex pairs weightings are supposed to offer a diversified method of providing a value for a currency. However, this is not always achieved in practice. For example, due to the advent of the Euro and the consolidation of European currencies into one, the US Dollar Index has a 57.6% exposure in EUR/USD.

- Limited Markets – While hundreds of forex pairs offer investors the chance to speculate on minor and exotic currencies, comparatively few forex indices currently exist.

- Reduced Trading Hours – The forex markets benefit from 24/5 trading thanks to the use of several global trading hubs, including London and New York. Unfortunately, forex indices do not benefit from this system and have significantly reduced trading hours compared to forex currency pairs.

Forex Index Trading Strategies

There are different strategies for live forex index training. Ultimately, experienced traders will draw upon a combination of leading forex indicators and signals to predict trades.

Rumours & News

Seasoned forex investors will know the power of breaking news on the value of a currency. Traders can capitalize on this trading opportunity using forex indices, which filter out the effects of other currencies through their diversification.

One popular strategy is to “buy the rumour and sell the news”. This hinges on getting your position locked in before the market reacts to the upcoming news to maximize profits. However, this is a risky strategy as rumours can often be incorrect. Additionally, there is no guarantee that news will affect markets in the way that investors predict.

Breaking news to look out for includes inflation and interest rate announcements as well as high-profile currency interventions, such as in late 2022 when the Bank of England stepped in to purchase long-dated gilt bonds.

This was to contain the mass sell-off that occurred after the government’s short-lived mini-budget, which affected the 30-year gilt yield by as much as 1% as well as the value of the pound against the dollar.

Fundamentals

Long-term investments in a forex index will often be driven by fundamental analysis. These are the economic and political factors that influence the value of a currency.

Examples of fundamentals include economic growth, as tracked by GDP and employment rates. Political stability is also a crucial fundamental, with markets notoriously sensitive to political changes. The balance of trade is also important, with high exports generally strengthening a currency.

Investors will often look at historical data to find trends in a currency’s fundamentals to make predictions as to its future value. However, if an investor believes that an upcoming event will change the pattern of fundamentals, a reversal trade is always a lucrative form of investing, especially when using options.

Technical Analysis

Thanks to the wide availability of retail analysis and platforms such as TradingView and MetaTrader 4, powerful technical analysis is more accessible to investors than ever.

Users may want to look at trend lines such as the relative strength index (RSI) in forex index trading or other leading indicators such as support and resistance lines and Fibonacci overlays.

Technical analysis can be done through various time frames, with short-term forex trading instruments such as binary options and CFDs able to analyse patterns on 1-minute or 5-minute charts.

How To Trade Forex Indices

Decide On Your Market & Instrument

While many brokers offer several currency indices, it is a good idea to decide on your favoured trading assets first. This is to ensure your chosen broker supports these assets before signing up and depositing funds.

It is also important to decide on your preferred trading vehicles, as most brokers support just one or two, for example, CFDs, ETFs, binary options or futures.

Choose A Broker

When it comes to trading forex indices, choosing a reputable and low-cost broker is key. Here are our top tips for finding the best forex index broker:

- Regulated by a reputable body, such as the FCA or CFTC

- Provides competitive trading and payment fee structures, such as a zero-commission account

- Supports your favoured payment methods, such as PayPal or wire transfer

- Supports reliable and user-friendly trading platforms such as MT4 or NinjaTrader

- Offers helpful and accessible customer support, available 24/5 via live chat or phone

Create An Account

Now, create an account. This is usually a simple process, but firms often require verification details for regulatory purposes, such as IDs, passports or bank statements.

Next up is to fund your forex index trading account. If you plan to trade a leveraged forex index market, ensure that you have sufficient capital to avoid a quick stop-out or margin call.

Find Your Market

Once your account is set up and funded, it is time to start trading forex indices. Download one of your broker’s supported trading platforms (some brokerages offer web-based platforms too) and navigate to your chosen product.

If your trading will centre around a small number of markets, most platforms allow traders to bookmark or favourite these asset pages for quick navigation in the future.

Make A Trade

Once you have conducted analysis of your forex index, it is time to make the trade.

As well as selecting your position, set stop-loss and take-profit levels, with advanced “trailing” tools available on some platforms. This will help keep a handle on your risk exposure.

Close Your Position

Monitor the market for the best opportunity to close your trade, taking your profit or closing out your losses.

With that said, some instruments like binary options may not offer an early cash-out opportunity. In these instances, hedging a trade to either lock in a profit or minimize losses may be possible.

Final Word On Trading Forex Indices

Forex index trading is a good choice for investors that wish to speculate on the value of a currency with less exposure to individual currency pairs. There are plenty of available forex index trading instruments, and these markets are largely low-cost. However, there is limited choice for exotic markets and trading hours are reduced compared to traditional currency pairs.

Use our list of the top forex index brokers to start trading.

FAQs

What Is An Index In Forex Trading?

A forex index is a basket of currency pairs with a common currency, such as the US Dollar. This provides a diversified measure of the value of this common currency.

Forex index trading essentially offers a means to speculate on the value of a single currency, such as the USD, EUR or GBP.

What Are The Best Currency Indices To Trade?

Forex indices such as the US Dollar Index, British Pound Index and Euro Index are highly liquid. However, a solid strategy can make any forex index a profitable trading market.

Head to our tutorial on forex index trading to find a suitable broker and get started.

What Is The Best Time To Trade Forex Indices?

The best forex index trading opportunities will occur around significant news, such as interest rate announcements, changes in government monetary policy and new global trade relationships.

Note that unlike trading standard forex pairs, FX indices may not be available 24/5.

Is Trading Forex Indices Better Than Forex Pairs?

Forex index trading allows investors to speculate on a single currency more reliably and stably than by using a single currency pair. However, currency pair trading can be more lucrative due to its comparative volatility, and investors have more options when it comes to available currencies.