Day Trading in Ethiopia

As the second-most populous country in Africa, Ethiopia boasts a rapidly growing economy with a GDP of around $200 billion. Its unique economic landscape presents both challenges and opportunities for day traders.

Despite being relatively underdeveloped compared to global standards, Ethiopia’s banking sector is undergoing substantial reforms to enhance financial inclusion and modernize the economic system.

Are you ready to start day trading in Ethiopia? This guide will get you started.

Quick Introduction

- Ethiopia’s financial industry is primarily regulated by the National Bank of Ethiopia (NBE), which focuses on maintaining currency stability rather than active market oversight.

- Ethiopia does not have an operational stock exchange. The country has been exploring establishing one to improve access to capital, financial inclusion, and economic growth.

- Ethiopia employs a progressive income tax system for active traders. Tax rates range from 10% to 35% and are payable to the Ethiopian Ministry of Revenues (MoR).

Top 4 Brokers in Ethiopia

Following extensive testing and analysis, these 4 platforms emerged as superior for day traders in Ethiopia:

What Is Day Trading?

Day trading involves buying and selling financial instruments, such as stocks, commodities, or indices, within the same day to profit from short-term price movements. It’s a high-risk approach to trading.

Ethiopia does not have a well-developed stock exchange like the US or Europe. Therefore, Ethiopian day traders may need to access regional African and global markets through online brokerage accounts.

Similarly, the NBE imposes strict regulations on forex trading in Ethiopia that limit dealing in the birr (ETB), forcing many residents to turn to international brokers to access a broader range of currency pairs.

Still, CFD trading in Ethiopia is popular with active traders – providing flexible opportunities to speculate on African and global financial markets.

Is Day Trading Legal In Ethiopia?

The NBE regulates Ethiopia’s banking sector, foreign exchange, and other financial activities. However, Ethiopia lacks a regulatory framework for securities trading, which is common in more developed markets.

Foreign exchange regulations in Ethiopia are particularly strict, which can impact the ability to transfer funds in and out of the country and the feasibility of day trading on some international platforms.

I suggest prioritizing platforms with licenses from highly-regarded regulatory bodies. DayTrading.com’s Regulation & Trust Rating identifies ‘green-tier’ authorities like the UK’s FCA or Australia’s ASIC as top choices.

These organizations are renowned for their rigorous oversight and robust investor protection, offering Ethiopian day traders a more secure trading environment.

How Is Day Trading Taxed In Ethiopia?

In Ethiopia, the taxation of trading activities, including day trading, is not explicitly detailed due to the absence of a formal securities market.

However, any income generated from online trading is likely to be considered personal income and subject to income tax under Ethiopian law.

Ethiopia’s income tax rates for individuals are progressive, ranging from 10% to 35%, depending on the total income earned and made payable to the MoR.

You must declare any profits from trading in your annual income tax filings. If trading involves capital gains, the tax treatment depends on whether the gains are considered part of your business or personal income.

Additionally, if the trading income is considered business income, it may also be subject to business profit tax, depending on the scale and nature of the trading activities.

Getting Started

Getting started with day trading in Ethiopia can be unpacked into three easy steps:

- Choose a broker. Prioritize critical features such as access to international markets, as the local Ethiopian financial market is underdeveloped. Regulatory compliance is crucial to ensure protection and reliability, even if the broker is overseas. Additionally, the broker should offer a secure and user-friendly trading platform with transparent fees, and strong customer support. Given the limited local financial infrastructure, having reliable payment methods for deposits and withdrawals is also essential.

- Set up your account. You must complete an online application form, providing personal information such as your name, contact details, and identification documents (like a passport or Ethiopia’s Kebele ID). The broker may also require proof of address and income based on our experience.

- Deposit Ethiopian birr. Once your account has been approved, you can fund it using payment methods supported by the broker, such as debit card, wire transfer, or popular digital wallets in the country like M-Pesa. Using a local base currency in your trading account can help reduce currency conversion costs and exchange rate fluctuations and simplify accounting and tax reporting, however ETB accounts are not widely available based on our investigations.

A Trade In Action

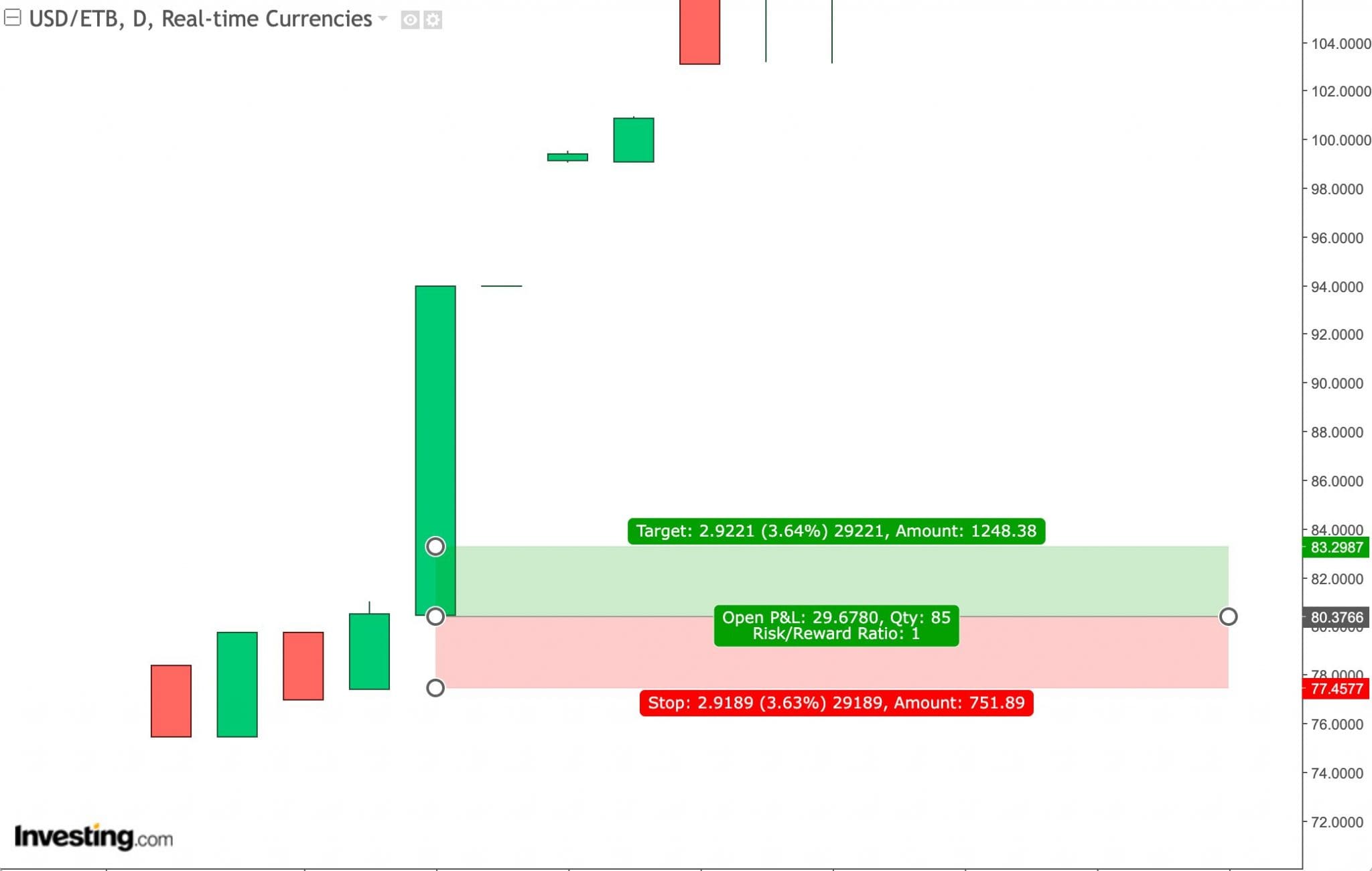

Let’s consider a scenario of day trading the USD/ETB (US dollar to Ethiopian birr).

The currency pair can exhibit volatility, which is influenced by several factors, including economic conditions, political stability, monetary policy, foreign exchange reserves, and global market sentiment.

Event Background

I closely monitored the USD/ETB pair, especially after Ethiopia announced an unexpected inflation spike, which reached 30% year over year.

This economic event could create significant volatility in the currency market, as the ETB had already been under pressure due to ongoing foreign exchange shortages.

This news heightened concerns about the country’s economic stability, which could lead to a sharp depreciation against the USD.

Trade Entry & Exit

To prepare for my day trade, I analyzed the market using a combination of fundamental and technical indicators.

The Relative Strength Index (RSI) showed that the pair was nearing an oversold level, indicating the potential for appreciation.

Additionally, I observed a bullish crossover in the Moving Average Convergence Divergence (MACD) indicator, suggesting upward momentum for the USD.

Given the data analysis, I entered a long (buy) position at market open, anticipating that the birr would weaken further due to the inflation shock and ongoing economic concerns.

I set my stop-loss at the previous day’s opening price (77.4577) to limit potential losses if the trade moved against me.

As the day progressed, I monitored any economic news that could impact the market. I noticed a continued sell-off in the ETB as traders reacted to the inflation news.

An increase in trading volume further supported my decision to short the birr, which confirmed the market’s strong bearish sentiment.

As the day went on, the ETB depreciated more than I initially expected, reaching my price target of 83.2987 in just a few hours.

At this point, I decided to close my position to lock in profits in case of consolidation or even price reversal.

Although I was tempted to hold on longer, the key to successful day trading is often knowing when to take profits, especially in an unpredictable market.

Bottom Line

Despite advancements, day traders in Ethiopia face unique challenges, including limited access to international financial markets, stringent foreign exchange controls, and an embryonic regulatory framework for securities trading.

However, the government’s commitment to economic reform and digital transformation presents promising opportunities for the country’s online trading growth.

As Ethiopia continues integrating into the global financial system, short-term traders can expect an evolving landscape with increasing access to diverse financial instruments and improved regulatory support.

To get started, browse DayTrading.com’s choice of the best day trading platforms.

Recommended Reading

Article Sources

- Ethiopian Ministry of Revenues (MoR)

- National Bank of Ethiopia (NBE)

- Ethiopian Taxes on Personal Income - PWC

- Ethiopia Datasets - International Monetary Fund (IMF)

- African Countries Population - Worldometers

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com