FBS Introduces Commission-Free Stock Indices

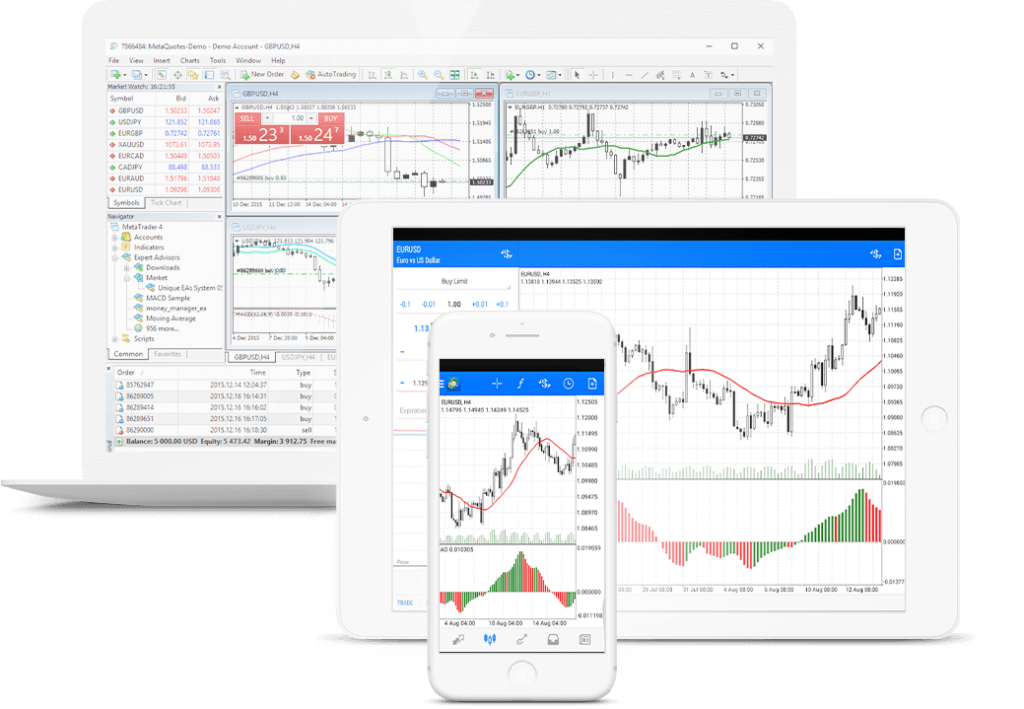

Popular retail broker, FBS, has introduced commission-free indices on its trading platforms. Offering access to global markets in just a few clicks, clients can speculate on US, European, Asian and Australian markets, among others. The broker’s new trading assets are available across the MT4, MT5 and FBS Trader applications.

Commission-Free Indices

FBS clients can trade cash-based indices on desktop and mobile devices. The indices have no expiration date, meaning long-term positions can be left open. Traders can choose when to close positions and don’t have to worry about commissions, making them a low-cost instrument. The latest asset-class is a great option for investors looking to diversify their portfolios on established stock exchanges.

The cash-based indices available at FBS include:

- US30 – Mini-sized DJIA Dow Jones

- JP225 – Japan 225 (Nikkei)

US500 – E-mini S&P 500 - AU200 – Australia 200

- EU50 – Euro Stoxx 50

- HK50 – Hang Seng

- UK100 – FTSE 100

- US100 – Nasdaq

- ES35 – Spain 35

- FR40 – CAC 40

- DE30 – DAX

About FBS

FBS is an established name in the online trading industry. The official partner of FC Barcelona, the brokerage has a long list of global awards under its belt. FBS uses a hybrid STP/ECN model and connects traders to the markets via the MT4 and MT5 platforms, in addition to its bespoke mobile app.

Clients can trade on 28 forex pairs, 4 precious metals, 40 global shares and now a generous selection of cash-based indices. A hefty 1:3000 leverage is available alongside a $10 minimum deposit, three live accounts and a copy trading solution. Customers can deposit and withdraw funds online using Skrill, Neteller, wire transfer and credit cards with low fees.

As a trusted brand, FBS already has millions of active traders but its latest suite of cash-based indices is likely to entice prospective users. See our review below for further details.