Forex Trading in Spain

Forex trading in Spain has accelerated sharply in recent years. The latest data from the Bank of International Settlements (BIS) shows that the average daily turnover of forex trades in the country totalled $39 billion in 2022. This was up 39% from levels recorded in 2019.

This guide explains how online traders can make money with Spain’s forex market. It covers regulatory and tax aspects, reveals the optimal times for trading, and offers a practical example of how a short-term currency trade could work.

Quick Introduction

- Spain’s vibrant economy and closely managed financial services sector make it a popular venue for forex trading, with the country’s local currency, the euro, playing a part in most currency transactions.

- Forex trading profits are subject to Spain’s capital gains tax, with levels ranging from 19% to 26% depending on the level of an individual’s earnings.

- Forex trading in Spain is governed by rules laid down by the National Securities Market Commission (CNMV) and the European Securities and Markets Authority (ESMA).

Top 4 Forex Brokers in Spain

Our hands-on assessments point to these 4 platforms going the extra mile for forex traders in Spain:

How Does Forex Trading In Spain Work?

Spain is one of Europe’s top ten forex trading hubs, a testament to the country’s highly regulated market and economic significance. The Spanish economy accounts for 8.3% of the European Union’s total GDP.

Currency trading in Spain has experienced a significant uptick in recent years, fuelled by the relocation of financial services firms from the UK to Continental Europe following Brexit. Some companies have moved only a portion of their operations, while others have transferred their entire operations.

The euro (EUR) is the most frequently traded currency in Spain, reflecting the nation’s membership of the eurozone. Popular currency pairings include the EUR/USD (US dollar), EUR/GBP (British pound), EUR/JPY (Japanese yen), and EUR/AUD (Australian dollar).

Is Forex Trading Legal In Spain?

Currency trading is legal in Spain. It is regulated and supervised by the National Securities Market Commission (Comisión Nacional del Mercado de Valores, or CNMV). Forex brokers should be authorized by the organization or another suitable European agency through the EU’s passporting scheme.

Spain’s membership of the European Union means the CNMV enforces rules from the European Securities and Markets Authority (ESMA). Established in 2011, the body describes itself as “an independent EU authority whose purpose is to improve investor protection and promote stable, orderly financial markets.”

I recommend that forex traders check a broker’s regulatory status using this search facility on the CNMV’s website. The commission also provides a list of companies it believes may be trading without authorization.

ESMA was responsible for the introduction of the Markets in Financial Instruments Directive II (or MiFID II) in 2018. This blanket piece of legislation was introduced to improve transparency, efficiency, and stability of financial markets across the European Union’s many member countries.

MiFID II has implications for those who wish to trade forex using contracts for difference (CFDs). The directive ramped up investor protection for these high-risk derivative products by:

- Imposing leverage limits of 1:30 on major currency pairings, and 1:20 for all other forex pairs.

- Introducing negative balance protection, which limits a trader’s potential losses to the funds they have deposited in their account.

- Rolling out margin close-out rules, which require brokers to close out one or more of a trader’s open positions if their margin falls below 50% of the initial margin required.

Is Forex Trading Taxed In Spain?

Any earnings made through dealing currencies are taxed and must be declared to the Spanish Tax Agency (Agencia Estatal de Administración Tributaria).

Profits are subject to capital gains tax, and are applied at the following rates for Spanish residents:

- 19% on earnings up to €6,000.

- 21% on profits of between €6,000.01 and €50,000.

- 23% on gains of between €50,000.01 and €200,000.

- 26% for earnings above €200,000.01.

Non-residents typically pay a flat rate capital gains tax at 19%.

When Is The Best Time To Trade Forex?

Forex markets are closed at weekends, but outside of these times currency dealers can conduct transactions at whatever time of the day or night they choose.

The trading week kicks off on Sunday night Central European Time (CET) when the Sydney market opens, and ends on Friday evening when traders in New York down tools.

However, trading forex is better at particular times of the day when liquidity is deeper and volatility can be sharper. In Spain, this is between the hours of 2:00pm and 6:00pm CET.

During this period, the trading session in major European financial hubs like Madrid cross over with those of London and New York. This means that there are more traders online to do business with.

Liquidity and volatility can also be higher around the time that major economic datasets are released.

A Forex Trade In Action

Let’s now look at how a forex trade in Spain might work in practice. I’ll explain how I could profit from movements in the euro (EUR) following the release of important economic data.

Trading Opportunity

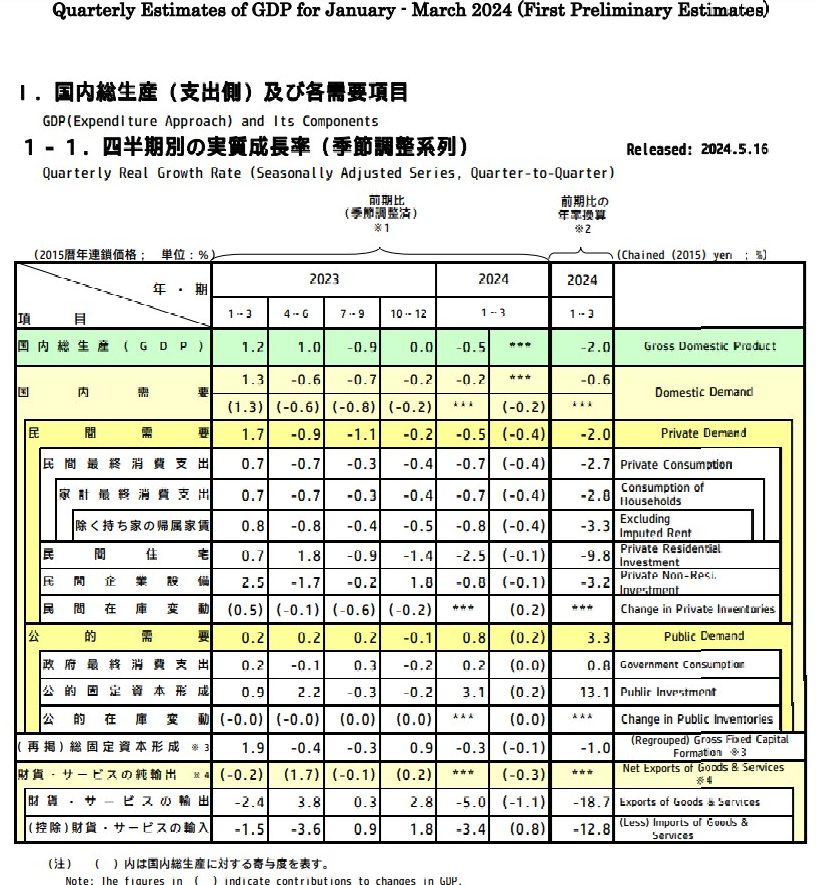

In this example, I’m looking to capitalize on a potential rise in the EUR/JPY pairing following the release of Japanese GDP figures. This currency cross pits the base currency of the euro against Japan’s yen, the counter currency.

In this hypothetical scenario, Japan’s economy is tipped by analysts to have expanded by 1% over the last quarter. Growth below this level will likely lead to weakness in the Asian currency, while a better-than-expected print could help it to rise.

Doing My Research

After studying recent economic data, my view is that Japan’s GDP is likely to have grown by a more modest 0.8% in the past three months. Depending on other market factors, this could lead to a fall in the value of the yen against other global currencies, including the euro.

To capitalize on this, I’d go long with the EUR/JPY, a strategy that will make me money if the pairing rises. But before placing this trade, I’ll look at the charts to give me further insight into its possible direction.

Technical analysis uses past price and volume data to help traders forecast future price movements. Chartists can use various tools and indicators, like chart patterns, trend lines and indicators, to identify recurring movements in the market.

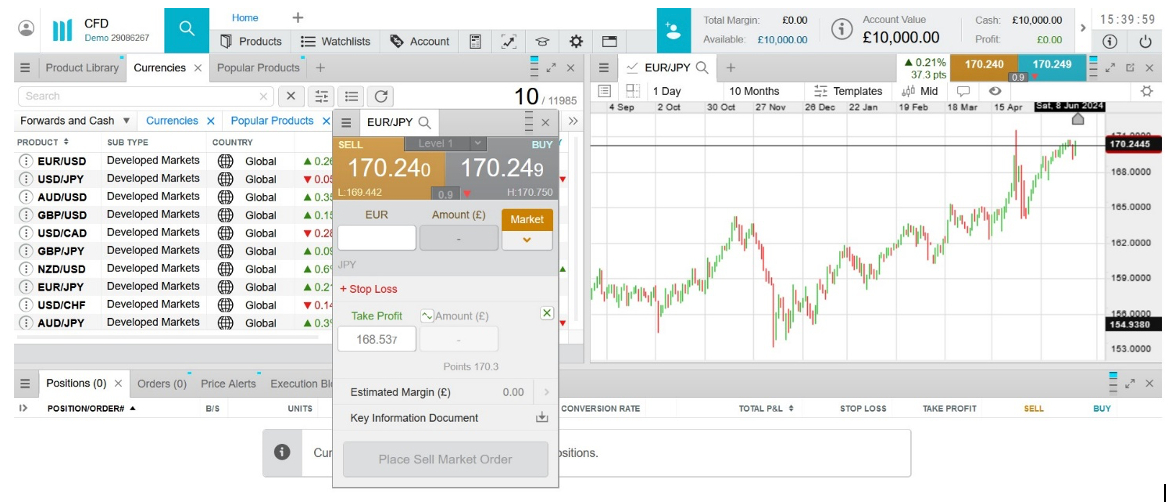

Placing The Trade

The Cabinet Office of Japan is responsible for compiling and releasing GDP data, and it is due to release the latest quarterly numbers at 1:50am CET (8:50am Japanese Standard Time (JST)).

Trading volumes are usually low at this time of the day. But I’m confident that – given the global significance of Japanese GDP data – I can still eke out a solid profit by making that EUR/JPY trade.

At 1.45am CET, the pairing is priced at 170.25. But I won’t just place a simple buy instruction to try and print a gain. Instead, I’ll use ‘take profit’ and ‘stop loss’ orders to help me manage risk.

By setting a ‘take profit’ instruction at, say, 170.36, my position will automatically close when the cross reaches this level, booking me a profit in the process.

Conversely, a ‘stop loss’ order at 170.14 (for example) will limit my losses if the euro instead falls against the yen.

Five minutes after I secure these orders, the Cabinet Office’s report comes out. It shows growth of 0.9% in the last quarter, higher than my 0.8% prediction but worse than analysts’ 1% forecast.

With growth lower than the market was expecting, the yen still falls in value against the euro, and within 15 minutes the EUR/JPY cross has risen to 170.36. At this point, my position is closed out thanks to that ‘take profit’ order, and I’ve booked a profit of 11 pips.

Bottom Line

Spain boasts a bustling forex market that is growing rapidly, thanks in part to an influx of UK financial services companies after Brexit. The sector is closely regulated and overseen by the CNMV, in accordance with ESMA regulations.

This makes it a relatively secure place for currency traders to do business, though it’s important to check that the forex broker in Spain you choose is regulated by suitable EU authorities before setting up an account.

Recommended Reading

Article Sources

- MiFID II/R - International Capital Market Association

- Tax in Spain - HSBC

- Homepage - Comisión Nacional del Mercado de Valores, or CNMV

- Turnover of OTC foreign exchange instruments, by country – Bank for International Settlements (BIS)

- Turnover of OTC foreign exchange instruments – Bank for International Settlements (BIS)

- Final Report - European Securities and Markets Authority (ESMA)

- Spain – European Union

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com