easyMarkets Review 2025

Awards

- Leading Broker of the Year 2024 - Forex Expo Dubai

- Best Regulated Broker 2024 - Smart Vision Summit – South Africa

- Best Forex Broker 2024 - TradingView Broker Awards

- Best Global Broker 2023 - Dubai Expo

- Best Cryptocurrency Innovation UAE 2022 - Finance Derivative Magazine

- Most Trusted Broker 2022 - Smart Vision Investment Expo Egypt

- Most Reputable Multi-Asset Broker 2022 - Forex Expo Dubai

- Most Trusted Forex Broker in Middle East 2022 - Fin Expo Egypt

Pros

- Unlike variable spreads offered by 90%+ of brokers we've tested, easyMarkets provides fixed spreads from 0.7 pips. This makes trading costs predictable, a significant advantage for beginners and those trading in volatile markets.

- easyMarkets added Bitcoin as a base currency in 2019. This marks it out against most of the market and eliminates the need to convert crypto to fiat, reducing conversion fees and simplifying management for crypto-focused traders.

- With 20+ years in the industry, multiple awards, and authorization from two ‘green tier’ regulators, easyMarkets continues to earn its reputation as a secure broker for active traders.

Cons

- easyMarkets is falling behind by not providing the copy trading features you get at category leader eToro, which are popular among beginners looking to follow the strategies of experienced traders.

- While easyMarkets provides solid educational resources for beginners, they fall short for advanced traders. The Academy offers well-structured courses and engaging gamification, but the overall content lacks depth.

- easyMarkets does not offer a zero-spread account like Pepperstone, which can be a drawback for day traders and high-frequency traders who require minimal transaction costs.

easyMarkets Review

Regulation & Trust

4.1 / 5Established in 2001, easyMarkets is highly trusted with a good reputation and authorization from five regulators:

- Easy Forex Trading Ltd is regulated by the Cyprus Securities & Exchange Commission (CySEC), license number 079/07, a ‘green tier’ body in DayTrading.com’s Regulation & Trust Rating. Up to €20K compensation.

- Easy Markets Pty Ltd is regulated by the Australian Securities & Investments Commission (ASIC), license number 246566, a ‘green tier’ body.

- EF Worldwide (PTY) Ltd is regulated by South Africa’s Financial Sector Conduct Authority (FSCA), license number 54018, a ‘yellow tier’ body.

- EF Worldwide Ltd is regulated by the Seychelles Financial Services Authority (FSA), license number SD056, a ‘red tier’ body.

- EF Worldwide Ltd is regulated by the British Virgin Islands Financial Services Commission (BVIFSC), license number SIBA/L/20/1135, a ‘red tier’ body.

easyMarkets seems to take regulation seriously, with oversight from trusted authorities, particularly ASIC and CySEC.This gives me a sense of security, especially with its focus on client protection measures like segregated accounts and negative balance protection, ensuring I can’t lose more than my deposit.

| easyMarkets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | CySEC, ASIC, FSCA, FSC, FSA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.8 / 5Live Accounts

easyMarkets offers three account types to cater to various trading needs:

- Standard: Requires a $25 minimum deposit and fixed spreads starting at 1.7 pips (EUR/USD). It includes features like personal account manager support and analysis updates but lacks advanced risk tools like guaranteed stop loss unless using the proprietary Web Platform. This is best suited to beginners.

- Premium: With a $2,000 deposit minimum, spreads are lower from 1.2 pips (EUR/USD), and similar support and 24/7 trading is available. This is best suited to traders with reasonable starting capital.

- VIP: With a $10,000 minimum deposit, traders get the tightest spreads from 0.7 pips (EUR/USD). VIP users benefit from same-day deposits and withdrawals, personalized account management, and educational resources. This is best suited to high-volume traders.

The leverage to up to 1:2000 for non-EU clients (location and platform dependant), or 1:30 in the EU, minimum trade size of 0.01 lots, and personal account management are very accommodating.

However, exclusive tools like dealCancellation and guaranteed stop-loss orders are only accessible on their proprietary platform, not on MT4/5 or TradingView, which is a bit limiting.

When I started using easyMarkets, I had to verify my account by uploading identity documents, completed within a few hours – fairly efficient in my experience.

Demo Accounts

The easyMarkets demo account is a fantastic way to get familiar with the platform.

Setting it up was quick – just an email and password – and the $10,000 in virtual funds let me experiment freely without financial risk.

I really appreciate that the demo account has no time limit, unlike most brokers we’ve tested, which restrict access to 30 days.

Plus, the ability to replenish the balance whenever needed means I can keep practicing and refining strategies at my own pace.

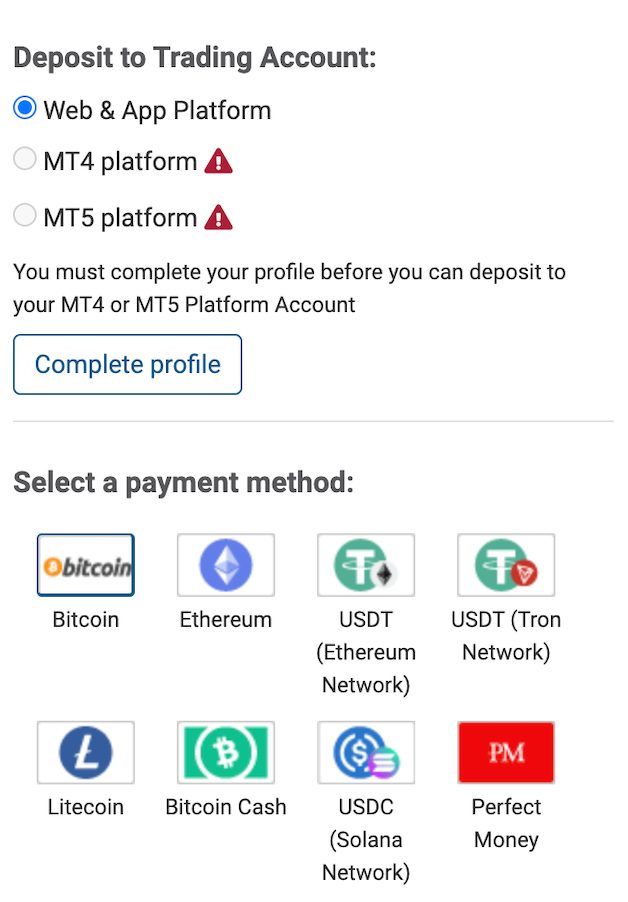

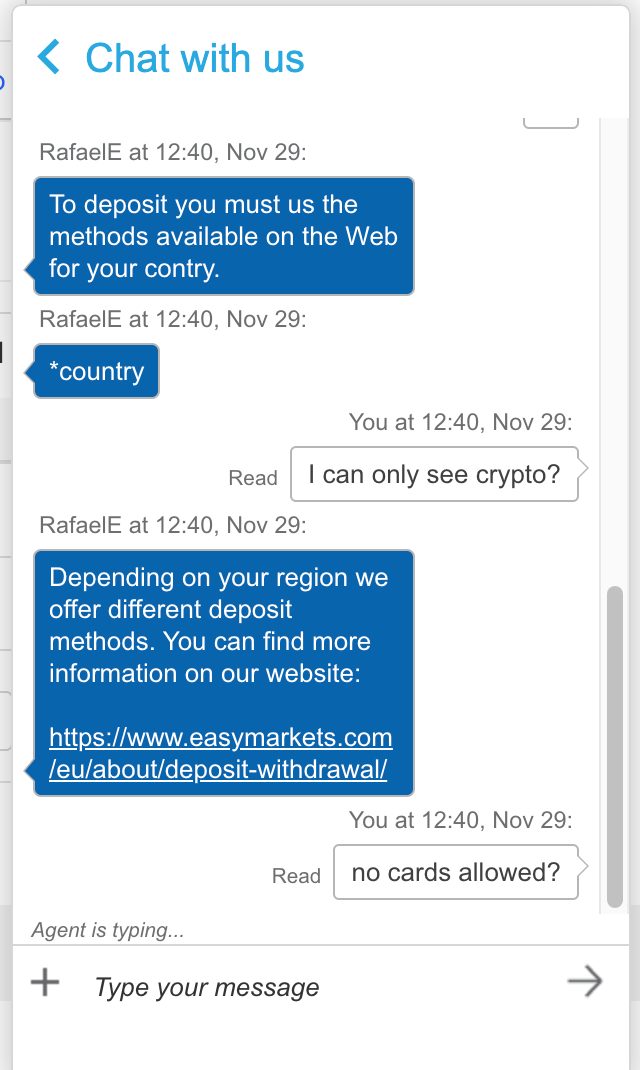

Deposits & Withdrawals

The ability to choose from 19 base currencies, including BTC, surpasses the options at almost every broker we’ve evaluated, providing flexibility to global traders.

The $25 minimum deposit also makes it accessible, but there are limitations for UK users, as debit/credit cards and bank transfers aren’t available.

While deposits took longer than I expected – up to a day – my withdrawals have been processed within a business day, adhering to strict anti-money laundering (AML) rules.

Although easyMarkets doesn’t charge for withdrawals, you may encounter fees from third-party processors when using crypto or e-wallets.

| easyMarkets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | AstroPay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Mastercard, Perfect Money, Sticpay, UnionPay, Visa, WebMoney, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $25 | $100 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3.5 / 5easyMarkets offers a small but practical selection of CFDs, options and forwards that has grown over the years.

200 assets were added in 2015, shares were added in 2019 and expanded in 2021 and 2022, while cryptos like Stellar, Bitcoin Cash, and Litecoin were added to the roster in 2020.

However, fast forward to 2025 and it still lacks passive investment options or trade-copying services. These features are available with brokers like eToro or XTB, which offer interest on cash balances.

Despite these limitations, easyMarkets’ variety of indices and cryptocurrencies provides diversification opportunities not always found in similar platforms:

- Forex: 60+ major and minor pairs (no exotics), including EUR/USD and GBP/JPY.

- Stocks: 60+ covering the US and Europe (eg Microsoft, HSBC).

- Crypto: 20+ cryptocurrency pairs, such as BTC/USD and ETH/USD.

- Metals: 19+ metals including gold and silver.

- Commodities: 12+ metals, oil, and naturals (eg gold, coffee) with up to 1:20 leverage.

- Indices: 26+ covering the US, Europe, Asia, and Australia (eg FTSE 100 and DAX 40).

To attract a wider audience, easyMarkets could expand its offerings to include ETFs, options, bonds, and interest rate instruments.Additionally, introducing a copy trading feature would cater to those seeking diversified opportunities and passive investment strategies.

| easyMarkets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:2000 | 1:200 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3.3 / 5easyMarkets tends to have slightly higher trading fees than some competitors based on testing. However, it offers fixed spreads during market hours.

This is rare – fixed spreads are available at less than 10% of firms we’ve evaluated. This simplifies cost calculations and offers a degree of certainty in the unpredictable world of short-term trading.

My investigations show spreads on MetaTrader are typically tighter than on the proprietary Web Platform. For instance, GBP/USD has a 1.3-pip spread on MT4 versus 1.7 pips on the Web Platform.

The VIP MT4 account provides the most cost-effective trading option, with fees as low as $7 per lot for EUR/USD. However, this account requires a $10,000 minimum deposit, putting it out of reach for many beginners.

easyMarkets does not charge direct commissions; costs are integrated into spreads, but overnight holding fees apply.

Additionally, dormant accounts incur a $25 fee every six months after 12 months of inactivity, with zero-balance accounts eventually closed. These fees are in line with industry norms.

On the downside, easyMarkets does not offer a zero-spread account like Pepperstone and IC Markets. This can be a disadvantage if you make high-frequency trades or scalp small movements, as it can result in higher transaction costs.

| easyMarkets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.7 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 1.0 | 100 | 0.005% (£1 Min) |

| Oil Spread | 1.1 | 0.1 | 0.25-0.85 |

| Stock Spread | 0.25 (Apple) | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

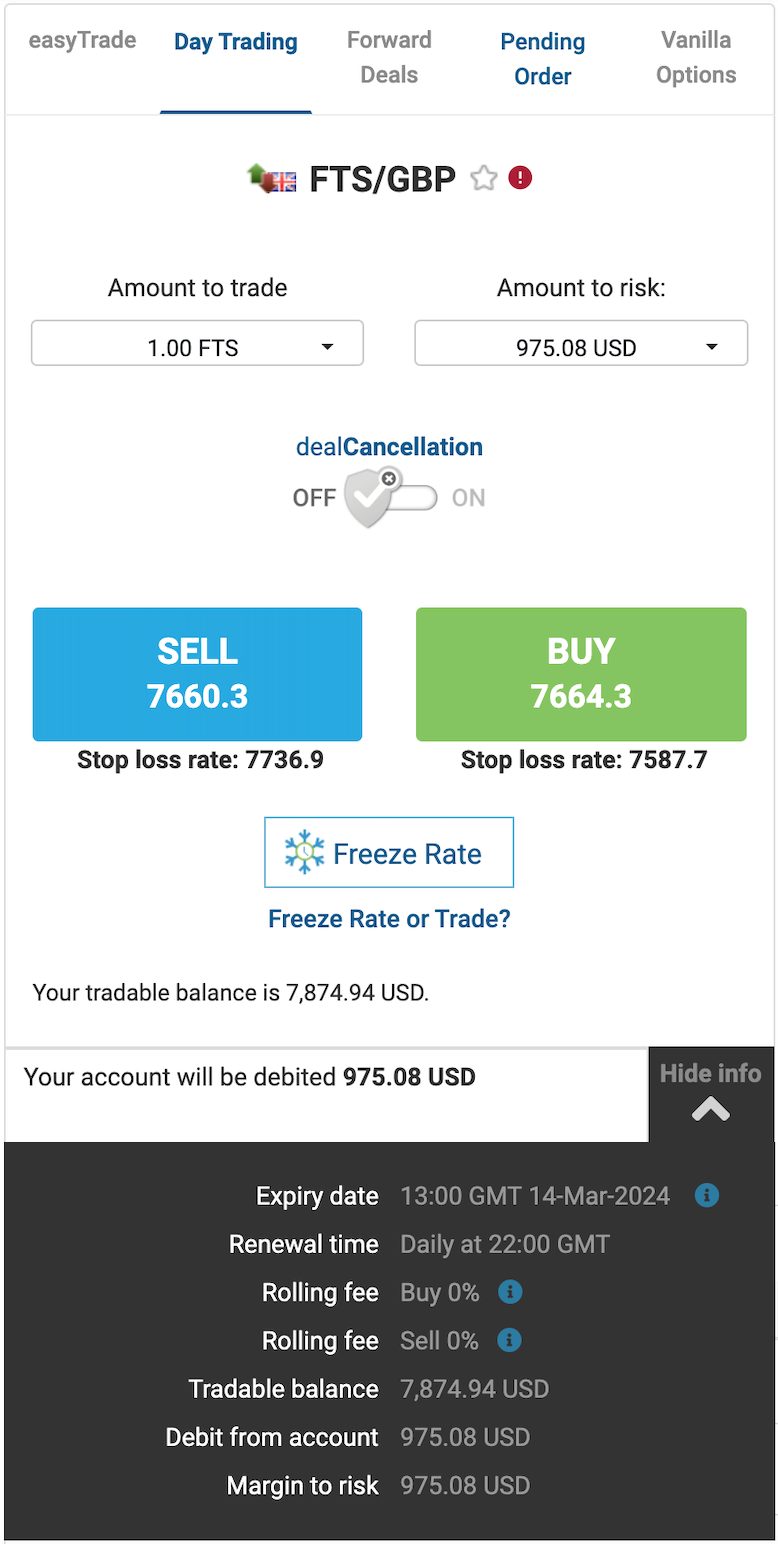

Platforms & Tools

4 / 5I’ve had hands-on experience with easyMarkets’ four trading platforms: Web Platform, MT4, MT5, and TradingView. Each platform offers a unique blend of features and tools, catering to different trading styles and preferences.

Check out my video tour of the easyMarkets platform below, to get a feel for the design and key tools.

The Web Platform is a great starting point for beginners. It’s incredibly user-friendly, with a clean interface and essential tools like technical indicators (powered by TradingView), market news, charts, and financial calendars.

I’ve found its exclusive features, such as ‘easyTrade,’ ‘dealCancellation,’ and ‘Freeze Rate,’ particularly helpful in managing risk and capitalizing on market opportunities.

dealCancellation in particular, has proven popular. Originally added in 2016, it’s been improved over the years, now covering periods of 1, 3 and 6 hours.

However, more support for automated trading and third-party plugins might be needed for more advanced traders.

For those who prefer the classic MetaTrader experience, MT4 (introduced in 2010) and MT5 (introduced in 2018) are available in web and mobile versions. I’ve used both mobile apps to check positions and execute trades quickly on the go.

While they don’t offer the full range of charting options and timeframes as the desktop versions, they still provide the core features most active traders will need, including technical indicators, graphical tools, and order management.

It’s important to consider that features like guaranteed stop loss, ‘Freeze Rate,’ and ‘easyTrade’ are exclusive to the Web Platform. The Web Platform might be the best choice if these features are crucial to your trading strategy.

There’s a reliable mix of platforms, but the proprietary Web Platform is the most user-friendly and best suited to beginners.TradingView and MetaTrader are more feature-packed but are better suited to more experienced traders.

If you’re an advanced trader who relies on automated systems and professional account management, the lack of VPS hosting and MAM/PAMM account management might be a limiting factor.

| easyMarkets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | easyMarkets App, Web Platform, MT4, MT5, TradingView, TradingCentral | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

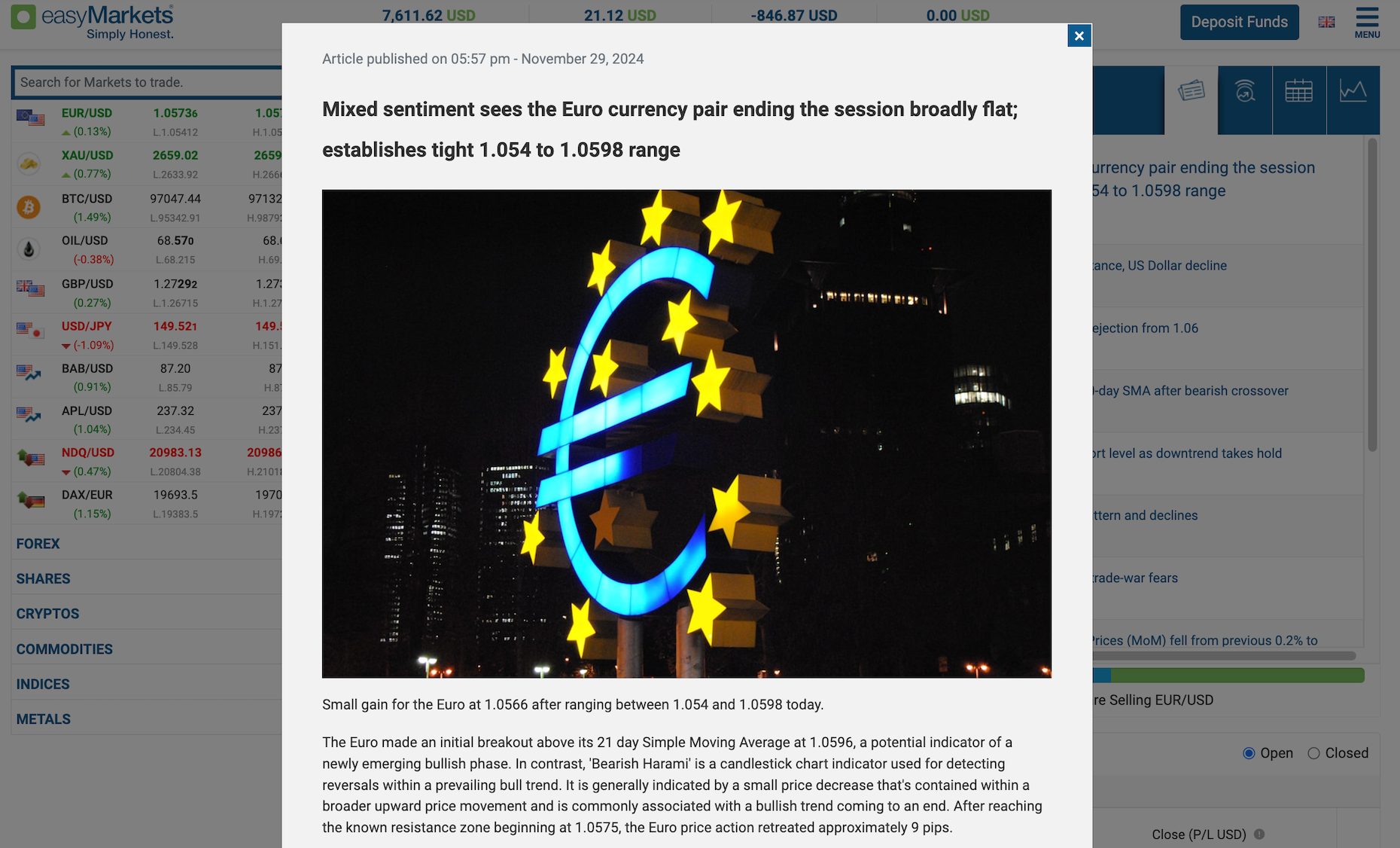

Research

4 / 5From my experience with easyMarkets, the research tools are excellent.

I’ve found daily market news, a monthly blog series, real-time currency rates, and an economic calendar helpful for staying informed.

The addition of an AI section is welcome too, providing technical analysis of popular assets like stocks and ETFs.

However, it lacks auto-generated signals like FXTM’s Signal Centre. Still, the Web Platform does offer built-in Trading Central analysis.

While features like webinars or podcasts are missing, the research tools available are helpful, especially for formulating trade ideas.

I’ve explored EasyMarkets’ blog posts, and they provide a steady stream of market insights and trading tips.The articles are well-written and cater to many traders, from beginners learning the basics to more advanced market updates.

| easyMarkets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

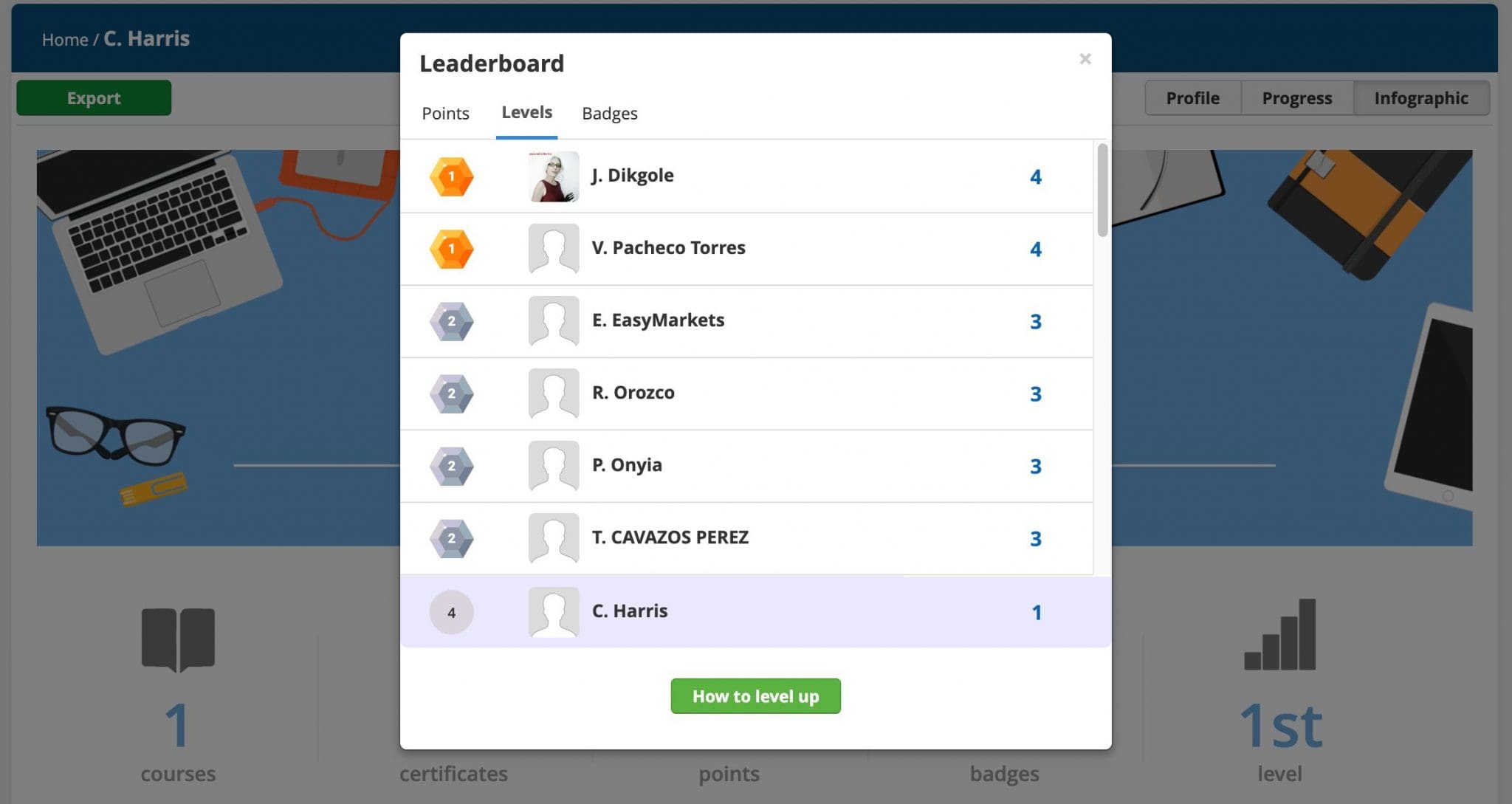

Education

4 / 5easyMarkets offers some excellent educational resources for beginners, though they could be more extensive.

The ‘Academy’, available after a $100 deposit, includes a well-structured course on key topics like technical and fundamental analysis and YouTube videos.

I also found the downloadable e-books and financial glossary helpful for beginners. The gamification features, such as badges and certificates, add an engaging touch.

Yet while these resources are helpful, I’d like to see more in-depth content for advanced traders.

| easyMarkets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

3.8 / 5easyMarkets offers excellent 24/5 customer service through email and live chat.

In my experience, connecting with a live chat agent takes only seconds. However, support is available only in English, which might limit accessibility for non-English-speaking clients.

The broker also extends its support via social media and messaging platforms such as Facebook Messenger, Viber, and WhatsApp, giving you more communication options than many competitors.

My only disappointment is the need for dedicated 24/7 phone support.

Additionally, easyMarkets provides detailed help documentation and FAQs to address common concerns. Its openness to customer feedback is a strong point, reflecting its commitment to improving support quality.

| easyMarkets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Customer Support | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With easyMarkets?

easyMarkets is a decent choice for beginner traders. It offers reliability, a low minimum deposit, fixed spreads, a variety of trading instruments, and an unlimited demo account for practice.

While it provides educational resources, these may need to be more detailed for more experienced traders who need advanced guidance.

Overall, the broker’s competitive spreads and choice of excellent platforms make it a good fit for active trading.

FAQ

Is easyMarkets Legit Or A Scam?

easyMarkets, which rebranded from easy-forex in 2016, is a legitimate broker with over 20 years of experience, regulated by ASIC, CySEC, and offshore bodies.

It prioritizes transparency, client fund protection, and features like negative balance protection.

Is easyMarkets Suitable For Beginners?

easyMarkets is suitable for beginners. It offers user-friendly platforms, fixed spreads, and a comprehensive education hub with courses, e-books, and tutorials. Bespoke tools it’s built like ‘easyTrade’, ‘Freeze Rate’, and ‘dealCancellation’ add extra safety for new traders.

However, there needs to be a copy trading service, which might limit learning opportunities for inexperienced traders seeking hands-on guidance.

Top 3 Alternatives to easyMarkets

Compare easyMarkets with the top 3 similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

easyMarkets Comparison Table

| easyMarkets | Dukascopy | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| Rating | 3.5 | 3.6 | 4.3 | 4.5 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $25 | $100 | $0 | $100 |

| Minimum Trade | 0.01 lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC, ASIC, FSCA, FSC, FSA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | 50% Deposit Bonus Or Up To A $2000 Tradable Bonus | 10% Equity Bonus | – | Active Trader Program With A 15% Reduction In Costs |

| Education | Yes | Yes | Yes | Yes |

| Platforms | easyMarkets App, Web Platform, MT4, MT5, TradingView, TradingCentral | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | 1:2000 | 1:200 | 1:50 | 1:50 |

| Payment Methods | 12 | 11 | 6 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by easyMarkets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| easyMarkets | Dukascopy | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | No | No | Yes | Yes |

| Options | Yes | No | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | No |

easyMarkets vs Other Brokers

Compare easyMarkets with any other broker by selecting the other broker below.

The most popular easyMarkets comparisons:

Article Sources

- easyMarkets

- Easy Forex Trading Ltd - CySEC License

- Easy Markets Pty Ltd - ASIC License

- EF Worldwide (PTY) Ltd - FSCA License

- EF Worldwide Ltd - FSA License

- EF Worldwide Ltd - BVIFSC License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of easyMarkets yet, will you be the first to help fellow traders decide if they should trade with easyMarkets or not?