eToro Launches Visa Debit Card For UK Traders

FCA-regulated eToro has launched its Money program which includes the distribution of VISA debit cards. The new payment system will facilitate instant deposits and withdrawals for holders of the broker’s investment account. The solution also enables the straightforward storage and management of fiat and crypto funds in the same place.

Hassle-Free Payments

The eToro Money account integrates with existing eToro investment accounts so users can instantly transfer funds and manage finances. With the free debit card, clients can also spend funds anywhere with zero setup fees. In addition, card holders can convert to USD for free, saving up to £5 on every £1,000 deposited.

The eToro Money program follows the acquisition of Marq Millions Ltd. In 2020. eToro Money is a Principal Member of VISA and offers its latest services under a license from the UK’s Financial Conduct Authority (FCA).

Doron Rosenblum, eToro’s Vice President of Business Solutions, commented: “I’m proud and excited that eToro Money is now available to all of our UK users… We know from our beta testing that eToro Money greatly improves our user experience providing instant cash-in and cash-out. We look forward to adding more features to the eToro offering.”

UK Roll-Out

eToro Money VISA debit cards are currently only available to UK members of eToro’s Club program. There will be zero one-off charges or monthly fees. But whilst the new payment system is only available to traders in the UK to start with, the company does have plans to expand the system to investors in other regions.

eToro isn’t the only major trading broker moving into the payments space. Hamburg-headquartered NAGA recently launched its own payment platform, aiming to streamline its traders’ deposit and withdrawal process while offering a reliable VISA debit card.

About eToro

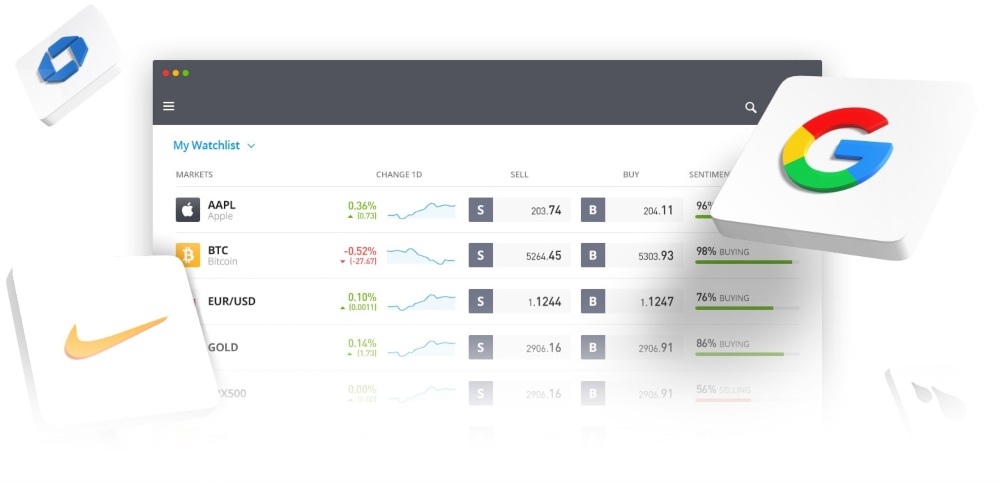

eToro is a multi-asset trading firm offering leveraged financial products and a user-friendly social trading platform. Around 1,000 stocks are available alongside 50+ ETFs, a dozen indices and a modest collection of commodities.

Clients can access advanced charting and research tools with deep market data available across the broker’s range of products. New users can get started with a $200 deposit and can test the broker’s services using a free demo account.

The eToro customer support team is available 24/5 and as well as the broker’s latest payment solution, traders can fund accounts using PayPal, Neteller, WebMoney and Yandex, among others. Competitive floating spreads are also offered in line with the broker’s transparent fee structure.

Follow the link below to start trading today.