Best Forex Trading Platforms In Spain 2025

Looking for a forex broker in Spain to trade currencies like the euro? Discover our selection of the best forex trading platforms in Spain, personally tested and rated by our experts.

Many of these platforms are geared towards Spanish traders with authorization from ‘green tier’ EU bodies in DayTrading.com’s Regulation & Trust Rating, such as the National Securities Market Commission (CNMV).

Top Forex Trading Platforms In Spain

As of our latest tests in April 2025, these are the 6 best brokers for forex traders in Spain:

Here is a short summary of why we think each broker belongs in this top list:

- RedMars - RedMars strongest investment category is forex with more than 50 currency pairs, from majors to minors and exotics. Spreads start from 0.0 pips, catering to active currency traders, and leverage can reach 1:500. However, there are no forex heatmaps or research tools to support aspiring forex traders.

- easyMarkets - easyMarkets offers 60+ major and minor currency pairs but no exotics. Forex day traders will appreciate the access to the industry’s leading software MT4, paired with the broker’s fixed spreads from 0.7 pips on EUR/USD, offering a degree of price certainty.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- Eightcap - Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

- PrimeXBT - PrimeXBT offers forex trading on over 50 majors, minors and exotics with margin opportunities and zero commissions. The forex platform is fast, reliable and feature-rich based on our latest tests with 3 charts, 10 timeframes, and 91 technical studies - ideal for active trading strategies.

- FXCC - FXCC's key selling point is its forex trading conditions. ECN spreads come in as low as 0.0 pips during peak trading hours, while it supports a wider range of currency pairs than the majority of rivals with over 70 forex assets. Additionally, you have access to MT4, which was built specifically for forex trading and excels for its charting tools.

Best Forex Trading Platforms In Spain 2025 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | EUR Account | Regulator |

|---|---|---|---|---|---|---|

| RedMars | 50+ | 0.7 | / 5 | €250 | ✔ | CySEC, AFM |

| easyMarkets | 60+ | 0.7 | / 5 | $25 | ✔ | CySEC, ASIC, FSCA, FSC, FSA |

| Vantage | 55+ | 0.0 | / 5 | $50 | ✔ | FCA, ASIC, FSCA, VFSC |

| Eightcap | 50+ | 0.0 | / 5 | $100 | ✔ | ASIC, FCA, CySEC, SCB |

| PrimeXBT | 45+ | 0.1 | / 5 | $0 | ✔ | - |

| FXCC | 70+ | 0.2 | / 5 | $0 | ✔ | CySEC |

RedMars

"RedMars is the best fit for experienced day traders familiar with the MetaTrader 5 platform and based in the EU, where the broker is authorized by the CySEC. However, the threadbare education and research tools make it unsuitable for beginners."

Christian Harris, Reviewer

RedMars Quick Facts

| GBPUSD Spread | 0.7 |

|---|---|

| EURUSD Spread | 0.7 |

| EURGBP Spread | 1.1 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Platforms | MT5 |

| Account Currencies | USD, EUR |

Pros

- The broker is one of a limited number of firms to offer an account specially designed for VIPs with premium support and invites to exclusive events

- The broker supports a range of flexible payment methods, including wire transfers, credit cards, e-wallets, and notably cryptocurrencies

- Clients in the EU, in particular, can trade with peace of mind knowing RedMars is authorized by the CySEC with up to €20K compensation available through the ICF in the event of bankruptcy

Cons

- The no-frills trading environment offers little beyond the basics, with no Islamic account, PAMM account or copy trading.

- RedMars falls short for newer traders, with little in the way of education, no beginner-friendly platform, a steep minimum deposit, and inadequate support during testing

- While RedMars' spreads are within industry averages, they don't offer a significant edge over the cheapest day trading brokers we've personally used, notably IC Markets

easyMarkets

"easyMarkets provides fixed spreads starting at 0.7 pips, making it an excellent choice for beginners seeking predictable trading costs. After adding a Bitcoin-based account, it’s also a stand-out option for crypto-focused traders who want to deposit, trade, and withdraw in digital currencies."

Christian Harris, Reviewer

easyMarkets Quick Facts

| GBPUSD Spread | 0.9 |

|---|---|

| EURUSD Spread | 0.7 |

| EURGBP Spread | 1.0 |

| Total Assets | 60+ |

| Leverage | 1:30 |

| Platforms | easyMarkets App, Web Platform, MT4, MT5, TradingView, TradingCentral |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, CZK, MXN, CNY |

Pros

- easyMarkets added Bitcoin as a base currency in 2019. This marks it out against most of the market and eliminates the need to convert crypto to fiat, reducing conversion fees and simplifying management for crypto-focused traders.

- With 20+ years in the industry, multiple awards, and authorization from two ‘green tier’ regulators, easyMarkets continues to earn its reputation as a secure broker for active traders.

- easyMarkets takes risk management seriously, with negative balance protection plus guaranteed stop losses and its dealCancellation (enhanced in 2024 to include periods of 1, 3, or 6 hours) in the Web Trader.

Cons

- easyMarkets is falling behind by not providing the copy trading features you get at category leader eToro, which are popular among beginners looking to follow the strategies of experienced traders.

- While easyMarkets provides solid educational resources for beginners, they fall short for advanced traders. The Academy offers well-structured courses and engaging gamification, but the overall content lacks depth.

- easyMarkets does not offer a zero-spread account like Pepperstone, which can be a drawback for day traders and high-frequency traders who require minimal transaction costs.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Bonus Offer | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme |

|---|---|

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:500 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage maintains its high trust score thanks to its strong reputation and top-tier regulation from the FCA and ASIC

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

- There’s an excellent suite of day trading software, including the award-winning platforms MT4 and MT5

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| GBPUSD Spread | 0.1 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.1 |

| Total Assets | 50+ |

| Leverage | 1:30 |

| Platforms | MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, the innovative algorithmic trading platform Capitalise.ai, and more recently the 100-million strong social trading network TradingView.

Cons

- Eightcap needs to continue bolstering its suite of instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

PrimeXBT

"PrimeXBT is perfect for aspiring traders looking for crypto derivatives alongside traditional markets like forex and indices, all tradable on an intuitive, web-based platform. The copy trading solution is also ideal for hands-off traders with 5-star ratings and performance graphs to help you find the right trader."

William Berg, Reviewer

PrimeXBT Quick Facts

| Bonus Offer | $100 Deposit Bonus |

|---|---|

| GBPUSD Spread | Variable |

| EURUSD Spread | 0.1 |

| EURGBP Spread | Variable |

| Total Assets | 45+ |

| Leverage | 1:1000 |

| Platforms | Own |

| Account Currencies | USD, EUR, GBP |

Pros

- PrimeXBT has added fresh opportunities with new tokens for exchanging and funding, including 1Inch, Aave, and Injective.

- 24/7 customer support, available via live chat, proved excellent during testing, while the extensive help centre is perfect for self-help.

- Ultra-fast execution speeds, averaging 7.12ms, make PrimeXBT an excellent option for day traders looking to secure the best prices in volatile markets.

Cons

- Despite improvements, the selection of around 100+ instruments still seriously trails competitors, notably OKX with its 400+ assets.

- The lack of integration with established platforms like MT4 will be limiting for traders familiar with the world’s most popular forex trading software.

- While common in the crypto industry, PrimeXBT lacks authorization from a trusted regulator, seriously elevating the risk for retail traders.

FXCC

"FXCC continues to prove itself an excellent option for forex day traders with an extensive range of 70+ currency pairs, ultra-tight spreads from 0.0 pips during testing, and high leverage up to 1:500 in the ECN XL account. "

Jemma Grist, Reviewer

FXCC Quick Facts

| Bonus Offer | 100% First Deposit Bonus Up To $2000 |

|---|---|

| GBPUSD Spread | 1.0 |

| EURUSD Spread | 0.2 |

| EURGBP Spread | 0.5 |

| Total Assets | 70+ |

| Leverage | 1:500 |

| Platforms | MT4 |

| Account Currencies | USD, EUR, GBP |

Pros

- As an MT4 broker, FXCC offers advanced charting tools and excellent support for algo traders, especially when combined with the free VPS

- There are no deposit fees except industry-standard mining charges on cryptos, which is advantageous for active traders

- FXCC is trusted and licensed by the CySEC, a top-tier European regulator offering high standards of safeguarding

Cons

- High withdrawal fees may catch out unsuspecting traders, including a significant $45 charge for bank wire payments

- Although MetaTrader 4 continues to shine for technical analysis, the subpar design dampens the trading experience, especially compared to modern alternatives like TradingView

- There is a threadbare selection of research tools like Trading Central and Autochartist, value-add features available at category leaders like IG

How We Chose The Best Forex Brokers In Spain

To identify the leading forex trading platforms in Spain, we began by filtering our database of 223 providers to select only the platforms that accept Spanish residents and offer forex trading.

Then we sorted the brokers by their total rating derived from our hands-on assessments. These were conducted by our traders and industry experts, and combine 200+ data points with personal insights in key areas.

These are the key factors we, and you, should consider when choosing a brokerage to trade currencies in Spain:

Trust

There’s a reason that at DayTrading.com we consider our Regulation & Trust Rating the most important criterion while rating a forex broker: you can’t afford to risk depositing your euros with a firm you can’t trust.

To help our readers pick the gems among the many unreliable forex firms that Spain’s regulator, the National Securities Market Commission (CNMV), has warned against, we employ a rigorous vetting process in our reviews:

- We check and rate each broker’s list of licenses, awarding the highest points to brokers with oversight from ‘green-tier’ bodies like CNMV, while unlicensed brokers or those with licenses from ‘red-tier’ regulators generally achieve a poor rating.

- We assess the broker’s track record in the industry by researching news and regulators’ announcements for reports of scams or unfair practices. Our most trusted brokers have a long, clean record in the industry.

- We award our highest ratings to brokers with a large number of clients and a listing on a major stock exchange, since this entails even more thorough vetting of their business in addition to those by regulators.

- Several of our team trade with IG because it’s one of the most trusted forex brokers, operating with a sparkling record since 1974 and a listing on the London Stock Exchange. As well as its near-perfect 4.9 Regulation & Trust rating, IG also wows with a huge range of EUR and other forex pairs.

Currency Pairs

Active traders often look for new trading opportunities across the global foreign exchange market, so we highly rate providers with a wide range of available currency pairs.

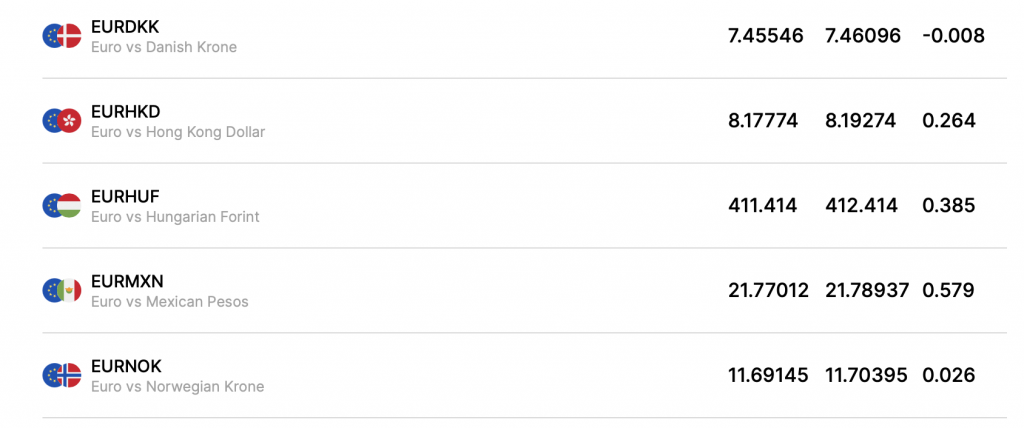

For traders in Spain, pairs with the euro (EUR) will usually take precedence. Fortunately, as the world’s second most traded currency, there are usually plenty to choose from.

This includes the most popular pairs like EUR/USD and EUR/GBP, which generally offer great liquidity, and thus, competitive trading costs.

We also look for minor and exotic pairs like EUR/TRY, since these often come with heightened volatility that can lead to opportunities to profit from large price swings.

However, in our experience, minors and exotics usually have wider spreads that can hurt short-term trading strategies.

- FxPro‘s offering of 70+ forex pairs remains towards the head of the pack, with all the majors plus a large range of EUR minor and exotic pairs like EUR/HKD, EUR/ZAR and EUR/PLN. You can choose between fixed spreads from 1.2 and a competitive floating spread on the MT5 account that starts from 0.0.

Fees

Your fees when trading forex will typically consist of the spread (the difference between the bid and ask price), sometimes a commission, plus any non-trading fees such as currency conversion or deposit charges.

The spread is generally the biggest fee you’ll pay and the greatest barrier to profit. So, we favor brokers with the tightest spreads and as part of our review process. We record spreads on the EUR/USD and EUR/GBP for each forex platform.

In some cases, on major pairs like EUR/USD and during busy trading hours, you’ll find spreads can go as low as zero (though you may need to pay a small commission)

- Vantage continues to impress by offering some of the best pricing around on its 57 forex pairs, with access to ultra-tight spreads on the ECN account for a low initial deposit of $50 – ideal for active traders. Vantage’s transparent pricing model also features no hidden charges such as deposit, withdrawal and inactivity fees.

Charting Platforms

Day trading is a complex and demanding form of forex trading that often involves sophisticated research and split-second accuracy.

As a result, a responsive charting platform with the depth to conduct technical analysis can be crucial.

Based on our tests, most forex brokers that accept clients in Spain support the long-time forex favorite, MetaTrader 4 (MT4).

MT4 still provides all the charting power, in-built tools and indicators, and automated trading features you’ll need to potentially profit on forex markets.

However, we’ve found newer platforms have started to surpass the classic MT4 in several key areas.

TradingView is a particular favorite among some of our team because it’s both easy to use and feature-rich, with a huge range of indicators and charting options as well as customizability through the powerful Pine script.

The market-leading integrated research and social trading also ensure FX traders have everything they need on one platform.

Additionally, I’ve been very impressed by some brokers’ bespoke platforms.In my experience, these are almost always the easiest way for beginner traders to get started, and they’re usually optimized to run through a browser window or mobile app.

- Eightcap still covers all the bases for everyone from beginning traders to pros with its platform offering of MT4, MT5 and TradingView, including mobile apps and web traders for all software options. Bundled with these platforms is Capitalise.ai, which allows traders to benefit from automated trading without needing coding knowledge, plus a useful AI-powered economic calendar to help pinpoint forex trading opportunities.

FAQ

Who Regulates Forex Trading Platforms In Spain?

To provide forex trading services in Spain, online brokers should be licensed by the Comisión Nacional del Mercado de Valores (National Securities Market Commission; CNMV), the country’s financial regulator.

Thanks to the EU’s passporting system, brokers authorized by other European regulators, such as CySEC (Cyprus) or BaFin (Germany), can also legally offer forex trading services in Spain while adhering to the EU-wide trading standards overseen by the European Securities & Markets Authority (ESMA).

Which Is The Best Forex Trading Platform In Spain?

The best forex platform for Spanish traders depends on individual preferences, trading experience, and budget.

DayTrading.com’s curated list of top forex brokers for Spain (which is updated regularly) is an excellent starting point, offering options suitable for both beginners and experienced traders.

For example, from our list, Eightcap is a fantastic starting point for newer traders, who can quickly get started on the WebTrader, while IG‘s extremely deep research resources and huge range of currency pairs with reliable execution will satisfy most experienced traders.

Recommended Reading

Article Sources

- Comisión Nacional del Mercado de Valores (CNMV)

- CNMV flags 14 unregistered forex firms - Finance Magnates

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com