Finrax Brokers 2025

Finrax is a gateway for cryptocurrency payments providing multi-currency support and exchange so that merchants can process transactions in digital tokens. The payment solution is also proving popular with traders, providing instant deposits due to the undisrupted flow of funds. This guide lists the best brokers that accept Finrax deposits in 2025. We also unpack the pros and cons of using Finrax.

Best Finrax Brokers

Our exhaustive tests have shown that these are the top 6 brokers that support Finrax payments:

This is why we think these brokers are the best in this category in 2025:

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- UnitedPips - Operating since 2016 and based in Saint Lucia, UnitedPips is a non-dealing desk broker serving clients in over 137 countries. It specializes in CFD trading across around 80+ assets with high leverage up to 1:1000.

- RedMars - Launched in 2020, Cyprus-based RedMars offers competitive spreads on more than 300 instruments and leverage up to 1:500. Three accounts are available - Standard, Pro and VIP - serving a range of budgets and experience levels, with a fast and fully digital account opening process.

Compare The Best Finrax Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| NinjaTrader | $0 | Forex, Stocks, Options, Commodities, Futures, Crypto | NinjaTrader Desktop, Web & Mobile, eSignal | 1:50 |

| Interactive Brokers | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | 1:50 |

| eToro USA | $100 | Stocks, Options, ETFs, Crypto | eToro Trading Platform & CopyTrader | - |

| FOREX.com | $100 | Forex, Stocks, Futures, Futures Options | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | 1:50 |

| UnitedPips | $10 | CFDs, Forex, Precious Metals, Crypto | UniTrader | 1:1000 |

| RedMars | €250 | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | MT5 | 1:30 (Retail), 1:500 (Pro) |

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Bonus Offer | Invest $100 and get $10 |

|---|---|

| Demo Account | Yes |

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- A free demo account means new users and prospective day traders can try the broker risk-free

Cons

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | Active Trader Program With A 15% Reduction In Costs |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, Stocks, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- Alongside a choice of leading platforms, FOREX.com offers a superb suite of supplementary tools including Trading Central research, SMART Signals pattern scanner, trading signals, and strategy builders.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

UnitedPips

"UnitedPips is ideal for traders seeking leveraged trading opportunities, the security of fixed spreads, and the flexibility to deposit, withdraw, and trade cryptocurrencies - all in one sleek TradingView-powered platform."

Christian Harris, Reviewer

UnitedPips Quick Facts

| Bonus Offer | 40% Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Precious Metals, Crypto |

| Regulator | IFSA |

| Platforms | UniTrader |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD |

Pros

- Although being handed off mid-chat due to shift changes during testing was frustrating, customer support is generally good with quick, helpful responses, and 24/7 support via phone and email for regional teams is a definite advantage.

- UnitedPips’ platform performs well, with an intuitive design that will appeal to beginners, while the TradingView integration delivers powerful charting tools without overwhelming users, making it straightforward to execute trades efficiently.

- UnitedPips offers impressive leverage up to 1:1000 with zero swap fees or commissions, which can enhance potential returns for day traders and swing traders looking to control prominent positions with less capital.

Cons

- UnitedPips lacks comprehensive research, while the educational content for beginner traders is woeful. Compared to brokers like eToro, which offers tutorials, webinars, and advanced courses, UnitedPips offers minimal resources to help new traders understand key concepts.

- Unlike brokers such as IG, UnitedPips is an offshore broker not regulated by any 'green tier' financial authorities, raising concerns for traders seeking assurance and protection under well-established regulatory frameworks.

- UnitedPips' selection of tradable instruments is still minimal, comprising a bare minimum selection of forex, metals and crypto. There are no equities, indices or ETFs, which may be a drawback for experienced traders looking for diverse opportunities.

RedMars

"RedMars is the best fit for experienced day traders familiar with the MetaTrader 5 platform and based in the EU, where the broker is authorized by the CySEC. However, the threadbare education and research tools make it unsuitable for beginners."

Christian Harris, Reviewer

RedMars Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Cryptos |

| Regulator | CySEC, AFM |

| Platforms | MT5 |

| Minimum Deposit | €250 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR |

Pros

- Clients in the EU, in particular, can trade with peace of mind knowing RedMars is authorized by the CySEC with up to €20K compensation available through the ICF in the event of bankruptcy

- RedMars offers one of the best platforms for day trading, MT5, hosting 21 timeframes, dozens of analytical tools, flexible templates and algo trading

- The broker supports a range of flexible payment methods, including wire transfers, credit cards, e-wallets, and notably cryptocurrencies

Cons

- The no-frills trading environment offers little beyond the basics, with no Islamic account, PAMM account or copy trading.

- While RedMars' spreads are within industry averages, they don't offer a significant edge over the cheapest day trading brokers we've personally used, notably IC Markets

- RedMars falls short for newer traders, with little in the way of education, no beginner-friendly platform, a steep minimum deposit, and inadequate support during testing

How Did We Choose The Best Finrax Brokers?

To list the top Finrax brokers, we:

- Searched our library of 500 online brokers, focusing on all those accepting Finrax payments

- Verified that they support Finrax deposits and withdrawals for online trading

- Ranked them by their overall rating, blending 100+ data points with our first-hand observations

What Is Finrax?

Finrax was established by directors Roberto Penchev and Miroslav Marinov. Founded in Bulgaria in 2018, the company moved bases to Estonia to gain a license, opening the subsidiary Finrax Exchange OÜ.

Today, the payment solution is available in 170+ countries, with 1.2m+ transactions processed, and 170M+ in monthly volumes.

For vendors, including online brokers, the company offers:

- International transactions

- Getting invoices paid

- Exchanging payment links

For end users, such as traders, benefits of the solution include:

- Low cost and secure transfers

- Send and receive payments in crypto

- Exchange crypto to fiat money immediately

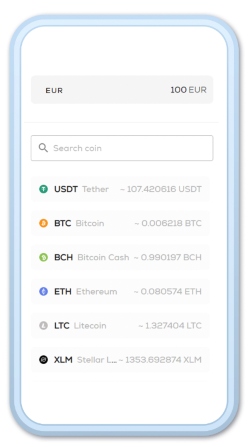

Finrax essentially allows traders to fund their online investing accounts using cryptocurrency. Users deposit via a variety of digital tokens, including Bitcoin, Ethereum, Metal, Civic Price, and AION. In total, 20+ cryptos paired with 30+ fiat currencies are available.

Transaction Times

The top Finrax brokers offer near-instant deposits with the payment solution.

With that said, the time also depends on the amount of money you are depositing and the coin you have selected. In addition, traders will need to ensure they have verified their account prior to requesting a withdrawal. This may require submitting proof of your address and identity.

Fees

Brokers that accept Finrax deposits will be charged blockchain fees for using it to facilitate cryptocurrency payments on their site. Firms will then either absorb those fees or pass them on to the trader. Which one your broker does is at their discretion, and therefore you should check this before opening a trading account to use Finrax.

Importantly though, using cryptocurrency to fund trading accounts can be a low cost option. This is because brokerages are looking to attract traders to their service, and therefore Finrax brokers are likely to keep fees down. Traders may only be asked to pay a small percentage of the transaction value.

Security

The firm implements KYT monitoring, so all deposits and withdrawals are checked to protect traders from bad actors. There are also advanced user access permissions in place which can be customized securely and keep funds safe. The firm is also compliant with EU regulations and for further safety, it offers payouts in stablecoins and Euros.

Using cryptocurrency to fund trading accounts is fairly low-risk since you don’t have to add bank account or credit card information to make a transaction. Many traders choose to use Finrax because of the financial security that it can offer. On the other hand, there is an inherent risk in using Bitcoin, in particular, as storage solutions can be susceptible to hacking.

Ensure the broker you are trading with is also trustworthy and reliable, as not every broker that accepts Finrax is going to be as secure as the payment method itself is. There have been reports of illegitimate offshore Finrax brokers using the payment method, for example. Therefore using a secure payment method is not enough; the broker itself needs to also be reputable.

How To Deposit Using Finrax

Begin by navigating to the deposits page on your broker, which may look different depending on where you are trading. For example, on Infinox this is under ‘Client Area’, but on others, it may be under ‘Payment Methods’ or similar. Then:

- Choose the currency to deposit. You will be redirected to Finrax’s payment portal where you can confirm the crypto to use

- Confirm your payment and check the conversion rate

- Once the transaction is approved, you can scan a QR code or copy and paste the address into your crypto wallet (you have 30 minutes to complete the transaction)

Withdrawals are done similarly and in the coin of your choice. Request your withdrawal in line with your broker’s limits and you should receive your payment within one working day. The funds will be withdrawn to your crypto wallet.

Pros Of Finrax Brokers

- Volatility – Volatility is one of the key risks associated with using cryptocurrencies, such as Bitcoin, partly due to the lack of regulation present in the market. However, Finrax does not expose traders to inherent crypto volatility and offers fixed exchange rates so that you get exactly what you expect.

- Fast Trading Deposits & Withdrawals – Crypto gateways are able to facilitate some of the fastest payments due to the undisrupted flow of funds. This means you don’t have to wait for blockchain confirmations for your funds to be processed.

- Token Support – Traders can deposit funds using various digital tokens, including Basic Attention Token (BAT), Bitcoin Cash (BCH), Civic Price (CVC), Augur (REP), Stellar (XLM), and Zilliqa (ZIL).

Cons Of Finrax Brokers

- Low Accessibility – It is not yet a widely accessible payment method for online trading – there are only a few brokers that accept Finrax deposits. This means that if you do decide you would like to use it, your selection of reliable Finrax brokers to choose from will be slim.

Is Finrax Good For Day Trading?

If you are looking to fund your trading account using cryptocurrencies, then the payment gateway is a good option. Your transactions will be fast if you select brokers that accept Finrax deposits, and you don’t have to add sensitive information like banking details to your brokerage account, which adds a level of security too.

Use our list of the top Finrax brokers to start trading.

FAQ

Can You Use Finrax For Trading?

Yes, brokers that accept Finrax deposits allow investors to use it to fund their trading accounts with cryptocurrencies rather than linking their bank accounts or credit cards.

The company is essentially a gateway for cryptocurrency payments, with multi-currency support inbuilt so that merchants like trading brokers can process payments made in digital tokens.

Is Trading With Finrax Too Volatile?

While funding your trading account using cryptocurrencies can expose you to high volatility, Finrax operates on pre-agreed rates protecting you from uncertain market conditions. This is a notable advantage over other crypto payment solutions.

How Long Do Deposits To Finrax Brokers Take?

Funding your trading account should take no longer than 15 minutes for the money to be deposited in full. Withdrawals should take no longer than 24 hours. However, this will also depend on the timeline of the brokerage in question.

Do Brokers That Accept Finrax Deposits Charge Transfer Fees?

This will depend on the trading broker. However the best Finrax brokers cover any fees so long as the payment value is above a certain value. This makes it a low-cost payment method for traders looking to deposit funds in digital currencies.