FBS Review 2025

Awards

- Best Trading Application Asia 2024

- Best Forex Broker in Africa 2023

- Best Forex Broker South Africa 2023

- Best Trading Account for Beginners 2023

- Best Financial Broker of 2022-2023

Pros

- FBS offers lightning-fast execution speeds from just 10 milliseconds, placing it among the industry leaders for highly active traders like scalpers who demand rapid order processing.

- FBS strikes the balance between robust features and ease of use, with a sign-up process taking <10 minutes, an intuitive app, advanced research through Market Analytics & more recently VIP Analytics, plus immersive education through the FBS Academy and Trader’s Blog.

- 24/7 customer support that performed excellently during testing is available, alongside a $5 minimum deposit, high leverage options, and a huge variety of 200+ funding options, making it ideal for traders with small accounts.

Cons

- Investor protection is only available for clients within the EU, meaning global traders may not be protected if their account goes negative, significantly increasing the risk to your funds.

- Despite enhancing the selection of currency pairs, now providing over 70, FBS still trails industry leaders like BlackBull Markets in its market offering with a particularly narrow selection of commodities and indices.

- There are only two base currencies available - EUR and USD - which isn't practical for minimizing currency conversion fees for many global traders, and is especially striking given the broker’s user base spans over 150 nations.

FBS Review

Regulation & Trust

4.3 / 5FBS is a trusted broker comprised of several regulated entities:

- Intelligent Financial Markets Pty Ltd is regulated by the Australian Securities & Investments Commission (ASIC) for its Australian operations – a ‘green tier’ regulator in line with DayTrading.com’s Regulation & Trust Rating.

- Tradestone Ltd is regulated by the Cyprus Securities & Exchange Commission (CySEC) for its EU operations – a ‘green tier’ regulator in line with DayTrading.com’s Regulation & Trust Rating.

- Intelligent Financial Markets Pty Ltd is regulated by the Belize Financial Services Commission (FSC) for its global operations – a ‘red tier’ regulator in line with DayTrading.com’s Regulation & Trust Rating.

To safeguard client investments, the broker employs strict account segregation. Client funds are held in separate accounts, insulated from the broker’s operational risks, and their safety is ensured under various circumstances.

Additionally, the EU branch offers negative balance protection for retail clients so you cannot lose more than your deposit amount.

An extensive client base of over 27 million traders, operations in more than 150 countries, and over 90 industry awards further underscore its legitimacy.

| FBS | Dukascopy | World Forex | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | ASIC, CySEC, FSC | FINMA, JFSA, FCMC | SVGFSA |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.5 / 5Live Accounts

The account types at FBS provide flexible trading conditions, including a wide range of order volumes (0.01 to 500 lots) and many open positions (up to 500).

However, where FBS stands out is its competitive leverage that varies depending on your region (up to 1:30 in the EU but up to 1:3000 globally which is among the highest we’ve seen).

FBS also excels for beginner traders in the EU, who can open a Cent account, which allows traders to invest with fewer funds, thereby reducing the risk with 1 Cent lot equalling 0,01 of a Standard lot or 1,000 units.

Additionally, FBS offers an Islamic account that aims to adhere to Sharia law, providing a trading environment that respects religious beliefs with no interest charges.

Demo Account

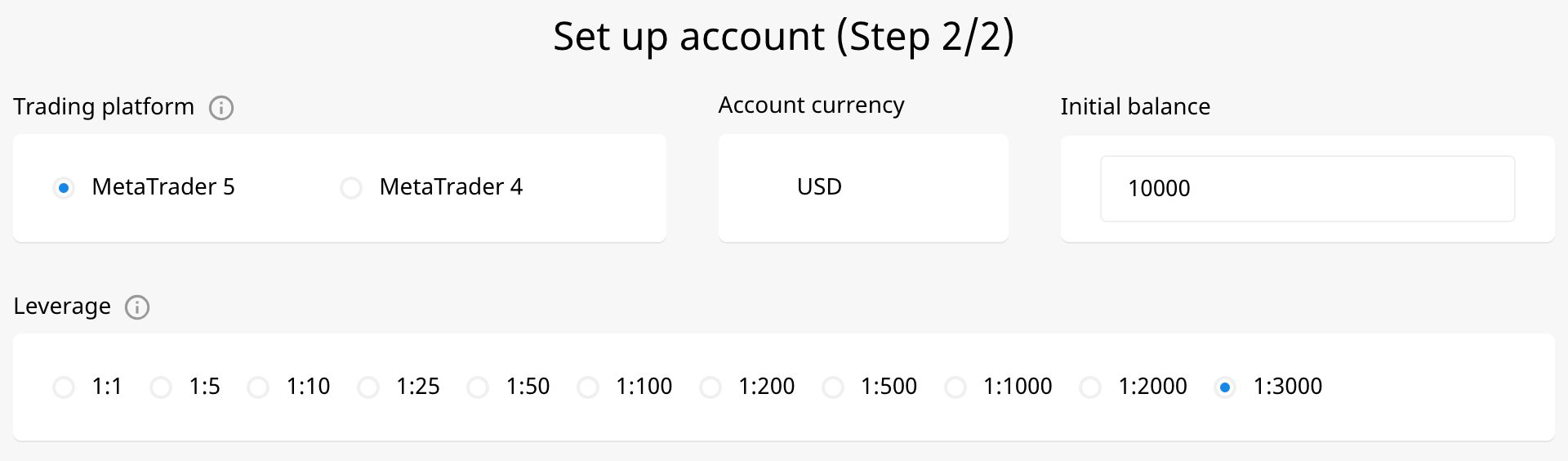

FBS offers a risk-free trading environment to get you started. The broker provides demo accounts accessible through the popular MT4 and MT5 platforms, which I was able to add easily from my client dashboard.

These demo accounts are funded with virtual money, allowing you to practice trading the broker’s 550+ instruments without risking real money. They remain open as long as you use them but will expire after 90 days of non-activity.

Once confident in my trading strategies, I was able to seamlessly transition to a live account from the client dashboard.

Registration

The account opening process on the client dashboard is quick and user-friendly. I signed up for a real MetaTrader account in just a few minutes using Google Sign-In, so I didn’t even have to worry about creating a new password. There is also the traditional option to register using an email address and password combination.

Once registered, which also required submitting identification documents to verify my details and country of residence, I gained access to MetaTrader’s comprehensive trading capabilities, including Expert Advisors (EAs), scalping, hedging, and VPS support for autonomous algorithmic trading.

Currency conversion fees could apply if your account currency differs from the transfer currency. To avoid this, I fund and maintain my trading account balance in USD.

Deposits & Withdrawals

The minimum deposit at FBS typically starts at $5, though this can vary depending on your location. For example, in the EU, it’s €10 for a Cent account and €100 for a Standard account.

FBS offers among the most extensive selection of funding options we’ve seen, with over 200 supported solutions. These include wire transfers, debit cards (Visa, Mastercard), and popular e-wallets like Skrill, Sticpay, and Neteller.

I was also delighted to see crypto funding options, although they were limited to USDT (TRC20 and ERC20).

Deposits are usually instant, except for wire transfers, while withdrawals can take up to 48 hours. FBS doesn’t charge fees for deposits or withdrawals, but your bank might.

FBS has done a great job streamlining the deposit and withdrawal processes, making them quick and easy. I also appreciated that they don’t charge unnecessary fees, which created an extremely positive user experience.

| FBS | Dukascopy | World Forex | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | AstroPay, Bitwallet, Credit Card, Debit Card, Doku Wallet, FasaPay, JCB Card, M-Pesa, Maestro, Mastercard, Neteller, Perfect Money, PIX Payment, Rapid Transfer, Skrill, Sticpay, Visa, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Google Wallet, Mastercard, Perfect Money, Visa, Volet, Wire Transfer |

| Minimum Deposit | $5 | $100 | $1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

2.8 / 5FBS caters predominantly to forex and CFD traders, providing a narrower range of tradable assets compared to many competitors.

You can trade:

- 72 currency pairs (e.g., EUR/USD and USD/JPY)

- 8 precious metals (e.g., gold and silver)

- 11 indices (e.g., S&P 500 and FTSE 100)

- 3 energies (WTI and Brent oil, plus natural gas)

- 470+ stocks (US, UK and German companies)

The section is reasonable but despite improvements to the forex offering, it still excludes popular asset classes like real stocks, real ETFs, options, and cryptocurrencies.

If you prioritize crypto trading, platforms like Eightcap, with over 100 crypto derivatives, might be a better fit. Also, consider CMC Markets (over 300 forex pairs) and XTB (2,100+ total asset classes).

Another notable absence at FBS is a proprietary copy trading service, which could disadvantage those seeking to follow experienced traders or adopt a hands-off investment approach.

| FBS | Dukascopy | World Forex | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Indices, Shares, Commodities | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:30 (EU & Restricted Countries), 1:3000 (Global) | 1:200 | 1:1000 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

4 / 5FBS offers competitive spreads and trading conditions.

Spreads vary depending on the market and region. There are no separate commissions, as all fees are included in the spread.

For instance, the typical EUR/USD spread is 0.9 pips, and for the Dow Jones 30, it’s 5.92 points. The same applies to stock CFDs.

While the broker offers a 0.7% commission for US stocks, overnight rollover fees apply to most positions (though you can avoid these if you’re day trading).

FBS offers the most competitive spreads on FX pairs and stocks, with rates falling in the average range for commodities. However, when trading indices, spreads tend to be higher than industry standards.

| FBS | Dukascopy | World Forex | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.5 | 0.1 | From 0.6 |

| FTSE Spread | 0.0 | 100 | NA |

| Oil Spread | 0.0 | 0.1 | NA |

| Stock Spread | Variable | 0.1 | From 0.03 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

3.5 / 5FBS offers MetaTrader 4 and MetaTrader 5 as its primary platforms.

Built for active traders, these platforms are available on desktop (Windows and Mac), web, and mobile (iOS and Android).

They excel in the charting department with 68 total indicators (30 on MT4, 38 on MT5), 30 total timeframes (9 on MT4, 21 on MT5), and 3 chart types (line, bar and candlestick on both).

The MetaTrader 5 desktop platform closely mirrors its web counterpart in design, functionality, and reporting. However, one key advantage of the desktop version identified during testing is its ability to send mobile push or email notifications, a feature absent on the web platform.

On the downside, FBS’s exclusive use of MetaTrader platforms may restrict day traders accustomed to specific charting tools.

For example, increasingly popular alternatives like TradingView and cTrader offer unique features and functionalities that are not replicated within the MetaTrader ecosystem, such as cTrader’s excellent copy trading functionality.

This limitation hindered my preferred workflow and analytical approach.

| FBS | Dukascopy | World Forex | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | FBS App, MT4, MT5 | JForex, MT4, MT5 | MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS, Android + Web Browser |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

3.8 / 5FBS offers a comprehensive educational and analytical toolkit. The platform provides many resources, including Market and VIP Analytics for global clients and financial news, webinars, and expert analysis available through Forex TV for EU clients.

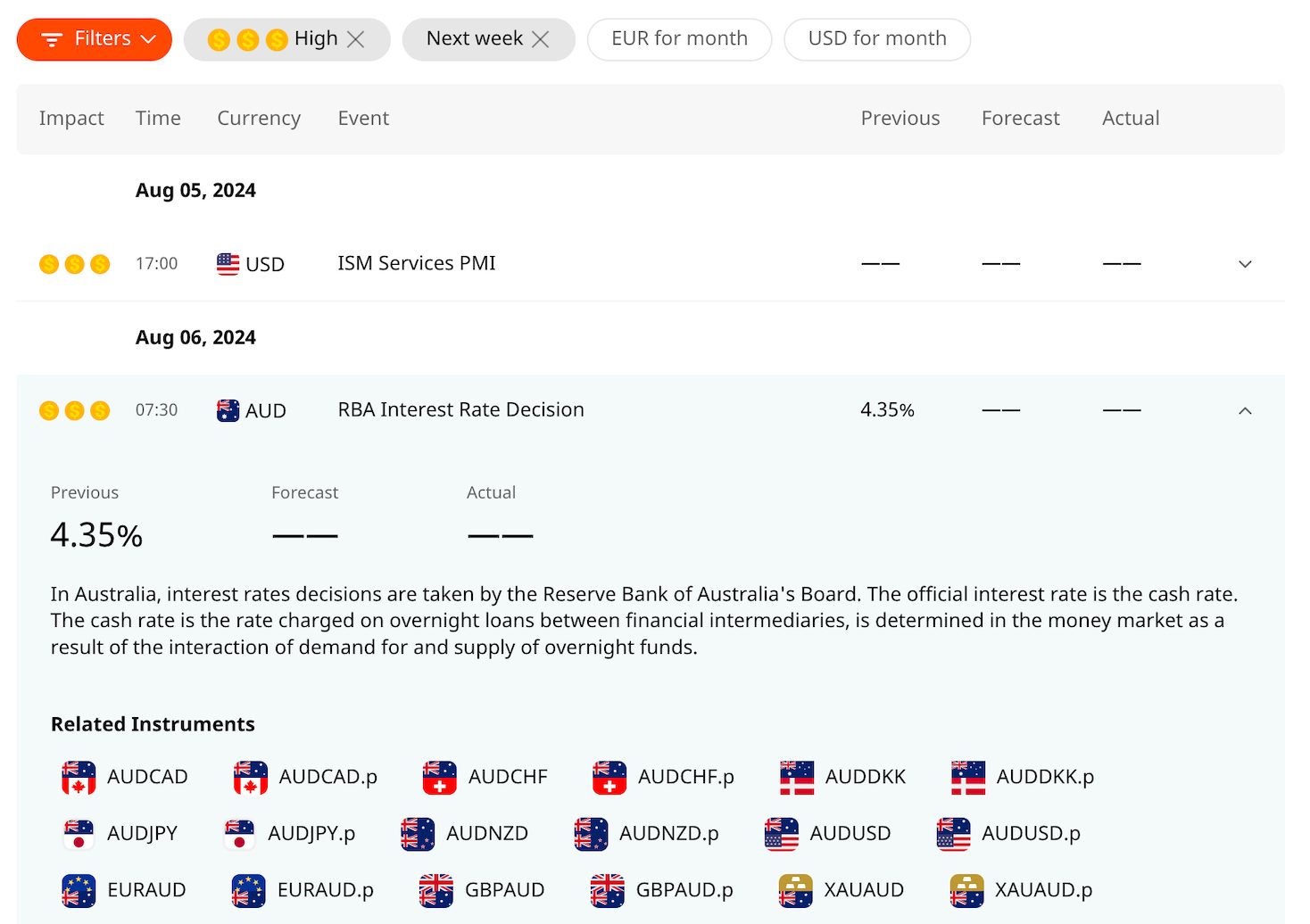

For on-the-go traders, the mobile app includes an economic calendar and trading calculators, and there’s an excellent Telegram channel, which I frequently use to stay informed about market and technical analysis.

MT5 includes a primary and non-filterable economic calendar, but FBS also provides their economic calendar within the dashboard to facilitate browsing.

I also find the stocks calendar helpful, allowing me to view upcoming dividend payments for US and European stocks.

| FBS | Dukascopy | World Forex | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.5 / 5FBS provides a robust educational offering featuring video tutorials, webinars, and written guides on a wide range of trading topics.

Forex trading has a solid foundation that covers core topics such as fundamental analysis, technical analysis, and risk management. The FX market has clearly been a priority for this broker, most recently adding a Forex Intensive course that is free and can take up to five weeks to complete.

Yet while these resources provide a solid foundation for day traders, there’s room for improvement to match industry-leading educational standards available at firms like IG, such as incorporating advanced trading concepts and insights from industry experts.

I would also like to see FBS expand their educational offerings by delving into more complex trading strategies and advanced market analysis techniques. This would benefit both beginners and experienced traders.

| FBS | Dukascopy | World Forex | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

3.8 / 5FBS customer support has proved consistently responsive and helpful during years of testing. Their multiple contact channels, including live chat, email, and phone, make it easy to get in touch.

The extended support hours, available 24/7, is particularly useful for traders in different time zones. Additionally, their comprehensive FAQ section is a valuable resource for finding answers to common questions quickly.

Live chat has always been my first option. In my experience, I have always connected quickly with a knowledgeable customer support representative who provides clear and informative answers to my questions about withdrawals, fees, and available trading instruments.I also like the way FBS includes a link to its Help Center from the client dashboard, so I don’t have to navigate away from the site manually.

| FBS | Dukascopy | World Forex | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With FBS?

FBS is an excellent broker for day trading mainly because they offer tight spreads from 0.7 pips, high leverage up to 1:3000, fast execution speeds from 10 milliseconds, and around-the-clock support, which are essential for this trading style.

Furthermore, the availability of platforms like MetaTrader, along with various account types, allows day traders to choose conditions that suit their strategies.

Our main criticism is that while the firm has a lot to like, the range of tradable instruments could be more extensive, especially in terms of indices and commodities.

Also, global traders are faced with a higher-risk trading environment compared to their EU and Australian counterparts owing to oversight from the ‘red tier’ regulator, the FSC, and extremely high leverage which could lead to thumping losses.

FAQ

Is FBS Legit Or A Scam?

FBS is a legitimate online broker based on our investigations and first-hand experiences using its platform.

It has been operating since 2009 and is regulated by two reputable authorities, which indicates some level of stability. FBS also claims to segregate client funds, which protects them from being used for the company’s operations.

However, as with any broker, it’s essential to exercise caution and start with a small amount of money to test the platform and feel comfortable before committing more significant sums.

Is FBS A Regulated Broker?

FBS has regulation in some regions, but it also has drawbacks, such as limited oversight in other areas.

For instance, they are regulated by the highly regarded ASIC (Australia) and CySEC (Cyprus), which suggests a strong level of oversight. Still, their Belizean regulation (FSC) is considered less stringent than most.

Is FBS Suitable For Beginners?

FBS is suitable for beginners. It offers a user-friendly proprietary trading app (in addition to MT4/5), educational resources, demo accounts, low minimum deposits, and no funding fees, which is ideal for new traders.

Does FBS Offer Low Fees?

FBS generally offers low fees. They don’t charge deposit, withdrawal, or inactivity fees; their spread costs are competitive, especially on forex and stocks.

However, you should compare their fees across all their accounts with other brokers to find the best deal for your specific trading style and volume.

Does FBS Have A Mobile App?

FBS has an excellent mobile app that allows you to trade various instruments directly from your mobile devices. It features real-time quotes, charting tools, and easy account management that performed well during our latest round of testing.

Additionally, FBS supports mobile versions of the MetaTrader 4 and MetaTrader 5 platforms, enabling you to access an advanced range of trading tools and features while on the go.

Top 3 Alternatives to FBS

Compare FBS with the top 3 similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

FBS Comparison Table

| FBS | Dukascopy | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 4.3 | 3.6 | 4.3 | 4 |

| Markets | CFDs, Forex, Indices, Shares, Commodities | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $5 | $100 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, CySEC, FSC | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | – | 10% Equity Bonus | – | 100% Deposit Bonus |

| Education | Yes | Yes | Yes | No |

| Platforms | FBS App, MT4, MT5 | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:30 (EU & Restricted Countries), 1:3000 (Global) | 1:200 | 1:50 | 1:1000 |

| Payment Methods | 18 | 11 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by FBS and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FBS | Dukascopy | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | No |

FBS vs Other Brokers

Compare FBS with any other broker by selecting the other broker below.

The most popular FBS comparisons:

- RoboForex vs FBS

- FXPro vs FBS

- FBS vs Pocket Option

- FBS vs Exness

- Deriv.com vs FBS

- IC Markets vs FBS

- Pepperstone vs FBS

- FBS vs IQ Option

- JustForex vs FBS

Customer Reviews

5 / 5This average customer rating is based on 4 FBS customer reviews submitted by our visitors.

If you have traded with FBS we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of FBS

Article Sources

- FBS Global

- FBS EU

- Tradestone Ltd (FBS EU) - CySEC License

- FBS Pty Ltd - ASIC License

- FBS Markets Inc - FSC License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’m not sure why assets & markets are scored so low, cause I don’t have anthing I can’t trade on here.

FBS broker is one of those that can be chosen by traders with drastically different levels of experiences

Here you can just trade about any strategy you want.

They don’t have any limitations, if its scalping or swing trading, all are welcome here at FBS✌

Trading with FBS is lit! Their platform makes life easy, everything is just smooth. FBS is my go-to, no cap.