Focus Markets Review 2025

Pros

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

Cons

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

Focus Markets Review

In this comprehensive review of Focus Markets, we explore its strengths and weaknesses, providing traders an honest assessment of the platform. After thorough testing, we evaluate the broker’s offering, with an emphasis on features for short-term traders.

Regulation & Trust

3 / 5Founded in 2019, Focus Markets is an Australian-based CFD broker that’s averagely trusted.

Focus Markets operates under multiple entities:

- Focus Markets Pty Ltd: This Australian-based entity is regulated by the Australian Securities and Investments Commission (ASIC) under Licence number 514425.

- Focus Markets LLC: This entity is incorporated in Saint Vincent and the Grenadines.

It’s important to note that while ASIC is a ‘green tier’ regulatory authority as per DayTrading.com’s Regulation & Trust Rating, providing a high level of oversight and consumer protection, the ‘red tier’ regulatory environment in Saint Vincent and the Grenadines (SVGFSA) is less stringent.

You can see which entity you sign up with in the client area. For example, the confirmation appeared at the bottom of the client area after we opened an account – it looks like the below.

Additionally, in our research, we discovered that Spain’s National Securities Market Commission (CNMV) has issued a warning against Focus Markets LLC, indicating that the offshore entity may not be authorized to offer financial services in certain jurisdictions.

| Focus Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | ASIC, SVGFSA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

2.8 / 5Live Accounts

Focus Markets offers two trading accounts designed to suit active traders of all levels, whether you prefer tight spreads with commissions or an all-inclusive pricing model.

Here’s a breakdown of what each account type offers:

- Standard: Designed for traders who prefer an all-inclusive pricing model, with spreads starting from 1.0 pips and no commission charges.

- Raw: Best suited to day traders seeking lower spreads, with pricing starting from 0.0 pips and a commission of $3.50 per standard lot traded.

Both accounts require a minimum deposit of $100, and you can choose from base currencies, including CAD, AUD, USD, GBP, NZD, SGD, and EUR. This is more accommodating than OANDA, which only supports USD, EUR, HKD and SGD base currencies.

Both Standard and Raw accounts have a minimum trade size of 0.01 lots, a maximum of 100 lots, and high leverage up to 1:500, which is ideal for smaller accounts. There is a maximum of five trading accounts allowed.

A dedicated account manager is also included to provide personalized support, a great feature that not many brokers offer – at least not until a specific account balance threshold is met.

Focus Markets does not offer an Islamic account either, meaning traders who follow Sharia law will incur overnight interest charges (swap fees) on positions that may not comply with their religious beliefs.

Demo Accounts

Opening a demo account with Focus Markets is a smooth and hassle-free experience. You can explore the MetaTrader 5 (MT5) trading platform, test different strategies, and get a feel for real market conditions – all before risking your own money.

The demo account replicates live trading, providing access to similar price feeds and execution speeds, making it feel like you are in an actual trading environment with up to $100,000 in virtual funds.

By default, the demo account only lasts for 30 days, which is restrictive compared to other brokers. However, if you want to keep using it beyond that, I found you can contact customer support to request a non-expiry version.

While this option is available, it adds an extra step to the process, making it slightly less convenient than brokers like XM, which offer unlimited demo accounts automatically.

Deposits & Withdrawals

Focus Markets accepts several payment methods for deposits. I find credit card and debit card deposits the most convenient, as they are available in AUD, USD, GBP, EUR, NZD, CAD, and SGD, with instant processing and a limit of $5,000 or the equivalent in other currencies.

Bitwallet supports JPY and offers the same instant processing and deposit limit. Cryptocurrency options include USDT (TRC20, ERC20) and BTC, which are also processed almost instantly and have a $5,000 deposit cap.

Neteller and Skrill provide additional flexibility, supporting USD, EUR, and CAD with higher deposit limits of $10,000.

Local bank transfers are also an option for AUD, USD, GBP, EUR, NZD, CAD, and SGD, although processing times range from 24 to 72 hours. Lastly, BPay, which is limited to AUD transactions, takes about one to two business days to process, with a USD $10,000 deposit limit.

I appreciate that Focus Markets does not charge internal deposit fees, though intermediary bank fees may apply, particularly for non-Australian banking institutions.Withdrawals are handled equally efficiently, with most transactions typically completed within one to two business days.

Focus Markets’ range of deposit and withdrawal options is competitive compared to other brokers. Many brokers don’t offer cryptocurrency options and multiple e-wallets, giving Focus Markets an edge for those seeking flexibility.

| Focus Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Bitwallet, Credit Card, Debit Card, Mastercard, Neteller, Skrill, Visa | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $100 | $100 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3 / 5Focus Markets offers a good range of over 1,000 CFDs across various asset classes, including:

- Forex: 50+ currency pairs, including major, minor, and exotic pairs such as USD/CAD. This selection allows for ample opportunities in the world’s most liquid market.

- Indices: 8+ major global indices including the Nikkei 225, FTSE 100 and Dow Jones. These indices represent key stock markets worldwide, enabling you to speculate on broader market movements.

- Commodities: 4+ primary commodities, including gold, silver and oil. These markets are popular for diversification and hedging strategies.

- Cryptocurrencies: 90+ cryptocurrency derivatives, one of the largest selections among MT5 brokers globally. This includes popular cryptocurrencies like Bitcoin and Ethereum, providing opportunities in the rapidly evolving crypto market.

- Stocks: 650+ stocks allow you to participate in worldwide equity markets without owning companies’ underlying assets, including Apple, Meta and Adidas.

The breadth of Focus Markets’ cryptocurrency offerings is particularly noteworthy when compared to top-tier brokers. However, other asset categories, such as commodities and indices, do not match the extensive selections found at leading firms.

For instance, CMC Markets offers access to 12,000+ CFD products, covering commodities, currencies, ETFs, stocks, indices, share baskets, and treasuries, providing a more extensive selection than most online brokers.

| Focus Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:500 | 1:200 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3 / 5Trading with Focus Markets offers several advantages, including competitive spreads and zero internal fees for deposits and withdrawals.

However, there are some costs to consider when trading with the broker. For instance, intermediary banks may charge around $20 if you make international transfers. Crypto transactions also typically incur fees.

The Standard account provides spreads starting from 1.0 pips, without additional trading commissions. Meanwhile, the Raw account offers tighter spreads, starting from 0.0 pips, but charges a commission of $3.5 per standard lot traded.

Compared to other industry leaders like Eightcap and RoboForex, Focus Markets’ trading fees are competitive, especially as the broker charges no inactivity fees on dormant accounts. This policy lets you maintain your live accounts without the concern of incurring additional charges due to inactivity.

| Focus Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.0 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 1.2 | 100 | 0.005% (£1 Min) |

| Oil Spread | 0.03 | 0.1 | 0.25-0.85 |

| Stock Spread | Variable | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

2.5 / 5Focus Markets exclusively offers MT5, with no support for MT4, cTrader, or TradingView. While MT5 is a powerful and versatile platform, if you’re accustomed to other interfaces, you may find the lack of options restrictive.

I appreciate MT5’s advanced charting tools at Focus Markets, the multiple timeframes, and the wide selection of technical indicators. The Depth of Market (DOM) feature is particularly useful, providing visibility into market liquidity and improving trade execution.

MT5’s clean interface makes navigating charts, orders, and account information easy. However, I miss an integrated economic calendar like the one in cTrader.

When analyzing charts in Focus Markets’ MT5, I typically add a couple of key technical indicators, such as the Moving Average (MA) and Relative Strength Index (RSI). These tools give me a solid indication of the market sentiment and potential reversal points.

Once I decide to enter a trade, simply click on the ‘New Order’ button. The order window lets me choose the trade size, stop loss, and take profit levels quickly.

The risk/reward ratio is clearly visible, and this helps me assess whether the trade fits my risk tolerance.

Trade execution is fast with Focus Markets, which is key for short-term traders. I immediately see my position in the Trade Tab, alongside all relevant details like price, stop loss, take profit, and floating profit/loss.

However, compared to top forex brokers, Focus Markets’ reliance on MT5 alone may be a drawback for traders who prefer alternative platforms like cTrader or TradingView, which I prefer for their unique tools and modern interfaces.

For those who favor MT5, Focus Markets still delivers a comprehensive and feature-rich trading experience that supports Expert Advisors (EAs) for automated trading – even though the broker doesn’t offer VPS services.

| Focus Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | MT5 | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

1 / 5Focus Markets does not provide dedicated research resources such as market analysis, trading signals, or economic insights. The best you get is margin, profit, pip, and currency conversion calculators available under ‘Tools’ in the client area.

This is a serious drawback for beginners, and this absence means you have to seek external sources for informed decision-making.

In contrast, leading brokers offer comprehensive research tools. For example, Saxo Bank delivers high-quality in-house analysis and third-party insights, while IG integrates in-depth market analysis with innovative third-party tools from Trading Central and Autochartist.

| Focus Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

1 / 5Focus Markets doesn’t offer any dedicated learning materials beyond the FAQ section. Again, this is a huge letdown for beginner traders.

While the FAQ provides essential guidance on account setup, funding methods, and trading conditions, it lacks in-depth educational content such as tutorials, webinars, or market analysis.

In contrast, leading brokers like AvaTrade offer extensive educational resources, including detailed trading courses, webinars, and interactive lessons designed to help traders at all levels.

| Focus Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

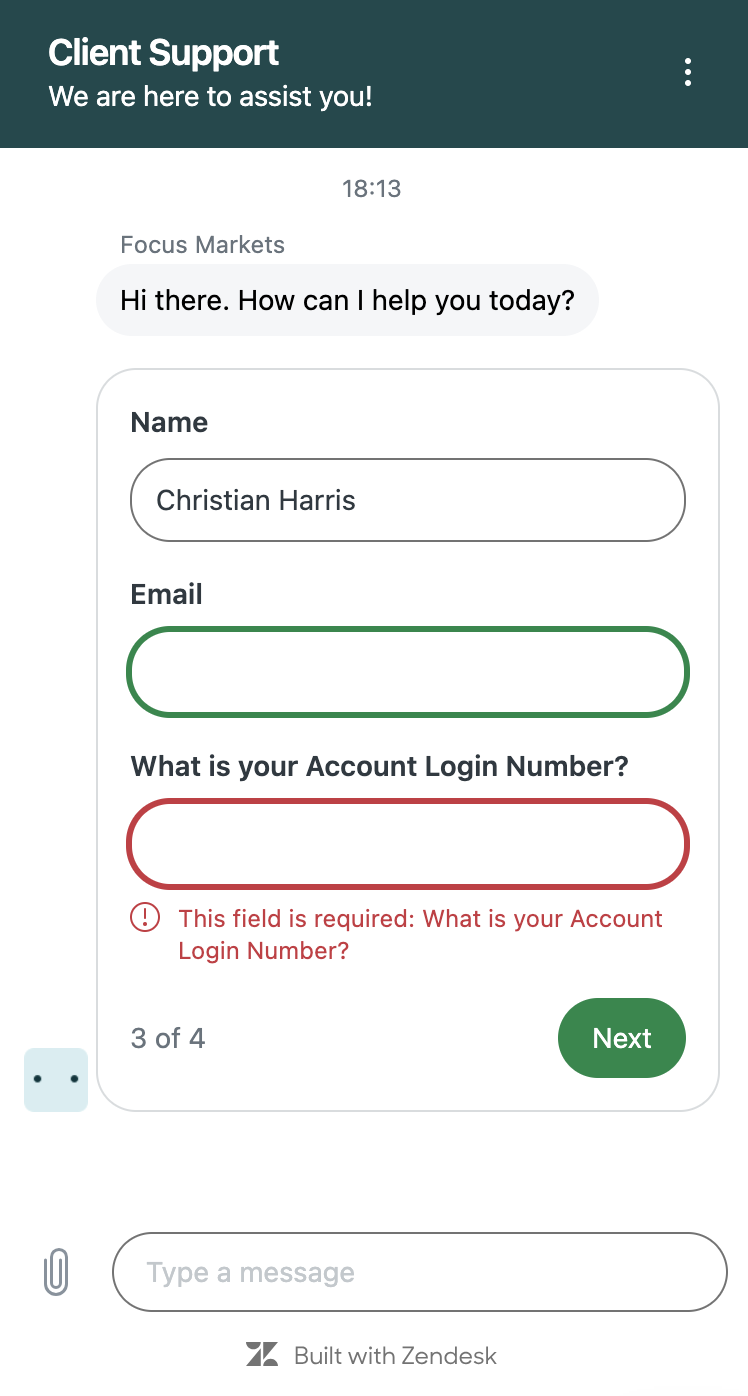

2 / 5When I’ve needed to contact Focus Markets’ customer support, I’ve found its service somewhat limited compared to that of top day trading brokers.

It provides 24/5 support, meaning assistance is available during the trading week but not on weekends. However, its contact options are restricted:

- Live Chat: I have failed to receive a response whenever I attempt to use the chat feature. This is really disappointing and frankly not good enough, as many top brokers provide instant support.

- Email: I received a response the next working day, which was helpful but slower than expected.

- Social Media: There are Facebook, X, Instagram, and LinkedIn channels where you can reach out for updates or inquiries, though response times may vary. It’s worth mentioning that the broker isn’t active on social media anymore – the most recent Facebook post was in 2022.

- FAQs: The website’s comprehensive FAQ section covers essential topics like account setup, funding methods, and trading conditions. However, for more in-depth information you still need to reach out to support.

Focus Markets does not provide a direct dial phone number, making it more difficult to get immediate assistance. Additionally, it does not offer a callback service, so you must rely solely on email or live chat for support.

In contrast, leading brokers like IC Markets offer 24/7 support, direct phone lines, and faster live chat responses.

| Focus Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Focus Markets?

Focus Markets can be a good choice if you’re looking for a broker with low entry costs, competitive spreads, access to MT5, and a wide range of crypto trading opportunities.

However, if you prioritize top-tier regulation, a choice of trading platforms, extensive educational resources and research tools, or global accessibility, you might consider alternatives.

FAQ

Is Focus Markets Legit Or A Scam?

Focus Markets has been operating since 2019, offering a real trading platform (MT5) and transparent deposit and withdrawal methods. It is a legitimate broker registered in Australia and Saint Vincent and the Grenadines, which adds some credibility.

However, it lacks multiple top-tier regulations like FCA or CySEC, and its SVGFSA registration provides limited investor protection. While not a scam, you should exercise caution if you prioritize strong regulatory oversight.

Is Focus Markets Suitable For Beginners?

Focus Markets is less suitable for beginners. The Standard account is beginner-friendly, offering no commission, spreads from 1.0 pips, and a $100 minimum deposit, making it accessible for new traders.

However, the broker isn’t available worldwide, restricting access for traders in certain regions, and the only trading platform supported is MT5.

Educational resources and research tools are also severely limited, especially compared to brokers like IG or eToro, so other brokers may be a better fit if you’re new to trading.

Top 3 Alternatives to Focus Markets

Compare Focus Markets with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- AZAforex – Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

Focus Markets Comparison Table

| Focus Markets | Interactive Brokers | Dukascopy | AZAforex | |

|---|---|---|---|---|

| Rating | 2.8 | 4.3 | 3.6 | 3.4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 | $1 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.0001 Lots |

| Regulators | ASIC, SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | GLOFSA |

| Bonus | – | – | 10% Equity Bonus | 25% Crypto Deposit Bonus, 120% Loyalty Bonus, 30% Spread Rebate |

| Education | No | Yes | Yes | No |

| Platforms | MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | Mobius Trader 7 |

| Leverage | 1:500 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 8 | 6 | 11 | 14 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

AZAforex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Focus Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Focus Markets | Interactive Brokers | Dukascopy | AZAforex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | Yes |

Focus Markets vs Other Brokers

Compare Focus Markets with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Focus Markets yet, will you be the first to help fellow traders decide if they should trade with Focus Markets or not?