Doo Prime Review 2025

Awards

- Most Potential Broker 2022, FOLLOWME

- Top 10 Popular Broker 2022, FOLLOWME

- Best Broker in Financial Technology 2020, FOLLOWME

- Excellent Customer Service 2020, Global Derivatives Real Trading Competition

Pros

- Excellent suite of trading tools including MT4, MT5, TradingView and Trading Central

- Two social trading platforms for beginners looking for community interaction

- FIX API for experienced traders requiring ultra-low latency and rapid performance

Cons

- Mediocre customer service following tests

- Limited educational materials vs alternative brokers

- Weak regulatory cover through offshore entities

Doo Prime Review

In this Doo Prime review, our experts assess the pros and cons of trading with this multi-regulated broker. We compare the broker’s investment offerings, trading fees, leverage and accounts. Find out whether to sign up with Doo Prime.

Assets & Markets

Doo Prime offers an impressive range of over 10,000 assets from 6 different classes.

This competes well with other brokers we have reviewed and will appeal to traders looking to diversify their portfolios with a varied selection of forex pairs and securities.

Supported instruments include:

- Metals – Gold or silver ETFs, CFDs or futures

- Energies – A small range of crude oil and gas instruments

- Stocks – US and Hong Kong securities including Apple and Tesla

- Forex – 60+ currency pairs including USD/JPY, EUR/CAD and GBP/USD

- Indices – 10+ stock indices including DAX 30, US SPX 500 and Russell 3000

- Futures – Including NASDAQ100 futures, soybean futures and gold CFD futures

Account Types

Doo Prime offers three accounts to retail traders: Cent, STP and ECN.

Overall, we found the conditions in the Cent and STP accounts were best suited to beginners looking for lower deposit requirements and reasonable fees.

The ECN account has higher entry requirements in exchange for the tightest spreads, making it a better pick for active and experienced day traders.

The minimum deposit of $100 in the Cent and STP accounts is competitive compared to brokers like IC Markets ($200), though not as low as some of the best brokers we have reviewed. For example, XM lets you start with just $5.

We have highlighted the key differences between the live accounts below.

Cent

Best for beginners

- Account Currency: USC

- Minimum Lot Size: 0.01

- Maximum Lot Size: 1000

- Minimum Deposit: 100 USC

- Limit And Stop Limit Orders: 50 points

- Trading Products: Forex, Metals, Commodities

STP

Best for beginners, stocks and futures traders

- Account Currency: USD

- Minimum Lot Size: 0.01

- Maximum Lot Size: 100

- Minimum Deposit: 100 USD

- Limit And Stop Limit Orders: 50 Points

- Trading products: Metals, Commodities, Indices, Stocks, Forex, Futures

ECN

Best for experienced day traders

- Account Currency: USD

- Minimum Lot Size: 0.01

- Maximum Lot Size: 100

- Minimum Deposit: 5000 USD

- Limit And Stop Limit Orders: Unlimited

- Trading products: Metals, Commodities, Indices, Stocks, Forex, Futures

On the negative side, there is no Islamic swap-free account for Muslim traders.

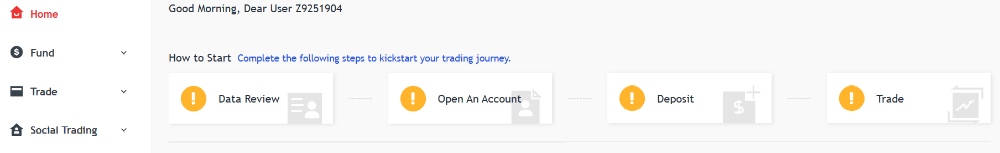

How To Open An Account

We found the sign-up process straightforward and didn’t come across any issues. To get started:

- Register with your email/phone number and choose a password

- Verify your account with the verification email/text

- Enter details such as your nationality and name and submit identity documents for verification

- Fill in your contact information

- Sign the compliance document

Payment Methods

I was impressed with the variety of payment methods. The broker offers 20 funding methods in 22 currencies, so global traders can avoid currency conversion fees.

For deposits, you can use local and international bank transfers, credit cards, Apple Pay, Google Pay, Epay, Skrill, Fasapay and HWGC. I was a little disappointed that more global e-wallets such as PayPal are not supported, but this is a minor complaint.

Furthermore, whilst bank transfers and e-wallets are supported for withdrawals, credit cards are not, and fewer currencies are available when withdrawing funds.

With that said, we did find that transferring funds was very simple and easy to do internationally. For instant deposits, we would recommend credit card or e-wallet funding as bank transfers can take up to 5 days.

I was also pleased to find there were no deposit or withdrawal fees (other than third-party fees), which is above the standard of eToro, for example, which charges $5 for withdrawals.

Overall, the payment method services at Doo Prime are very good, competing well with top brokers.

How To Deposit Funds

I found the depositing process straightforward and fast:

- Log in to the client portal

- Click on the ‘Fund’ icon in the left-hand menu

- Press the ‘Deposit’ icon in the drop-down menu

- Select the payment method you want to use and enter the amount you want to transfer

- Confirm the deposit

Trading Fees

Trading fees at Doo Prime are average.

While the broker advertises spreads as low as 0.1 pips, we got 1.3 pips on GBP/USD and 1.7 on EUR/AUD upon testing, which aren’t the lowest.

We were pleased with the zero transaction fees in the CENT and STP accounts, but it is a shame that they are charged in the ECN profile.

Ultimately, we found real-time spreads and commissions relatively unclear and the lack of transparency around pricing is a noticeable drawback.

Non-Trading Fees

Our team rated that there are no inactivity fees at Doo Prime, which is good compared to the likes of XTB which charge $10 per month after 12 months of inactivity.

The copy trading tools are also free for account holders, making the broker attractive to beginners.

Trading Platforms

Doo Prime offers the popular and reliable MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Whether you are a beginner or a more experienced trader, both interfaces are simple and user-friendly yet boast a comprehensive suite of advanced tools. With that said, we would recommend the MT4 platform to beginners whilst the MT5 platform will suit more experienced traders looking for further analysis tools, order types and faster processing.

In both cases, traders can access an excellent range of customizable layouts, Expert Advisors (EAs), charting features, and technical analysis tools.

You can download the platforms onto your computer or opt for the highly-rated iOS or Android apps.

It is good to see that Doo Prime also offers TradingView and FIX API 4.4 Pros platforms which offer excellent analysis tools and low-latency trading technology for experienced technical traders.

I have listed my favorite features from each platform below.

MetaTrader 4

- 9 timeframes

- 31 graphical objects

- Expert Advisors (EAs)

- In-depth pricing history

- Single-thread strategy testing

- 30 technical indicators including RSI and Moving Average

- 4 pending order types (buy limit, buy stop, sell limit and sell stop)

MetaTrader 5

- 21 timeframes

- Expert Advisors (EAs)

- 6 pending order types

- Built-in economic calendar

- Multi-thread strategy testing

- 38 technical indicators including MACD and Stochastic Oscillator

- 44 graphical objects such as Elliott Wave and Fibonacci Retracement

TradingView

- Upper-End Pine Scripts

- 50 smart drawing tools

- 12 customizable chart types

- 100+ fundamentals columns and ratios

- 100+ columns and customize your own filters

- 12 different alerts on indicators and strategies

- 100+ technical indicators including Volume Distribution

FIX API 4.4

- Direct market access

- Automatic exchange and hedging currency pairs

- Complete reference information of all trading varieties

- Exchange trading information and transfer financial data with other servers

- Stable, high-frequency information transmission speed, up to 250 quotes updates per second

How To Place A Trade

I find it very simple to place a trade on both MetaTrader platforms:

- From your MetaTrader platform click on the asset you want to trade

- In the ‘New Order’ pop-up enter the lot volume

- Adjust stop loss or take profit if you want to

- Select whether the order is instant or pending

- Press ‘Buy’ or ‘Sell’ to make the trade

Mobile App

Doo Prime has also developed its own proprietary mobile app called Doo Prime InTrade, which we enjoyed using. The platform is downloadable for iOS and Android devices.

The app also integrates seamlessly with your MetaTrader terminals, so you can easily view your accounts and track your investments whilst on the go.

Overall, I found the app very user-friendly, with access to real-time price data, trading history, market news and more.

Regulation & License

Our experts are satisfied with the regulatory status of Doo Prime.

The Doo Group is regulated by top-tier institutions: the SEC and FINRA in the US, the UK’s FCA, and Australia’s ASIC.

In addition, the broker holds offshore licenses with the Seychelles FSA, Mauritius FSC, and Vanuatu FSC.

Overall, we are comfortable that this broker can be trusted, however, traders should be aware that the level of client protection offered will depend on your jurisdiction. Our team also found that the offshore entities are offered to traders in regulated areas, such as the UK, which may reduce account and fund safety.

The details of the individual governing bodies are listed below:

- Elish & Elish Inc – Regulated by the United States Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) with license numbers SEC: 8-41551 and CRD: 24409, respectively

- Doo Financial Australia Limited – Regulated by the Australian Securities & Investments Commission (ASIC), with license number 222650

- Doo Prime Seychelles Limited – Regulated by the Seychelles Financial Services Authority (SC FSA), with license number SD090

- Doo Prime Mauritius Limited – Regulated by the Mauritius Financial Services Commission (MU FSC), with license number C119023907

- Doo Prime Vanuatu Limited – Regulated by the Vanuatu Financial Services Commission (VFSC), with license number 700238

- Doo Clearing Limited – Regulated by the United Kingdom Financial Conduct Authority (FCA), with license number 833414

- Doo Financial Labuan Limited – Regulated by the Malaysia Labuan Financial Services Authority (MY Labuan FSA), with license numbers SL/23/0022 and MB/23/0108, respectively

In terms of security, it is good to see that the broker uses multi-encryption including 256-bit SSL asymmetric transmission to protect clients and traders against DDoS/CC cyber-attacks.

Leverage

Leverage at Doo Prime varies depending on the asset you want to trade and your location. The broker does offer high leverage up to 1:1000 through some entities, which is well above the UK/AU/EU cap of 1:30.

This high leverage allows traders more purchasing power but also comes with the risk of much greater losses. With this in mind, I would recommend employing solid risk management tools.

The broker imposes a stop-out at 30%.

Demo Account

We were pleased to find that Doo Prime offers a free demo mode to simulate the STP and ECN accounts.

These are great for those new to trading as they allow you to learn without financial risk. Furthermore, it can be a good way for more experienced traders to test out their strategies before investing funds.

However, it was a shame that there is no demo available for the Cent account, especially as it is primarily aimed at beginners.

How To Open A Demo Account

Opening a demo account at Doo Prime is fairly straightforward, however, you do have to follow the same initial registration and verification process for a live account first. As a result, the process takes longer than some competitors.

To get started:

- Enter your email address or phone number

- Verify your account with the link sent to your email address/phone

- Log in to your client portal

- Enter your identity information and verify your account

- Click on the ‘home’ icon in the left-hand menu

- Scroll down and under the Demo Account section click on the ‘Add More Accounts’ icon

- Enter the account conditions and confirm your demo account

Bonuses & Promotions

At the time of writing, Doo Prime offers a lucky draw event which gives traders the chance to win luxury prizes including cars, iPhones and up to $888.

Clients who meet the deposit and trading terms receive one entry into the draw while new clients who register during the bonus period will receive two entries.

But importantly – we do not recommend picking a broker based only on their bonus. Other factors should be considered, including accounts, fees and trading tools.

Additional Tools

Overall, we were impressed with the variety of additional trading tools offered by this broker, including two copy-trading platforms and top-class market analysis from Trading Central.

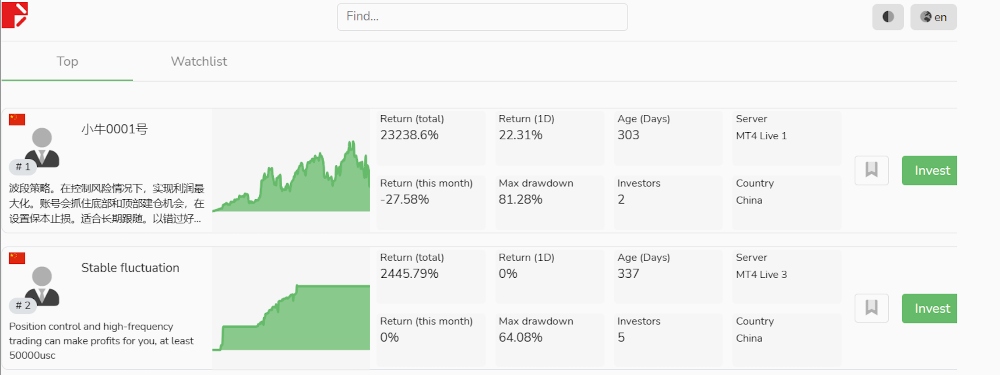

Social & Copy Trading

Doo Prime’s social trading platforms, Outrade and FOLLOWME, allow traders to communicate and share information with experienced traders globally.

Once you sign up, you can follow and copy other strategies by investors which match your goals. The tools are especially useful for beginners as they allow you to learn from investors whilst engaging in the social element of online trading.

When we tested the tools, we particularly liked Outrade’s heatmap and exposure tools, showing client sentiment on key assets. You also get a comprehensive summary of the strategies supplied by the top signal providers.

Trading Central

Doo Prime also offers the hugely popular analytics software, Trading Central, which boasts over 8000 trading tools and real-time analysis with 24/7 coverage.

The tool is highly user-friendly yet provides in-depth daily insights on key markets.

VPS

We were pleased to find the broker offers a virtual private server (VPS) allowing traders to execute uninterrupted trades at fast speeds.

The VPS uses an external server to manage trading connectivity so your account can run without the downtime caused by computer problems.

This will suit high-volume, serious traders although it should be noted that you need to deposit $5000 to use the VPS, which is fairly steep.

Education & Research

We liked the broker’s dedicated news page, offering a vast library of company news, market updates, product notifications and analysis. The volume and quality of the content are impressive, rivalling some top brokers like IG Index.

The educational resources are also commendable. After login, traders get access to MTE media, an educational tool offering trading courses, e-books, investment tips and a trading glossary. The section will be useful for beginners but doesn’t compete with the likes of eToro.

Customer Support

I was fairly happy with the customer support offered by Doo Prime. Customer services are available 24/7 and there are a variety of avenues for help.

The broker offers support via email and live chat, as well as phone numbers and social media channels. Additionally, the website has a FAQ section which we found useful although not as extensive as some competitors.

When we tested the email and live chat options, we got responses promptly (within 5 minutes on the live chat and 24 hours via email) and they were polite and helpful.

However, occasionally our questions had to be passed onto the Account Manager as customer service could not answer more specific questions and they were slow to reply. I think this area could be improved to align with competitors like CMC Markets.

- Phone number – +85237044241

- Contact form – In the broker’s help center

- Live chat – The bottom right-hand side of the brokerage’s website

- Email – en.support@dooprime.com

Company Background

Doo Prime is an online stock and forex broker founded in 2014. They now have over 90,000 users in 40 countries who they support through their offices in Dallas, Sydney, Singapore, Hong Kong, Dubai and Kuala Lumpur.

The broker employs over 750 people and has 250+ institutional partners.

It is also reassuring to see that the broker has won multiple awards including the Excellent Customer Service Award in the Global Derivatives Real Trading Competition and the Best Broker in the Financial Technology Honor Awards.

Trading Hours

Trading hours vary depending on the asset you want to trade. For example, securities can be traded from 2:30 pm on Monday until 9:00 pm on Friday, while forex is available from 10:06 pm on Sunday until 9:55 pm on Friday.

Helpfully, the broker’s website has a trading calendar showing events that affect the times of market opening.

Should You Trade With Doo Prime?

Overall, we think Doo Prime covers a good range of trading needs with a variety of assets, low minimum deposits, reliable platforms and some useful tools. The firm is also regulated by multiple trustworthy bodies including the FCA, ASIC and SEC, which is reassuring.

On the negative side, we found that the lack of transparency around fees does make the broker less appealing than some alternatives. Additionally, the educational resources offered are not the best in the market and the customer service could be improved.

FAQ

What Is Doo Prime?

Doo Prime is an online forex and securities broker that offers traders multiple account types and access to a variety of trading tools. The company offers 10,000+ instruments across six asset classes and provides access to the popular MT4 and MT5 platforms.

Is Doo Prime Trustworthy?

Doo Prime is regulated by multiple financial bodies. This includes the US SEC and FINRA, the UK FCA, the Australian ASIC, the Seychelles FSA, the Mauritius FSC, and the Vanuatu FSC.

With that said, the lack of transparency surrounding trading fees is a letdown and brings the trust score down for us.

Is Doo Prime Legit Or A Scam?

Doo Prime is a legitimate broker, established in 2014, with a good reputation and positive user reviews. The brand appears to operate in compliance with the regulations of top-tier financial bodies and has 90,000 client accounts.

With that said, traders should be cautious when signing up with any new broker.

Is Doo Prime A Good Or Bad Broker?

There are several positives to trading with Doo Prime. The company is heavily regulated with multiple accounts, a wide range of assets and an excellent suite of extra tools.

However on the downside, the broker lacks clarity on fees, which will be a concern for some traders.

Does Doo Prime Offer Low Trading Fees?

Doo Prime offers no transaction fees on their CENT and STP accounts and low spreads of 0.1 pips. However, clarity around trading fees is lacking, making it difficult for clients to gauge their trading costs before signing up. We also got average spreads while using Doo Prime, so it doesn’t compete with the cheapest brokers.

Top 3 Alternatives to Doo Prime

Compare Doo Prime with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Doo Prime Comparison Table

| Doo Prime | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 3.2 | 4.3 | 3.6 | 4.5 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Futures, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, ASIC, SEC, FINRA, FSA, FSC, VFSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5, TradingView, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | 1:1000 | 1:50 | 1:200 | 1:50 |

| Payment Methods | 11 | 6 | 11 | 8 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Doo Prime and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Doo Prime | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Doo Prime vs Other Brokers

Compare Doo Prime with any other broker by selecting the other broker below.

Customer Reviews

1 / 5This average customer rating is based on 1 Doo Prime customer reviews submitted by our visitors.

If you have traded with Doo Prime we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Doo Prime

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

I am writing this review out of sheer frustration and anger at Doo Prime, a broker that has proven to be utterly unreliable and untrustworthy. If you value your money, stay far away from this broker!

Doo Prime has held my funds hostage for far too long, and their excuses for delaying my withdrawals are nothing short of pathetic. It’s outrageous that a broker can operate with such blatant disregard for their clients’ hard-earned money. I have submitted multiple withdrawal requests, and each time, I am met with vague responses and empty promises. This is unacceptable!

Their customer support is a joke. When you finally manage to get in touch with someone, they seem clueless and incapable of providing any real answers. It feels like they are doing everything possible to keep your money from you. The lack of transparency is infuriating, and it raises serious questions about their integrity as a financial institution.

Let me be clear: Doo Prime markets itself as a reputable broker, but my experience has been nothing short of a nightmare. They lure you in with flashy features and enticing offers, but when it comes time to access your funds, they become evasive and unresponsive. This is not just poor service; it’s downright fraudulent behavior.

I strongly advise anyone considering Doo Prime to think twice before putting your money at risk. There are countless other brokers out there who prioritize their clients’ needs and provide reliable service. Don’t make the mistake I did by trusting Doo Prime with your funds.

In summary, if you want to avoid the stress and frustration of dealing with a broker that holds your money hostage, steer clear of Doo Prime. They have shown themselves to be untrustworthy and unreliable—your money deserves better!