Best Day Trading Platforms and Brokers in Europe 2025

The best day trading brokers in Europe have superior charting platforms, fast execution, excellent pricing, and are normally authorized by at least one of the 25+ regulators adhering to the directives established by the European Securities and Markets Authority (ESMA).

Many also offer EUR accounts for convenient deposits and provide access to local stock markets, such as the Euronext, and currency pairs like the EUR/USD.

Discover the best brokers for day trading in Europe. All our recommended platforms have been tested by our European experts.

Top 6 Platforms For Day Trading In Europe

After thoroughly testing hundreds of brokers, these 6 emerge as the best platforms for day traders:

This is why we think these brokers are the best in this category in 2025:

- Plus500 US - Plus500 is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- UnitedPips - Operating since 2016 and based in Saint Lucia, UnitedPips is a non-dealing desk broker serving clients in over 137 countries. It specializes in CFD trading across around 80+ assets with high leverage up to 1:1000.

Best Day Trading Platforms and Brokers in Europe 2025 Comparison

| Broker | Regulated in Europe | EUR Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| Plus500 US | - | - | $100 | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | WebTrader, App | - |

| NinjaTrader | - | - | $0 | Forex, Stocks, Options, Commodities, Futures, Crypto | NinjaTrader Desktop, Web & Mobile, eSignal | 1:50 |

| Interactive Brokers | - | ✔ | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | 1:50 |

| eToro USA | - | - | $100 | Stocks, Options, ETFs, Crypto | eToro Trading Platform & CopyTrader | - |

| FOREX.com | - | ✔ | $100 | Forex, Stocks, Futures, Futures Options | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | 1:50 |

| UnitedPips | - | - | $10 | CFDs, Forex, Precious Metals, Crypto | UniTrader | 1:1000 |

Plus500 US

"Plus500 US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500 US Quick Facts

| Bonus Offer | Welcome Deposit Bonus up to $200 |

|---|---|

| Demo Account | Yes |

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | 0.0 Lots |

| Account Currencies | USD |

Pros

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls, instilling a sense of trust

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- Plus500 US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

Cons

- Although support response times were fast during tests, there is no telephone assistance

- Despite competitive pricing, Plus500 US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- While Plus500 US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- The premium platform tools come with an extra charge

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Bonus Offer | Invest $100 and get $10 |

|---|---|

| Demo Account | Yes |

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

Cons

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | Active Trader Program With A 15% Reduction In Costs |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, Stocks, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- Alongside a choice of leading platforms, FOREX.com offers a superb suite of supplementary tools including Trading Central research, SMART Signals pattern scanner, trading signals, and strategy builders.

Cons

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

UnitedPips

"UnitedPips is ideal for traders seeking leveraged trading opportunities, the security of fixed spreads, and the flexibility to deposit, withdraw, and trade cryptocurrencies - all in one sleek TradingView-powered platform."

Christian Harris, Reviewer

UnitedPips Quick Facts

| Bonus Offer | 40% Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Precious Metals, Crypto |

| Regulator | IFSA |

| Platforms | UniTrader |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD |

Pros

- UnitedPips’ platform performs well, with an intuitive design that will appeal to beginners, while the TradingView integration delivers powerful charting tools without overwhelming users, making it straightforward to execute trades efficiently.

- UnitedPips offers impressive leverage up to 1:1000 with zero swap fees or commissions, which can enhance potential returns for day traders and swing traders looking to control prominent positions with less capital.

- Although being handed off mid-chat due to shift changes during testing was frustrating, customer support is generally good with quick, helpful responses, and 24/7 support via phone and email for regional teams is a definite advantage.

Cons

- UnitedPips lacks comprehensive research, while the educational content for beginner traders is woeful. Compared to brokers like eToro, which offers tutorials, webinars, and advanced courses, UnitedPips offers minimal resources to help new traders understand key concepts.

- Unlike brokers such as IG, UnitedPips is an offshore broker not regulated by any 'green tier' financial authorities, raising concerns for traders seeking assurance and protection under well-established regulatory frameworks.

- UnitedPips' selection of tradable instruments is still minimal, comprising a bare minimum selection of forex, metals and crypto. There are no equities, indices or ETFs, which may be a drawback for experienced traders looking for diverse opportunities.

Choosing A Day Trading Broker In Europe

Based on our extensive experience in the day trading industry, there are several factors to consider:

Trust

Choose a trusted day trading broker to keep your funds safe.

Online trading scams are rife in Europe, with fraudsters adopting increasingly aggressive and brazen methods to target victims. In recent years, scammers have even impersonated representatives of the Cyprus Securities & Exchange Commission (CySEC), promising compensation to traders in return for fees.

This is why we verify the regulatory status of brokers, checking whether they are licensed by any of the 25+ reputable regulators that comply with the Markets in Financial Instruments Directive (MiFID), and its update MiFID II, set by the European Securities and Markets Authority (ESMA), designed to safeguard retail traders.

- IC Markets emerges as one of the most trusted brokers in Europe, with authorization from the CySEC, over 17 years in the industry, and multiple awards. We’ve also traded at IC Markets using real money and never encountered withdrawal issues.

Investment Offering

Choose a day trading broker with a wide range of trading opportunities.

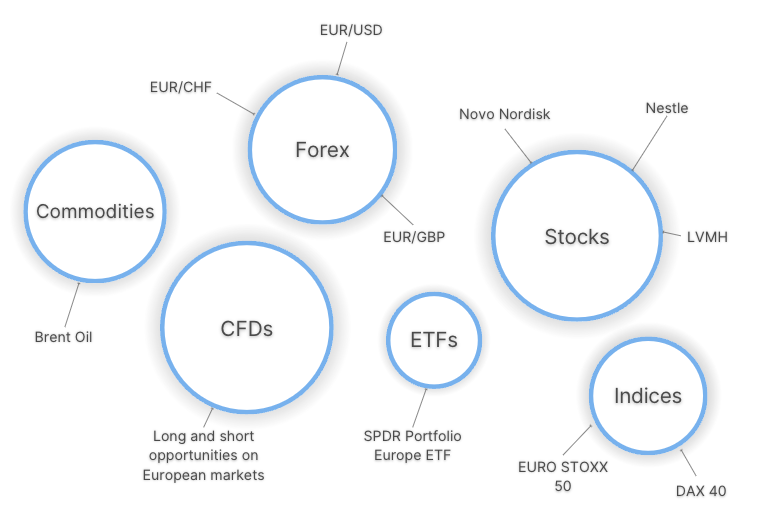

For many European traders, it will be important to have access to local financial markets, providing opportunities to speculate on regional events and assets.

That’s why we look for access to stock markets like Euronext, the largest stock exchange in the region which connects seven major economies, including France, Italy and the Netherlands.

We also look for currency pairs involving the Euro, such as the EUR/USD, EUR/GBP and EUR/AUD, plus popular commodities, including those listed on the Intercontinental Exchange (ICE), Europe’s most recognized commodity marketplace.

In addition, we consider whether brokers offer contracts for difference (CFDs), a popular financial product with short-term traders that allows you to go long or short without taking ownership of the underlying asset, such as shares in LVMH.

- AvaTrade excels here, with a wide range of trading opportunities spanning CFDs, stocks, forex, commodities, indices, bonds, cryptos and ETFs, including European treasuries and indices like the DAX, CAC and IBEX.

Trading Fees

Choose a broker with low trading fees.

This is especially important for day traders because frequent trading amplifies the impact of fees on overall profitability.

That’s why we record and evaluate the fees you can expect to incur making short-term trades, including spreads on popular markets in Europe like the EUR/USD and EUR/GBP, as well as any inactivity fees that can penalize casual traders.

This allows us to assign an overall ‘Fees & Costs’ score that helps us pinpoint the cheapest brokers for day traders.

- Pepperstone maintains its position as one of the best day trading brokers with excellent pricing, especially if you opt for the Razor account with spreads from 0.0 pips and qualify for rebates through the Active Trader program. There are also zero deposit fees, withdrawal charges or inactivity penalties.

Order Execution

Choose a day trading broker with fast and reliable order execution.

If you’re day trading in volatile markets, such as commodities, being able to enter and exit the market at the desired price can be the difference between profit and loss.

We consider execution speeds of <100 milliseconds fast, helping to prevent slippage – the difference between the expected price and the execution price.

However, we also consider execution quality, encompassing factors like price and probability of execution, which together can help ensure you secure optimal trades.

- Deriv continues to deliver favorable conditions for active day traders, with execution speeds averaging 50 milliseconds plus superior, uninterrupted price feeds.

Leverage Trading

Choose a day trading broker with transparent leverage and margin conditions.

Leverage trading allows you to open larger positions than you would otherwise be able to with your capital. Essentially, for a small outlay, known as margin, you can multiply your buying power and profits (or losses).

The ESMA introduced industry-wide limits on leverage offered to retail traders in 2018. The maximum available through EU-regulated entities is 1:30 for major currency pairs, though lower limits are imposed on more volatile assets, such as commodities (1:10) and cryptocurrencies (1:2).

While 1:30 is a safer limit than the very high leverage available at offshore brokers, the risk of heavy losses is still present.I recommend that beginners, in particular, approach leverage trading with caution and take a proactive approach to risk management.

We check whether leverage trading is available as part of our exhaustive review process. We also make sure brokers are transparent about margin requirements, including when they will close out your positions if you fail to meet a margin call (a demand by your broker to deposit additional funds to cover potential losses).

- IG stands out as an excellent option for trading with leverage, providing a full breakdown of the margin required to open a position, along with the leverage equivalent for each tradable asset. It also complies with ESMA’s limits on providing leverage up to 1:30 for traders in Europe.

Charting Platforms

Choose a day trading broker with a user-friendly and powerful charting platform.

Short-term traders typically rely on technical analysis to identify and capitalize on market opportunities, more so than longer-term investors who often use fundamental analysis. As a result, it’s important to find an excellent charting platform.

That’s why we personally test platforms where possible to assess their suitability for day traders, weighing the design and ease of use with the suite of technical indicators, drawing tools, chart types and other features.

Our analysis of hundreds of brokers shows the most widely available third-party platforms are MetaTrader 4, MetaTrader 5, cTrader and TradingView. These all offer excellent charting packages for intermediate and advanced traders.

However, our tests also show that the proprietary software offered by some brokers can provide a more user-friendly toolkit for newer traders, often featuring a more intuitive workspace.

- Forex.com continues to offer a fantastic selection of charting tools, from MT4, MT5 and TradingView to insights from AutoChartist and TradingCentral, which can help day traders discover opportunities.

Methodology

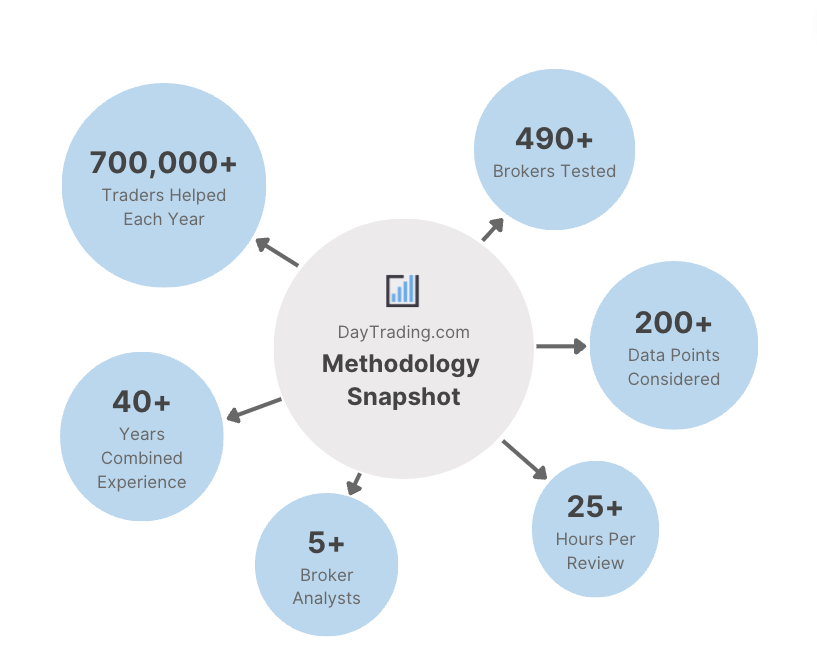

We used our extensive database of day trading brokers, selecting those accepting European traders and ranked them by their overall rating from our reviews, which focus on several factors, including:

- Whether they are trusted and regulated by a credible authority, such as the CySEC.

- Whether they provide access to a good range of tradable assets, such as European stocks.

- Whether they offer low fees for day traders, such as tight spreads on EUR/USD.

- Whether they support user-friendly and powerful charting platforms, such as MT4.

- Whether they offer fast and reliable order execution.

- Whether they are transparent about leverage trading.

FAQ

How Much Money Do I Need To Start Day Trading In Europe?

The vast majority of platforms offer an accessible account minimum of <€250. However, some stand out with no minimum deposit, notably Pepperstone, OANDA and City Index, making them attractive for day traders on a budget.

Who Regulates Day Trading Platforms In Europe?

Over 25 European regulators should adhere to the Markets in Financial Instruments Directive (MiFID), established by the European Securities Markets Authority (ESMA), to offer products suitably for day trading, including forex and CFDs.

The Cyprus Securities & Exchange (CySEC) oversees the largest number of brokers accepting day traders in Europe.

Which Is The Best Broker For Day Trading In Europe?

Use our list of the best day trading platforms and brokers in Europe to find the right provider for your needs. Most of our top-rated platforms are regulated in Europe, support accounts in EUR, and offer access to regional financial markets.

Article Sources

- European Securities and Markets Authority (ESMA)

- Markets in Financial Instruments Directive (MiFID)

- Intercontinental Exchange (ICE)

- ESMA - Check Whether A Broker Is Regulated

- Euronext Stock Exchange

- Finance Feeds CySEC Trading Scam

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com