Trading EUR/JPY

The EUR/JPY currency pair is a highly liquid and often volatile duo, making it popular with short-term traders. In fact, the Euro and Japanese Yen are the second and third most traded currency pairs globally, according to the Bank of International Settlements.

This guide will help you understand the EUR/JPY and how to start day trading this forex combination.

Quick Introduction

- Trading the EUR/JPY currency pair involves buying or selling the Euro against the Japanese Yen.

- The EUR/JPY is the seventh most traded forex pair according to Saxo, which adds its “regular volatility [attracts] day traders”.

- The EUR/JPY is notably choppy following economic news like interest rate decisions from the Bank of Japan and European Central Bank.

- The optimal time to day trade EUR/JPY is from 07:00 to 10:00 UTC, during the European and Asian session overlap, when liquidity and volatility peak.

Best EUR/JPY Brokers

These 6 brokers offer excellent platforms and pricing for day trading the EUR/JPY:

Here is a short summary of why we think each broker belongs in this top list:

- XM - XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC and CySEC and offers a comprehensive MetaTrader experience.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- Deriv - Established in 1999, Deriv is an innovative broker now serving over 2.5 million global clients. The firm offers CFDs, multipliers and more recently accumulators, alongside its proprietary derived products which can't be found elsewhere, providing flexible short-term trading opportunities.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

- eToro - eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Crypto Trading is offered via eToro USA LLC; Investments are subject to market risk, including the possible loss of principal. CFDs are not available in the US Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail accounts lose money.

- BlackBull - BlackBull is a New Zealand-based CFD broker providing diverse trading opportunities on over 26,000 instruments. After undergoing a rebrand in 2023, it now sports a modern look and feel complete with professional-grade trading tools and ultra-fast execution speeds averaging 20ms.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | ASIC, CySEC, DFSA, IFSC |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

| Currency Pairs | EUR/AUD, EUR/JPY, EUR/SGD, EUR/TRY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY, NZD/SGD, USD/HKD, USD/SGD |

Pros

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of <2 minutes and now a growing Telegram channel.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with the weak IFSC regulator and UK clients are no longer accepted, reducing its market reach.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Bonus Offer | $30 No Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

| Currency Pairs | EUR/AUD, EUR/JPY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY |

Pros

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

Cons

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

Deriv

"Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours."

Christian Harris, Reviewer

Deriv Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs |

| Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

| Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP |

| Currency Pairs | EUR/AUD, EUR/JPY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY |

Pros

- Although response times trail alternatives in our personal experience, Deriv offers 24/7 support and is one of the few brokers to offer WhatsApp assistance.

- Deriv stands out with its innovative products, from multipliers and derived indices to its addition of accumulator options, providing exclusive short-term trading opportunities.

- Deriv revamped its app in 2025, now sporting a slicker interface alongside improved position management and streamlined contract details for smarter mobile trading, earning it DayTrading.com's 'Best Trading App' award.

Cons

- While the Academy launched in 2021 is a step in the right direction, there is limited education on advanced trading topics for seasoned traders and no live webinars to upskill new traders.

- Apart from the MFSA in the EU, Deriv lacks top-tier regulatory credentials, reducing the level of safeguards like access to investor compensation.

- Leverage up to 1:1000 will appeal to traders with a large risk appetite but frustratingly there is no ability to flex the leverage in the account area.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

| Currency Pairs | USD/CNH, EUR/AUD, EUR/JPY, EUR/SGD, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/HUF, GBP/JPY, GBP/ZAR, NZD/SGD, USD/HKD, USD/INR, USD/SGD, USD/THB |

Pros

- Fusion Markets continues to impress with its pricing that provides tight spreads with below-average commissions that will appeal to active day traders.

- The market analysis features, Market Buzz and Analyst Views, are great tools for discovering opportunities and conveniently integrated into the client dashboard.

- Average execution speeds of around 37 milliseconds are noticeably faster than many rivals and can help day traders secure optimal prices in fast-moving markets.

Cons

- Traders outside of Australia must sign up with weakly regulated global entities with limited safeguards and no negative balance protection.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

- Fusion Market trails alternatives, notably eToro and IG, in the education department with limited guides and live video sessions to upskill new traders.

eToro

"eToro's social trading platform leads the pack with a terrific user experience and active community chat that can help beginners find opportunities. There are also competitive fees on thousands of CFDs and real stocks, plus excellent rewards for experienced strategy providers."

Christian Harris, Reviewer

eToro Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Options, Crypto |

| Regulator | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF |

| Platforms | eToro Web, CopyTrader, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Leverage | 1:30 EU |

| Account Currencies | USD, EUR, GBP |

| Currency Pairs | EUR/AUD, EUR/JPY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/HUF, GBP/JPY, USD/HKD, USD/SGD |

Pros

- eToro has bolstered its investment offering, most recently with new crypto assets, now offering over 90 digital currencies.

- eToro elevated the social trading experience in 2025, integrating insights from Stocktwits 10M+ users to help gauge market sentiment.

- eToro has finally introduced EUR and GBP accounts, cutting conversion fees and providing a trading experience more tailored to local needs.

Cons

- There are no guaranteed stop loss orders which would be a useful risk management feature for beginners.

- There is a $30 minimum withdrawal amount and a $5 fee, which will affect novices with low capital.

- There are limited contact methods aside from the in-platform live chat.

BlackBull

"After improving its trading infrastructure with Equinix servers in New York, London, and Tokyo, reducing latency for traders, BlackBull is an obvious choice if you want to day trade stock CFDs with ECN pricing."

Christian Harris, Reviewer

BlackBull Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Stocks, Indices, Commodities, Futures, Crypto |

| Regulator | FMA, FSA |

| Platforms | BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, SGD |

| Currency Pairs | EUR/AUD, EUR/JPY, EUR/SGD, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY, GBP/ZAR, NZD/SGD, USD/SGD |

Pros

- BlackBull offers every ingredient for day traders; fast execution speeds of <100ms, leverage up to 1:500, and tight spreads from 0.0 pips.

- BlackBulls’s research is superb, especially the daily ‘Trading Opportunities’ articles that break down complex market movements into easy-to-understand insights, making it simpler to capitalize on emerging trends.

- With three ECN-powered accounts (Standard, Prime, and Institutional), BlackBull accommodates beginners, experienced traders, and professionals, offering flexibility based on trading needs and capital.

Cons

- Although the Education Hub now features improvements like webinars and tutorials, the courses we’ve explored need more focus on explaining the wider economic factors influencing prices.

- Despite a growing selection of 26,000+ assets, including additions to its Asia Pacific indices, they are mainly stocks with an average selection of currency pairs and indices.

- BlackBull lacks a proprietary platform, relying on MetaTrader, cTrader and TradingView. While these are excellent, other brokers' exclusive platforms, notably eToro’s, often have unique features for beginner traders.

Understanding The EUR/JPY

This currency pairing illustrates the exchange rate between two of the world’s biggest currencies: the Yen, which is the official currency of Japan; and the Euro, which is shared by 20 European countries including regional economic heavyweights Germany, France and Italy.

This crossover is not considered one of the world’s major currency pairings. Such assets typically involve the US Dollar paired up against the Euro (EUR/USD), the Yen (USD/JPY) and the British Pound (GBP/USD).

The EUR/JPY is known as a ‘cross’ currency pair, which is the broad term for combinations that don’t involve the North American currency. It is also broadly categorized as a ‘minor’ forex pair, unlike those mentioned above.

Having said that, the significance of the eurozone and Japanese economies to the global economy means it sits on the very edge of this elite group.

The EUR/JPY is informally known by traders as the ‘Yuppy’!

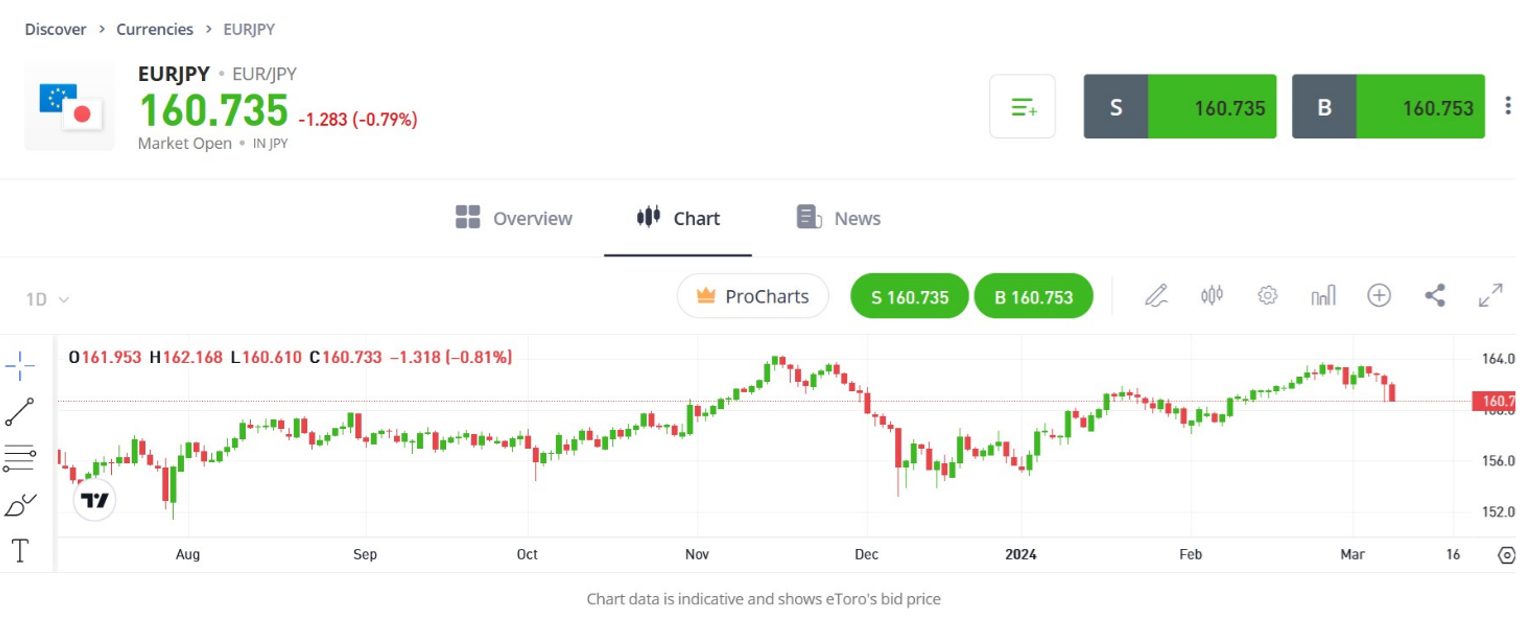

Live Chart

Why Trade The EUR/JPY?

With hundreds of currency pairings to speculate on, why choose the Japanese and eurozone counters?

- Deep Liquidity. The pairing is traded across the globe, which makes it easy to find buyers and sellers at all times of the day. This allows short-term traders to enter and exit positions quickly and easily. High liquidity also means that bid and ask spreads tend to be quite narrow, so the EUR/JPY can help day traders keep costs down.

- Frequent Volatility. The EUR/JPY is famous for having higher levels of volatility than most other currency pairs. As a consequence, it provides short-term traders with regular opportunities to profit from steep price fluctuations. That said, rapid and severe price changes can also see traders rack up large losses in a short space of time. For this reason, new traders should be especially careful and use risk management tools like stop loss instructions and take profit orders.

- Multiple Ways To Trade. Speculators can try to profit from the EUR/JPY pair using a wide variety of different instruments. They can trade the forex combination itself by buying or selling the Euro itself against the Asian counter. Traders can also use derivatives like contracts for difference (CFDs), futures and options, which allow them to bet on price changes without owning the counters themselves. Or they can choose to invest in an exchange-traded fund (ETF).

What Moves The EUR/JPY?

The EUR/JPY pair can be influenced by a wide range of factors, notably:

- Interest rate decisions and commentary from the Bank of Japan (BoJ) and European Central Bank (ECB). Japan’s quantitative easing measures in recent years have been the most aggressive in the world – even bigger than the US, despite its economy being half the size.

- Gross domestic product (GDP), employment, inflation and purchasing managers’ index (PMI) numbers from both regions. PMIs are released each month and report on the strength of each sector. Inflation must be kept below or close to 2% by the ECB. Movement in this could cause the bank to take action.

- Trade data, as Japan is famous for being a major goods exporter. Equally, in recent years, Japan has been the fourth-largest importer of crude oil and the second-biggest importer of natural gas. The relationship between the Yen and energy pricing, therefore, can impact the EUR/JPY.

- Information on the Bank of Japan’s bond-buying programme. The Bank is a major purchaser of government bonds, and in 2023 it owned more than 50% of these instruments.

- Natural disasters. Earthquakes and tsunamis are common phenomena in Japan that have serious economic consequences on its economy.

- Political events like election results, news on trade deals, and government stimulus initiatives. Political disagreements as to the future of the Euro may also cause it to weaken vs the Yen.

On top of this, the pairing is also highly sensitive to factors outside Japan and the eurozone. It can whipsaw wildly according to economic news from other major economies like the US and China. As a cross-currency pair, it is also influenced by movements in the US dollar.

All this means that traders need to have a good grasp of fundamental analysis to succeed, though this is not the only requirement. As with short-term trading of any forex pairing, EUR/JPY traders also need to be up to speed when it comes to technical analysis.

Studying charts reveals information on price and volume trends that investors can use to identify trading opportunities. Identifying support and resistance levels, and utilizing technical indicators (like the relative strength index (RSI) and Bollinger Bands), are essential tools in the successful trader’s toolbox.

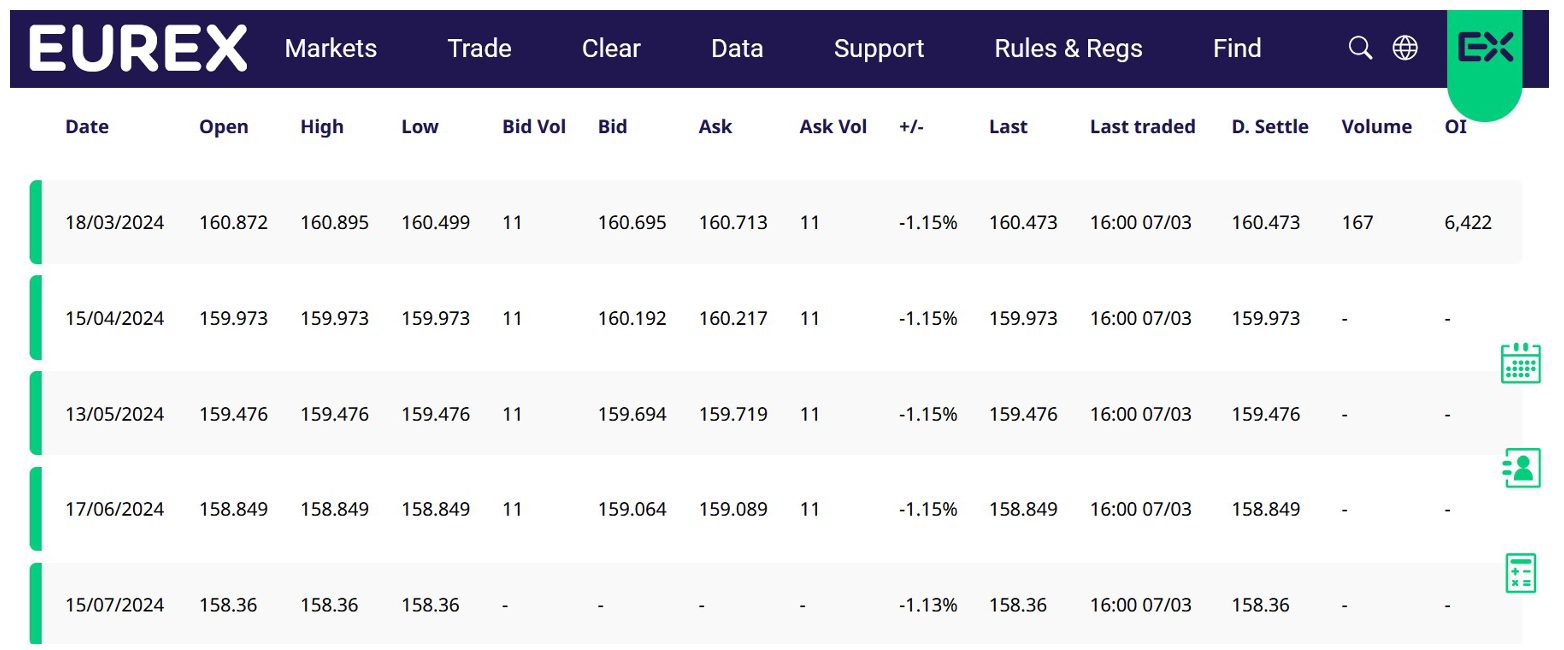

Price History

Trade

The EUR/JPY relationship blossomed to some extent, by the increased trading activity between Japan and the EU. Consequently, Japan is the fourth largest global economy and much of its trade is driven by exports to the EU.

Having said that, between 2005 and 2015, political disagreements and tariffs saw the EU consistently run a negative trade balance with Japan. In fact, from 2005 to 2011, the trading relationship generated an average annual negative balance of £28,741 million to the EU.

However, to try and tackle this one-sided trade balance, both the EU and Japan have looked to promote the following measures:

- Pursuit of a comprehensive Free Trade Agreement (FTA)

- Development of the EU-Japan Business Roundtable (BRT)

- Participation in the Asia-Europe Meeting (ASEM)

Financial Crisis

The EUR/JPY relationship has been turbulent since the introduction of the Euro in 1999. In fact, one of the most influential events was the 2008 global financial crisis. As a result, the EUR/JPY fell from 169.78 in July 2008 to a low of 115.00 in February 2009.

The EUR/JPY downtrend resulted in a 30% appreciation of the JPY. It illustrates why traders and investors have traditionally seen the Japanese Yen as a safe haven currency. It also appears that Japan’s economy is relatively isolated from global economic crises, attracting investment during these times.

In these periods both domestic and international investors choose to retain their capital in the Yen, resulting in the Yen strengthening against other currencies, such as the Euro.

‘Abenomics’

EUR/JPY rates and prices are also affected by significant political decisions. For example, in 2012, Japanese Prime Minister Shinzo Abe introduced his “Abenomics” plan to bolster the economy.

The result – long-lasting devaluation of the Yen against the Euro. Hence in the wake of his election, investors instead chose to hold Euros over Yen. As a result, the EUR/JPY rose from 98.75 on July 1, 2012, to a high of 118.82 on January 1, 2013.

Switched-on day traders will keep abreast of such political trends and announcements to allow them to make more accurate predictions and forecasts on price fluctuations.

A Trade In Action

Let’s put all this together and look at trading this currency pair in real life.

I’m looking to trade the EUR/JPY around the time of an interest rate decision by the ECB. I expect that the central bank will decide to raise its benchmark rate, a development that could push the value of the Euro higher from its current level of 160.00.

At these levels, one Euro is equivalent to 160 Japanese Yen.

I wish to invest €500 in this trade and select a lot size of 100,000.

The Trade

To profit from this, I need to enter a long position at the current price of 160.00. This involves me buying the base currency (the Euro), and simultaneously selling the quote currency (the Yen).

Along with executing this trade, I place a stop-loss order at 159.00 to manage risk and limit losses if the euro instead falls.

I also decide to execute a take profit instruction at 163.00, a move that will lock in my gains if the forex pairing reaches this level.

The Outcome

As I expected, the ECB announces an interest rate hike, causing the Euro to rise. Within a few hours, the single currency has increased to my take-profit level of 163.00, giving me a 300-pip gain.

But what is the monetary profit I’ve made from this trade? It can be worked out with the following calculation:

- Lot Size: 100,000

- Change In Exchange Rate: 163.00 – 160.00 = 3.00 (or 300 pips)

- Pip Value: (0.01 / 160.00) * 100,000 = €6.25

- Profit: €6.25 * 300 pips = €1,875

This simplified calculation does not consider the impact of bid and ask spreads on my eventual profit.

How To Start Trading The EUR/JPY

It takes minutes to start trading the Euro and Yen combination. It requires three simple steps:

Choose A Forex Broker

The first thing to do is check that the forex broker in question is regulated. There is a long list of unauthorized operators out there that could put your funds at risk.

Next, see which financial instruments the company will allow you to trade. The popularity of trading the EUR/JPY cross means that many brokers will let you deal in the currency pairing itself as well as in related instruments like CFDs.

Investors who wish to trade forex with leverage need to remember that the amount of borrowed money can differ substantially from broker to broker and between regulatory jurisdictions. That said, in Europe, leverage is often available up to 1:30 on the EUR/JPY for retail investors.

With both of these essentials ticked off, look at the fees the company charges, the quality of its trading platform, and any additional resources or sophisticated trading tools that it offers, for example, economic calendars that highlight upcoming announcements from the ECB or BoJ.

If you’re happy at this stage, open an account and get ready to trade by depositing funds. This can usually be done quickly and easily via a bank transfer or through a debit card transaction.

Devise A Strategy

Don’t jump straight in and start placing buy and sell orders, of course. It’s essential to come up with a detailed trading strategy first, setting up clear risk management rules and establishing an acceptable risk-to-reward ratio.

You’ll also need to carry out fundamental and technical analysis so you can make an informed decision as to which way the currency pair may move. It can also be a good idea to start with a demo account to ensure you are well-prepared before putting cash on the line.

Place A Trade

When starting out, remember to deal only in small amounts and to never trade with funds you can’t afford to lose.

It’s also important to maintain a close eye on market movements and to keep up to speed with fundamental and technical developments. Forex prices can move sharply, especially in the EUR/JPY, and you may need to act quickly to exploit a profit opportunity or limit a loss.

It can also be a good idea to keep a journal. This can provide valuable data that helps you evaluate the effectiveness of your short-term trading strategy, and pinpoint where you need to make adjustments.

Bottom Line

The EUR/JPY currency pair offers the dual qualities of frequent volatility and deep liquidity. Yet to profit in this competitive marketplace, you will need to keep abreast of developments primarily in the eurozone and Japan and further afield.

Use our ranking of the best EUR/JPY brokers to start trading.

Article Sources

- Forex Trading: The Basics Explained in Simple Terms – Jim Brown

- The Most Commonly Traded Forex Pairs – Saxo Bank

- Foreign Exchange Turnover - Bank of International Settlements

- European Central Bank (ECB)

- Bank of Japan (BoJ)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com