eToro On Track To Close Q4 With A 33% Jump In Revenue

In a report to the US Securities and Exchange Commission (SEC) this week, eToro revealed it was expecting an excellent finish to Q4. The broker is anticipating a 33% jump in commission revenue, bringing the quarter total to between $285 million and $295 million. The company also onboarded an impressive 2.1 million users in the final three months of the year.

Strong Financials

eToro, which is set to become a publicly listed company following its American SPAC merger, is closing the financial year after a solid final quarter. Revenues are up between 28% and 33% on the $164 million reported in the same period of 2020. This brings total commissions for the year to approximately $1.2 billion, representing a more than 100% increase on last year’s $602 million.

eToro’s 2.1 million new clients will also bring the broker’s total customer base to more than 27 million and is an increase on the 1.6 million new traders acquired in Q3 of 2021. Of course, this is all good news for the brokerage that is working to get its SPAC merger over the line, despite a series of recent delays.

eToro Co-Founder and CEO, Yoni Assia, commented: “Our preliminary fourth quarter 2021 financial metrics show continued strong growth and demonstrate that we are executing very well on our business plan… We continue to see a strong increase in the number of users engaging with our platform across our global footprint and are very excited for what lies ahead in 2022 and beyond.”

About eToro

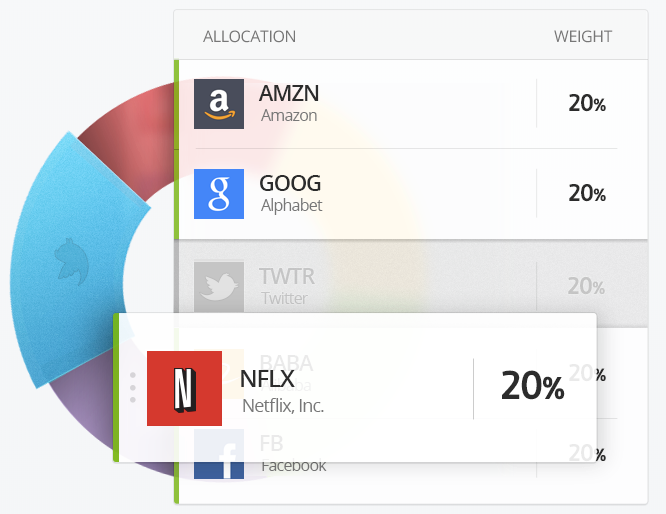

eToro is a popular online trading platform offering access to a range of financial products, from stocks and shares to forex and cryptos. The brokerage is regulated by both the Cyprus Securities Exchange Commission (CySEC) and the UK Financial Conduct Authority (FCA).

Alongside its intuitive web trader platform, account holders can engage in copy trading using the broker’s free mobile application. Clients can analyse top traders and replicate positions in their own accounts, adjusting trade parameters and risk management tools to meet individual needs.

New users can get started with a low minimum deposit and can choose from a range of popular payment solutions, including PayPal, Skrill, Neteller and Apple Pay, amongst others. A free paper trading account is also available for those wishing to trial the broker’s products and trading tools before investing real cash.

Use the link below to start trading today.