Best Day Trading Platforms and Brokers in Spain 2025

To day trade financial markets like stocks listed on the Bolsa de Madrid, the IBEX 35 index, or currency pairs containing the EUR, you’ll need to open an account with an online broker.

The Comisión Nacional del Mercado de Valores (CNMV) regulates brokers in Spain, though other EU-regulated platforms can provide short-term trading products to Spanish investors through the EU’s passporting scheme. That said, it’s important to follow CNMV regulations and tax rules in Spain.

We’ve identified the best day trading brokers in Spain following rigorous tests. Many of these platforms offer tailored services for Spanish traders, including local securities, EUR accounts and the most popular e-wallet in the country, PayPal.

Top 6 Platforms For Day Trading In Spain

Following our extensive tests of hundreds of online brokers, these 6 stand out as the best for short-term traders in Spain:

Here is a short overview of each broker's pros and cons

- easyMarkets - Established in 2001, easyMarkets has made for a name for itself as a trusted, fixed spread broker. Improvements to its tools over the years, from adding the MetaTrader suite and TradingView to enhancing its exclusive risk management tools like dealCancellation, mark it out from the competition.

- RedMars - Launched in 2020, Cyprus-based RedMars offers competitive spreads on more than 300 instruments and leverage up to 1:500. Three accounts are available - Standard, Pro and VIP - serving a range of budgets and experience levels, with a fast and fully digital account opening process.

- IC Trading - IC Trading is part of the established IC Markets group. Built for serious traders, it boasts some of the most competitive spreads, reliable order execution, and advanced trading tools. The catch is that it’s registered in the offshore financial centre of Mauritius, enabling it to offer high leverage but in a weakly regulated trading setting.

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

- LiteForex Europe - LiteForex Europe is a CFD broker established in 2008 and authorized by the CySEC. The brokerage offers forex, commodities and indices via the MT4 and MT5 platforms. Spreads are ultra tight on ECN accounts and leverage is available up to 1:30 in line with EU regulations. LiteForex also offers a rich education centre for new day traders and social trading capabilities.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

Best Day Trading Platforms and Brokers in Spain 2025 Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage | Regulator |

|---|---|---|---|---|---|

| easyMarkets | $25 | CFDs, Forex, Stocks, Indices, Commodities | easyMarkets App, Web Platform, MT4, MT5, TradingView, TradingCentral | 1:30 | CySEC, ASIC, FSCA, FSC, FSA |

| RedMars | €250 | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | MT5 | 1:30 (Retail), 1:500 (Pro) | CySEC, AFM |

| IC Trading | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | MT4, MT5, cTrader, AutoChartist, TradingCentral | 1:500 | FSC |

| Eightcap | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:30 | ASIC, FCA, CySEC, SCB |

| LiteForex Europe | $50 | CFDs, Forex, Indices, Commodities | MT4, MT5 | 1:30 | CySEC, AFM |

| Fusion Markets | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, cTrader, TradingView, DupliTrade | 1:500 | ASIC, VFSC, FSA |

easyMarkets

"easyMarkets provides fixed spreads starting at 0.7 pips, making it an excellent choice for beginners seeking predictable trading costs. After adding a Bitcoin-based account, it’s also a stand-out option for crypto-focused traders who want to deposit, trade, and withdraw in digital currencies."

Christian Harris, Reviewer

easyMarkets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities |

| Regulator | CySEC, ASIC, FSCA, FSC, FSA |

| Platforms | easyMarkets App, Web Platform, MT4, MT5, TradingView, TradingCentral |

| Minimum Deposit | $25 |

| Minimum Trade | 0.01 lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, CZK, MXN, CNY |

Pros

- easyMarkets added Bitcoin as a base currency in 2019. This marks it out against most of the market and eliminates the need to convert crypto to fiat, reducing conversion fees and simplifying management for crypto-focused traders.

- easyMarkets takes risk management seriously, with negative balance protection plus guaranteed stop losses and its dealCancellation (enhanced in 2024 to include periods of 1, 3, or 6 hours) in the Web Trader.

- Unlike variable spreads offered by 90%+ of brokers we've tested, easyMarkets provides fixed spreads from 0.7 pips. This makes trading costs predictable, a significant advantage for beginners and those trading in volatile markets.

Cons

- While easyMarkets provides solid educational resources for beginners, they fall short for advanced traders. The Academy offers well-structured courses and engaging gamification, but the overall content lacks depth.

- easyMarkets does not offer a zero-spread account like Pepperstone, which can be a drawback for day traders and high-frequency traders who require minimal transaction costs.

- easyMarkets is falling behind by not providing the copy trading features you get at category leader eToro, which are popular among beginners looking to follow the strategies of experienced traders.

RedMars

"RedMars is the best fit for experienced day traders familiar with the MetaTrader 5 platform and based in the EU, where the broker is authorized by the CySEC. However, the threadbare education and research tools make it unsuitable for beginners."

Christian Harris, Reviewer

RedMars Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Cryptos |

| Regulator | CySEC, AFM |

| Platforms | MT5 |

| Minimum Deposit | €250 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR |

Pros

- Clients in the EU, in particular, can trade with peace of mind knowing RedMars is authorized by the CySEC with up to €20K compensation available through the ICF in the event of bankruptcy

- The broker is one of a limited number of firms to offer an account specially designed for VIPs with premium support and invites to exclusive events

- Getting started on RedMars is incredibly easy - you can be up and running in just a few minutes based on tests

Cons

- While RedMars' spreads are within industry averages, they don't offer a significant edge over the cheapest day trading brokers we've personally used, notably IC Markets

- The no-frills trading environment offers little beyond the basics, with no Islamic account, PAMM account or copy trading.

- With just 300 instruments, RedMars offers a narrow trading environment, particularly compared to category leaders like BlackBull Markets which offers 26,000 assets

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Trading Central and Autochartist are valuable tools for in-depth technical summaries and actionable trading ideas and are accessible from within the account area or the cTrader platform.

- IC Trading offers unusual flexibility in its accounts, enabling traders to open up to 10 live and 20 demo accounts, meaning you can run separate profiles for different activities, such as manual trading and algo trading.

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

Cons

- Unlike IC Markets, IC Trading does not support social trading through the group’s IC Social app or the third-party copy trading platform ZuluTrade.

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, the innovative algorithmic trading platform Capitalise.ai, and more recently the 100-million strong social trading network TradingView.

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

Cons

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

- Eightcap needs to continue bolstering its suite of instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

LiteForex Europe

"LiteForex is a good option for active day traders with variable spreads from 0.0 pips, daily analysis and high-quality training guides. The forex copy system also lets you duplicate the positions of experienced traders."

William Berg, Reviewer

LiteForex Europe Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Commodities |

| Regulator | CySEC, AFM |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CHF |

Pros

- Fast ECN execution model with low spreads from 0.0 pips

- LiteForex offers a client-oriented approach, with personal manager assigned to each trader and 24/5 multilingual customer support

- LiteForex offers a range of proprietary mobile app tools which are ideal for traders who want to analyze the markets on the go

Cons

- Cryptocurrency trading is not offered

- Fees are fairly high, with spreads starting from 2.0 pips in the Classic account and $10 forex commissions in the ECN account

- The range of day trading markets is limited compared to alternatives, with no share CFDs offered

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Average execution speeds of around 37 milliseconds are noticeably faster than many rivals and can help day traders secure optimal prices in fast-moving markets.

- Fusion Markets continues to impress with its pricing that provides tight spreads with below-average commissions that will appeal to active day traders.

- Fusion Markets offers best-in-class support with very fast, friendly and helpful responses during tests and no frustrating automated chatbot to navigate.

Cons

- Fusion Market trails alternatives, notably eToro and IG, in the education department with limited guides and live video sessions to upskill new traders.

- While the selection of currency pairs trumps most rivals, the broker's alternative investment offering is average with no stock CFDs beyond the US.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

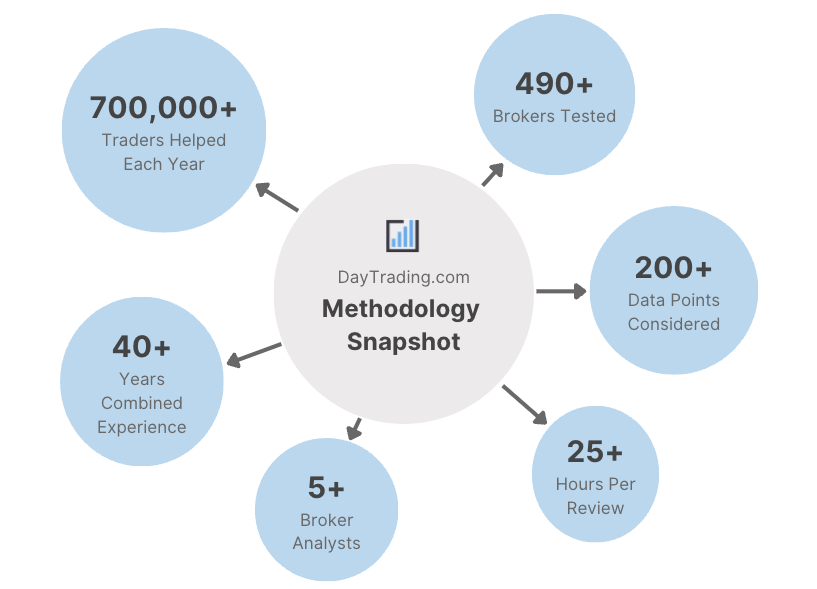

Methodology

To find the best day trading platforms in Spain, we searched our database of 223 online brokers, removed any that don’t accept traders from Spain, and ranked them by their overall rating.

Our ratings combine the results of 100+ data points with the firsthand observations of our testers.

- We verified that each broker accepts Spanish day traders.

- We prioritized trusted brokers with credible licensing.

- We focused on brokers with competitive day trading fees.

- We checked each broker for a wide range of day trading markets.

- We confirmed that each broker offers powerful charting tools for technical analysis.

- We favored brokers with transparent leverage and margin requirements.

- We investigated each broker’s execution speed and quality.

How To Choose A Day Trading Broker In Spain

Our years of experience and countless hours testing day trading platforms have shown us that there are several important factors to consider when choosing a broker:

Choose A Trustworthy Broker

A trusted firm will have a long track record, a great reputation, and be licensed by a respected financial body. They’ll also provide safeguards to protect you from trading scams, which have targeted Spanish investors in recent years.

Euronews, for example, reported the arrest of 8 suspects who ran a pyramid scheme targeting young people. The organizers ran a fake trading academy, employing cult-like techniques on young victims to cut ties with their families and dedicate themselves to the academy.

This highlights the importance of day trading with platforms regulated by a reputable authority. In Spain, the Comisión Nacional del Mercado de Valores (CNMV) oversees online brokers, although other European-regulated brokers can onboard Spanish traders through the European Union’s passporting scheme.

- IG is a highly trusted broker with 50+ years in the industry, a public listing on the London Stock Exchange (LSE) and licensing from multiple ‘green tier’ authorities, including the FCA (UK), FINMA (Switzerland) and CFTC (US).

Choose A Broker With Low Fees

Low trading fees will help you keep frequent transaction costs down and in turn, protect your profits.

Spreads and commissions are the most common day trading fees, but we also consider non-trading costs like funding or account maintenance charges.

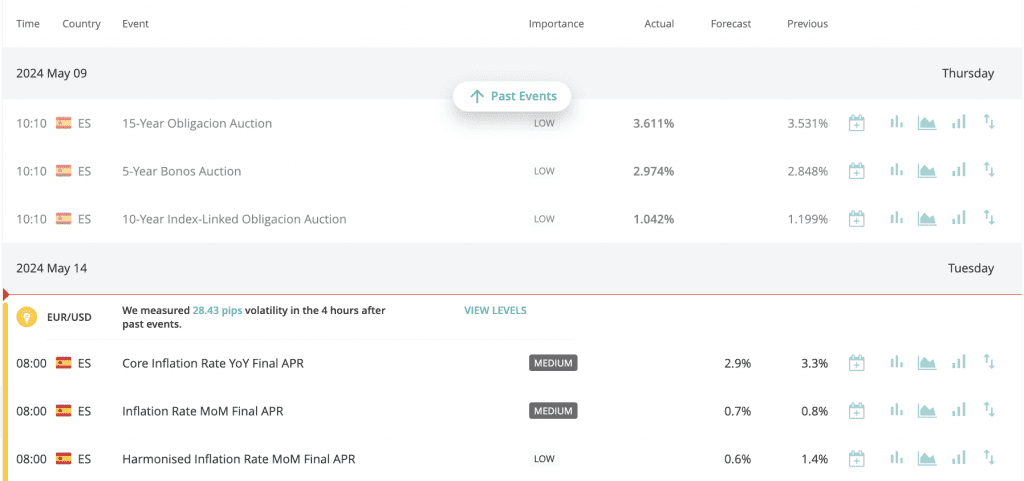

It’s also worth weighing the costs with the overall quality of service provided. For example, we’ve found some of the best brokers provide specific insights into Spanish markets, like the IBEX 35 index, or tools that give you direct economic updates from the Banco de España, helping you identify short-term trading opportunities.

- Fusion Markets continues to offer terrific pricing on major assets like EUR/USD, with spreads from 0.0 pips and ultra-low commissions from $2.25 per side. I also love that you get free access to tailored tools, including an intuitive economic calendar where you can filter for events in Spain.

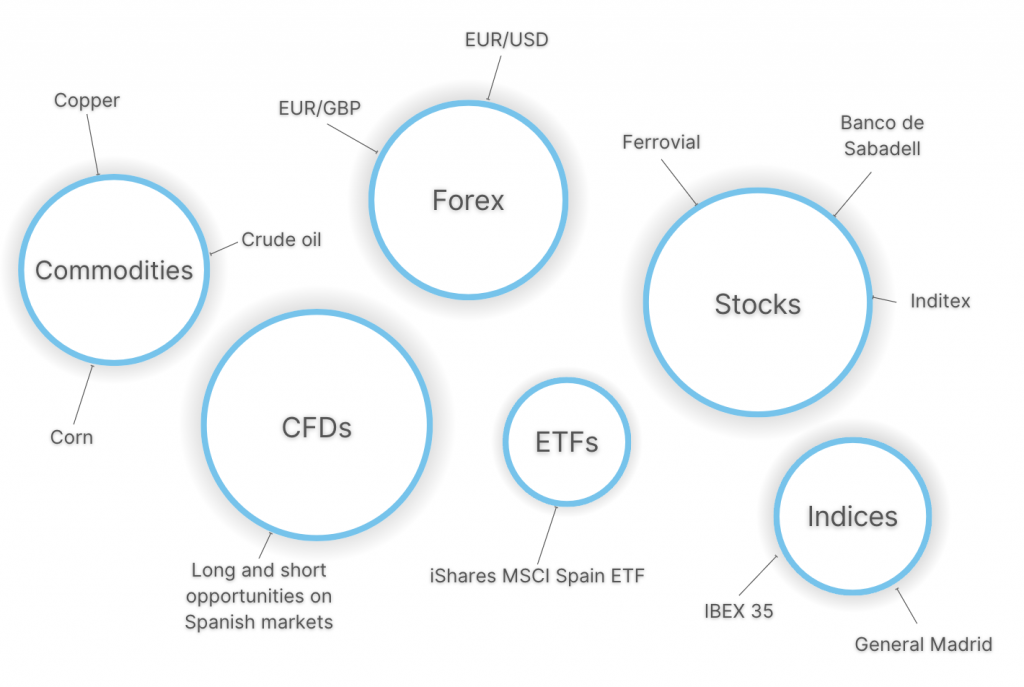

Choose A Broker With The Markets You Want To Trade

Trading a wide range of markets will allow you to spread your risk and explore different market opportunities.

For forex traders in Spain, we look for local assets like currency pairs involving the EUR. Equally, we may investigate Spanish indices and stocks listed on the Bolsa de Madrid, and the country’s chief export commodities like crude oil and copper.

- CMC Markets is a top pick for Spanish traders, with 12,000+ instruments on offer including all major EUR currency pairs, the IBEX 35 index, plus a range of local stocks such as Banco de Sabadell and Ferrovial.

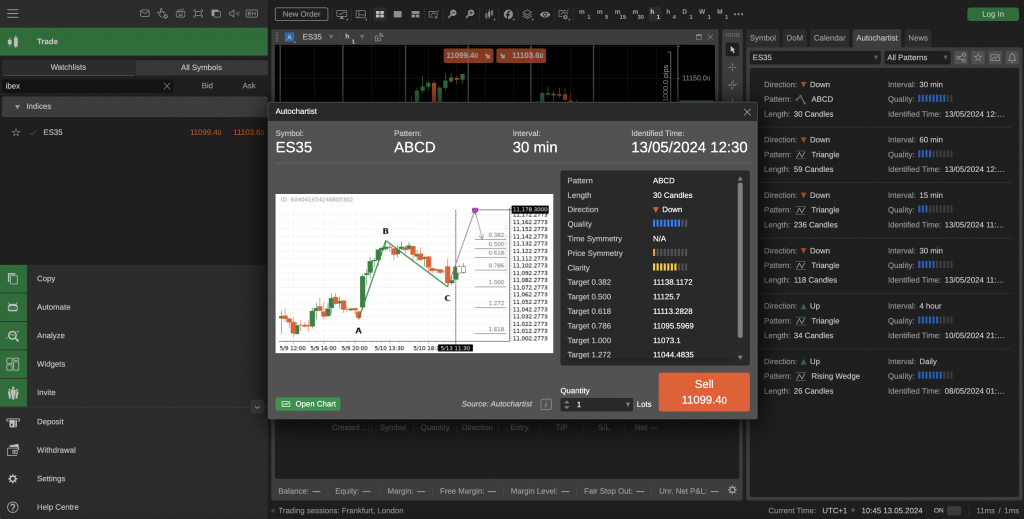

Choose A Broker With Reliable Charting Platforms

A powerful charting platform is crucial for day traders developing their short-term strategies.

Common solutions include the renowned MetaTrader 4 and MetaTrader 5, but we also highly rate the modern alternatives that are becoming prevalent, namely cTrader and TradingView.

I love cTrader’s intuitive and feature-rich interface that makes research and technical analysis smooth.

As you can see in the example below, I was able to leverage the platform’s Autochartist integration to view real-time insights and chart patterns for the ES35 Index, directly from my workspace.

- Vantage remains a top pick when it comes to charting tools, with terminals to suit all requirements including MT4, TradingView and a proprietary solution: ProTrader. Short-term traders also benefit from additional automated trading tools and research from Autochartist and DupliTrade.

Choose A Broker With Good Execution Quality

The best brokers deliver optimum conditions for fast-paced trading strategies like day trading.

Low latency and slippage will ensure that trades are executed at the requested time and price. We also investigate the speed at which trades are executed where possible – ideally looking for less than 100 milliseconds.

- FxPro maintains its position as one of the fastest brokers in the industry, delivering ultra-fast non-dealing desk execution of less than 12 milliseconds. Additionally, more than 84% of trades were executed at the requested price or better in 2023.

Choose A Broker With Transparent Leverage and Margin Requirements

A key component of day trading, leverage allows you to magnify your potential returns using only a small outlay, known as margin.

The best brokers are crystal clear about how much money you need to put down and maintain in your account to trade with leverage.

Let’s say I believe the IBEX 35 is going to increase because I anticipate better-than-expected GDP and unemployment figures are about to be released.

My broker offers me 1:10 leverage on the IBEX, meaning if I put down €100, my purchasing power would be €1000 (10 x €100).

If the IBEX does indeed increase, my profits will be multiplied by 10. That said, so too will my losses if it falls. As a result, a solid risk management strategy is crucial.

- Eightcap offers flexible leverage rates depending on the entity you trade with. The international branch, for instance, offers leverage up to 1:500, while the EU-regulated entity caps leverage at 1:30, making it a safer option for retail investors in Spain, especially beginners.

Choose A Broker With An Accessible Minimum Deposit

Based on our regular evaluations, most brokers require up to €250 to open a live account, though many day trading platforms let you start with much less.

We also favor brokers that support local payment methods which may offer cheaper and faster transactions. Findings from Pay.com reveal that PayPal is still the most popular digital wallet in Spain, though alternatives like Apple Pay and Google Pay are gaining ground.

FAQ

Who Regulates Day Trading Platforms In Spain?

The Comisión Nacional del Mercado de Valores (CNMV) is responsible for overseeing the financial markets in Spain, including day trading brokers.

That said, other European regulators, such as the CySEC and BaFin, are also permitted to accept Spanish traders through the EU’s passporting scheme. If you do choose to trade with an international broker, make sure you adhere to the CNMV’s regulations and tax rules in Spain.

Which Is The Best Broker That Accepts Day Traders From Spain?

Use our ranking of the best day trading brokers in Spain to find a suitable option.

IG, for example, is highly trusted and offers an excellent range of local markets, including Spanish ETFs and bonds, plus a EUR account.

Recommended Reading

Article Sources

- Comisión Nacional del Mercado de Valores (CNMV)

- Bolsa de Madrid (BME)

- Banco de España

- Day Trading Pyramid Scheme In Spain - Euronews

- Ferrovial (FER) - BME

- Banco de Sabadell (SAT) - BME

- 6 Top Payment Methods In Spain - Pay.com

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com