Errante Review 2025

Awards

- Best ECN/STP Broker 2022 - UF Awards

- Best Forex Newcomer 2021 - Forex Awards

- Fastest Growing Broker 2021 - Ultimate Fintech Awards

- Best Trade Executions 2020 - Forex Awards

Pros

- Good range of cryptocurrencies including Bitcoin

- Reputable and trustworthy multi-asset broker

- Supports cTrader, MT4 and MT5 platforms

Cons

- Small selection of shares

- Advanced educational content is expensive to unlock

- MT4 not available to EU traders

Errante Review

Errante is an online broker offering trading on forex, stocks, indices, cryptos and commodities at competitive rates. With 30+ years of industry experience, Errante connects traders with global markets through the MT4 and MT5 trading platforms.

In this review, we evaluate the full breadth of Errante’s services from trading apps to spreads, fees, welcome no deposit bonuses, leverage, and account types. Our experts also share their verdict on the multi-regulated brokerage.

Key Takeaways

- Errante is a good fit for beginners with a low starting deposit, copy trading service, plus free educational materials

- High volume traders will find lower fees and more advanced tools at alternative brokers

Company Details

Errante is a Cyprus-based forex and CFD broker offering trading across multiple asset classes via the popular MetaTrader platforms.

- In Europe, the brand is owned and operated by Notely Trading Ltd, an Investment firm authorized and regulated by CySEC under license number 383/20.

- Outside of Europe, the broker is owned and operated by Errante Securities (Seychelles) Ltd, which is regulated by the Seychelles Financial Services Authority (FSA) under license number SD038.

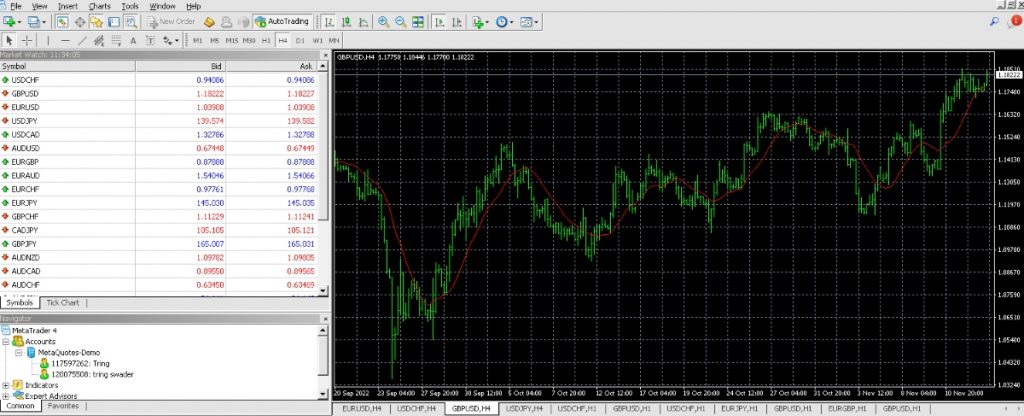

Trading Platforms

Errante offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

MT4 and MT5 are available on Mac, Windows, Android and iOS devices. They can be downloaded free of charge directly from the broker’s website.

MetaTrader 4

One of the world’s most widely used and versatile platforms, MT4 offers powerful features, tools for analysis and a range of options for customization.

- 9 time frames

- 1 click trading

- Unlimited charts

- 24 analytical objects

- 30 technical indicators

- 2000+ custom indicators

Note, MT4 is supported for Errante global clients only.

MetaTrader 5

The cutting-edge platform is fully customizable, offering clients an array of advanced tools and features, including in-depth qualitative and quantitive analysis.

- 21 time frames

- Unlimited charts

- 44 analytical objects

- 38+ technical indicators

MT5 is a multi-asset platform, in contrast to its forex-focussed predecessor. MT5 is used by millions around the world and is particularly popular amongst experienced traders who stand to benefit from the advanced analysis tools.

Those new to trading might find the MT5 platform difficult to navigate. However, Errante does offer support on how to use the platform via a personal Account manager. Clients can get in contact via live chat, email or phone.

Note, in Europe, clients will only have access to the MT5 platform.

How To Make A Trade

- Select the ‘New Order’ button in the top menu

- Choose between instant and pending order

- Input the trade details, including volume, stops and limits, any comments

- Confirm the buy or sell order

- Monitor the position on the chart

Instruments & Markets

Errante offers trading across five asset classes:

- Forex – trade 50 forex pairs, including majors and minors

- Shares – global shares from companies such as Amazon, Alibaba and Google

- Indices – trade some of the world’s most liquid indices including UK100, NASDAQ, S&P 500 and Dow Jones

- Energies and Commodities – diversify your portfolio and trade Crude and Brent Oil or Natural Gas

- Metals – spot metals: Silver, Gold, Platinum and Palladium

- Cryptos – trade the biggest names in crypto including Bitcoin, Litecoin, Ethereum, and Ripple

Errante offers a complete range of investment opportunities, making it a good fit for traders looking to build a diverse portfolio.

Errante Leverage

Leverage is available up to 1:30. This is in accordance with CySEC regulation.

Higher leverage rates are available under FSA regulation. Leverage is available up to 1:500.

Leverage limits are put in place to protect traders. Whilst leverage can increases returns, it can also put traders at risk of significant losses.

The margin call is 100% and the stop-out level is 20%.

Spreads & Commission

When we used Errante, we found that the trading fees offered are fairly standard, especially for popular assets like major forex pairs and large indices.

Spreads start from 1.5 pips with the Standard account, 1 pip with the Premium account, 0.8 pips with the VIP account, and 0.0 pips with the Tailor Made account. There is no commission with the Standard, Premium, and VIP accounts, though the Tailor Made profile does come with a commission charge.

There is also no requoting. Clients receive the market price direct from liquidity providers.

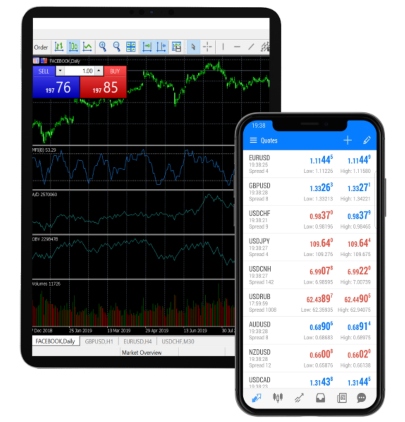

Errante Mobile App

Errante does not offer a proprietary mobile trading app, however, the MT5 platform can be downloaded onto your mobile device.

Mobile trading offers clients greater flexibility, however, traders should note that some features may be limited to desktop devices. For example, technical analysis is harder to conduct. Managing client accounts, including deposits and withdrawals, is also less user-friendly than the desktop members area.

Deposits & Withdrawals

Deposits

Errante offers an excellent range of funding methods, including:

- Wire transfers – standard bank transfers

- Credit / Debit cards – Visa and Mastercard

- E-wallets – Skrill, Neteller, Sticpay, Advcash and more

- Cryptocurrencies – BTC, ETH, XRP and USDT

The minimum deposit requirement is $50 / €50. There are no fees associated with making a deposit.

Bank transfers will be credited within 2-4 working days. Credit / debit card deposits, e-wallet deposits and crypto deposits will be processed instantly.

The broker does not accept third-party deposits. Traders should also note that any funds received in an alternative currency will be automatically converted into the base currency (USD or EUR). This may incur a fee.

Withdrawals

Withdrawals must be made to the account from which the funds were deposited.

Withdrawals made via debit / credit card or e-wallets will be processed within one working day. The minimum withdrawal is 20 units of the account’s base currency.

Withdrawals made with Skrill or Neteller have a 1% fee, which is a downside vs competitors. Withdrawals made via bank transfer or credit / debit card are free.

To move funds between accounts, a request for an Internal Transfer will need to be made. The request can be made in the client portal and the transfer is instant.

Demo Account Review

Errante offers all prospective clients the opportunity to trade risk-free via the demo account.

The demo account is a great way to get to grips with the MT5 platform and test out new trading strategies or instruments.

The Errante demo account does not have an expiration date. However, a demo account that has been inactive for more than 90 days will be closed.

Bonuses & Rebates

In accordance with CySEC regulation, Errante does not offer any promotional offers or welcome bonuses.

This is a drawback vs alternative brokers, many of which offer deposit joining bonuses and cashback schemes.

Regulation & License

Errante is regulated by a leading financial body – the Cyprus Securities and Exchange Commission (CySEC). License number 383/20.

For global clients, Errante is authorized and regulated by the Seychelles Financial Services Authority (SD038). However, it’s worth noting that this is not a top-tier financial regulator.

Trading with a regulated broker is always recommended. Licensed brokers can offer clients a greater degree of protection than their unregulated counterparts.

Additional Features

Errante offers a decent suite of educational materials designed to help traders.

The resources are free of charge and can be found in the Education Centre. From webinars to videos and market analysis, a range of experience levels, as well as learning styles are catered for. On the downside, tutorials on advanced topics carry a $300 fee to unlock.

Clients also benefit from access to multiple calendars and calculators, including margin calculators and an economic calendar.

Errante also publishes a weekly newsletter, the Newsroom. Again, free to access, Newsroom shares the latest on industry events, market movements and speculation.

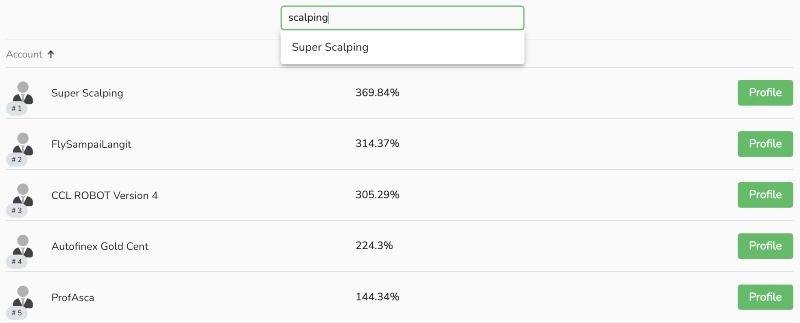

Copy Trading

For global clients, copy trading is also available. Supporting clients to find other successful traders to learn from and emulate. It can be a good strategy for traders that do not wish to or do not have time to follow the market themselves.

The service is most useful for short-term trading and particularly popular amongst forex trading. Copy trading can be done automatically or manually.

How To Start Copy Trading

Getting started requires just a few simple steps:

- Login to your Errante trading account (select Members Login)

- Do your research and find the copy trader you wish to emulate (use the top-ranked traders and view their returns over different periods, volatility ratio, recovery factor, and more)

- Copy the trades within the Errante trading platform (automated or manual copying)

- Set stop and limit levels (protect your risk exposure)

The copy trading service is an excellent feature, helping to separate the broker from many of its competitors.

Errante Account Types

Errante offers four account types, each catering to varying capital requirements and trading styles:

- Standard – Deposits start from $50 and spreads start from 1.8 pips. Commission-free trading and supports EAs

- Premium – Deposits start from $1000 and spreads from 1 pip. Also commission free, but with the added bonus of daily market summaries, personalized support and access to more educational resources

- VIP – Deposits start from $5000 and spreads from 0.8 pips. There are zero fees on deposits and withdrawals and a free VPS is available

- Tailor Made – Deposits from $1,5000 and spreads from 0.0. A commission will be charged, for more information, contact the customer support team

Errante also offers a swap-free account for religious purposes only. To apply for a swap-free account, visit the client portal.

A corporate account is also offered upon request.

Clients can open a maximum of two trading accounts per currency.

An account that has been inactive for more than 12 months will be considered dormant and a fee will be charged.

To change an account type, email backoffice@errante.eu.

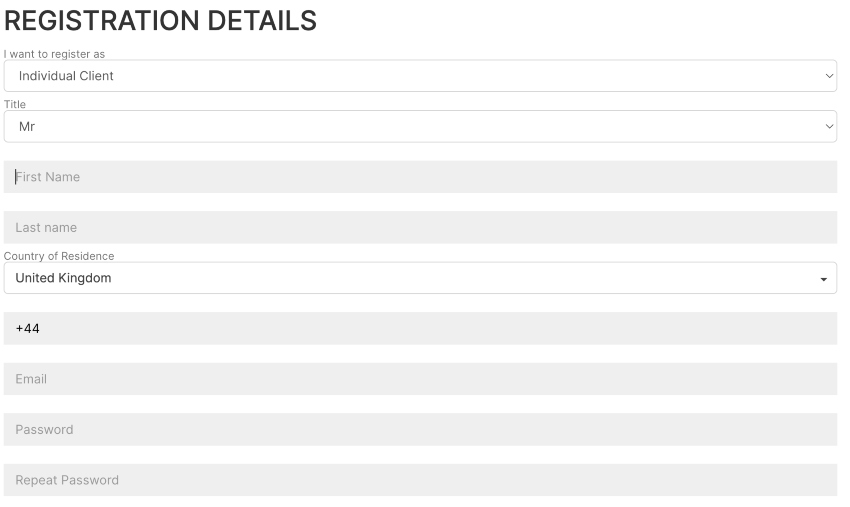

How To Open An Account

To register for an account, use the ‘Visit’ button above. Select ‘Register’ and follow the steps.

You will need to enter your title, name, country of residency, phone number, and email. You will also need to confirm that you are not a US citizen.

Account registration is quick and easy and can be done in just five minutes.

Customer Support

3.3 / 5Customer support is available 24/5. For assistance with a range of queries from login to fees and more, get in touch via:

- Phone: +347 25 253300

- Email: info@errante.eu

- Address: 67 Syprou Kyprianou, 4042, Limassol, Cyprus

Alternatively, clients can submit a ticket to the team. The form can be found under the ‘Contact Us’ tab on the broker’s website.

For an instant response to more general queries, visit the FAQ page. Questions cover a range of topics including trading platforms and accounts, verification and transfers.

The Errante website is available in English, Spanish, Italian, Portuguese, Russian, Japanese, Chinese and more.

Our experts also found that the broker is active on social media. For the latest updates, follow the firm on Facebook, Instagram, Twitter, LinkedIn, YouTube and Telegram.

While using Errante, our traders found the customer support team were responsive and knowledgeable. Our testers received a response to queries within minutes.

Safety & Security

The online broker follows a number of industry-standard safety measures.

Errante partners with top-tier banking institutions to hold client funds. Funds are held in segregated accounts.

For European clients, the Investor Compensation Fund affords clients a further level of security. The fund acts as a safety net and compensates eligible clients in the event that the company fails to return funds as a result of financial problems.

Broker Ranking

Errante is an established, regulated broker offering a good range of tradeable instruments at competitive rates. Errante has a lot to offer the right trader not least two of the world’s leading trading platforms, MT4 and MT5, as well as flexible account options, a knowledgeable customer support team, plus a copy trading service.

Traders in the EU should note that only the MT5 trading platform is available. So, if you are not a fan of this platform, this probably is not the broker for you. Traders outside of the EU should also remember that the Seychelles FSA does not provide the same level of regulatory scrutiny and protection as tier-one financial watchdogs.

FAQs

Is Errante A Good Broker?

Errante is a multi-regulated broker that offers a wide selection of instruments, competitive fees, plus useful tools like copy trading and a VPS. As a result, it is popular with online traders and recieves a fairly high rating.

Is Errante A Legit Broker?

Errante is a legitimate and trustworthy broker, regulated by both the Cyprus Securities & Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA). Client funds are also segregated from company capital.

Which Currencies Can I Use To Deposit Funds In My Errante Live Account?

Funds can be deposited in any currency but they will be converted into EUR or USD, meaning a conversion will likely carry a fee.

Is It Possible To Change The Base Currency Of An Errante Account?

It is not possible to change the base currency of an account once funds have been deposited. If you have not yet deposited funds, the base currency can be changed. Alternatively, clients can open an additional account in the base currency of your choosing.

Can I Withdraw Funds From My Errante Account At Any Time?

To withdraw funds, the account must be verified. Once you have received confirmation that the account has been verified (after submitting copies of ID documents) you can log into the client portal, navigate to the ‘Withdrawal’ tab and submit a payment request.

What Documents Do Errante Require To Verify An Account?

To verify your account, you must submit proof of identity and proof of address. This could be a national identity card or driver’s license, for example.

How Can I Update My Personal Account Information with Errante?

To change your name, update your email address or residential address, email backoffice@errante.eu and attach any relevant documentation.

Top 3 Alternatives to Errante

Compare Errante with the top 3 similar brokers that accept traders from your location.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Errante Comparison Table

| Errante | World Forex | Interactive Brokers | Dukascopy | |

|---|---|---|---|---|

| Rating | 4 | 4 | 4.3 | 3.6 |

| Markets | CFDs, Stocks, Indices, Forex, Metals, Energies, Cryptos | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $1 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC, FSA | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | 100% Deposit Bonus | – | 10% Equity Bonus |

| Education | No | No | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:500 | 1:1000 | 1:50 | 1:200 |

| Payment Methods | 12 | 10 | 6 | 11 |

| Visit | – | Visit | Visit | Visit |

| Review | – | World Forex Review |

Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Errante and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Errante | World Forex | Interactive Brokers | Dukascopy | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | No | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

Errante vs Other Brokers

Compare Errante with any other broker by selecting the other broker below.

Customer Reviews

5 / 5This average customer rating is based on 10 Errante customer reviews submitted by our visitors.

If you have traded with Errante we would really like to know about your experience - please submit your own review. Thank you.

The customer service at Errante is amazing. They are always responsive, knowledgeable, and incredibly helpful. With their detailed market analyses, they have made it so much easier for me to understand market dynamics and refine my trading strategies. So thanks to them.

Starting with Errante was straightforward due to their easy onboarding process and multiple account options. The lack of deposit fees and their regulation under CySEC adds an extra layer of trust and financial safety for traders.

I really enjoy using this platform because it’s affordable, user-friendly, and I feel confident in its security measures. It gives me peace of mind knowing that my investments are well-protected.

They are transparent and reliable. Their quick support responses make them a top pick for me. I also like that my transactions were all very smooth so far.

I worked with many brokers before, it was the first time I found a support team so responsive. I was also happy with my withdrawals.

Setting up my account here was surprisingly easy. No unnecessary or complicated forms to fill out. They kept it simple, and I like that.

I’ve had no issues with withdrawals here. The process is straightforward, and the money arrives on time. Spreads are low too.

When it comes to consistency, this broker succeeds. Since I’ve been using them, all of my trades have gone through without any issues. Having a trustworthy broker in the trading business is good.

Regular updates on market trends. Helps me stay informed without drowning in information. Highly recommend!

I have been with them for a while now. No major issues and trades go through very smoothly. I would recommend using them.