EverFX Review 2025

Please see the list of similar brokers or the Best Brokers List for alternatives.

Awards

- Fastest Growing Broker Europe 2019 - Global Brands Awards

- Best New Multi-Asset Broker 2018 - Global Brands Awards

- Best Online CFD Broker Middle East 2018 - International Business Magazine

EverFX Review

EverFX Global is an international broker offering trading in a range of financial markets, including forex and Bitcoin. The brand have however, been caught up in numerous cases involving unethical behaviour towards clients.

We have received a number of complaints regarding EverFX and advise all traders to stay away from the brand. If you are contacted in a way which suggests EverFX have any connection to DayTrading.com, you are being misinformed and should cease communication with the parties involved immediately.

EverFX Company Overview

EverFX is a broker offering flexible funding options and 130 instruments across 6 asset classes. The global brokerage is owned by ICC Intercertus Capital Ltd and regulated by the CySEC, FSA and CIMA.

Headquartered in Limassol, Cyprus, EverFX is also a partner of the CashFX group and a former sponsor of Sevilla FC. The football club have since distanced themselves from the brand however.

The owner and CEO put an emphasis on providing clients with powerful trading tools, market insights, and a 24/5 customer support team.

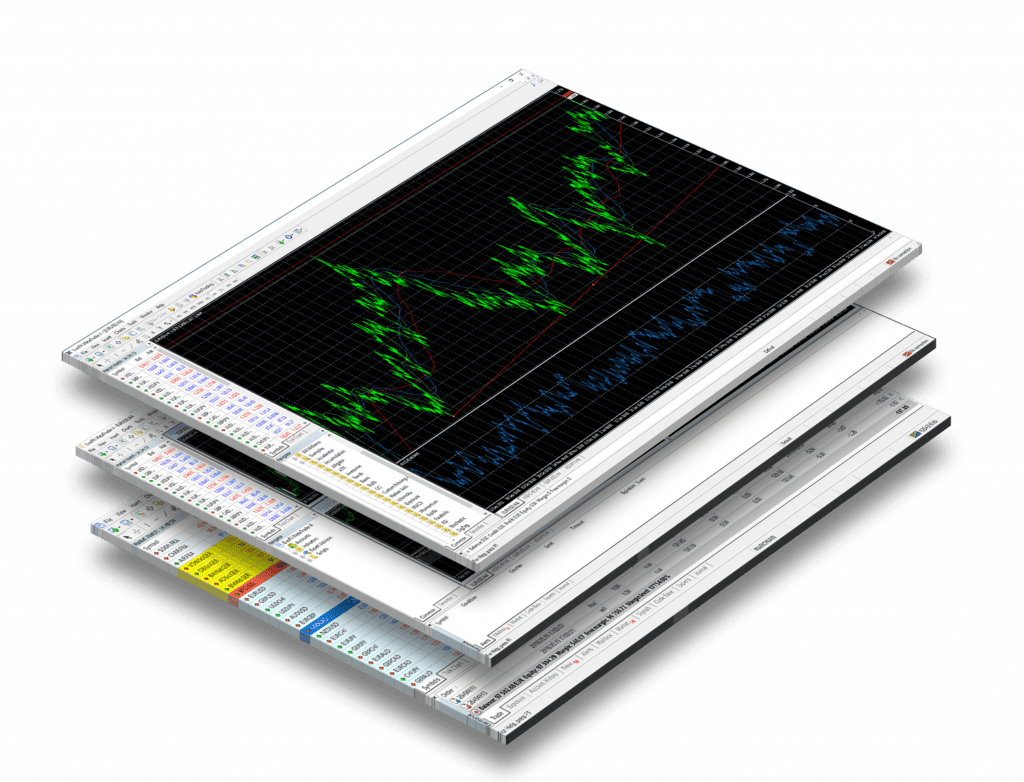

Trading Platforms

EverFX Global offers the popular MetaTrader 4 and MetaTrader 5 platforms, in addition to a web-based alternative.

MetaTrader 4

MT4 is a trusted option among traders, receiving excellent customer reviews. The system is known for its ease of use and reliability. Packed with technical analysis tools and multiple order types, it meets the needs of beginners and experienced traders alike.

Users benefit from:

- Dozens of technical indicators & graphical tools

- 9 timeframes & 3 chart types

- Customisable interface

- Algorithmic trading

- One-click trading

MetaTrader 5

MT5 offers a powerful toolset to clients looking for advanced trading features. The sophisticated software download promises more execution options, analysis tools and customisability than its MT4 predecessor. Users benefit from 21 timeframes, 38 technical indicators, 6 pending order types, a market depth feature, plus a built-in economic calendar and newsfeed.

EverFX also offers a WebTrader platform. This browser-based alternative offers all the popular features of MT4 without the need to download any software.

Markets

At EverFX, clients can trade 130 financial assets:

- Forex – Trade popular forex pairs, including the EURUSD, GBPUSD and USDJPY

- Stocks – From Amazon to Facebook and Apple, shares in household names are available

- Indices – Trade on world-leading indices, such as the Dow Jones, Nikkei 225 and Euro Stoxx 50

- Metals – Gold, Aluminium and Copper offer an interesting alternative to forex and stock trading

- Commodities – Trade futures on commodities such as coffee, cotton and wheat

- Cryptocurrency – Trade 15 of the biggest brands including Bitcoin, Ethereum and Ripple

Spreads & Commission

The spreads offered by EverFX Global are generally competitive.

For Entry accounts, spreads start at 1.5 pips, for Standard account holders, spreads begin at 1.2 pips, for Premium account holders spreads begin at 0.8 pips, and zero-pip spreads are available with the VIP account.

Commission is payable for VIP account holders and it ranges from $2 to $6 per lot depending on your jurisdiction.

There is no information regarding overnight fees or other associated charges. We would recommend that traders contact the support team to avoid any hidden fees.

Leverage

Entry and Standard account holders can utilise leverage up to 1:500, Premium account holders up to 1:400 and VIP accounts, up to 1:200.

High leverage offers clients the chance to earn sizeable returns with little initial investment, however, leverage also carries significant risk.

Mobile Apps

As mobile trading continues to gain momentum, EverFX Global has ensured its services are available on Android and iOS devices.

The mobile app allows for detailed market analysis through charting and graphical tools, as well as fast execution through instant and pending orders. Risk management tools and push notifications can also be set up.

The app is available for download free of charge from the Apple App Store and Google Play Store.

Payment Methods

Payment methods vary depending on your jurisdiction, but include:

- Credit/Debit card – Visa Mastercard

- E-wallets – Skrill, Neteller, Alipay, QIWI

- Online bank transfer

The minimum deposit is $250 with the Entry account but can reach $50,000 with the VIP account. Deposits are processed in real-time and at no charge, however, a 3% fee is charged with credit card and Neteller withdrawals.

There is also a 1% charge with Skrill payments. Withdrawals from EverFX are usually processed in one business day and to make a withdrawal, clients need to fill out a request form.

Demo Account

EverFX does offer a demo simulator but you need a real-money account before you can open one. This is a significant downside as it means clients can’t test the broker’s trading services before opening an account.

There is also limited information on the website regarding the terms and conditions of a demo account. This is one area where EverFX falls down in this review.

Bonuses & Promos

EverFX offers a number of promotional offers. At the time of writing, clients can enjoy free MT4 VPS, a 100% rebate bonus, a 10% interest rate and a gift points promotion which enables clients to accumulate points to spend on smartphones, smartwatches, tablets and gold. For full terms and conditions, head to the EverFX website.

Licensing Status

EverFX is a trading name of ICC Intercertus Capital Ltd and is regulated by the Cyprus Securities and Exchange Commission, the Cayman Islands Monetary Authority (CIMA) and the Seychelles Financial Services Authority (FSA).

Unfortunately there are numerous cases where account managers from EverFX try and ‘on-board’ EverFX clients to other, unregulated, brands. At this point the clients become victims of frauds – though the paper trail shows they willingly moved funds away from EverFX – making it harder to make claims with the regulator.

Check local regulators, such as the FCA, for warnings about untrustworthy brokers.

Additional Features

EverFX offers clients several educational tools and resources suitable for both beginners and veterans:

- EverFX Academy – webinars, courses & tutorials

- Newsroom and market analysis

- Multilingual support

- Economic calendar

Accounts

EverFX offers four options, offering more competitive trading conditions as you increase your initial deposit:

- Entry – $250 minimum deposit, spreads start at 1.5 pips, 1:500 leverage, up to a 30% bonus, intro call an from account manager

- Standard – $2,500 minimum deposit, spreads start at 1.2 pips, 1:500 leverage, up to a 50% deposit, account manager, market research and analytics from Trading Central

- Premium – $10,000 minimum deposit, spreads start at 0.8 pips, 1:400 leverage, account manager, up to a 100% bonus, market research and analytics from Trading Central, a monthly session with senior market analyst

- VIP – $50,000 minimum deposit, zero pip spreads, $2-$6 commission per lot, 1:200 leverage, up to a 100% bonus, personal account manager, market research and analytics from Trading Central, a weekly session with a senior market analyst, exclusive strategies, development of a business plan

Clients can login to their EverFX global account via the ‘sign in’ tab located in the top right of the broker’s homepage.

For more information regarding account structure or how to delete a trading account, clients should contact a member of the customer support team using the details below.

Benefits

- CySEC, FSA and CIMA regulated (This protection is lost if a client moves funds to a new broker on the advice of an EverFX account manager)

- MT4 & MT5 platforms

- Automated trading

Drawbacks

- Implicated in unethical, fraudulent activities

- Account Managers encourage over trading

- US clients not accepted

- Limited demo account

- No signals service

Trading Hours

The www.EverFX.com website is accessible 24/7. However, some markets are subject to specific trading hours. For more information regarding instrument-specific opening times, clients should contact the customer support team.

Customer Support

From the ‘Contact Us’ page, clients can choose between live chat or email support. There is also a callback form. You can contact the 24/5 support team in several languages:

- Email – support@everfxglobal.com

- Live chat – only available to real-money traders

- Telephone number – 00134 576 955 71, +357 25 885000

Note that account managers are notoriously pushy and will hound traders to make further deposits, and/or move funds to unregulated brokers.

Trader Security

EverFX’s global website and platforms are secured using industry-standard encryption protocols. MetaTrader platforms also have a dual-factor authentication option at login.

In compliance with CySEC regulation, client and company funds are separated and all funds are held by banks.

EverFX Verdict

EverFX have been implicated in far too many complaints for us to give them any other rating than 0. The regulation and advanced platforms are ruined by pushy account managers and using unethical methods.

Top 3 Alternatives to EverFX

Compare EverFX with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

EverFX Comparison Table

| EverFX | Interactive Brokers | World Forex | Dukascopy | |

|---|---|---|---|---|

| Rating | 2.5 | 4.3 | 4 | 3.6 |

| Markets | Forex, stocks, commodities, cryptocurrencies | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $250 | $0 | $1 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | CySEC, FSA, CIMA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA | FINMA, JFSA, FCMC |

| Bonus | 100% rebate bonus | – | 100% Deposit Bonus | 10% Equity Bonus |

| Education | No | Yes | No | Yes |

| Platforms | MT4, MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 | JForex, MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:1000 | 1:200 |

| Payment Methods | 11 | 6 | 10 | 11 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by EverFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| EverFX | Interactive Brokers | World Forex | Dukascopy | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | No | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

EverFX vs Other Brokers

Compare EverFX with any other broker by selecting the other broker below.

Customer Reviews

1 / 5This average customer rating is based on 2 EverFX customer reviews submitted by our visitors.

If you have traded with EverFX we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of EverFX

FAQ

Where is EverFX Global regulated?

EverFX is a regulated broker operating under several authorities; CySEC, FSA and CIMA.

Does EverFX offer a swap-free account?

Yes, EverFX does offer a swap-free account. Clients can trade interest-free in compliance with Sharia law.

How much money do I need to trade with EverFX?

The minimum deposit to open an Entry account is $250. As you move up the account tiers, the minimum deposit rises, reaching $50,000 with the VIP account.

Which trading platforms does EverFX offer?

EverFX offers both the MT4 and MT5 trading platforms in addition to a web-based trading platform.

Does EverFX accept US traders?

EverFX does not accept clients from the US, Canada, Belgium or Iran.

Is EverFX Global a scam?

EverFX has been involved in unethical practices and accused of operating scams whereby account managers encourage traders to move their capital to unregulated entities.

We do not recommend trading with EverFX.

Is EverFX a legitimate broker?

EverFX offers a range of tradeable instruments, platforms and account types for novice and experienced traders.

However, we have received complaints regarding its operations, including account managers pressuring investors to move their funds to offshore firms. Clients then lose their money and regulatory safeguards.

This is a major red flag – consider alternatives.

Article Sources

- https://www.bbc.com/news/world-65038949

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Scam see documentary. Don’t fall for get rich quick schemes. Hard to get scammed if you’re not greedy.

Yes EverFX was mentioned in a BBC news report on the subject of trading scams. Never allow yourself to be talked into trading (especially if someone else offers to do it for you) or depositing large sums of money.

Awful scam broker. Don’t use them. Check all the press about them being dodgy. Stick to trusted forex brokers.