Dukascopy Improves Overnight Swaps & Launches 10 New Crypto CFDs

The Swiss forex and derivatives broker Dukascopy has rolled out two enhancements to its trading experience, with more competitive overnight swap charges on DeFi assets and ten new cryptocurrency instruments. The new tokens will bring the total number to 19 and will be available to European and global clients through both Dukascopy Bank and Dukascopy Europe JForex.

Enhanced Crypto Trading Conditions

Dukascopy saw the benefits and potential of cryptocurrencies early on, even launching a native token Dukascoin. The ten new currencies added to the broker’s list continue to demonstrate the firm’s faith in DeFi, appending some very in-demand coins amongst retail traders to reach a total of 19 crypto CFDs.

The new instruments are all digital tokens paired with the US dollar, making them crypto-fiat pairs that demonstrate the value of the cryptos against the US currency. The coins that have been added are Cardano (ADA), Chainlink (LINK), Uniswap (UNI), Yearn Finance (YFI), Aave (AAVE), Basic Attention Token (BAT), Compound (COMP), Enjin (ENJ), Polygon (MATIC) and Maker (MKR).

In the announcement, the broker said “Dukascopy continues its crypto expansion by significantly improving its overnight rates for crypto instruments together with launching trading for 10 new cryptocurrency pairs.”

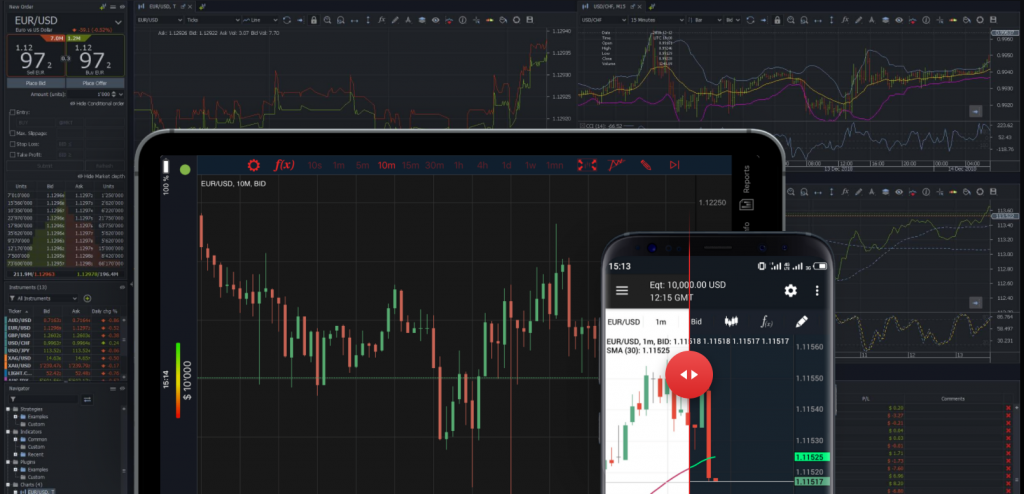

The new crypto instruments will be available for clients with Dukascopy Europe JForex self-trading accounts, which utilise the broker’s proprietary trading platform, JForex. However, the broker is hoping to bring them to their other platform, MetaTrader 4 (MT4), on which clients can already trade some existing pairs.

Further demonstration of the broker’s commitment to competitive cryptocurrency trading conditions includes the recent introduction of Tether (USDT) as a payment method, alongside the existing Bitcoin (BTC) and Ethereum (ETH) options, and the increase of maximum deposit limits with cryptos to $100,000.

About Dukascopy

Dukascopy is a regulated, global entity offering competitive forex, CFD and binary options trading across a wide range of markets and countries. Clients can speculate on stocks, indices, ETFs, commodities, bonds and cryptocurrencies using the broker’s own JForex platform, its web-based binary options software or the world-renowned MT4.

The broker is regulated by the Swiss FINMA and the FCMC, providing legal protection to clients in the event of disputes or insolvency. Automated trading and high leverage rates are supported for all assets, alongside competitive spreads, mobile apps and regular promotional events.

To get started with the new crypto CFDs on Dukascopy’s platform, click the button below or check out our full broker review.